The Current Reality

*

Update – For student loan considerations during COVID-19, check out

this post.

“I wasn’t prepared to pay back pharmacy school loans, I didn’t understand all of my options, or I don’t know how to balance student loans with other financial goals.” That’s what I hear from many pharmacists and exactly how I felt when I graduated from pharmacy school.

I once bought into the illusion that my “awesome pharmacist salary” would enable me to

pay back pharmacy school loans very quickly and put me in the fast lane to building wealth. Unfortunately, it didn’t exactly work out like that and I made a couple of critical mistakes that cost me

hundreds of thousands of dollars! Because I didn’t know all of the payoff strategies available, I failed to identify the best option and ended up paying way more than I should have.

A

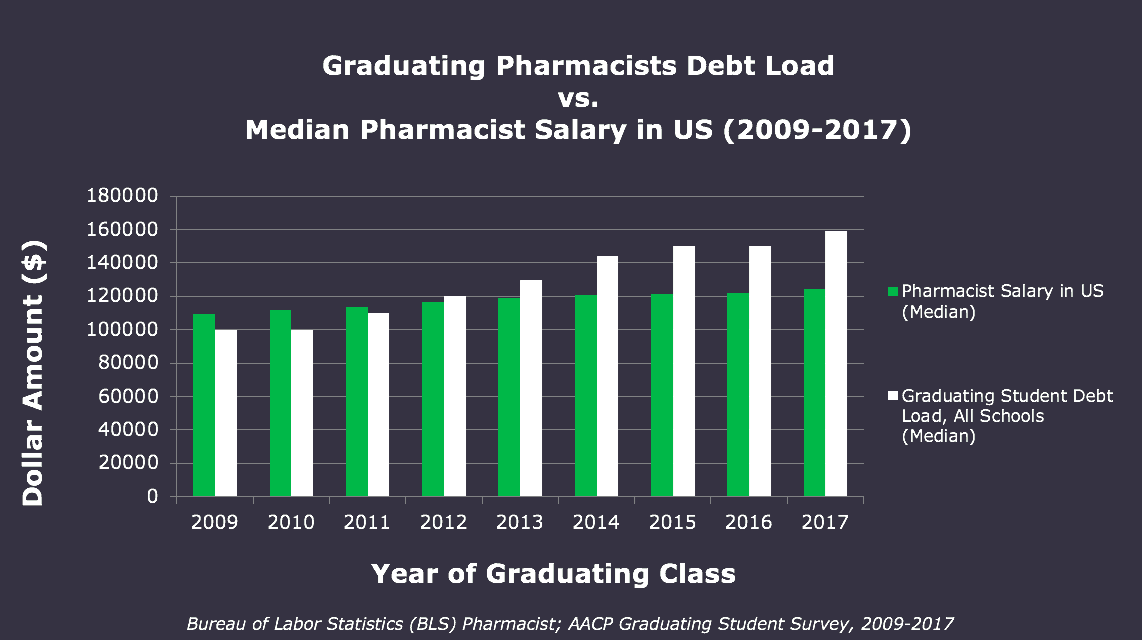

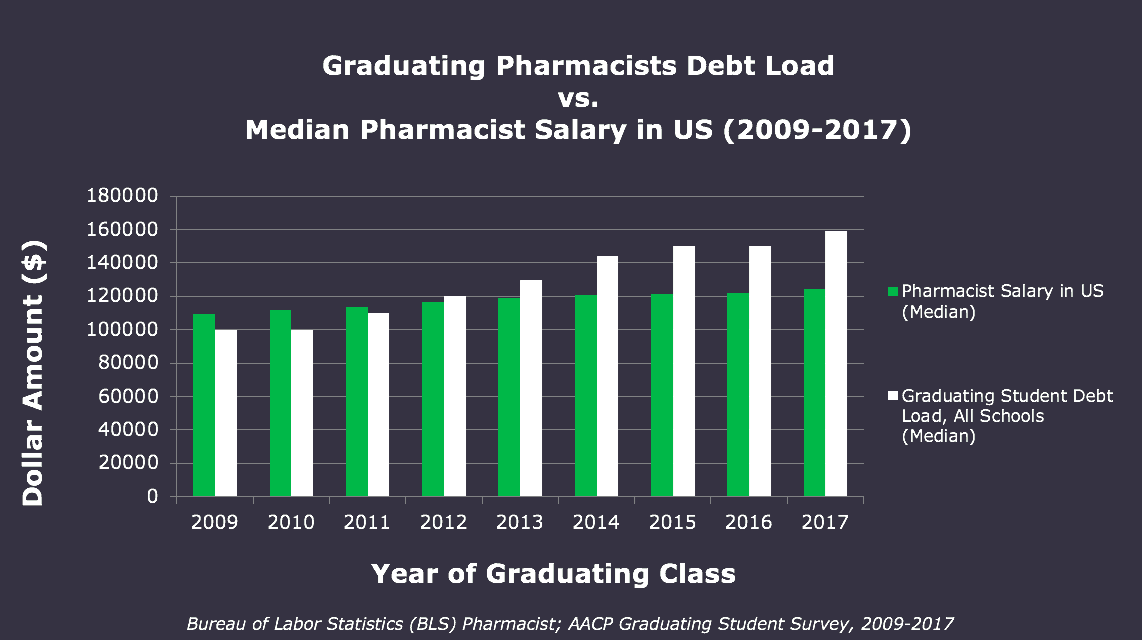

pharmacist paying off student loans in 2018 is a lot different than one who graduated a decade ago. Since 2009, the median pharmacy debt reported has increased about $60,000 with those attending private institutions reporting a median amount borrowed of $200,000. However, these numbers may even be underestimating the issue. Since these amounts are self-reported, they may not include undergraduate debt or capitalized interest.

In addition, the rising debt loads are only part of the problem. Salaries are not keeping pace with rising debt levels and since 2012 there has been a trend with graduates facing an increasing debt to income ratio year after year. Furthermore, many companies are cutting pharmacist hours forcing many to work full-time with less pay.

Therefore, now more than ever you as a pharmacist have to have a solid game plan to pay back pharmacy school loans. Pharmacy schools are not currently required to teach personal finance. Some offer electives and some provide education for their graduating class, but in general, the onus is on you to become informed. Sure, everyone is required to do the mandatory federal loan “exit” counseling but that’s really insufficient and doesn’t typically provide clarity in choosing the best payoff strategy.

With the multitude of student loan types, repayment plans, forgiveness programs, and

refinancing and consolidation, it can be overwhelming trying to come with a plan. This post is a comprehensive guide to help you

take down your loans with clarity and confidence and choose the best strategy that saves you the most money and aligns with your goals. Even if you have been paying on your loans for years, this will help confirm you’re on the right path. We will go through 5 key steps in detail but if you want the short version, you can

download the quick start guide.

Step 1: Inventory Your Loans

Before jumping into the payoff strategies it’s important to know exactly how much you owe and who you owe. Unless you used a private lender or already refinanced your loans to a private lender after pharmacy school, you likely have federal loans through the Department of Education.

You can access all your federal loan information through the National Student Loan Data System (NSLDS). This is the national record of all of your loans and grants during their complete life cycle and contains information on your outstanding balance, interest outstanding, interest rate, and associated servicer. This can be accessed a number of ways but the most user-friendly path is the

Federal Student Loan Repayment Estimator. Logging in with your Federal Student Aid (FSA) ID will pull up all of your loan information and quickly show you your total federal loan balance and weighted interest rate. Check out the video below for a step-by-step approach to access the information.

If you have already started making payments on your federal loans, it’s a good idea to match up the information with your current servicer(s) and the NSLDS.

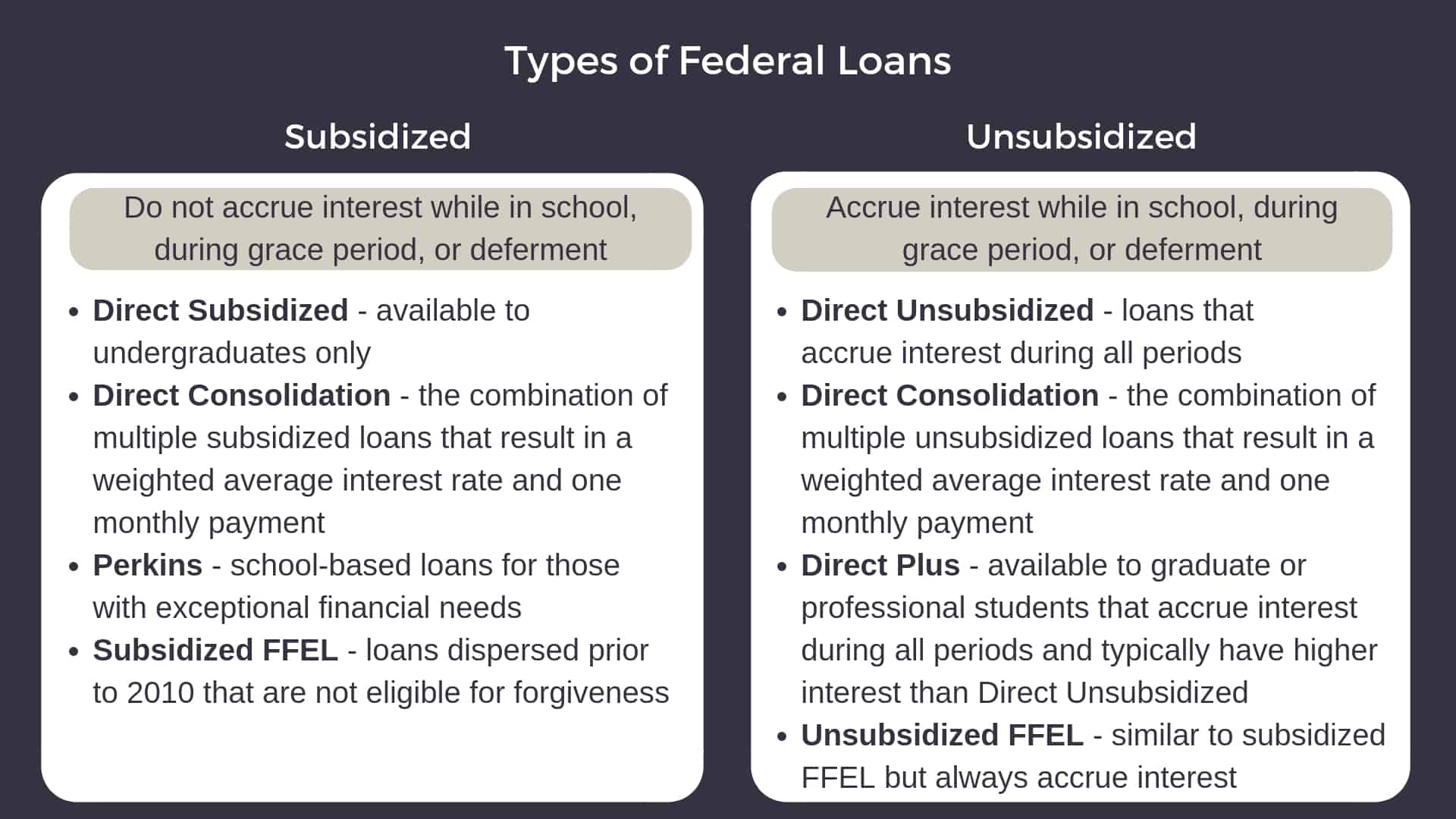

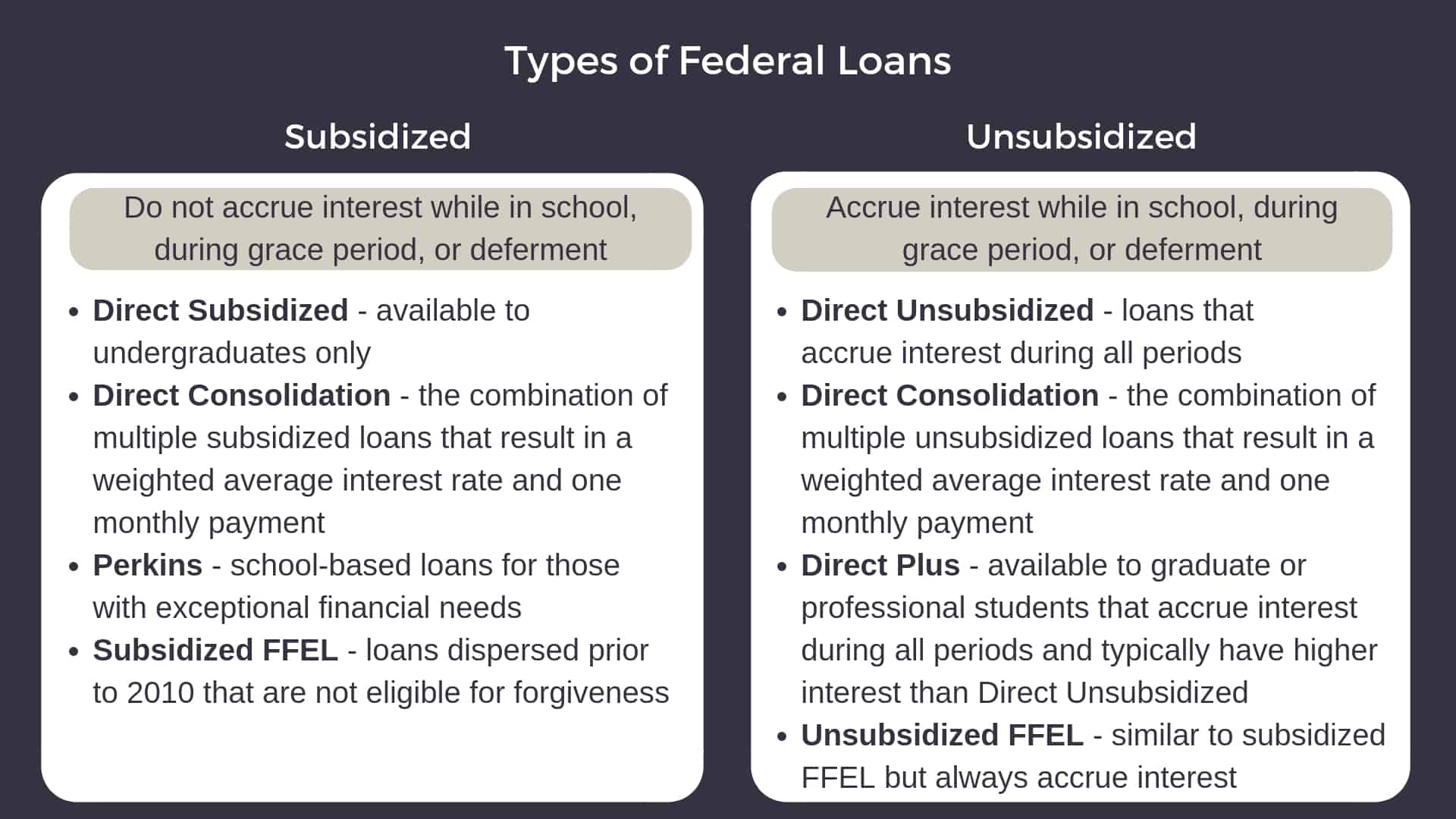

The specific type of federal loans and the respective interest rate is really important to know as it has implications for how interest is accruing, eligibility for forgiveness programs, and deciding which loans to consolidate or refinance. The figure below summarizes the major types of federal student loans and the key points about them.

To confirm the balance on any private loans, go to

www.annualcreditreport.com. Through this site, you are able to access a free report once per year from the three reporting agencies: Equifax, TransUnion, and Experian. Also, when doing an inventory of all your loans, don’t forget to include any balances owed to family members or friends.

Step 2: Determine Your Options

As I mentioned, one of the biggest mistakes I made with my student loans was not analyzing all of the options available. I was pretty much focused on figuring out how to pay them off as fast as possible without even considering the alternatives. Let’s review these strategies in detail.

Three Strategies to Pay Back Pharmacy School Loans

People often get student loan repayment options and payoff strategies confused.

A repayment plan dictates your minimum payments over a designated term whereas a payoff strategy is your game plan for the most effective way to tackle your loans to save the most money which can be executed using a number of repayment plans. While there are many plans with federal and private lenders, tuition reimbursement, forgiveness, and non-forgiveness will be the major ways how to pay off pharmacy school loans.

Tuition Reimbursement Programs

While not abundantly available, tuition repayment programs essentially provide “free” money typically from your employer or institution in exchange for working a certain period of time. Pretty awesome right? Others will require you to pay an amount toward your loans and they will match or reimburse you. The ones that tend to provide the most generous reimbursement are those offered by the federal government through the military, Veteran Health Administration, and the Department of Health.

However, there are many state programs that offer assistance as well. Because the programs vary in amounts and how payments are structured, it’s important to know all the details so you determine how much to pay out of pocket in order to maximize the total benefit offered to you. Also, since many of these programs will not cover your entire student loan bill, you may have to combine one of the other payoff strategies to completely take down your loans.

The following are programs currently available:

Federal

Veterans Health Administration – Education Debt Reduction Program

Eligibility

Pharmacists at facilities that have available funding and critical staffing needs.

Benefit

Up to $120,000 over a 5 year period

Army Pharmacist Health Professions Loan Repayment Program

Eligibility

Pharmacists who commit to a period of service when funding is available

Benefit

Up to $120,000 ($40,000 per year over 3 years)

Navy Health Professions Loan Repayment Program

Eligibility

Must be qualified for, or hold an appointment as a commissioned officer in one of the health professions and sign a written agreement to serve on active duty for a prescribed time period

Benefit

Offers have many variables

Indian Health Service Loan Repayment Program

Eligibility

Two-year service commitment to practice in health facilities serving American Indian and Alaska Native communities. Opportunities are based on Indian health program facilities with the greatest staffing needs

Benefit

$40,000 but can extend contract annually until student loans are paid off.

