Tim Ulbrich and Tim Baker discuss the role of credit in financial planning: why it matters, how it works, what makes up a credit score, common credit misconceptions and more.

Episode Summary

In this episode, Tim Ulbrich and Tim Baker discuss the role of credit in financial planning. They explore why credit matters, how it works, and how it influences important areas in your financial plan.

Tim and Tim break down the factors that make up a credit score, from payment history and credit utilization to the age of credit and hard inquiries. They also dispel common credit myths, essential strategies for protecting your credit and identity, including the importance of monitoring credit reports.

About Today’s Guest

Tim Baker is the Co-Founder and Director of Financial Planning at Your Financial Pharmacist. Founded in 2015, YFP is a fee-only financial planning firm and connects with the YFP community of 12,000+ pharmacy professionals via the Your Financial Pharmacist Podcast podcast, blog, website resources and speaking engagements.

Tim attended the United States Military Academy majoring in International Relations and branching Armor. After his military career, he worked as a logistician with a major retailer and a construction company. After much deliberation, Tim decided to make a pivot in his career and joined a small independent financial planning firm in 2012. In 2016, he launched his own financial planning firm Script Financial and in 2019 merged with Your Financial Pharmacist. Tim now lives in Columbus, Ohio with his wife (Shay), three kids (Olivia, Liam and Zoe), and dog (Benji).

Key Points from the Episode

- Understanding the Importance of Credit [0:00]

- Debt Utilization and Its Impact [2:07]

- How Credit Works and Its Impact on Financial Planning [32:14]

- Factors Affecting Credit Scores [32:27]

- Strategies to Improve Credit Scores [32:38]

- Common Credit Misperceptions [32:52]

- Credit Security and Identity Protection [33:06]

- Conclusion and Future Topics [38:27]

Episode Highlights

“If you kind of look at some of the things that credit affects, it’s your ability to get credit and what you pay on that debt. So interest rates. Lenders use your credit score and history to determine whether to approve a loan or to give you preferable or less than preferable rates, and this affects mortgage, auto and personal loans.” Tim Baker [08:17]

“The credit report is kind of your report card with regard to your credit. It’ll show all the different adverse accounts and also accounts that are in good standing. Now, it’s hard, in a snapshot world to say, okay, like I’m looking at a bunch of pages of a credit report. How does a creditor, as someone that’s going to lend this person money, quantify the ability to pay back in a timely manner? That’s where we get the credit score. The credit score basically distills down your ability to pay back the money that you owe. – Tim Baker [11:20]

“If we talk about the factors of a credit score, probably the highest impact factor is payment history, and from what I understand, it makes about 35% of your score. This is the most predictive factor in determining whether a borrower will repay debt as a history of on time payments indicate lower risk for lenders. So if you are missing payments, then your score is gonna get hurt.” -Tim Baker [18:17]

“It’s important to know what’s not used to calculate credit scores: age, sex, religion, race, marital status, zip code, if you’ve ever disputed things on a credit credit report, employment history, occupation and salary. So they don’t care if you make $200,000 or $2 million a year. As we say, income is not a financial plan. Income is also not a good credit score.” – Tim Baker [28:05]

Links Mentioned in Today’s Episode

- Intuit CreditKarma

- FICO

- Vantage Score

- YFP Book a Discovery Call

- YFP Disclaimer

- Ask a financial question to YFP

- Subscribe to the YFP Newsletter

- Tim Ulbrich on LinkedIn

- Tim Baker on LinkedIn

- YFP on Instagram

- YFP Facebook Group

Episode Transcript

Tim Ulbrich 00:00

Hey everybody. Tim Ulbrich here and thank you for listening to the YFP Podcast, where each week, we strive to inspire and encourage you on your path towards achieving financial freedom. This week, Tim Baker and I talk all about credit as an important thread of the financial plan. Specifically, we discuss why credit matters, how credit works, the makeup of a credit score, and how to improve that score, common credit misperceptions and strategies to protect your identity and secure your credit before we jump into the show, I recognize that many listeners may not already be aware that at YFP, we support pharmacists at every stage of their careers to take control their finances, reach their financial goals and build wealth through one on one comprehensive, fee-only financial planning and tax planning. If you’re ready to see how YFP can support you on your financial journey, you can book a free discovery call by visiting yourfinancialpharmacist.com. Whether or not our financial planning and tax services are a good fit for you, know that we appreciate your support of this podcast and our mission to help pharmacists achieve financial freedom. All right, let’s jump into today’s episode.

Tim Ulbrich 01:08

Tim Baker, welcome back to the show.

Tim Baker 01:10

Good to be back. Tim, how’s it going?

Tim Ulbrich 01:12

It is going well, I’m excited for this discussion. I’m not sure most listeners are going to be. I think when they see something like credit, maybe, maybe like tax, they’re like, whoa, blah. You know, not, not the most exciting thing to discuss. But I think especially true for those that are focused on more inspiring goals of the financial plan, right? Those that are focused on investing or making a large purchase, maybe paying down debt or giving goals that you’re working towards achieving, those are, those are exciting, right? Credit, maybe like tax, not so much, but as we’re hopefully going to lay the case out today, such an important thread and part of the financial plan that we want to make sure we’re aware of and we’re optimizing the best that we can. So we’re going to talk today about why credit matters. Factors that impact your credit score. If we understand those, we can work to improve those. Some of the misperceptions around credit, and then how to protect your credit and how to protect your identity with credit. So Tim, before we get any further, I think it’s important that we check in with ourselves about debt and how we feel about debt, whether it be having debt, using debt, everyone can feel different if we think about the spectrum of this. So tell us more about debt utilization and why this is important before we get into the discussion of optimizing credit.

Tim Baker 02:27

Yeah. So if you look at the spectrum of debt, you know, you, most people probably heard of the term, like good debt and bad debt. And I think, like, if you put all the types of debt out there, you know, everyone’s line is a little bit different, probably not too different. So if you think if you think about like things like a mortgage debt, so you know, this is a note that you have on a home that you’re living in, it’s a use asset. Maybe you’re raising a family. Hopefully that home is appreciated over time, so you are paying interest on it. Most people would say, Hey, pretty good debt. Things like, if we go over kind of a notch, you know, something like student loan debt, which I know is near and dear to a lot of our listeners, a lot of people still say, for the most part, student loan. You take out loans to be educated and trained, for the ability, for the opportunity to essentially earn out earned peers that don’t necessarily have a college degree. You can argue there’s probably a spectrum inside of that spectrum itself, of like, what’s good student loan debt and bad student loan debt type of thing, but most people would say, hey, you know, even today, most people would agree, the studies show that if you’re if you, if you have a degree, you’re going to earn more over the course of your career. So most people say good debt. When you get beyond that, that’s where it kind of gets a little bit shady. So you know, the next one over is probably things like, like a car note, like an auto debt. The problem with a car note is that you’re you are paying interest on an asset that is depreciated the second that it pulls off the lot, and every year thereafter. So it’s still a use asset. It does the job of kind of getting you from A to B, hopefully, you know, to work or just to live your daily life. But a lot of financial experts would say, if you can go without, you know, financing a car, do that right? Because of all the things that I mentioned. What I typically see the evolution of things, Tim, is like a lot of people, if they’re a couple, a lot of them will see them early in their career. Maybe there’s two car notes, and then maybe they transition to one, and then towards the end of their career, we should be buying cars in cash. And I think it does, you know, force the issue of, like, do we really need an, you know, $80,000 car? You know, can we get by on a $30, $40,000 or whatever it is? Again, no, hate on that. If that, if that’s your your bag, it’s just, you know, is this part of your plan? But most people, that’s kind of where the line is drawn is like, okay, what kind of debt is that? Is that good, bad or indifferent? So from there, you get into things like the cost of, you know, like furniture. A lot of people, hey, I just moved, you know, I need to, you know, I, uh, basically fit out my apartment. So I’m, I’m putting furniture on, uh, on, on debt, and I’m paying that off. Again, a lot of people say, don’t necessarily do that, and you have all the way out to so, you know, the purchases of wants and not necessarily needs, that’s typically can fall on credit card debt, which can be super predatory, if that can get out of control. And you know, you have things like payday loans, which are, you know, really, really bad. So that spectrum of sorts is kind of where you, you know, kind of review. And I would have people look at their own debt that’s on the books and say, Hey, like, is this good bad debt? And if it’s, if it’s bad debt, let’s really, you know, that’s the bleeding head wound potentially, of your financial plan. So let’s really tend to that and triage that. If it’s good debt, we’re not going to, you know, ignore it. We’re going to have a plan for it. But we just know that it’s more about the plan to pay off the debt versus paying off the debt, you know, make sure that we’re doing for the bad debt. So that’s kind of the spectrum in terms of how I look at at debt, and you know, how this can fit over, you know, into the whole, you know, credit, you know, credit discussion.

Tim Ulbrich 06:05

It’s important we start there, right? Because credit, by definition, is we’re taking on debt, right? And we’ll talk about how that might be utilized. What are the risk? What are the upside, you know, potential leverage opportunities. How do you optimize credit? Where does it have an impact? But you know that is a step in the direction of taking on debt. Now, some people will talk about the different types of more detail if you’re paying off card each and every month, like you might not look at that as necessary taking on debt, but that’s essentially what the bank is evaluating. Is, what is your risk? What risk are you to the bank in terms of being able to pay off that debt? And that’s going to depend on the terms that you’re able to get. And I think, as we so often say when we think about debt for our own financial plan, or I know our team’s doing this when they’re advising people, we’ve got to look at the math, we’ve got to look at the different types of debt, and we’ve got to look at how someone feels about the debt, and we put all of that together when we’re looking at debt as a part of the financial plan. And when you have two individuals, spouses, partners, significant others, coming together on the financial plan, especially if we have different feelings around debt, you know, there has to be some discussion to be to be had there as well.