National Institute of Mental Health (NIH) Loan Repayment Program

Eligibility

Two year commitment of qualified research funded by a domestic nonprofit organization.

Benefit

$35,000 per year with renewal potential

National Institute of Health (NIH) Loan Repayment Program

Eligibility

Two year commitment to conduct biomedical or behavioral research funded by a nonprofit or government institution.

Benefit

Up to $50,000 per year

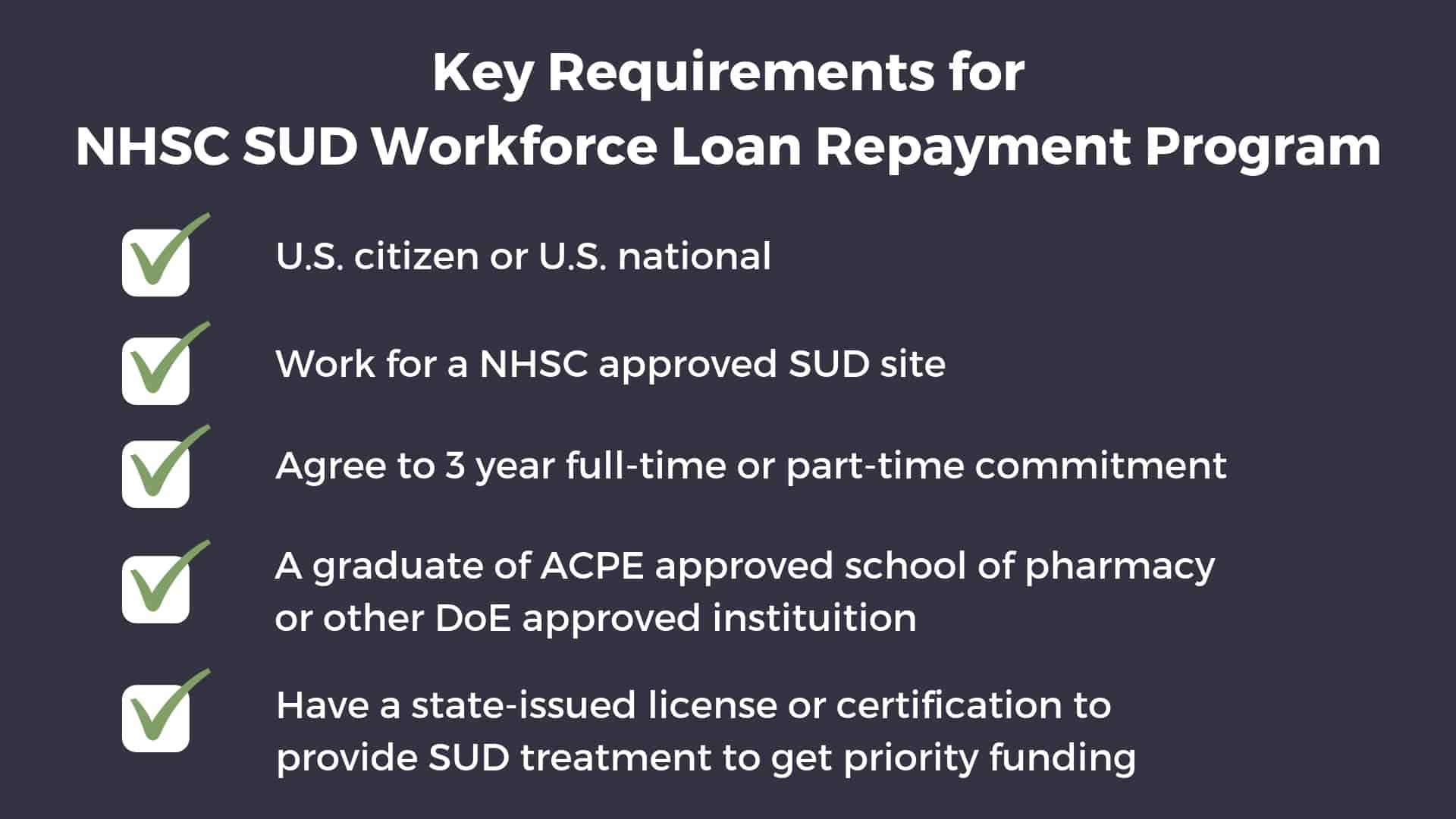

NHSC Substance Use Disorder Workforce Loan Repayment Program

Eligibility

Three commitment to provide substance use disorder treatment services at NHSC-approved sites.

Benefit

$37,500 for part-time and $75,000 for full-time

State Specific

Alaska – SHARP Program

Eligibility

Pharmacists working in underserved communities. In order to qualify, pharmacists must work full-time or half-time and commit to serving for at least three years. After that, eligible candidates may qualify for an additional three years of loan repayment assistance.

Benefit

Up to $35,000 per year. In some cases, if the position is hard to fill, pharmacists may be eligible for up to $47,000 per year.

Arkansas – Faculty Loan Repayment Program

Eligibility

This program is for Health Professions Faculty from disadvantaged backgrounds who serve on the faculty of an accredited health professions college or university for 2 years.

Benefit

Up to $40,000 towards repayment. The government pays up to $40,000 of the participant’s student loans and provides funds to offset the tax burden. Participants should also receive matching funds from their employing educational institution.

Arizona – State Loan Repayment Program

Eligibility

Pharmacists serving at an eligible nonprofit or designated HPSA. Funding varies depending on a variety of factors, such as HPSA score, years of service, and more.

Benefit

Up to $50,000 in loan repayment assistance for a two-year contract and can receive additional funding by committing to additional years of service.

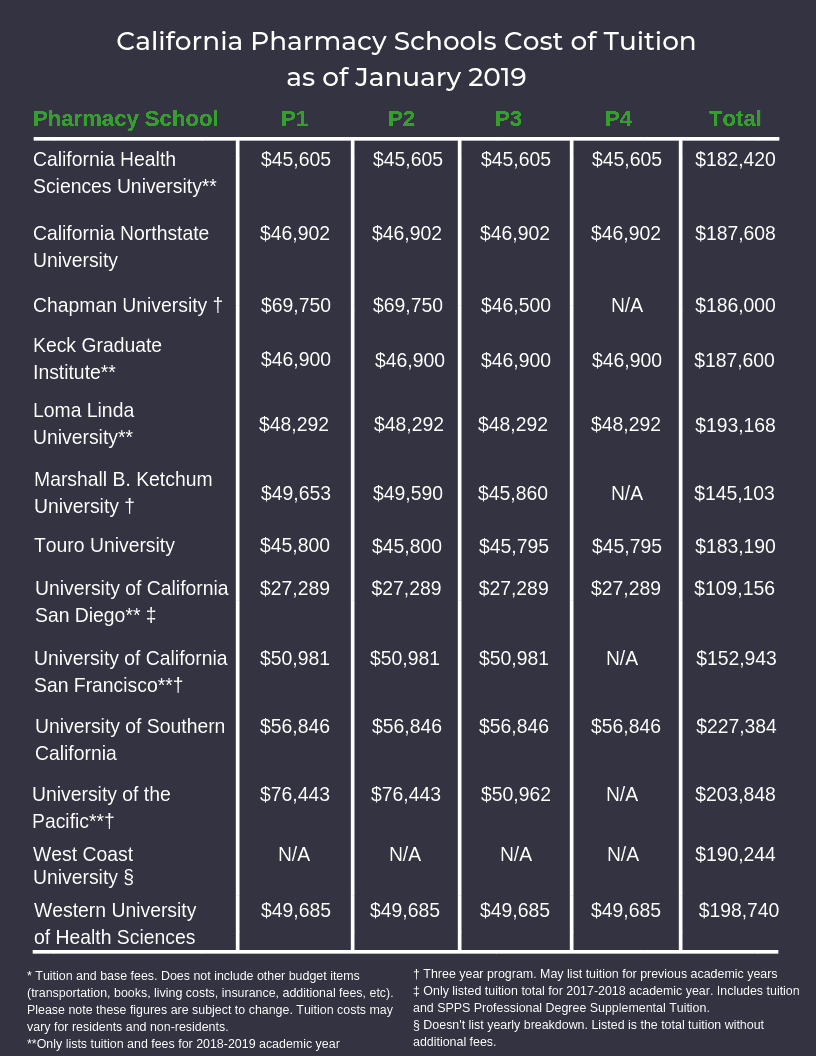

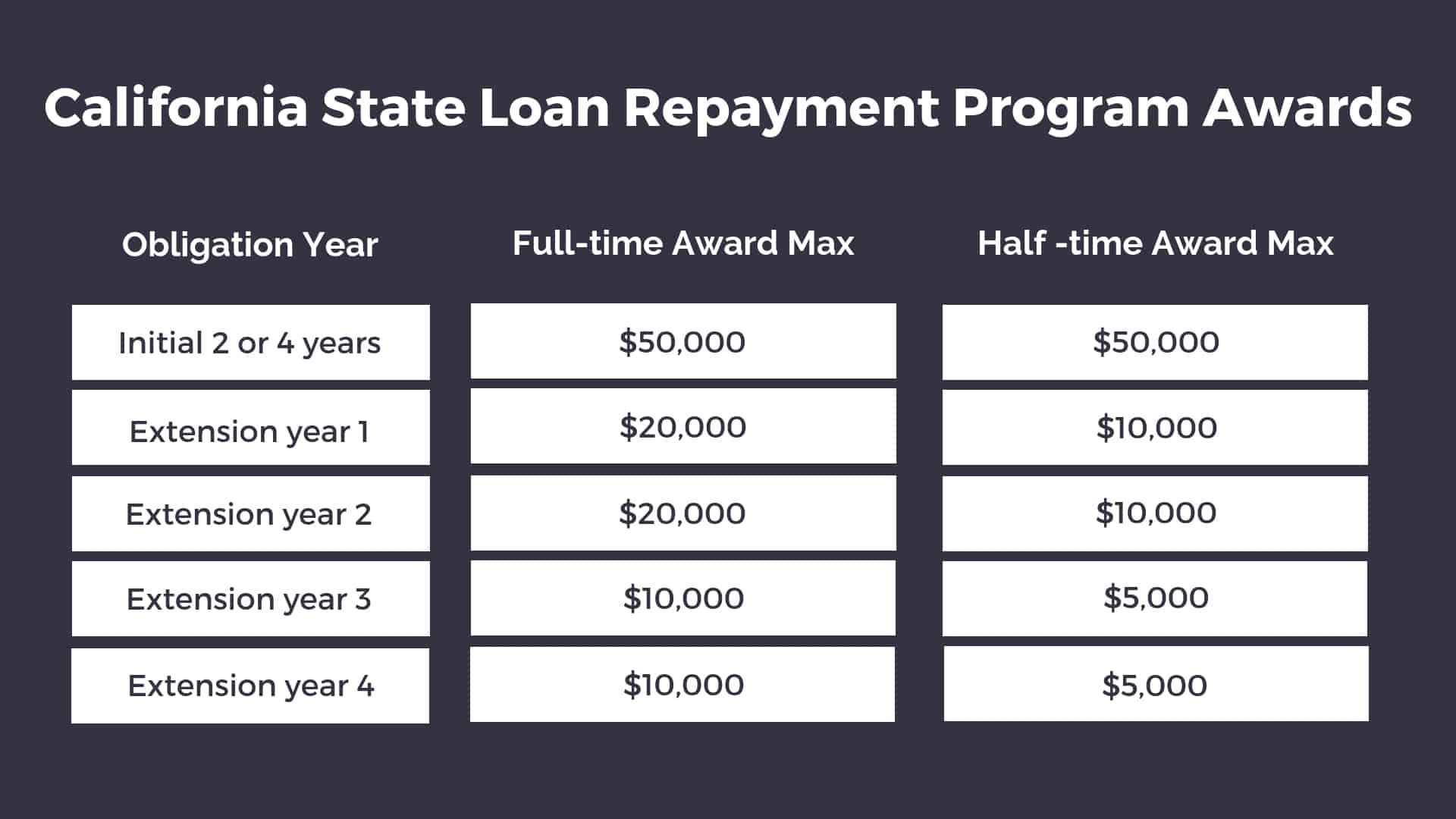

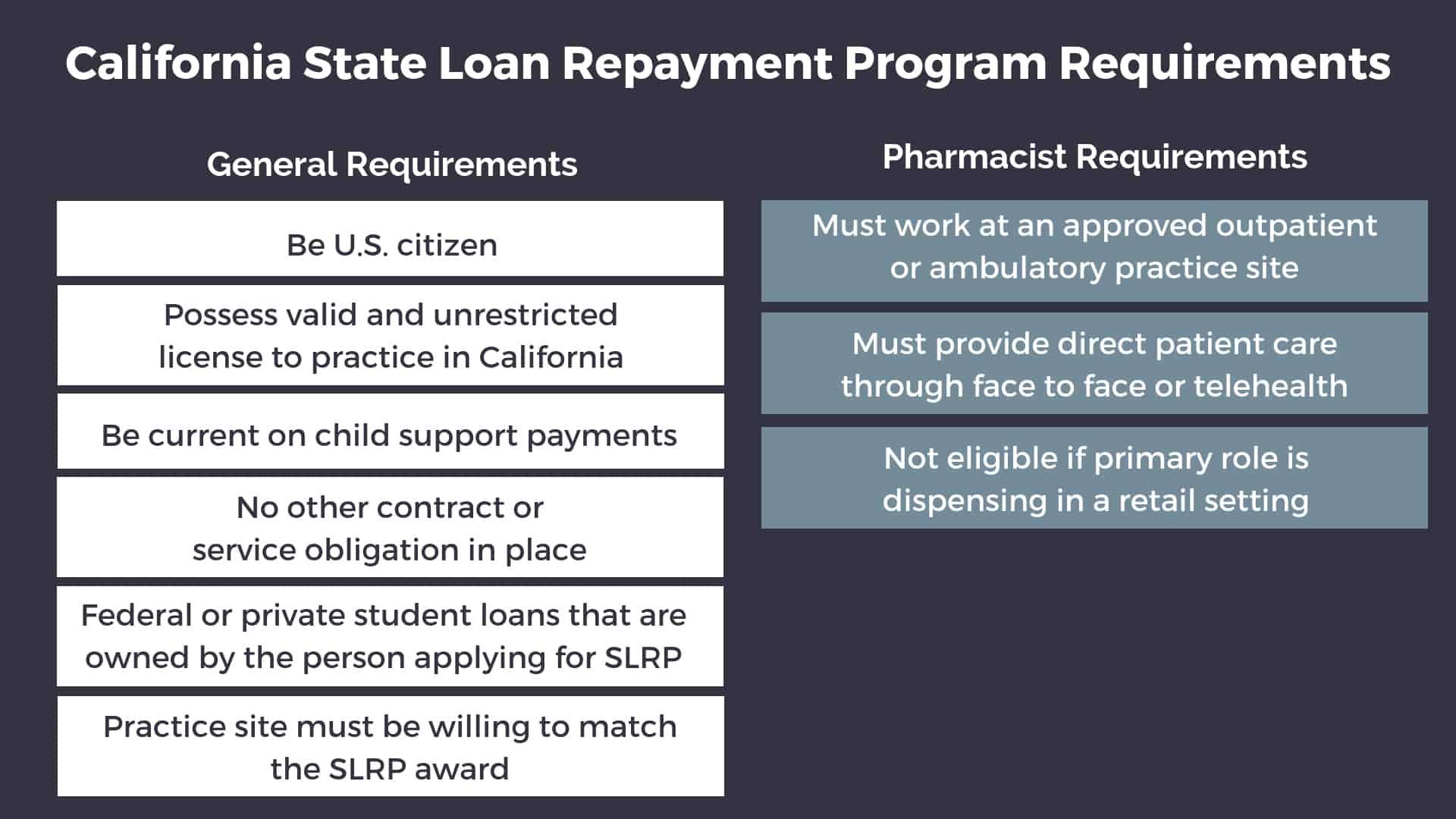

California – State Loan Repayment Program

Eligibility

Pharmacists who commit to working in a designated Health Professional Shortage Area (HPSA). It’s important to note that pharmacists working in a retail setting are not eligible for the program. In order to qualify, pharmacists must work in an approved site, such as an outpatient or ambulatory setting.

Benefit

Up to $50,000 for a two-year service agreement — $25,000 from the program and a $25,000 match from the provider site. Full-time pharmacists may be eligible for one-year extensions for a total of four years, which could result in an additional $60,000 maximum in loan repayment assistance. Half-time applicants are also eligible for awards.

Colorado – Health Service Corps Program

Eligibility

Full-time clinical pharmacists working in a designated shortage area. Pharmacists must commit to three years of service and work either part-time or full-time.

Benefit

Up to $50,000 for full-time while part-time pharmacists are eligible for up to $25,000.

Idaho – State Loan Repayment Program

Eligibility

Full-time pharmacists working in designated HPSAs and nonprofits. This is a matching program, so for every dollar provided by the program, the work site must also match the contribution.

Benefit

From $20,00 to $50,000 for serving a two-year commitment. It is possible to extend the contract for an additional two years as well.

Iowa – PRIMECARRE Loan Repayment Program

Eligibility

Two years full-time service at a public or nonprofit private entity that serves a federally designated HPSA or four years or part-time work

Benefit

Up to $50,000

Kentucky – State Loan Repayment Program

Eligibility

Qualified candidates that work at a designated HPSA and work full-time. This is a matching program, but with a twist. For every federal dollar spent, an employer, family member, friend, or state foundation can match the contribution.

Benefit

Up to $80,000 and must serve a two-year commitment.

Massachusetts – Loan Repayment Program

Eligibility

Full time pharmacists working in a public or non-profit position, located in a high need area, participate in MassHealth, and serve all patients regardless of ability to pay or source of payment. The program is a two year full-time requirement.

Benefit

Up to $50,000 over two years.