Tim Baker 07:06

Yeah, for sure. I mean, there, there are, there are some people we take the student loans, for example. There’s some people that are like, this needs to go yesterday, like, I have anxiety. It’s a weight, blah, blah, blah. And there’s some people that are like, meh, yeah, it is what it is, right? Yeah. And that emotion plays right? So I think now, again, I think the way you can like, if you’re like meh for credit card debt, like, I think there’s a like we there’s a realignment that we need to do like, because, again, mathematically, if you’re a meh, you’re gonna, you’re gonna see that, you know, talk to a prospective client that had $25,000 in credit card debt, you’re gonna see that, if you have a meh attitude, that 25,000 is gonna grow, you know, balloon to $50k. Very, very quickly. So I think it’s important to understand that too.

Tim Ulbrich 07:50

So let’s jump into our first part of the episode, why credit matters. And as we start this discussion, I think it’s important we understand how credit works. And so Tim, you know, as a consumer, you know, whether it be, you know, credit card purchase you’re using, you know, you swipe your card at the store, and then somehow, some way, that ends up impacting our credit report, our credit score, as well as other types of debt. So take us through the credit cycle so we can understand how credit works.

Tim Baker 08:17

Yeah, before I get into this, let me, let me just talk about, like, kind of the legislation that kind of set us on this path of like our credit system so, or at least revised. So back in 2003 the Fair and Accurate Credit Transaction Act, or FACT Act was passed that essentially allows free access to credit reports, and kind of what I’m describing here shortly, to every US resident, at least one free credit report every 12 months from each of the three major credit reporting agencies, which is Equifax, Experian and Transgenium. It also set up provisions to reduce identity theft, which we know continuously are becoming more and more of a thing as we as we kind of transition to more, even more and more of a digital world. It requires, you know, companies to securely dispose of your consumer information. That’s a big thing for us as an RIA oversight by the SEC, and on the tax side, a tax firm oversight by the SEC like or the IRS, I should say there, it’s a big deal, right? And the last thing it does is it doesn’t necessarily require a lot of these companies to give you free credit credit scores, and we’ll talk about the, you know, the report versus the score, but they become more ubiquitous through like, Hey, you can get it through an app or your bank oftentimes. So a lot of that has been, you know, less a B to C of like, Hey, Tim Baker’s gonna go buy my you know, see my credit score, where the places that I bank or do business with kind of do that B to B, and then they and then they do that as a benefit if I’m banking or doing whatever with them. So the fact that kind of, like lays the groundwork, essentially how this works, Tim, is you have, you the consumer, you the the the borrower, and your behaviors kind of, kind of start this cycle. So you essentially, you know, you’ll go and you’ll buy a car, or you’ll swipe your credit card for groceries. Essentially what, what’s happening here is, when I do that, I’m asking MasterCard or Toyota, a creditor for credit to basically make these purchases because I don’t have or I don’t want to spend the cash in that moment. The creditor, especially for something major, like a car, a car note or a mortgage, will say, okay, this person do I want to grant them credit? So the way they typically do is they look at those three reporting agencies that are there that are basically the gatekeepers of the information of the behavior related to your ability to pay back your debts in full and on time. So those reporting agencies for all the different transactions, whether it’s credit cards, whether it’s another type of revolving debt, student loan, a mortgage, whatever it is, collate all this information from these creditors and at the reporting agencies, and then they basically build out credit reports. So the credit report is kind of your report card with regard to your credit, credit, so it’ll show all the different, you know, adverse accounts. So hopefully you don’t have any of those. And then also accounts that are in good standing, that are basically like, Hey, we’re doing what we’re supposed to be doing. Now, it’s hard, in a snapshot world to say, okay, like I’m looking at a bunch of pages of a credit report. How do I actually as a creditor, as someone that’s going to lend this person money? How do I quantify their ability to pay me back in a timely manner, and that’s where we get the credit score. So the credit score basically distills down your ability to pay back the money that you owe, and then that credit score then feeds back to you where you say, okay, hey, I have a 750 or an 800 credit score. So then I then take that back to the credit card and say, like, see, this is like, I’m good, or like, maybe I’m not so good, and that affects, again, that whole cycle. So that’s essentially how it works, in terms of, like, how credit is tracked and reported and then quantified for you, the consumer.

Tim Ulbrich 12:18

That’s a great summary, Tim, because I think is we’ll talk about improving your credit score here in a little bit. If you understand your credit report and you’re checking your credit report, I know this is something you said on the show before, like, hey, mark your calendar once a year. Maybe it’s when the clocks change, whatever, where you’re pulling your report, right? You mentioned the three agencies, Equifax, Experian, TransUnion, and when you start to dig into those reports, you’ll understand the different variables of which are being aggregated up and reported on to the credit score, which will then help you understand, oh, well, maybe I can increase this or improve this, or do this differently to grab up my credit score, which then has an impact on the different parts of the financial plan. So all connected. Great description. And why does credit matter, right? I want to make sure we don’t, we don’t brush by that obvious but important question we’ve all probably been told at some point in our lives by a parent or, you know, an advisor, or someone like, you got to build credit. You got to have credit. You got to have a good credit history. What’s the so what? Why is this so important?

Tim Baker 13:17

Yeah, so I think, like, if you, if you kind of look at some of the things that credit effects, it’s, it’s it’s kind of your ability to get credit and like what you pay on that debt. So interest rates. So lenders use your credit score and history to determine whether approve a loan or to give you preferable or less than preferable rates, and this affects mortgage or auto personal loans. So good credit usually, you know, good credit score usually gets the best the lower interest rates. You know that which saves you money over time, which could be huge. When you talk about, you know, a 2, 3, 4, $500, $600,000 purchase, when we talk about a home. You know, renting a home, you know, a lot of landlords check credit reports to assess whether potential, tenants are financially responsible. We do this with our tenants. You know, it’s one of the things we that a lot of landlords will do to make sure that, hey, is this person going to actually, like, they’re going to assign the dot line say they’re going to, you know, pay this rent? Like, are they actually going to do it? Insurance premiums, in some cases, insurance companies use credit information to set premiums, particularly on auto insurance. Again, it’s kind of a measure of of reliability, even employment. Some employers check reports as a part of their hiring process. For you know, especially if it’s related, you know, to finances or sensitive information. So poor credit can negatively affect your job prospects. I think it’s tied, it’s also tied to utility services. So utility companies think electric, water, internet, may check your credit when you sign up for a service. So they could actually require a deposit or deposit or even deny services. You know, if you’re obviously, if you’re, if you’re applying for credit cards, you know you’re going to get the best rates and the higher, higher limits if you if you have better credit, maybe even better rewards. And then, you know, just good, like financial flexibility, right? A good credit history gives you more options for borrowing and managing your finances during emergencies or making major purchases. Now, some of those are going to be systemic, and we talk about this with business owners like right now is the time to get a line of credit right? Because once the market changes, or the economy, you know, we go through a recession, you know, that’s when, you know, a lot of credit freezes. So you want to establish good behavior and be able to access credit when things are good, not when things are bad, right? Goes back to planning. So that’s really the so what, Tim, of like, why it’s important, and is, I think it is becoming more of a measure of overall reliability. That is, again, it’s very much for your finances, but I think that’s a good indicator of your overall reliability in general. So that’s the so what.

Tim Ulbrich 15:59

That’s why I used the word thread earlier, right? Look at the list of examples you just gave of where this can impact the plan. I think the one that people are often thinking about is like, Oh, if I go to buy a home, you know, very practical. If my credit score is x versus y, and x is better than y, then I’m probably going to get a more favorable, you know, rate on my loan or, you know, buying a car purchase. But I think there’s some other ones that you’re alluding to when you talk about, like, line of credit out in the business on the business side, you know, having good credit puts you in a position to take calculated risks in the form of leverage, and to do so at the lowest cost possible. Now, calculated risk, right? There’s always going to be risk involved, and there can be a downside to that as well. But fair or not, I mean, that’s really the system that we live in, and and our financial systems are rewarding those who can take on and pay off their credit. And so, you know, starting a business, investing in a business, buying real estate, you know, beyond your primary all these things are going to require, unless you’re bringing cash, they’re going to require you to have your credit evaluated.

Tim Baker 16:54

That’s right, that’s right.

Tim Ulbrich 16:56

All right. Second part is understanding and improving your credit score. And there are several factors, Tim, that go into the credit score, and I think as we understand each one of these, we can begin to then think about the strategies to improve our score over time. Maybe some of our listeners have great credit, and it’s keep doing what you’re doing. Others, maybe, you know, because of a final year of pharmacy school residency, other things you know, they had missed payments and other types of debt that accrued. Maybe there’s some repair a credit that needs to go on. So take us through the the main factors as it relates to the makeup of a credit score, and especially those that have some of those higher impact factors. Yeah.