Minnesota – Rural Pharmacist Loan Forgiveness Program

Eligibility

Eligible candidates are those that work in a designated rural area. Candidates must work at least 30 hours per week, for 45 weeks or more per year and commit to three years of service.

Benefit

Up to $26,000 per year, for a maximum of four years, totaling $96,000.

Montana – State Loan Repayment Program

Eligibility

Must work at a National Health Service Corp (NHSC) approved site.

Benefit

Up to $30,000 total over a two year period.

Nebraska NHSC State Loan Repayment Program

Eligibility

Pharmacists that work in designated HPSAs. In order to qualify, candidates must commit to at least two years of service.

Benefit

Between $25,000 to $50,000 per year.

Nebraska Loan Repayment Program for Rural Health Professionals

Eligibility

Pharmacists that serve in rural communities in a designated shortage area. This is a matching program and a local entity must match the dollars you receive. There are opportunities for full-time workers and half-time workers, though benefits are reduced if working half-time.

Benefit

Up to $30,000 per year and must commit to three years of service.

New Mexico – Health Professional Loan Repayment Program

Eligibility

Health professionals that serve in a designated shortage area. In order to qualify, candidates must work full-time for two years at an eligible site. Pharmacists may be eligible for the program, but funding priority is given to other healthcare professionals.

Benefit

The maximum award eligible candidates can receive is $25,000 each year, however, the award amount depends on a number of factors, including your student loan debt balance and the program’s available funding.

North Dakota – Loan Repayment Program

Eligibility

In conjunction with the Department of Health, offers loan repayment assistance to registered pharmacists who work in designated shortage areas. This is a matching program where work sites must match the dollars provided. In order to qualify, candidates must commit to two years of service.

Benefit

up to $50,000 a year.

Oregon – Partnership State Loan Repayment Program

Eligibility

Pharmacists who work in designated shortage areas. The program requires a two-year commitment, with the possibility of two additional one-year extensions.

Benefit

Full time providers may receive up to a total of 50% of their qualifying educational debt, up at a maximum of $35,000 per obligation year, for an initial two year obligation.

Part time providers may receive up to a total of 50% of their qualifying educational debt, up to a maximum of $17,500 per obligation year, for an initial four year obligation.

The award maximum is $100,000.

The pharmacist’s practice site needs to provide 1:1 matching award funds in addition to a 10% administrative fee.

Rhode Island – Health Professional Loan Repayment Program

Eligibility

Pharmacists who work at a qualified site in a designated shortage area. There are award options for full-time and half-time employment. Candidates must commit to two years of service, or four years of service if they are working part-time.

Benefit

No specific amount or maximum listed.

Virginia – State Loan Repayment Program

Eligibility

Pharmacists who serve in a designated HPSA at a qualified site in Virginia. The program requires a dollar match from the community work site. In order to qualify, eligible candidates must commit to two years of service.

Benefit

Maximum award of $140,000 for a four-year commitment.

Texas – Rural Communities Healthcare Investment Program

Eligibility

Pharmacists licensed within the past 24 months or be a licensed health professional practicing in a county with more than 500,000 people and move to practice in a qualifying community in the field. Must also provide services to clients that receive at least one form of indigent care in a qualifying community and practice there for at least 12 months.

Benefit

Up to $10,000 in student loan reimbursement or stipend.

Washington – Health Professional Loan Repayment Program

Eligibility

Pharmacists who work at an eligible site. This program does require pharmacists to work at a designated HPSA. Minimum three-year service obligation.

Benefit

Up to $75,000 in exchange for three years of service.

West Virginia – Health Sciences Service Program

Eligibility

Students in their final year of pharmacy school. Must commit to two years of full-time or four years of half-time practice at an eligible practice site located in West Virginia.

Benefit

One-time $15,000 award.

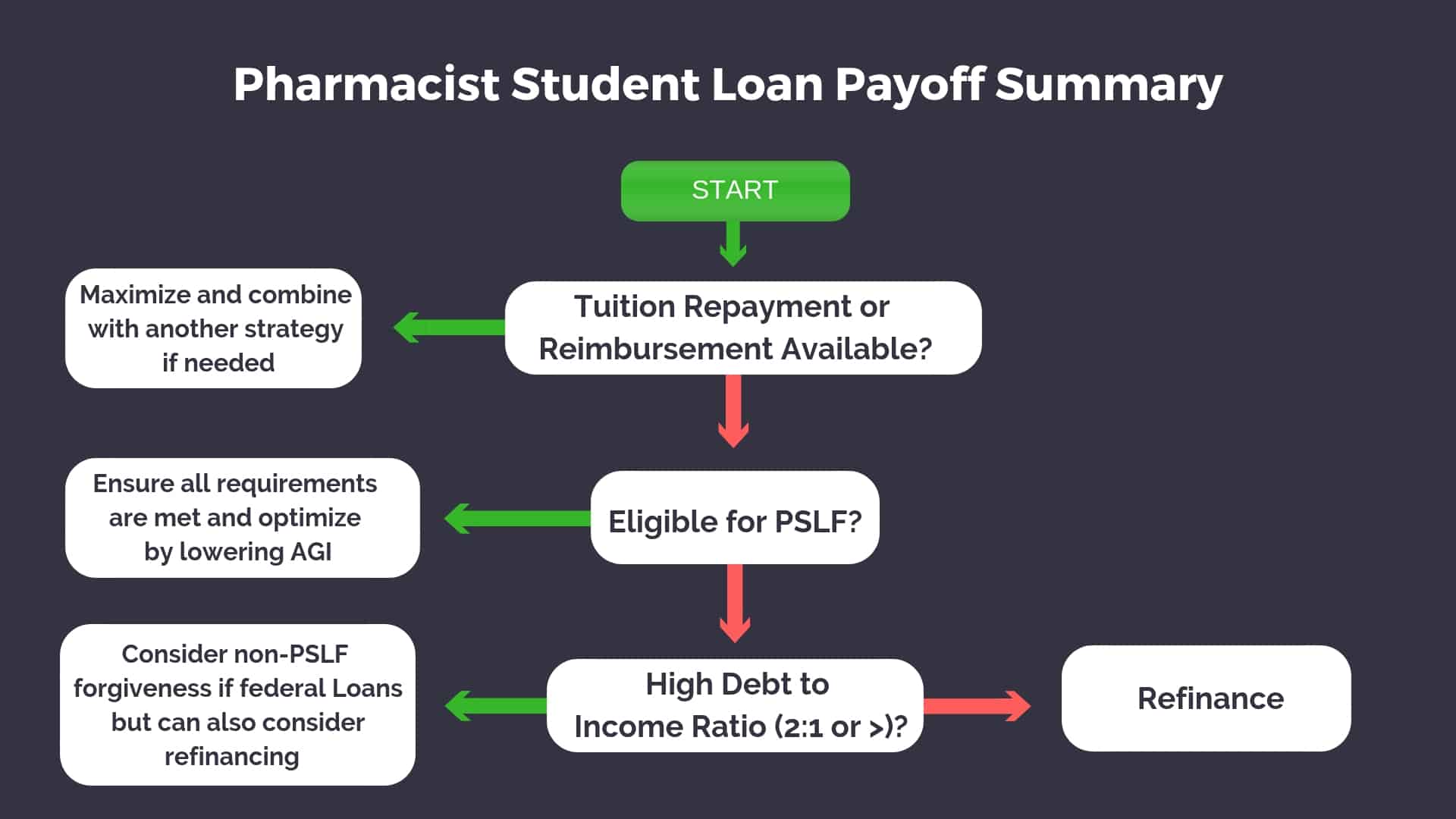

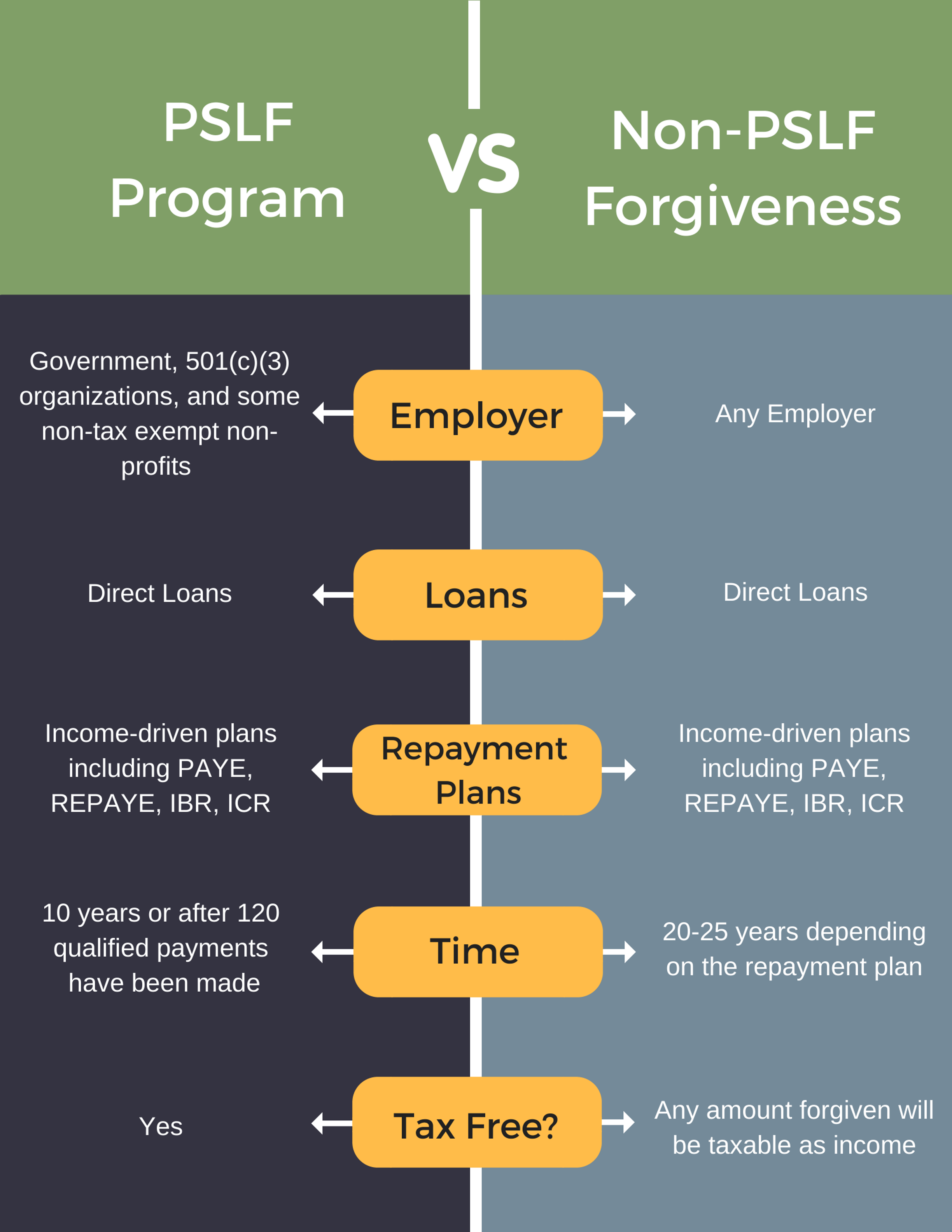

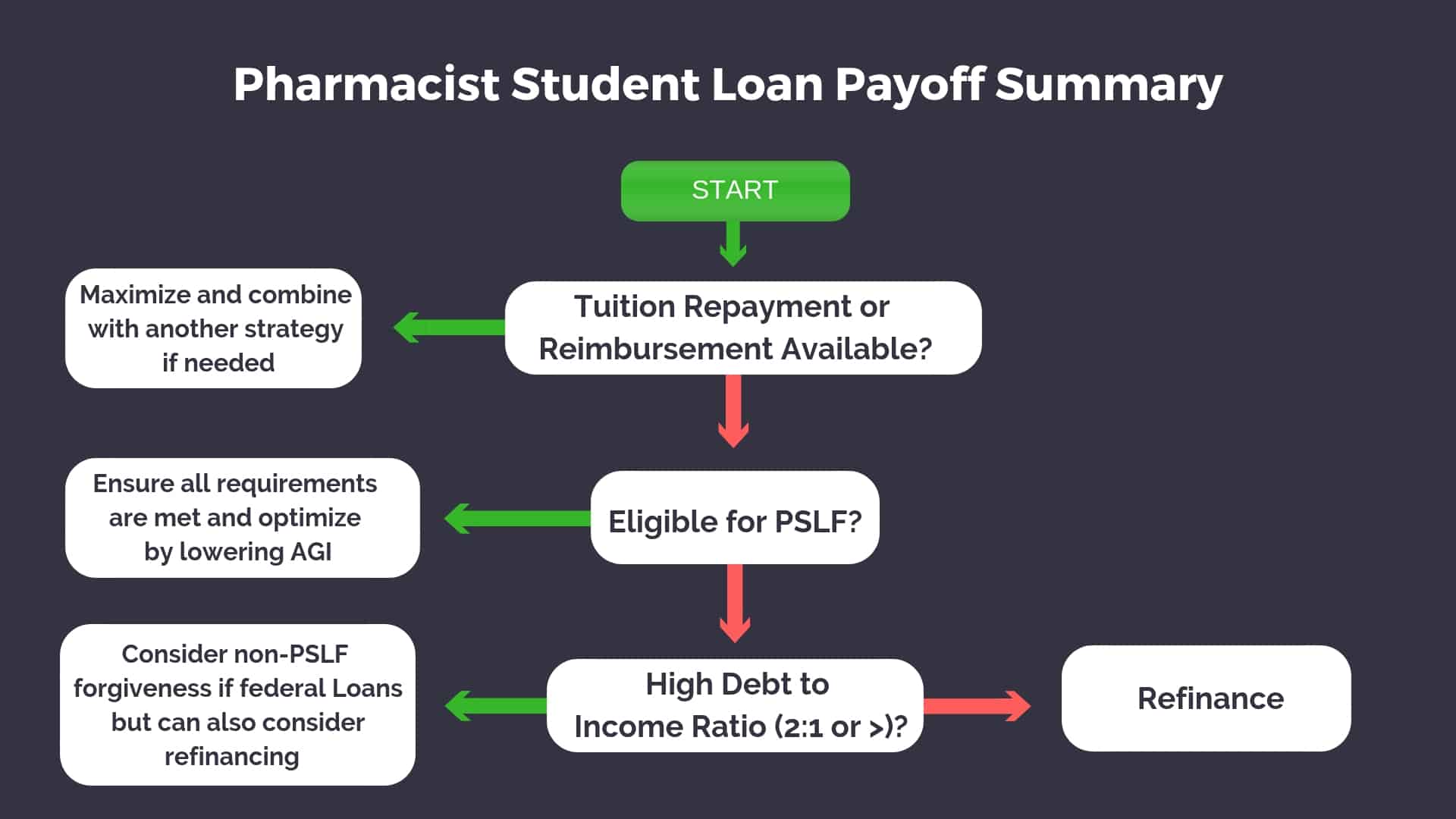

Forgiveness

If tuition reimbursement is not available, the first strategy to assess is forgiveness. You might be thinking this strategy isn’t for if you don’t work for the government or a non-profit, but what most borrowers don’t know is that you have the opportunity to have your loans forgiven regardless of who your employer is. Pique your interest? First, let me explain the Public Service Loan Forgiveness (PSLF) option and then forgiveness outside of PSLF.

Public Service Loan Forgiveness (PSLF)

This is typically the loan forgiveness strategy that gets all the press, usually for all the wrong reasons, which we’ll outline in the coming paragraphs. Let’s first take a trip down memory lane to explain how this program came to be *flashback wavy transition*

The Public Service Loan Forgiveness program was created under the George W. Bush administration via the College Cost Reduction and Access Act of 2007 (CCRAA). Since the program’s inception, its faced political opposition from both administrations since Bush. President Obama proposed a cap of $57,500 for all new borrowers in his 2015 budget proposal to Congress. In 2016, the PSLF program was threatened this time by the Republican party with a Congressional budget resolution that saw PSLF on the chopping block for the first time for all new borrowers. PLSF has remained an endangered species since, as both President Trump’s budget and the Republican-backed PROSPER Act proposes the elimination of the program for borrowers after July 1, 2019.