Tim Baker 17:37

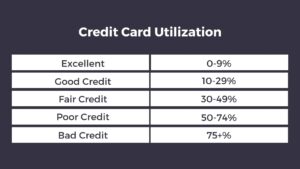

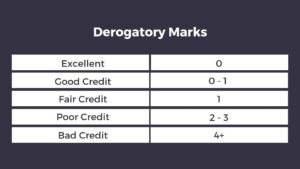

So and when I, when I first started learning about credit back in the day. Tim, like, a lot of the information that I researched, and like, Credit Karma was a great resource for me. And if you actually, again, not a commercial for them. But I personally use Credit Karma, a lot of their things checked out. That’s where I can get, like, a free it’s not free -they’re selling my information. And every time I go on their app, you’re like, hey, this is a great credit card. So like, there is a there’s a price for it. But like, I was, you know, I was skeptical at first, I’m like, Hey, is this really legit? And then I, you know, actually purchased the TransUnion credit score and everything was kind of like, matched out, right? But they, I think they do a good job. It’s a great resource to kind of understand at a very high level, like, how this works. So if we talk about the factors of a credit score, where the rubber meets the road, probably the highest impact factor is payment history, and from what I understand, it makes about 35% of of your score. This is the most predictive factor and determine whether a borrower will repay debt as a history of on time payments indicate lower risk for lenders. So if you are missing payments, then you’re gonna, you know, your your score is gonna get hurt, which is gonna, you know, affect all those other things that we talked about. So can you pay your bills on time? And on time is actually flexible, so, like, once you go 30, days beyond like, a due date, that’s when you typically get hit. So like, if my credit card bill is due on October 15, and I miss that payment and I don’t pay it by November, if I pay it by November 1, I’m still good. It’s still on time for the credit reporting agencies. Once I get to that November 15 date, then that’s where I get I get dinged. So that is the that’s kind of where the rubber meets the road and everything else around this is important, but it’s not as important as, Are you paying your you know, what’s the history? Are you paying it back on time? The other high impact factor, which makes up about 30% it’s called, Credit Card Utilization. I’ve also seen it called like, what’s the amount that you owe, amounts owed? So this is the amount of debt you carry, especially as a percentage of your total credit line, your limit. So this is credit utilization, and it’s it’s highly correlated with risk. So in this case, what lenders like to see is it’s the lower your utilization, the better. So they like to say, hey, you have available credit to you, you’re just not using it. So anything that is basically 10% or below you, it’s typically excellent, right? So if I have a $10,000 limit on my credit card. Let’s say I have a five and a five. I have two cards. If I’m carrying anything more, carrying meaning like I don’t I don’t pay it off at the statement balance. If I’m carrying $2,000 then my credit utilization is 20% and that’s it’s still good, but it’s not excellent. So lenders like to see you have the ability to use it, but then they want you to pay it back in a timely way. So the big thing here is to keep the balances low. The next one, Tim and these, these last, really three or so, are more medium and low impact. So the next one is age of credit or, like, the length of credit history. So make sense, right? The longer you know, if this is not your first rodeo, the longer that you’ve been using credit successfully, it’s a little bit of like, like, again, your parents have been doing this for a while. If you’re just out of college, or you’re just in college, you don’t necessarily have the wherewithal to, like, understand how it works. So typically, the higher is better. So they want excellent means you’ve had, you know, accounts open for nine plus years, and this is on average. So lenders like to see that you have experience using using credit. The next one is the total accounts, which makes up about 10% that you can also think of this as, like credit mix mix, so managing a variety of credit types, whether it’s credit cards, auto loans, student loans, mortgages, suggest a responsible borrower that can handle different forms of credit. So the idea here is, they want you to be able to do a little bit of a lot of different types of credit, right? So, you know they want, they want you to say, Okay, we have fixed, we have revolve, and that type of thing. The big thing here that I thought that was kind of counterintuitive, is that the higher the number of counts, the better I would think, like, man, if you know, if I only had one or two, that would be a lot better from a from an agency perspective, or for a lender perspective, than if I had like 20. But what they what we have to remember is that your your your accounts, they own your report for 10 years. If they’re good, if you have if it’s negative, it stays on for seven years. So think about the last 10 years of all the different things that you’ve done, Credit Wise, that’s what they’re counting. For a lot of pharmacists, they get a number. They get in another account with every student loan. For a lot of us, like when we’re looking at a client’s credit report, particularly when we’re looking at student loans, it’s several pages longer than most people just because of the student loan burden. And the last thing that’s there is the hard inquiries, or, like, the new credits part of the score, and that’s also 10% so that’s where, you know what lenders don’t like to see is they want, the lower the amount, the better. So what they want to see, they don’t want you basically going around town, proverbially, going around town, like inquiring on additional lines of credit. So this results when you apply for credit. So if I go to buy a car and I’m buying it through Ford, they’re going to run my credit. That’s a hard inquiry. Or if I’m, if I’m getting a mortgage, or if I’m, you know, moving and I’m renting a place, they might run it a credit on there, and then, and then the utility. So they really like hard inquiries to be excellent is zero to one, good is one to two, and anything above that is fair. I could tell you, Tim, I have a crap ton of hard inquiry just because of the things that we’ve done over the years, that those typically fall off after two years, but that, and I think what they’re trying to do again is they’re trying to look at, okay, how much is this person actively accessing new credit now, I think, I believe that, I don’t know if it’s a week or two week, but say, like, I go and I apply for credit at Ford, Toyota, Tesla, they’ll group that, those hard inquiries into one, if it’s within like, a two, a one or two, yeah, so they don’t ding you on multiple I would, I would say, though, like you probably shouldn’t apply for credit for all of those, but that that’s what happens with those. So those are the kind of the big, the big factors that kind of play a part into your credit score.

Tim Ulbrich 24:44

Great stuff. Quick summary, you mentioned five factors, payment history, credit utilization. Those together more than 60% so those are two big ones we want to pay attention to. The other three that are medium to low impact, age of credit history, total accounts, hard inquiries. I’m glad you mentioned the student loan piece, right? Because one of things I’ll often hear from new graduates that are learning about credit and trying to improve their credit, they’re like, oh, well, I haven’t had a credit card for that long, and they might only be thinking in that and that bucket, right? But if you have student loans, like you have multiple accounts on your credit report, and you’re going to start to establish the credit history as you pay those off, or you mentioned car notes, credit cards, obviously, there are other things there as well. Again, Tim, if we if we start to understand these, especially if I just focus on the first two for a moment, payment history, so on time payments, and then credit utilization, so the percentage of credit available that we’re actually using month to month. If we understand those and the large impact them at our credit score, we can really start to lean into strategies to address those, if they’re an issue, right? So I think about things like automatic payments, auto bill pay. Is that strategy? Yeah, with credit utilization, I know I’ve gone back about once a year, ish, maybe every 18, 24, months, to say, Hey, by the way, can we increase our credit limit? So asking for increases in credit limit now, understanding that that might have counted a hard inquiry, but asking for an increase in credit limit is then going to obviously drive down your utilization rate, unless your spending is going up, you know, at the same price. So these are some common things that we can think about, auto bill pay, asking for increases in credit limit if it makes sense that that can be favorable to our credit score. Yeah.

Tim Baker 26:20

Another, another thing you could do, like, again, if there’s parents out there of, like, kids that are starting to drive, I remember working with a pharmacist that I looked at their credit – I don’t know, they were probably born in like 1990 but their credit history stemmed back to like 1976 and I’m like, How is that possible? But their parents put them on like a Sunoco gas card. So that kind of give them an advantage, you know, early on, where, you know, typically, younger people have, you know, less than ideal credit scores. And as you get older, almost by osmosis, you know, you figure things out. And you know your accounts age, things like that, you have more of a history. But that was, you know, that’s a hack you mentioned, like, if I’m, if I’m in a good credit band, and maybe I should go through those Tim, but like a good credit band, you know, for scores, is anything excellent, is anything 750 or above. So, and I’m using FICO. FICO is, I think 90% of lenders use FICO. Vantage is another one that’s kind of come onto the scene, I think is used as well. I think they’re similar in this regard. But the score ranges anywhere from 300 to 850, anything above 750 is excellent. 700 to 749, is good. Fair Credit, 650 to 699, poor credit, 600 to 649, and anything lower than 600 is is bad. Now the average, when I look back at this in like 2018, I think the average scores was maybe like 693, in 2020 October, 2023, when I looked at this, it was like 717 which is interesting, because balances for credit, you know, for credit cards for Americans, are at all time high. Yeah, I know they’re trying to look at more like trended data. So like, if you’re if your balances are trending down versus like a snapshot. But I think it’s also important to know for people, like, what’s not used to calculate credit scores, age, sex, religion, race, marital status, zip code, if you’ve ever disputed things on a credit credit report, employment history, occupation and salary. So they don’t care if you make $200,000 or $2 million a year. It’s more about, again, your ability to be so we talk about this with the financial you know, income is not a financial plan. You know, income is not a good credit score. Sometimes people say like, oh, I make $300,000 my score should be great. They’re not. They’re not tied together. So I think it’s important to kind of understand that too, is like, what’s what’s not counted, and how does that play a factor?

Tim Ulbrich 28:47

And those, those may become a factor. I’m thinking about the impact the income specifically, right? If you’re, if you’re buying a home, obviously they’re looking at your credit score, but they’re looking at your debt to income ratio, in addition to the credit score as well. So alright, let’s shift gears and talk about top credit misperceptions. You gave an example of, you know, if you’re buying a car through Ford financing and you go through that application, that’s a hard inquiry, right? That might have a short term negative impact on your credit. Which leads me, I think, to one of the common misperceptions that people confuse, which is your credit score drops if you check your credit. So very different thing that we’re talking about here applying for credit versus checking your credit score. So that’s one of the most common misperceptions I hear is, hey, if I check my credit, it’s going to impact my credit score negatively. What other common misperceptions, Tim, are you typically hearing around credit?