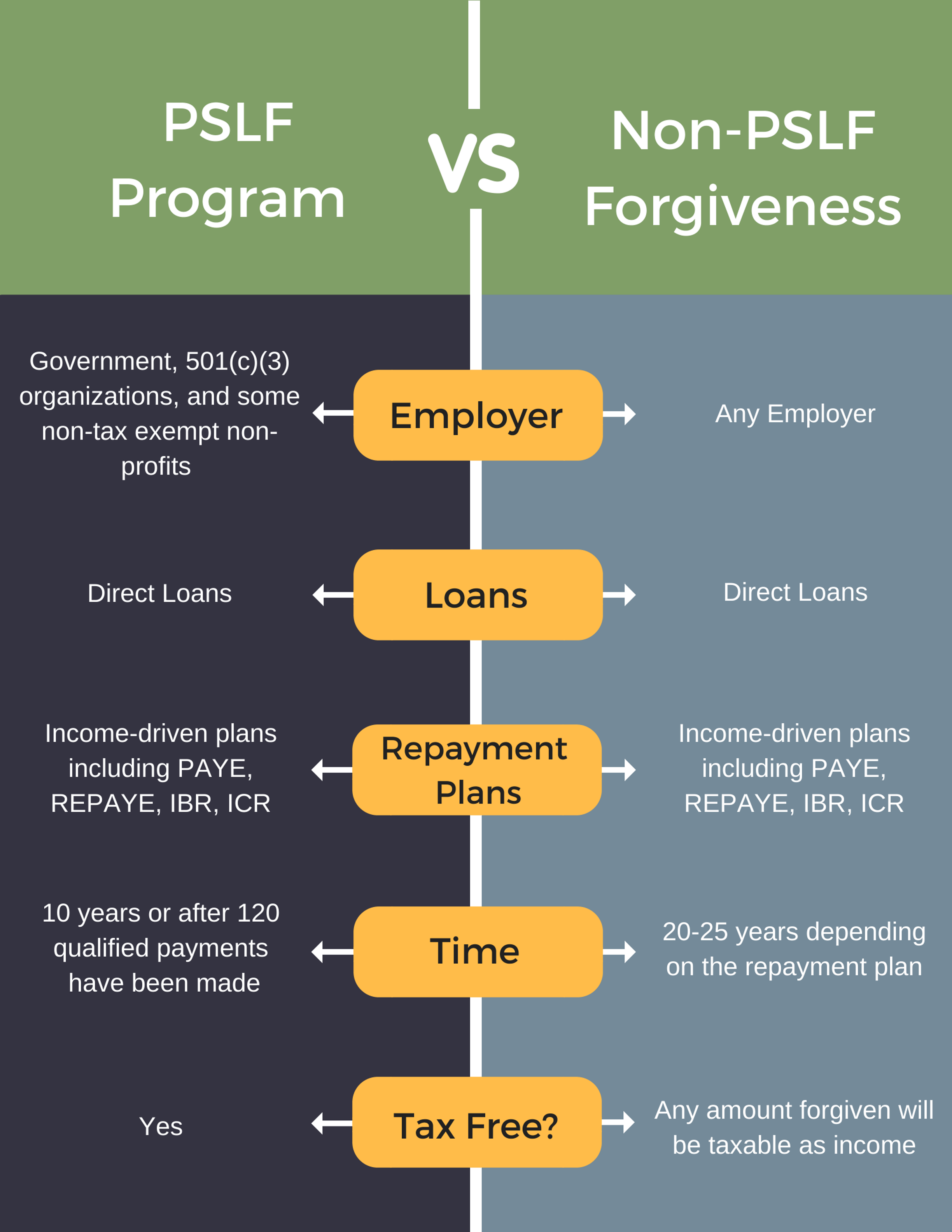

Despite its rocky past and uncertain future, the PSLF program is one of the best payoff strategies available for pharmacists paying off student loans. Without question, it is often the most beneficial to the borrower in terms of the monthly payment (it’s the lowest) or the total amount paid over the course of the program (it’s the lowest). These two factors are widely why the program is so attractive despite its poor and frustrating administration.

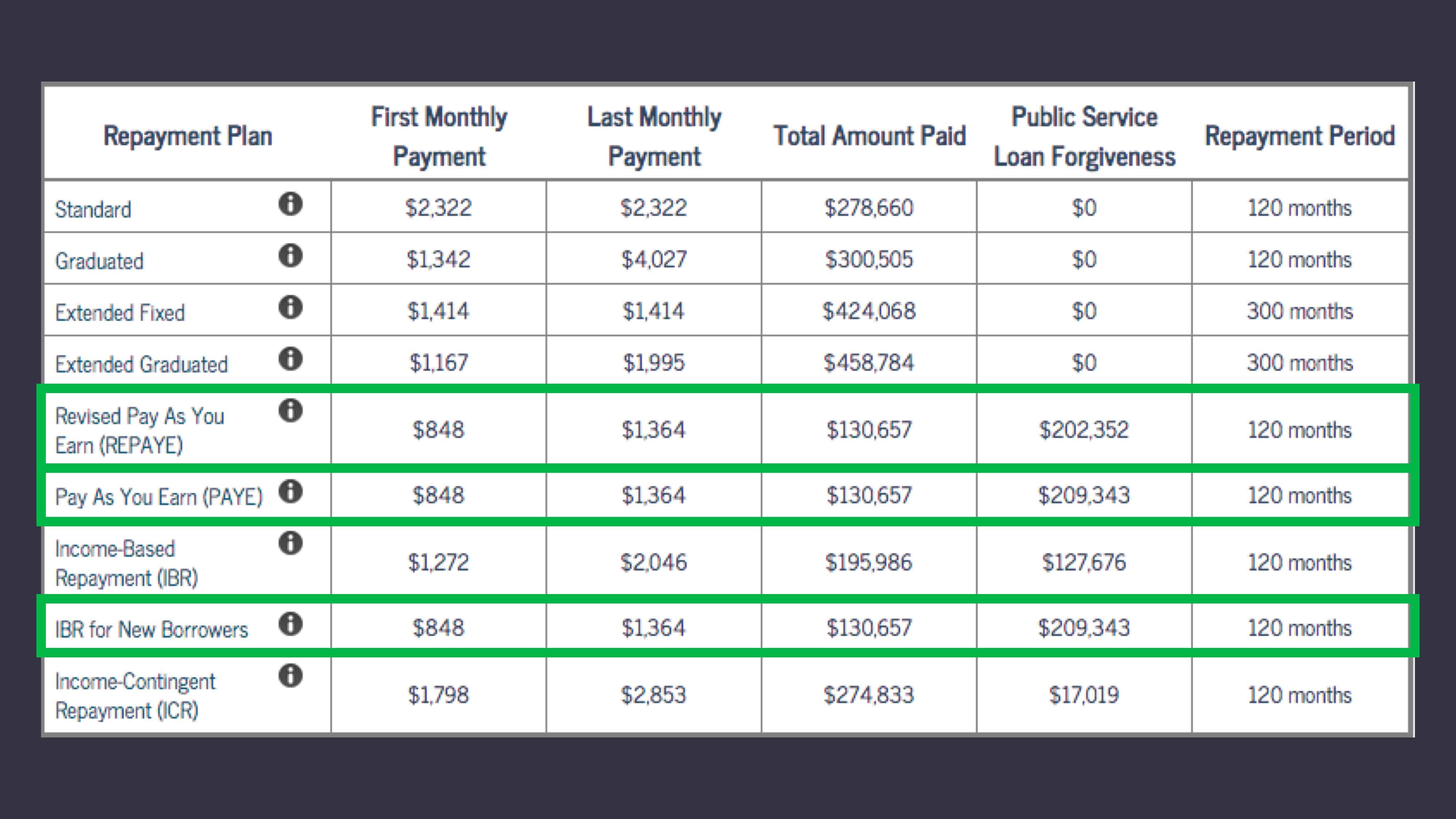

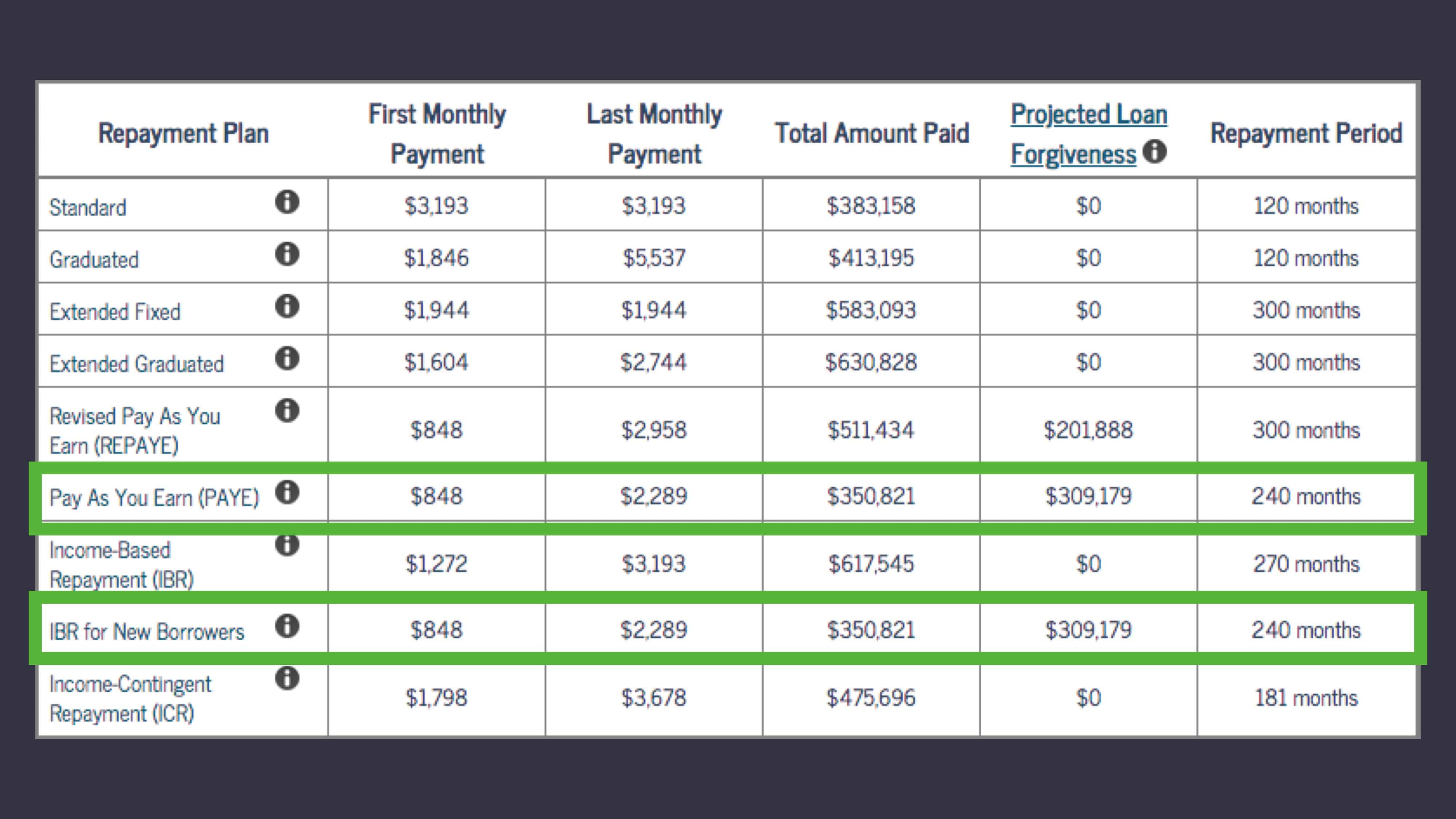

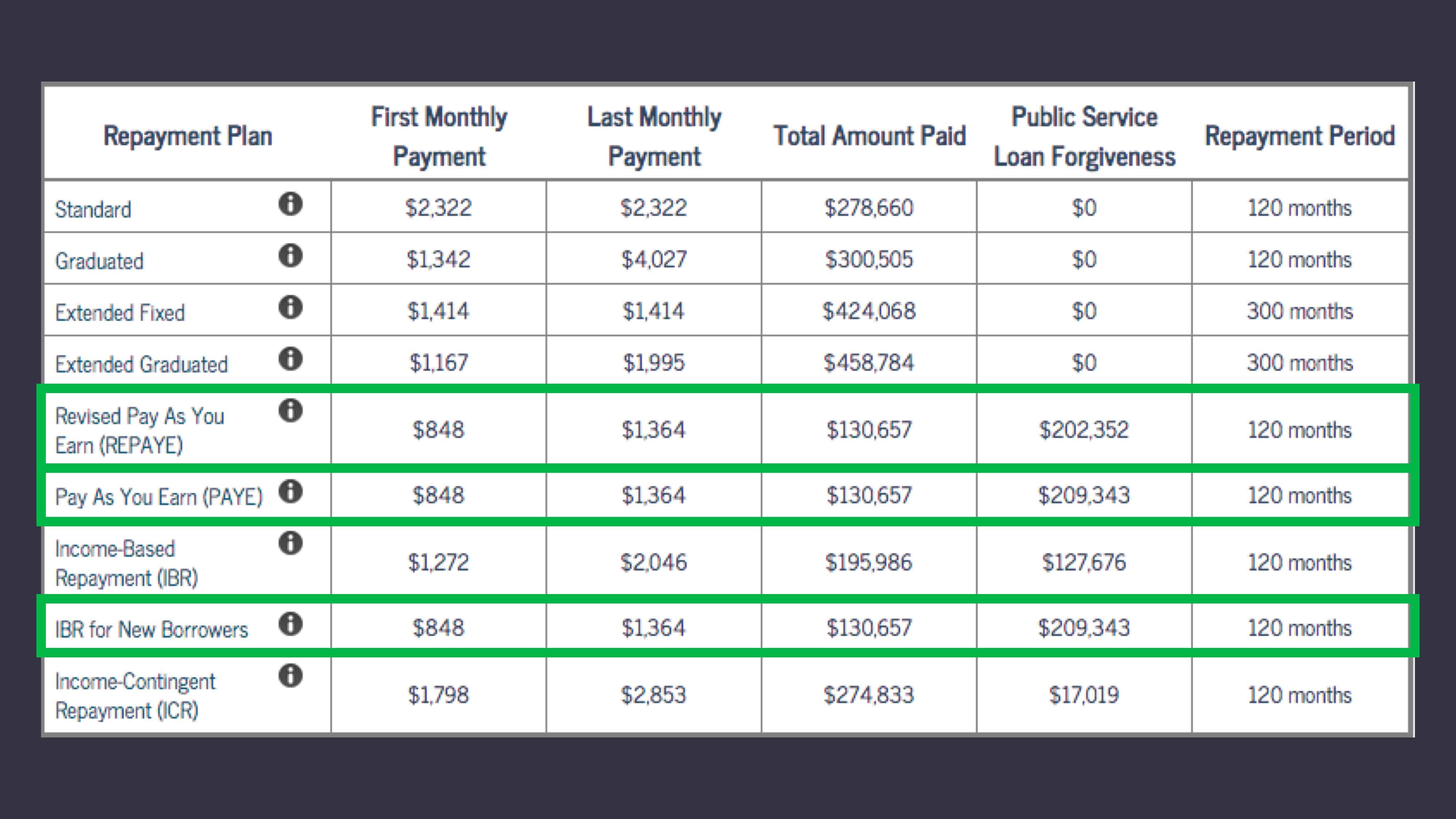

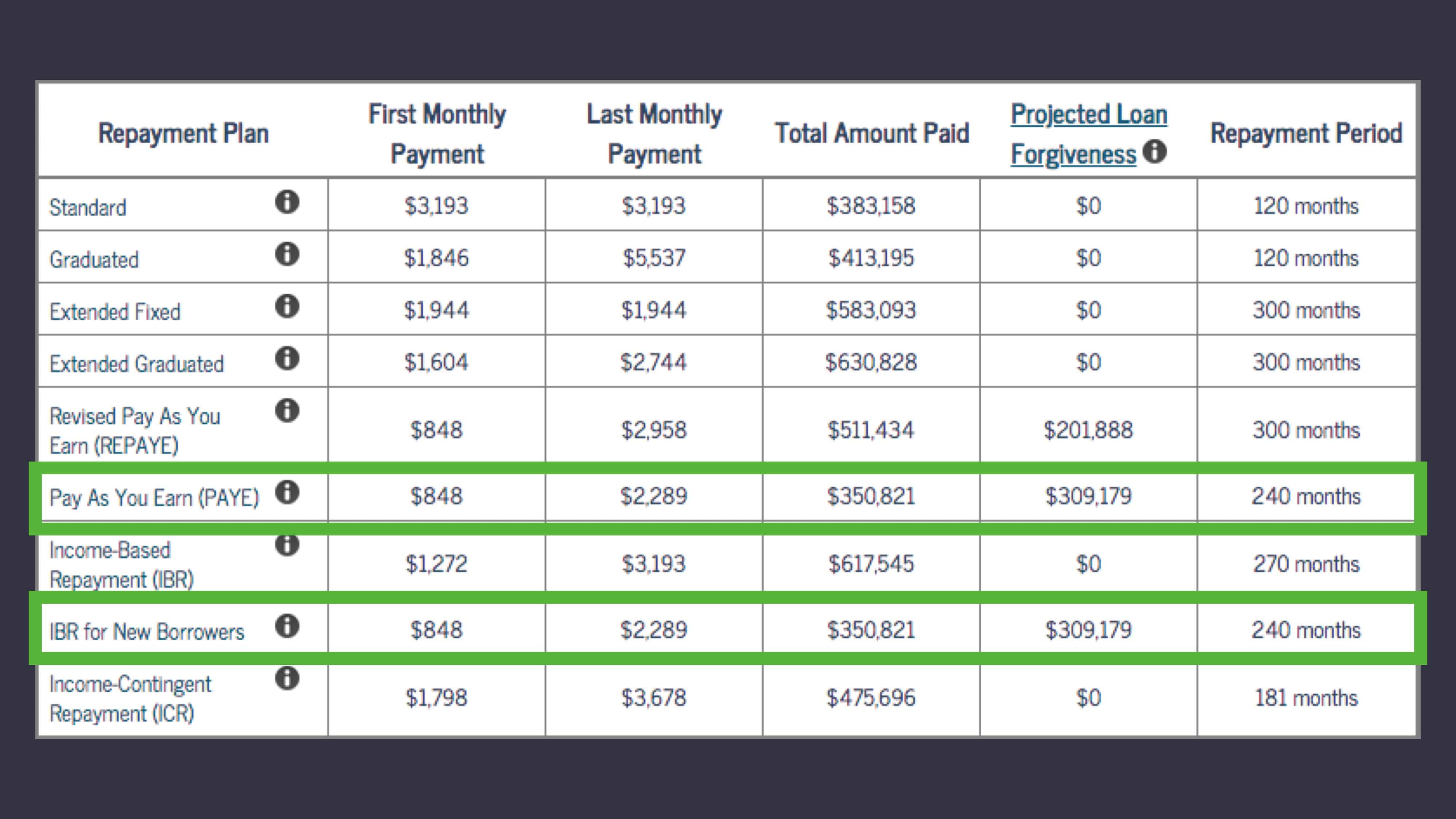

Let’s look at an example of how impressive the math is for a pharmacist who plans on pursuing PSLF. We will make the following assumptions: single, lives within the contiguous U.S., has a student loan balance of $200,000 in Direct Unsubsidized loans with an average interest rate of 7%, and an adjusted gross income of $120,000, and 5% income growth per year (standard per repayment calculator).