Tim Baker 29:36

One of the big ones is like, oh, like, I’ve had this account. I’ve had this Abercrombie and Fitch credit card since, you know, I was in, you know, high school, like, should I close this account? Because this will improve my credit score? The answer is probably not, because that’ll actually ding you on your, you know, age of credit so, and I had one, I had one recently, where my my age of credit was really good, and I decided to. I had an old card. It wasn’t Abercrombie, it was something else, but I had this old car and I wasn’t using and I’m like, I’m just going to close it. I don’t have any credit decisions. And I closed it in my age of credit, took a took a hit. So, you know, that’s, that’s one of the things. You know, once you pay off an account with the derogatory markets removed from your credit report. So a lot of people like, Man, I missed the payment I got dinged and I have a 30 day lateness. Let me, let me pay it in full. And that’s going to basically go away, unfortunately, no, and I always talk about this when I talk, you know, there was a time where I did, I had this. you know, I ran my credit report, and in May of 2010, I had a 30 day pass, which I don’t know what happened there, and that stays on my credit report for seven years. So it fell off in 2017 but that was something that you know, a lender could say, you know, not so good. And I think what happens too, is, like some people, when they, you know, when they when they when maybe they’re spiraling, or they’re, they’re like, Oh, I missed it. They’re like, they kind of put their head in the sand and they like, they’re like, it is what it is. I’m not gonna be but like, those things cascade, right? So, you know, if you have a derogatory mark, like, that’s fine, but like, stem it, stem the stem the bleed in, right? You don’t want to go into a 60 day and 90 day to where you end up in collections. And I talked to pharmacists that this happens, right and that and like, to me, it’s like, all right, like, that’s in the past. Let’s like, let’s move forward. So, but that will stay on your on your record, on your credit report, for seven years. Another one I hear is like, hey, if I co sign, will that make me responsible for the account? That’s exactly what they do. So be wary when cousin Fred or brother Paul or someone else says, Hey, can you co sign this? Because you’re essentially, you know, from the from the lender perspective, they’re not putting all of their eggs in brother Paul’s or cousin Fred’s baskets. It’s now in your basket as well. So they look at this as a less risky but if your co signer acts a fool and kind of things go awry, you are on the hook for that. And you know, where we see this the most often is like parents co sign in student loans, right? So you want to make sure that you’re on your best behavior. So you don’t necessarily, you know, you know, affect your co signers credit and vice versa. You want to make sure that if you’re co signing for someone, they’re on their best behavior, so it doesn’t affect your credit. And probably the last thing up here, it’s like, oh, if I pay off this day, will I add I’m buying a house? Will I add 50 to, you know, 50 100, 150, doesn’t necessarily work like that. It’s not a it’s not a binary thing. It could help if it drops your your utilization. But it’s not necessarily like a, you know, a, you know, $1 for dollar, it’s going to, you know, increase, you know, your points, so to speak. So those are some of the misconceptions I hear, you know, the one that you brought up about like, hey, if I check myself, I don’t want to check it because I don’t want to like, affect it. If you’re applying and it’s hard, but even that, it’s 10% it’s not going to affect it that much. The big drivers are, are you paying your bills on time? And like, are you using a fraction of the credit that’s available to you? Those are going to be the big the big drivers of of this.

Tim Baker 30:38

Tim, let’s wrap up by talking about credit security, and specifically, the difference between a credit freeze and a credit lock. I think these terms get, get thrown around a lot, perhaps interchangeably sometimes.

Tim Baker 33:27

So broad strokes, like, when, when you think about your credit like, before we get to the lock in the freeze, like, you want to monitor your credit, your credit report regularly, like, so, you know, typically, you know, if the clocks spring forward, they fall back. I think that’s a great time to do it. Admittedly, Tim has been a while since I checked mine. I actually looked at all three of them recently, because I just wanted to see how they’ve changed over the years. And you know, admittedly, I hadn’t run it. I probably ran it over the pandemic, because during the pandemic, they’re like, you can check it every month if you want. So I think monitoring is a good safeguard. I think that using strong passwords and enabling things like two factor authentication will prevent, you know, some nefarious activity if people are trying to apply for credit in your name. So I think that’s a good thing. Setting fraud alerts, a lot of like, you know, banks now they’ll say, like, hey, we just saw Hey, Tim, did you buy that bottle of whiskey in Louisville because you live in Columbus? Like, yes, I did. Okay, get off my back. So. But a lot, you know, I’ll get an email from Credit Karma that says, like, hey, this, this happened is that is that, is that real or a bank? So, you know, credit cards do this too, so you want to be so if you can set fraud alerts, that’s good. Be cautious about sharing your personal information. Shred documents. So like, if you are, if you have documents that you get in the mail that have, like account numbers or social securities, don’t just put that in the trash can, like people take that and mine that data. So I think it’s important to you want to review bank statements, you know, credit card statements from time to time, just to make sure that that those are good to go. When we talk about the freeze, is probably the thing, right? I’m not a big like when I look think of a freeze and a lock the freeze is, I believe it’s legislated by Congress that you have to have the ability to freeze your credit, which means basically, no one can access your like, if you can authorize someone to pull your credit, but if you’ve already frozen it, then, like, you actually have to unfreeze it before you do that. So I did that. I forgot about it. They’re like, Hey, we’re gonna pull your credit. I’m like, Cool. And they’re like, we can’t pull your credit. You have to unfreeze it. So I had to it, and it probably takes about 10 or 15 minutes on each end. So it’s kind of like, you know, you put in your identity, give a blood sample, no, I’m kidding, give a launch code. But it’s pretty it’s pretty onerous to kind of be able to freeze it and unfreeze it, so probably, like, 10 minutes on either side, if you are not making any type of like credit, granting decisions or applying for credit, freezing your credit as a normal part of your overall process should be you shouldn’t have frozen credit at all times. It can be a little bit of a pain. But if you’re not doing those things, freeze, it. The big difference between a freeze and a lock, as I understand it, is that locks are typically paid services by Equifax, Experian, TransUnion that are like, hey, for this extra fee per month, we can lock your credit and maybe you get a little bit more features. So I’m almost like, I’m good with the freeze, and that’s what I typically do. So I would say again, if you are not actively using credit, you want to have your credit frozen and then open it when you know when you do have that. Because Tim is really not a matter of, unfortunately, and I said this to a group of fellows the other day. They’re like, what? And I’m like, It’s true. It’s not a question of if your identity and some of your information is going to get stolen, it’s it’s when, in my opinion. Because you know, you have bad actors that can make a lot of money with your information, so the the more that you can do to proactively safeguard sensitive information and your credit is one of this the better, because I just think that it’s always this cat and mouse game of like, all right? Well, we do two factor, what’s the what’s the, how can we get around that, right? So I think the more that you do to safeguard your identity, your credit, the better. And I think a credit freeze is something that, and again, you can go on each of the reporting agencies and say, and they’ll walk you through how you can freeze and unfreeze it. And, yeah, another one I meant to mention, although I think one of them was hacked, was like, using a password, you know, like a like a Last Pass, or a OnePassword, things like that. I think LastPass was was hacked. But those are it. Those are better than if you’re the pharmacist that’s listening out there that has a note on their phone that that has their passwords, again, guilty as charged in the past, long ago, but you know, you want to have a password vault, so to speak, that you’re using that you know that is you’re using 12 plus characters and that type of thing.