Compared to the 10-year Standard Repayment plan, pursuing forgiveness through REPAYE, PAYE, or IBR-New would result in only $130,657 paid, a difference of almost $150,000! Plus, the total amount paid could be even lower if the pharmacist were to maximize traditional 401(k) contributions and other options to lower adjusted gross income. Oh and that $209,343 loan balance remaining after 10 years? Forgedda bout it! It’s eliminated and no taxes to pay on that money.

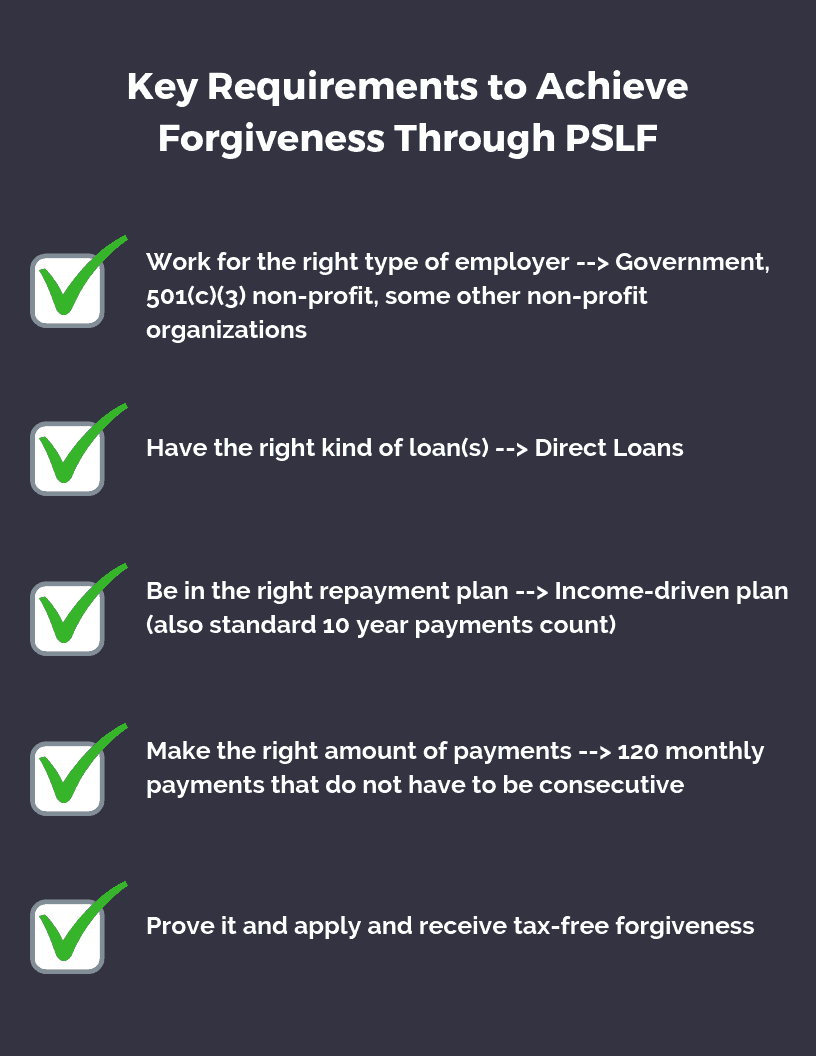

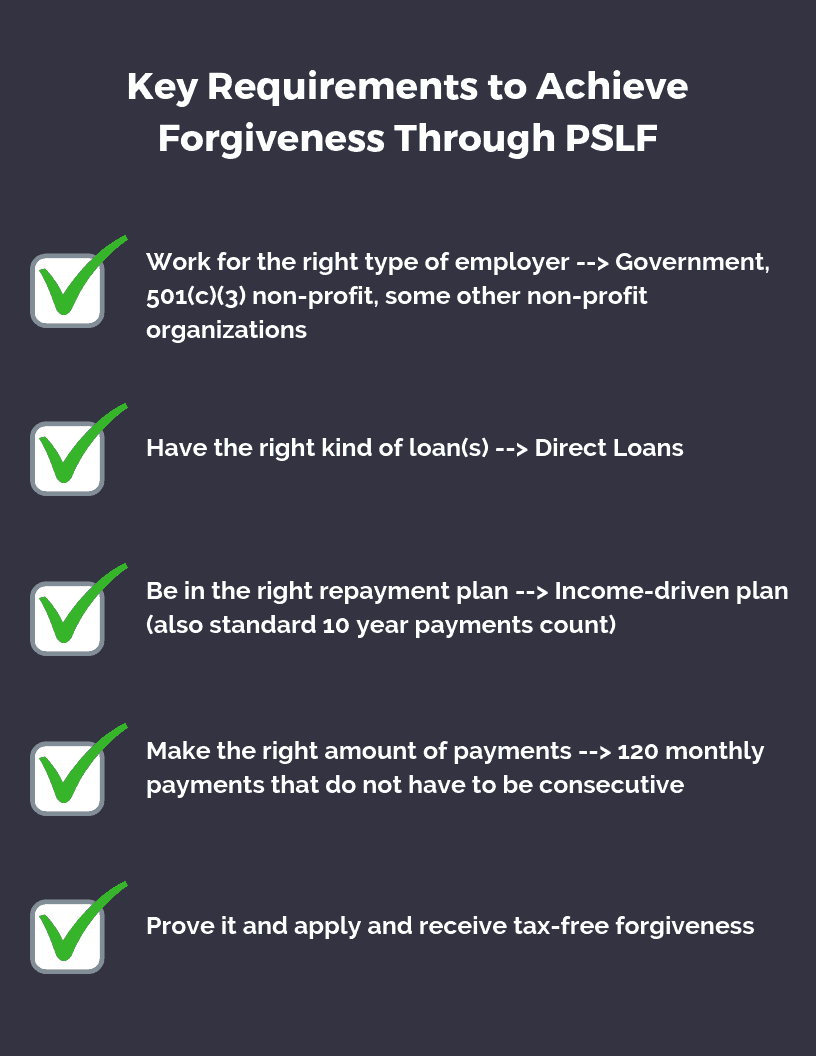

If you think you can stomach this gauntlet to take down your loans, there are a number of requirements to meet. Typically the cadence of the programs goes like this: you need to work for the right type of employer (typically a 501(c)(3) non-profit), with the right kind of loans, in the right repayment plan (one of the four income drive plans to be outlined soon), you need to make the right amount of payments (120 on-time payment which equates to 10 years, but does not have to be consecutive), you need to prove it (via the employment certification form) and then apply and receive tax-free forgiveness. *catch breath* Let’s break the requirements down into a little more detail.

Qualified Employment

Verifying that your employer is a government organization or a 501(c)(3) non-profit organization is the first key to the whole process. You don’t want to make payments for 10 years only to find out the hospital you work for is actually for-profit. This is really important. Even though FedLoan Servicing determines your initial eligibility, the Department of Education has overturned some of these decisions after 10 years which has resulted in lawsuits by borrowers who thought they were on track to receive forgiveness. Shady right? These cases involved people who worked for a non-profit organization that was not tax exempt but was considered public service. This is really the grey area for what exactly qualifies as “public service” and you could be rolling the dice if that’s your situation.

Qualified Employment

Verifying that your employer is a government organization or a 501(c)(3) non-profit organization is the first key to the whole process. You don’t want to make payments for 10 years only to find out the hospital you work for is actually for-profit. This is really important. Even though FedLoan Servicing determines your initial eligibility, the Department of Education has overturned some of these decisions after 10 years which has resulted in lawsuits by borrowers who thought they were on track to receive forgiveness. Shady right? These cases involved people who worked for a non-profit organization that was not tax exempt but was considered public service. This is really the grey area for what exactly qualifies as “public service” and you could be rolling the dice if that’s your situation.

Besides having the right employer, you have to be working full-time based on how your employer defines that or 30 hours/week, whichever is greater. If you are working part-time for more than one qualifying employer, you can still meet the full-time requirement if you are working at least 30 hours per week.

Qualified Loans

Only federal Direct Loans are eligible for PSLF and this would be you if you’re a new borrower after July 1, 2010. If you borrowed before that time, you may have FFEL Loans. These, including Perkins loans, are technically ineligible but you can consolidate them through the federal Direct Consolidation Loan. This will unlock the eligible income-driven repayment plans and all payments moving forward would qualify. Take caution with this step, however! If you’ve been making standard 10 year or income-driven payments on any Direct Loan while working for a qualifying employer and you decide to consolidate, you’re essentially hitting the reset button on your PSLF timeline and starting your 10-year period anew. Therefore, you may have to designate specific loans to be consolidated vs. all of them.

After you verify your loans are eligible or finalize the consolidation process, you want to complete the employment certification form that you and your employer will complete. Once you submit and your application is accepted, all of your loans will be combined and transferred to FedLoan Servicing, the exclusive servicer for PSLF. Some people wait to do this step after they have been in repayment for several years and technically you can do that. However, since only FedLoan Servicing will “count” your qualified payments, from an administrative and organizational perspective it makes sense to do this as soon as you can.