Tim Ulbrich 38:21

Mike, our IT guy would be so proud, Tim,

Tim Baker 38:25

Kudos to me. Yeah, exactly.

Tim Ulbrich 38:27

Great stuff. We covered a lot. We talked about why credit matters as a part of the financial plan, how to understand and improve your credit score. We discussed some of the common misperceptions around credit and credit security as well. So our hope is to have this episode be one that we can link back to in the future. So as always, if you have some thoughts, ideas, topics you’d like to see, reach out to us [email protected] you can also go to yourfinancialpharmacist.com/ask, record a question. Let us know your thoughts. I will also put a plug next week. Our episode, a week from today, is going to be a special one. We’re bringing Joe Baker onto the show to talk about living and leaving a legacy. Joe Baker, many of you know that name. He’s the author of baker’s Dirty Dozen: Principles for Financial Independence, just a great individual, someone who’s a huge advocate for financial wellness, financial education, in the profession of pharmacy, and who is very philanthropic in his own right. And so we’re going to talk about why is giving an important part of his financial plan, and what are some of the areas of focus that he has had as he’s looking at making an impact today, leaving a legacy for tomorrow. So thank you so much everyone for listening. Have a great rest of your week, and we’ll catch you again next week. Take care.

Tim Ulbrich 39:34

As we conclude this week’s podcast, an important reminder that the content on this show is provided to you for informational purposes only, and is not intended to provide and should not be relied on for investment or any other advice. Information in the podcast and corresponding materials should not be construed as a solicitation or offer to buy or sell any investment or related financial products. We urge listeners to consult with a financial advisor with respect to any investment. Furthermore, the information contained in our archive, newsletters, blog posts and podcasts is not updated and may not be accurate at the time you listen to it on the podcast. Opinions and analyzes expressed herein are solely those of Your Financial Pharmacists, unless otherwise noted, and constitute judgments as of the dates published. Such information may contain forward looking statements which are not intended to be guarantees of future events. Actual results could differ materially from those anticipated in the forward looking statements. For more information, please visit yourfinancialpharmacist.com/disclaimer. Thank you again for your support of the Your Financial Pharmacist podcast. Have a great rest of your week.

[END]

Current Student Loan Refinance Offers

Note: Referral fees from affiliate links in this table are sent to the non-profit YFP Gives. | Bonus | Starting Rates | About | YFP Gives accepts advertising compensation from companies that appear on this site, which impacts the location and order in which brands (and/or their products) are presented, and also impacts the score that is assigned to it. Company lists on this page DO NOT imply endorsement. We do not feature all providers on the market. |

$750* Loans ≥150K = $750* ≥50K-150k = $300 | Fixed: 4.89%+ APR (with autopay) | A marketplace that compares multiple lenders that are credit unions and local banks | ||

$500* Loans ≥50K = $500 | Variable: 4.99%+ (with autopay)* Fixed: 4.96%+ (with autopay)** Read rates and terms at SplashFinancial.com | Splash is a marketplace with loans available from an exclusive network of credit unions and banks as well as U-Fi, Laurenl Road, and PenFed |

Recent Posts

[pt_view id=”f651872qnv”]