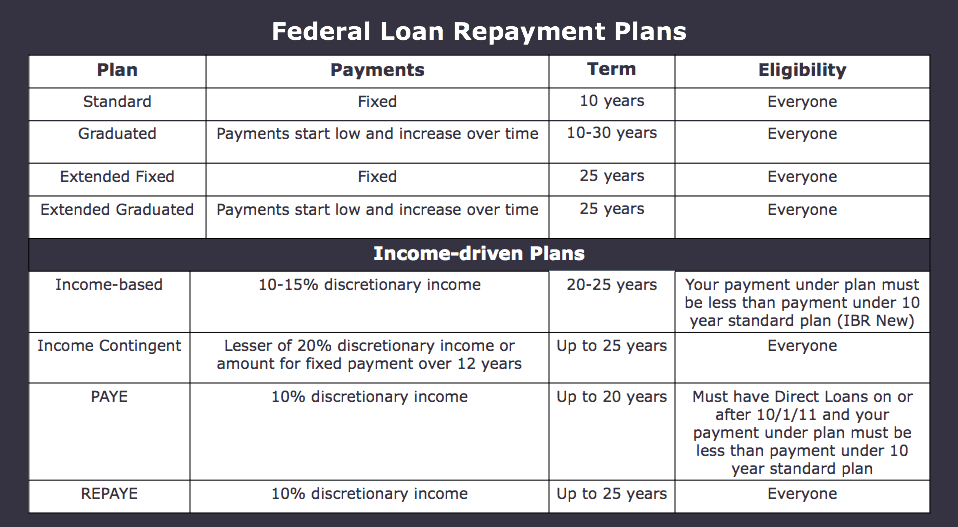

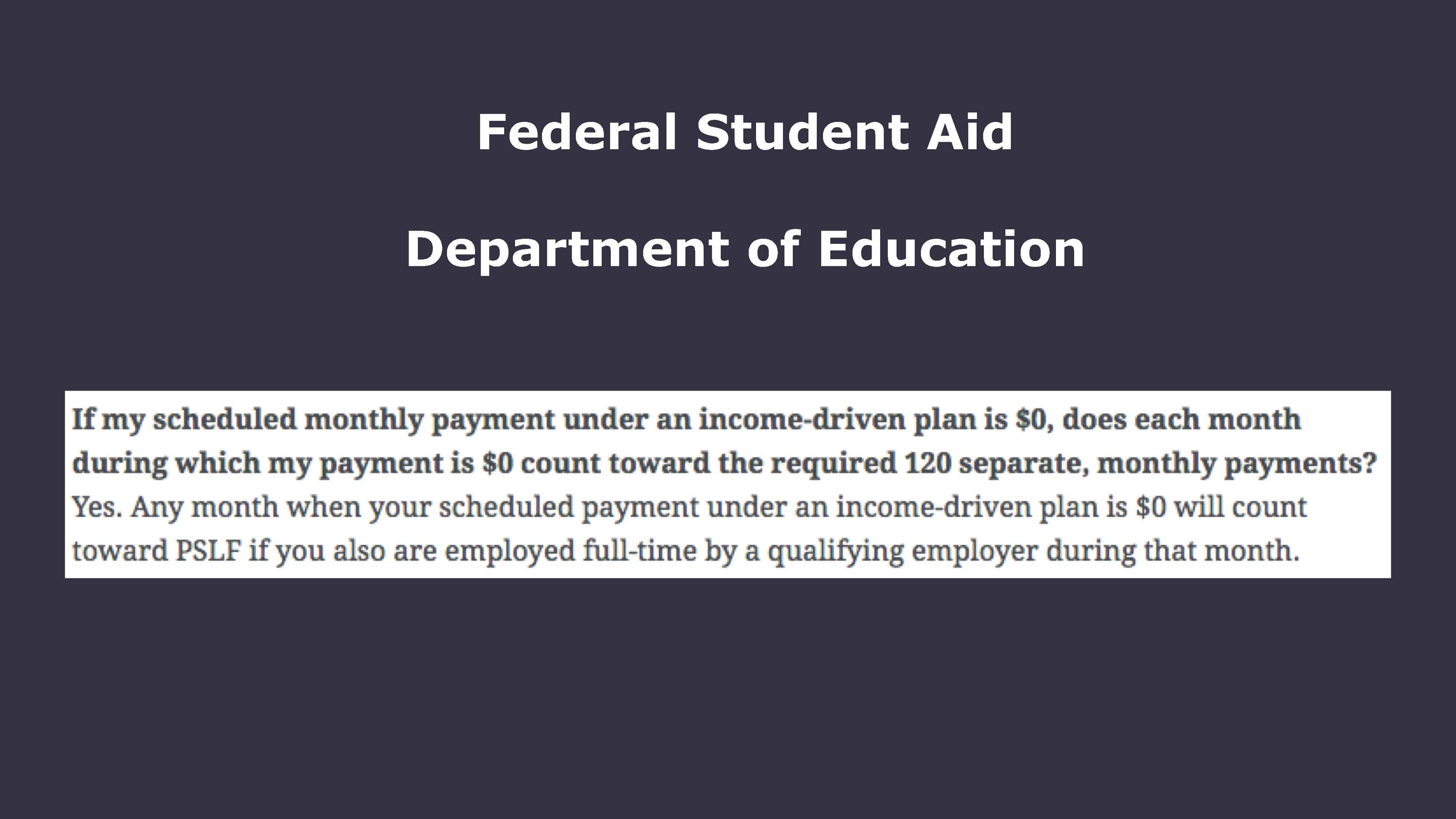

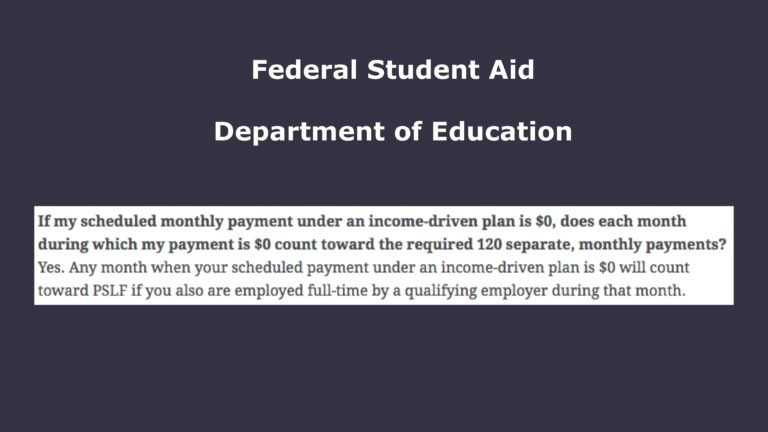

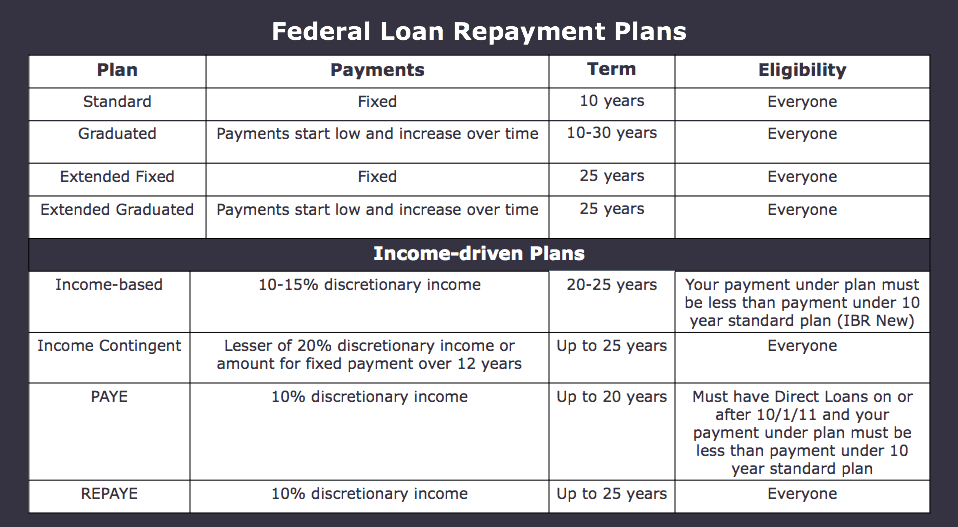

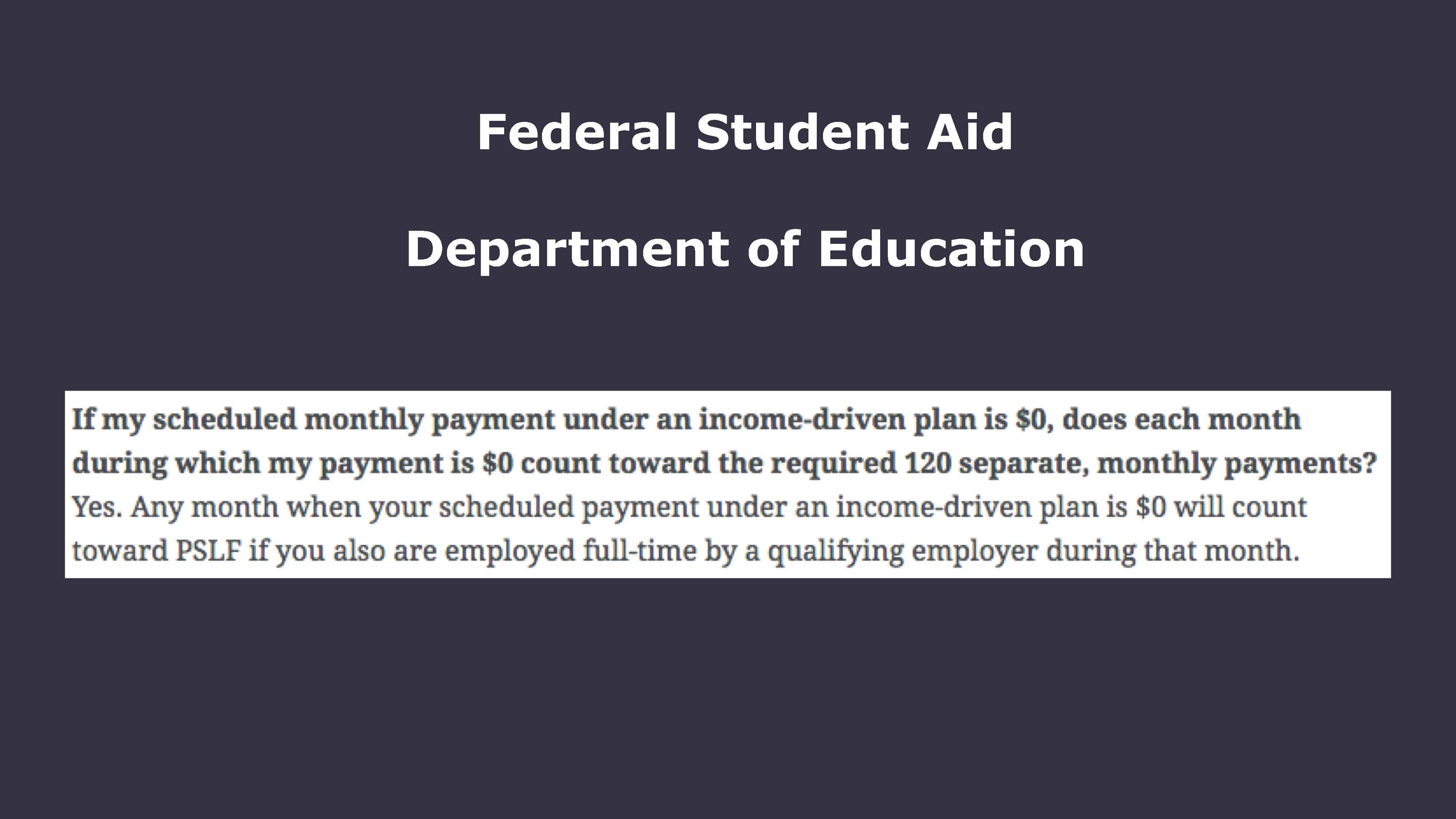

Qualifying Monthly Payments

You have to make 120 qualified payments prior to receiving forgiveness and you can’t make the process go any faster than 10 years. One key point though is that these payments do not have to be consecutive. So if you have to switch jobs from one qualifying employer to another and there is gap in employment, you can pick back up where you left off when you start working again. Qualifying payments have to be for the full amount on your bill and cannot be made more than 15 days past the due date. In addition, only payments under a qualifying repayment plan count. These include income-based repayment (IBR), income-contingent repayment (ICR), Paye-as-you-earn (PAYE), Revised-pay-as-you-earn (REPAYE), and payments under the 10 year Standard Repayment Plan. Even though the 10 year Standard Repayment plan is an option, it really does not make sense to use this option since your goal with PSLF is to pay the least amount of money over 10 years. So get moving and switch that ASAP if that is you!

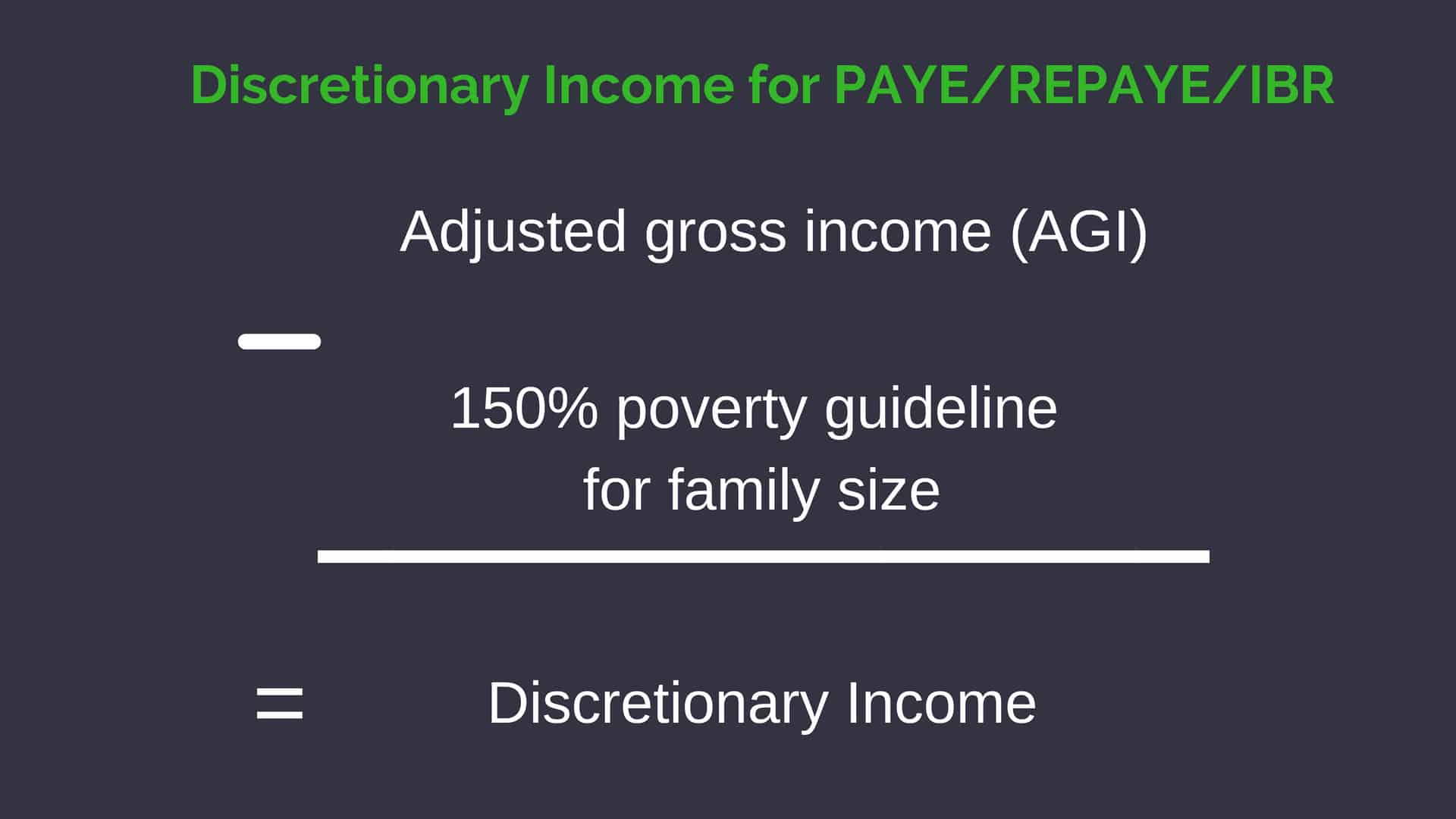

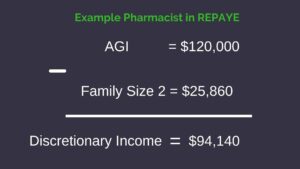

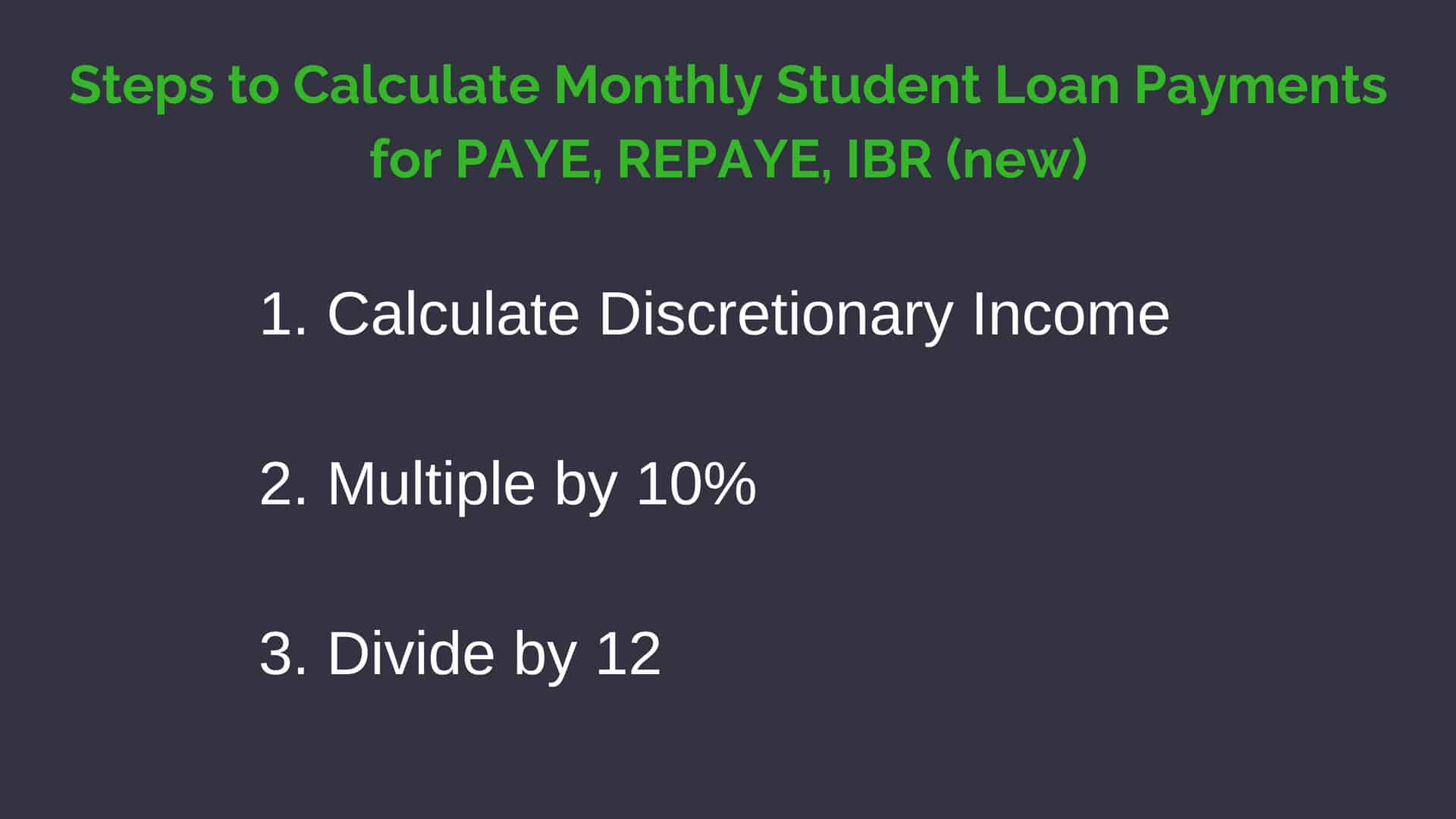

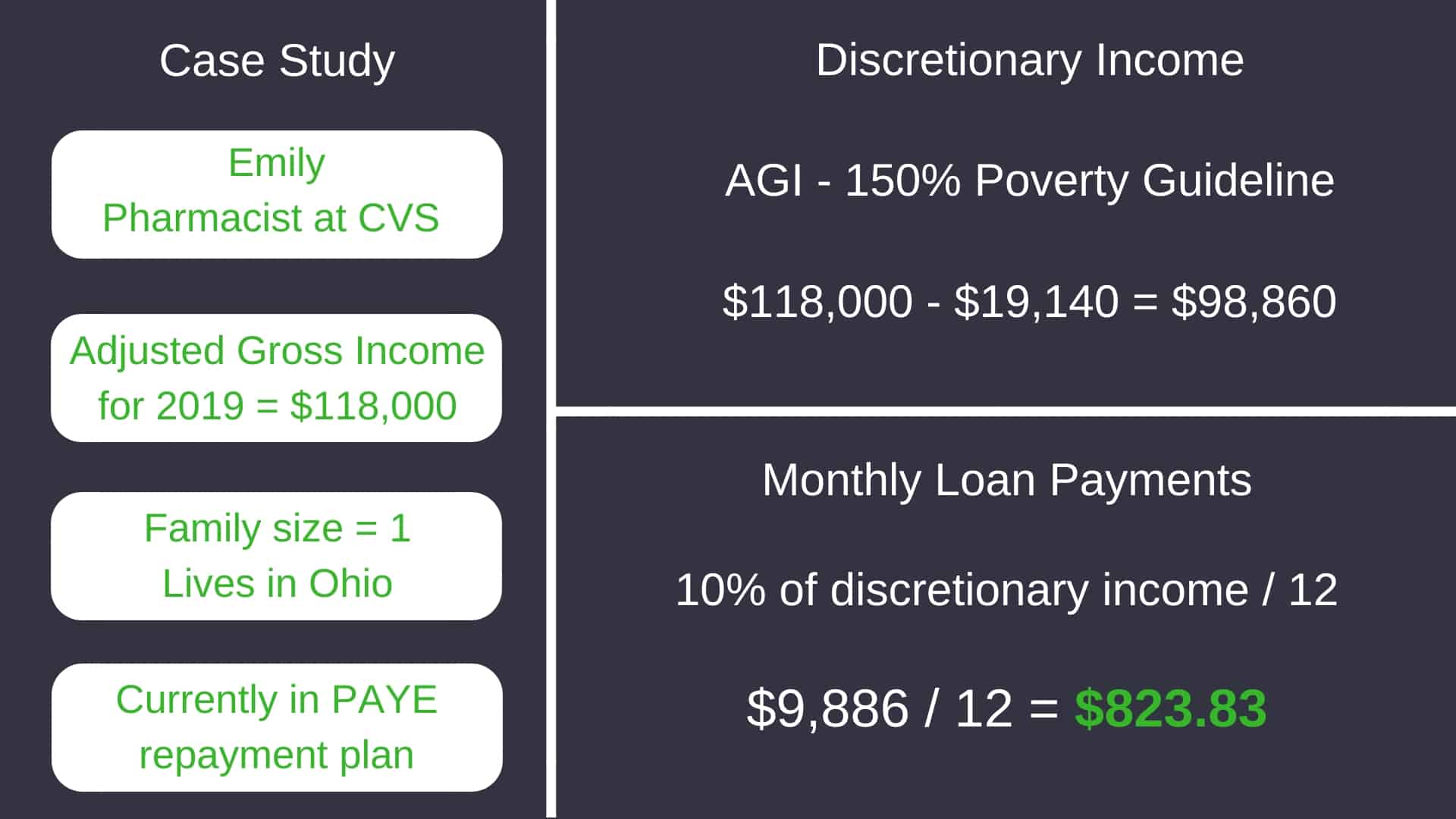

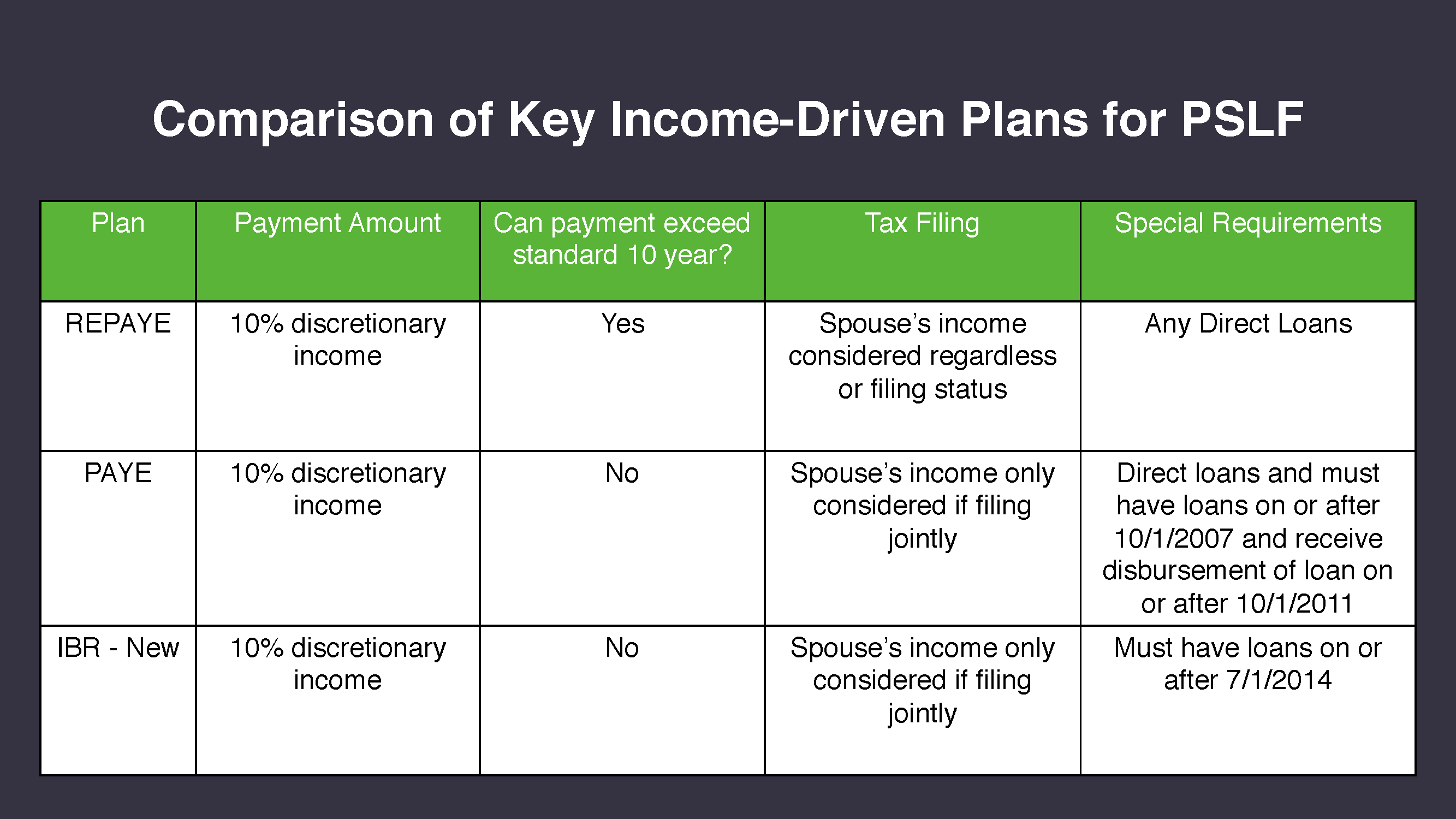

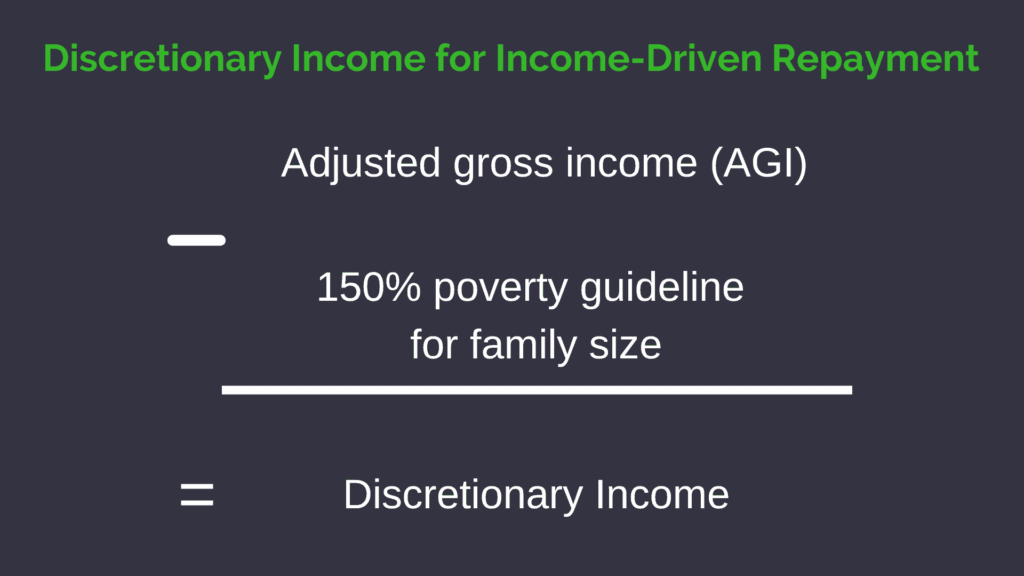

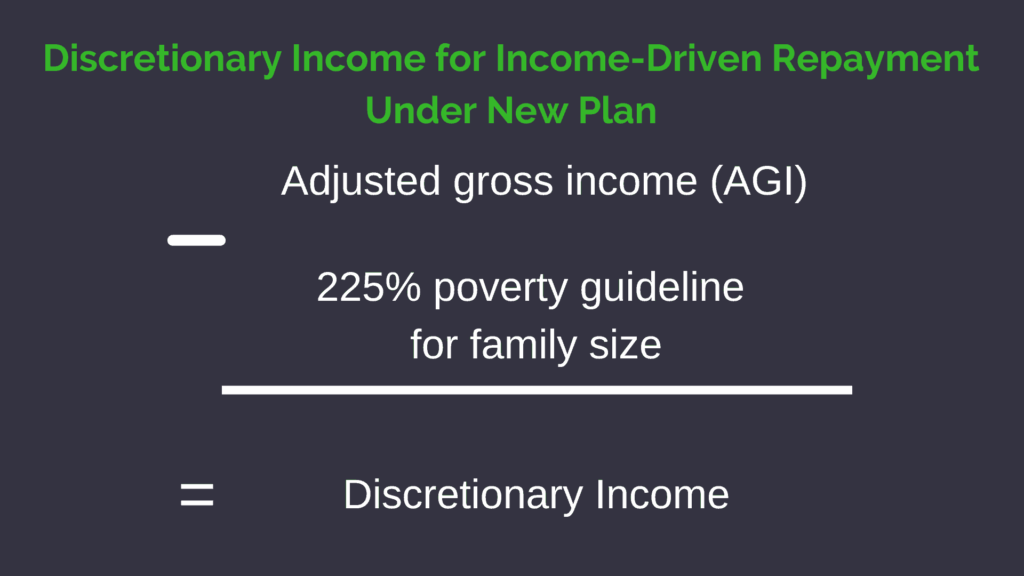

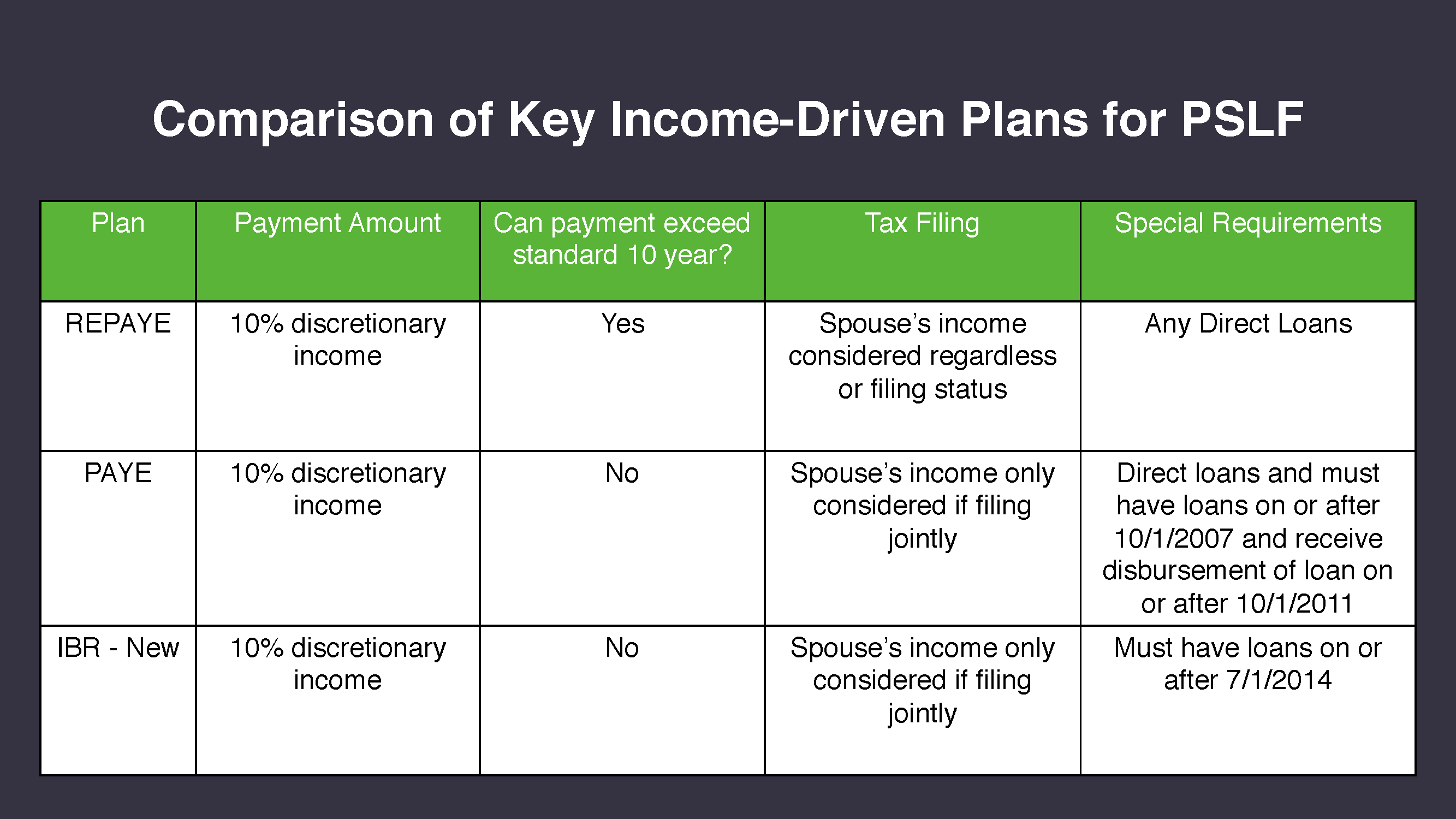

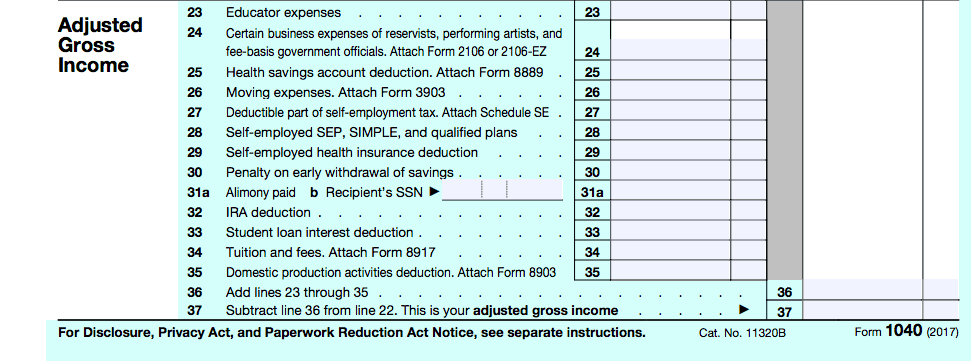

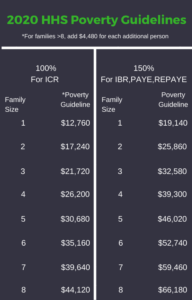

The plans that will result in the lowest monthly payments are REPAYE, PAYE, and IBR-New (which functions essentially the same as PAYE) since they are calculated as 10% of your discretionary income. Discretionary income is specifically your

adjusted gross income minus 150% of the poverty guidelines for these plans. The

repayment estimator will calculate this for you but if you want a detailed look at how to calculate discretionary income check out

this post.

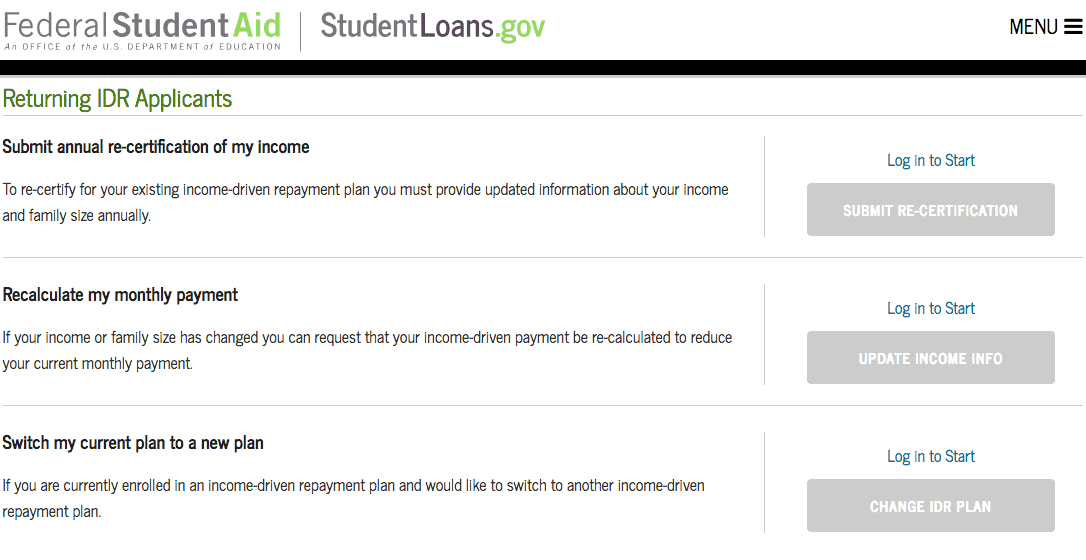

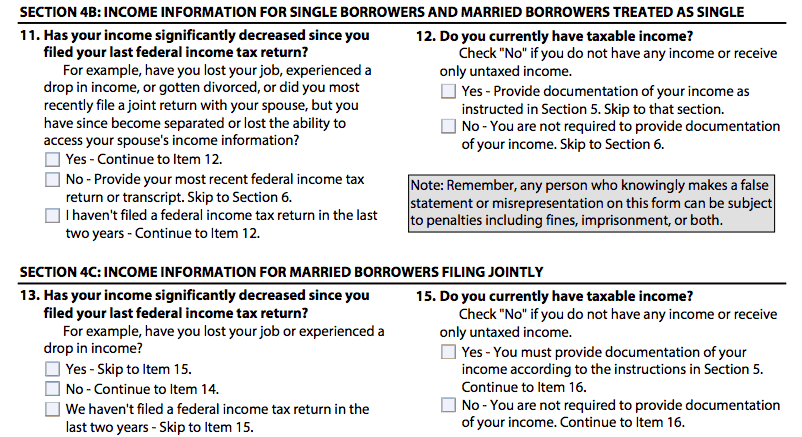

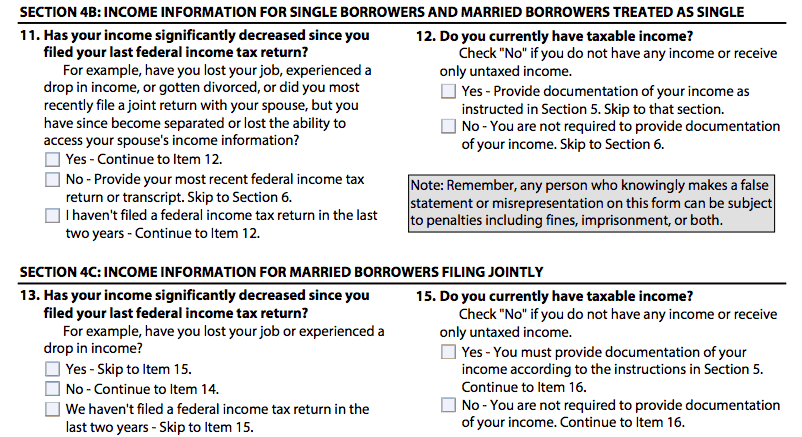

At the time of applying for an income-driven repayment plan, you will need to document your current income. Usually, this is based on the previous year’s tax return, but if your income has changed “significantly”, you may have to provide your most up to date paystub that documents your adjusted gross income and other sources of income you are receiving (dated within past 90 days).

This would obviously be beneficial if you experienced a pay cut since your last filing. But what about an increase in pay? Previously the

income driven repayment form asked the question “has your income significantly increased or decreased since you filed your last federal income tax return?”. However, this has actually changed and now only asks if your pay has

significantly decreased since last filing.

This is a big deal especially if you are a resident or fellow transitioning from student life or from resident to first-year practitioner. Previously, you would have had to disclose if your income increased which would be true going from having zero to minimal earnings as a student to 1/3 of a typical pharmacist salary or from resident to new practitioner.

However, with this change, you are going to pay substantially less during your transition years since your income is going to be based on the previous year’s earnings. Of course, you want to be truthful and accurate when filling out the form but if you are not required to disclose increases in your income then you shouldn’t. Why not take full advantage of the system in place?

Incorporating spousal income into this calculation will depend on the income-driven plan and how you file your taxes. For REPAYE, spousal income will count toward AGI regardless of how you file. If you file separate income tax returns, then only your income will be counted under PAYE (and IBR-New).

Initially, to qualify for PAYE you cannot have any outstanding loan balance on a Direct or FFEL Program loan when you received a Direct Loan or FFEL Program loan on or after October, 1, 2007, and you must have received a disbursement of Direct Loan on or after 10/1/11. Confusing right? If you can need more clarity on this check out

this article. Besides that, for PAYE (and IBR-New), your calculated payment based on your income has to be

less than what you would pay for the 10 year

Standard Plan.

During the 10 years you are making payments you have recertify your income annually. If your income happens to increase either because of your own efforts or spouse to the point where payments would match or exceed the 10 year Standard Plan, it is possible that you would no longer technically qualify for these plans and could be told or persuaded to change to REPAYE. The problem with this is that under REPAYE, you can actually pay MORE than the standard 10 year payment. Again, you want to pay the least amount of money as possible over 10 years so if you ever get in that situation,

insist to FedLoan Servicing to remain in PAYE or IBR-New and cap your payments at whatever the 10 year standard payments would be. In other words no matter how much money you earn, you cannot be disqualified from the program or be forced into REPAYE.

The best practice to confirm your qualifying payments is to submit the employment certification annually, so there are no surprises at the end of the 10-year repayment period. FedLoan will respond to your annual submissions via letter detailing the number of qualifying payments you’ve made thus far. Make sure you call them out if there are any inaccuracies. Unfortunately, this has been reported often so you want to ensure you get credit for ALL your qualifying payments.

Once you have made all of your qualifying payments, you complete the Public Service Loan Forgiveness Application for Forgiveness form, cross your fingers/hold your breath as it is reviewed and receive tax-free forgiveness.

Other PSLF Considerations

I’ve outlined the history and the steps to get into the PSLF program and the benefits of the program, so what gives? How come borrowers aren’t flocking to and lining up to get their loans forgiven. Unfortunately, there’s been a lot of uneasiness about the program that’s completely justified.

In March 2018, the Department of Education announced a new program, the Temporary Expanded Public Service Loan Forgiveness, to aid those borrowers who thought they were on the path to forgiveness but were ultimately denied when they applied after their 10 years of repayment. The reconsideration fund allocated by Congress and totaling $350M should provide relief for those borrowers who thought they took the necessary steps to achieve, but fell short for one reason or another. That demographic of people is quite large as Forbes reported that only 96 borrowers have had their loans forgiven as of June 30, 2018, equating to 1% of total applicants seeking loan forgiveness. Yikes.

Aside for the mishaps of the past with this program, borrowers also have to look to the future with a measure of concern too. Usually, when we talk risk related to financial matters, it involves the risk you take with your investments, whether it be market risk or interest rate risk. However, borrowers who enroll and put their proverbial eggs in the PSLF basket take on legislative risk, which is the risk that a change in the laws could lead to a loss or adverse effects in the jurisdiction affected (i.e. ‘Merica). This program is at the whim of the President and Congress, which may not allow you to sleep easy at night.

However, it is likely that any change in the program will merely affect future borrowers and not those already enrolled in the PSLF program. This is based on the fact that Congress has allocated that sizeable sum of money for those “oops” situations and the fact that the language suggesting that student loan forgiveness should go by the way of the dinosaur seems to suggest future borrowers. Lastly, many borrowers who seek this strategy often see their loans grow over their PSLF timeline although they are making qualifying payments. For that hypothetical borrower who is halfway through their PSLF timeline but has seen the balance balloon because of reduced income driven payments, would the government actually issue a legislative “sike…just kidding” for the loan forgiveness program and not grandfather that borrower in? It’s not out of the realm of possibility, but the political fallout that would ensue from many of those in public service would be a steep price to pay.

The best practice to confirm your qualifying payments is to submit the employment certification annually, so there are no surprises at the end of the 10-year repayment period. FedLoan will respond to your annual submissions via letter detailing the number of qualifying payments you’ve made thus far. Make sure you call them out if there are any inaccuracies. Unfortunately, this has been reported often so you want to ensure you get credit for ALL your qualifying payments.

Once you have made all of your qualifying payments, you complete the Public Service Loan Forgiveness Application for Forgiveness form, cross your fingers/hold your breath as it is reviewed and receive tax-free forgiveness.

Other PSLF Considerations

I’ve outlined the history and the steps to get into the PSLF program and the benefits of the program, so what gives? How come borrowers aren’t flocking to and lining up to get their loans forgiven. Unfortunately, there’s been a lot of uneasiness about the program that’s completely justified.

In March 2018, the Department of Education announced a new program, the Temporary Expanded Public Service Loan Forgiveness, to aid those borrowers who thought they were on the path to forgiveness but were ultimately denied when they applied after their 10 years of repayment. The reconsideration fund allocated by Congress and totaling $350M should provide relief for those borrowers who thought they took the necessary steps to achieve, but fell short for one reason or another. That demographic of people is quite large as Forbes reported that only 96 borrowers have had their loans forgiven as of June 30, 2018, equating to 1% of total applicants seeking loan forgiveness. Yikes.

Aside for the mishaps of the past with this program, borrowers also have to look to the future with a measure of concern too. Usually, when we talk risk related to financial matters, it involves the risk you take with your investments, whether it be market risk or interest rate risk. However, borrowers who enroll and put their proverbial eggs in the PSLF basket take on legislative risk, which is the risk that a change in the laws could lead to a loss or adverse effects in the jurisdiction affected (i.e. ‘Merica). This program is at the whim of the President and Congress, which may not allow you to sleep easy at night.

However, it is likely that any change in the program will merely affect future borrowers and not those already enrolled in the PSLF program. This is based on the fact that Congress has allocated that sizeable sum of money for those “oops” situations and the fact that the language suggesting that student loan forgiveness should go by the way of the dinosaur seems to suggest future borrowers. Lastly, many borrowers who seek this strategy often see their loans grow over their PSLF timeline although they are making qualifying payments. For that hypothetical borrower who is halfway through their PSLF timeline but has seen the balance balloon because of reduced income driven payments, would the government actually issue a legislative “sike…just kidding” for the loan forgiveness program and not grandfather that borrower in? It’s not out of the realm of possibility, but the political fallout that would ensue from many of those in public service would be a steep price to pay.

Non-PSLF Forgiveness

Many borrowers are under the impression that they have to work for a government or a non-profit in order to be granted student loan amnesty. Not so fast! Relief is out there, albeit with not as attractive terms, but forgiveness can still happen.

The cadence for this program is similar to PSLF with a few differences: it doesn’t matter who you work for, you still need to have the right kind of loans, be in the right repayment plan (one of the four income drive plans to be outlined soon), make the right amount of payments (typically over 20 or 25 years depending on the type of loan), and then you can apply to receive taxable forgiveness. *catch breath x2*

That doesn’t sound so different than the PSLF program aside from the term (20 or 25 years versus 10 years), but the taxable forgiveness versus the tax-free forgiveness is actually a big deal. Let me explain why.

In the PSLF program if you pay for 10 years and have a balance of $100,000 when you apply for forgiveness, hakuna matata! It means no worries for that balance is forgiven! In the non-PSLF program, if you have a $100,000 balance forgiven at the end of 25 years, that $100,000 is viewed as taxable income. That means that if you’re in a 25% tax bracket, you’ll owe an additional $25,000 in taxes in the year following when you received forgiveness. Often referred to as a “tax bomb”, it’s something that non-PSLF forgiveness borrowers need to account for, typically by saving or investing concurrently to paying off your loans.

Although the length of repayment and tax bomb can make this strategy unattractive to some, there are some situations where it can make a lot of sense. Typically, this strategy is best suited for those who are not employed by a non-profit and have a high debt-to-income ratio such as 2:1 or greater. What does this mean? If your total loan balance is $275,000 and your making $120,000, your debt-income ratio is 2.3:1. Depending on your cost of living, liabilities, and other and financial responsibilities, it could be very difficult to make non-income driven payments through the standard plan or even the others. Let’s look at how this plays out using the DoE Repayment Estimator. To make things easy we will assume the pharmacist is single, all loans are unsubsidized and qualify for PAYE and IBR-New, and the average interest rate is 7%.

You can see that if this person were to extend payments out 25 years using the extended fixed plan, there would be a $1,944 payment and a total amount paid of $583,093. However, considering non-PSLF forgiveness using PAYE or IBR-New, payments would start $848 and increase to $2,289 (using a 5% increase in income/year per calculator assumption) and the total paid would only be $350,821. However, there would be $309,179 forgiven that is treated as taxable income. If we continue with the assumption of a 25% tax bracket, there would a tax bill of around $77,000. So even with the tax bomb, there are definitely some advantages here:

1. The total amount paid over 25 years will be much less even with considering the additional tax bill (by over $100,000).

2. For many of the years during repayment, the monthly payments will be significantly lower which allows more disposable income for retirement contributions and other financial goals.

3. The tax bill of $77,000 is in future value which is much less than it is today

Therefore, this pharmacist should at least consider non-PSLF forgiveness as a viable strategy. The debate for using this strategy can also get interesting if refinancing is on the table. Depending on how low you can get your rate, you would also want to consider this vs. non-PSLF forgiveness.

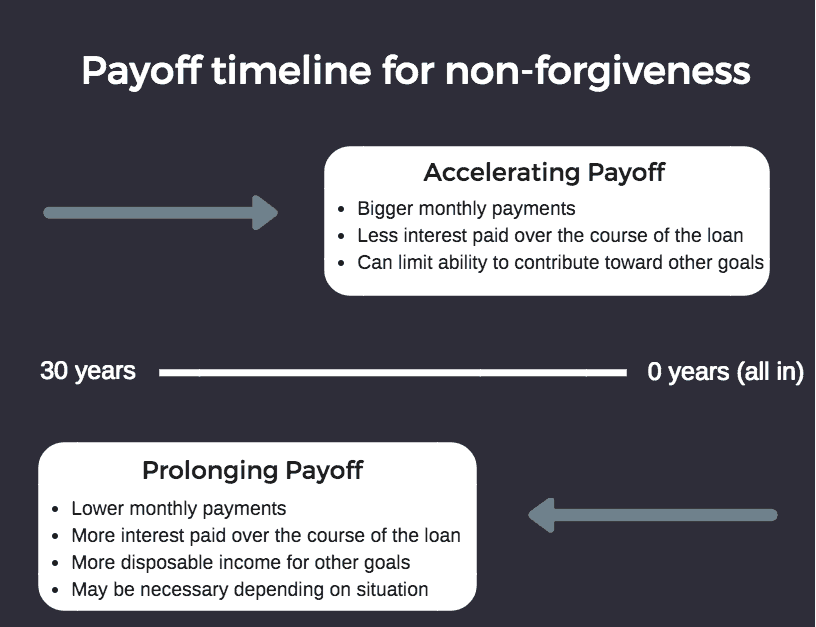

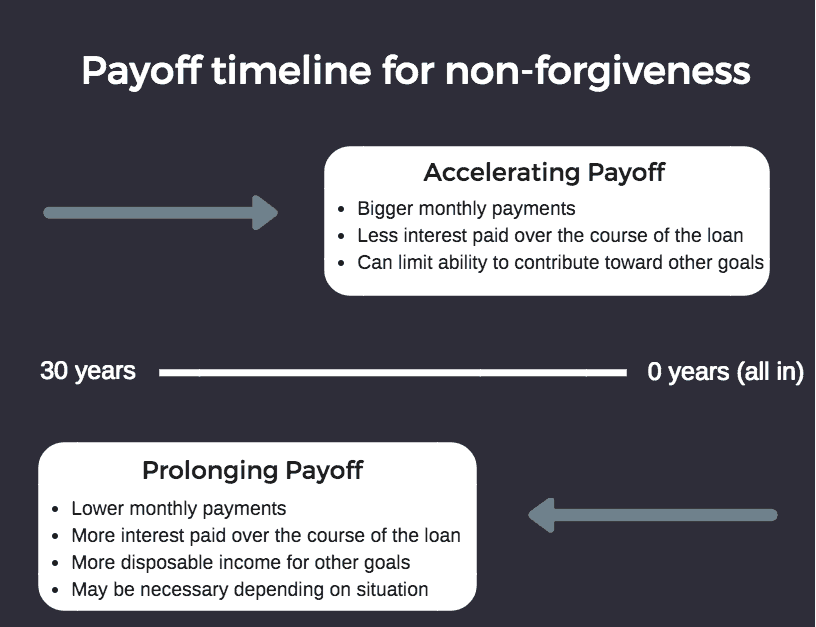

Non-forgiveness

Outside of tuition reimbursement and forgiveness programs, what’s left is basically

paying off pharmacy student loans all on your own. There’s no set timeline or years you have to wait. You determine the time to pay off. You could pay off the balance today if you have the cash or extend payments as long as possible (generally up to 30 years). You make it happen when it’s best for you. Although your monthly payments will be dictated based on the repayment plan you’re in, you are not bound to this and can always accelerate and pay more if you want to. If you want to see how extra payments or a lump sum payment affect your savings or time to payoff you check out our

early payoff calculator. Through this strategy, you can either pay off your loans through the federal loan program using one of the many repayment plans (if you still have federal loans) or

refinance student loans to a private lender.

Federal Loan Program

If you’re like most pharmacists, you probably took out federal student loans to fund pharmacy school. If your grace period is up for you or you have already started making payments, then you will have one or more of the federal servicers handling your account. These include Nelnet, Great Lakes Education Loan Services Inc, Navient, FedLoan Servicing, MOHELA, HESC/EdFinancial, Cornerstone, GraniteState, and OSLA. Since it is possible to have multiple servicers, you may actually be making multiple monthly payments to different servicers each month. If you’re in this situation, you could use a Direct Consolidation Loan to combine all of these loans into one and then make one monthly payment to one lender. This will take the weighted interest rate of all of your loans but not lower the overall interest rate as refinancing could. It really just makes things more convenient.

Repayment Plans

The default loan repayment plan is the standard 10 year plan where you make the same monthly payments over ten years. It’s the most aggressive of all the repayment plans and you will pay less total interest than other plans. Depending on your loan balance, household income, and other financial priorities, this could be tough to make it work. There are several other repayment plans available with some having eligibility based on the type of loan you have and income.

The monthly payments under the income-driven plans are determined based on your previous year’s discretionary income as mentioned above.

Advantages of the Federal Loan System

Advantages of the Federal Loan System

Keeping your loans in the federal system will give you some protection and safeguards that are not always available through private lenders. If you die or become permanently disabled, your loans will be discharged without any tax bill on that amount. In addition, if you’re facing a financial hardship, want to go back to school, or have circumstances where it could be tough to make payments, you can request deferment or forbearance which would result in a temporary stop in making payments. The other advantage is the ability to make income-driven payments if needed which generally is not available through private lenders. Lastly, all federal loans have fixed interest rates so your monthly payments will not change unless you are in an income-driven plan or one of the graduated plans.

Refinance Student Loans

Advantages of Refinancing

*Disclaimer – Due to recent changes to federally held student loans secondary to the COVID-19 crisis, we are recommending those with Direct Federal Loans eligible for the temporary waiver of payments and interest through December 31, 2022,

carefully review their situation prior to refinancing as these benefits are not available through private lenders.

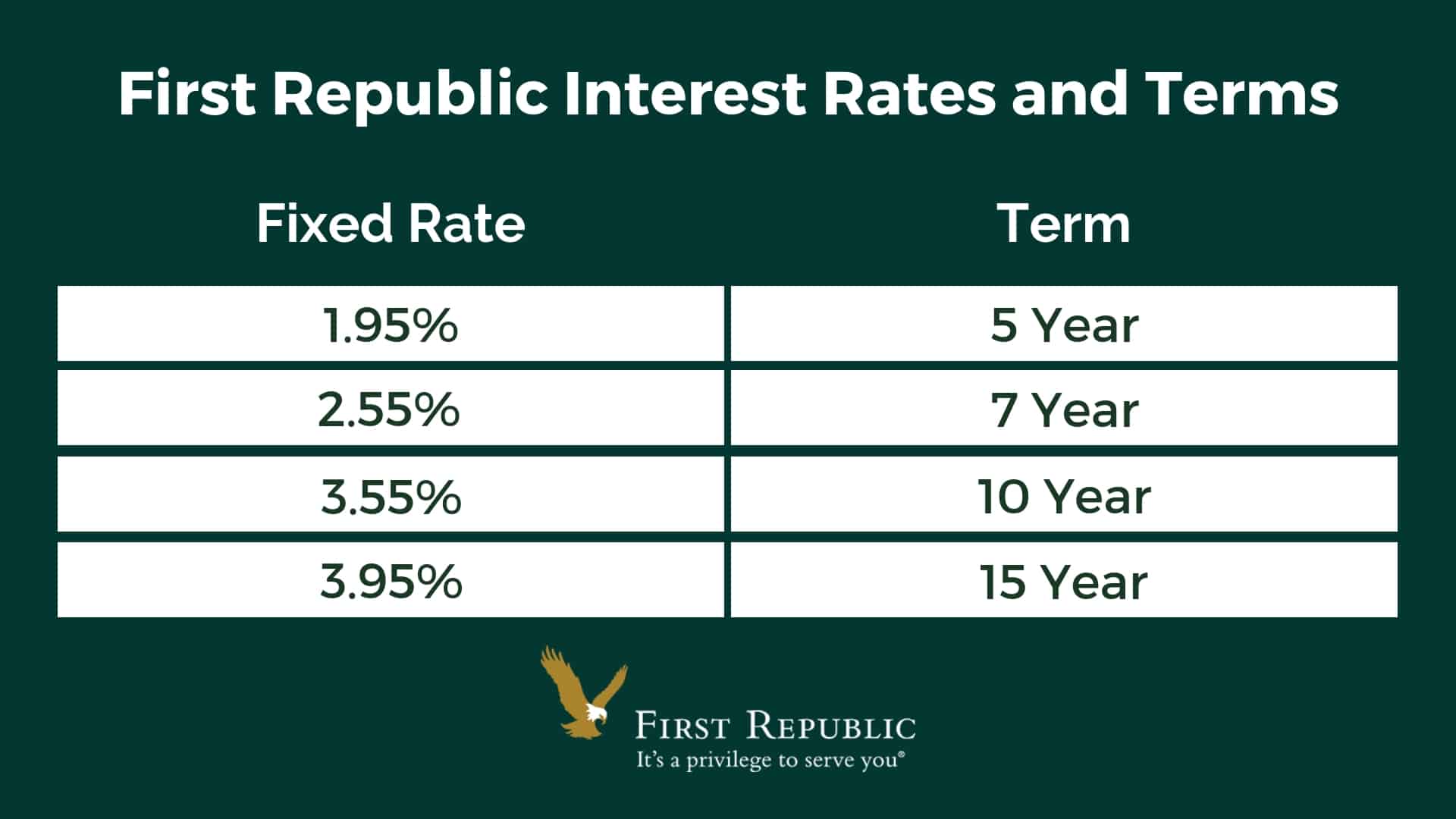

The main downside to keeping your loans in the federal system is that you will often pay more in interest given most unsubsidized graduate/professional loans are 6-8%. When you refinance student loans, you essentially reorganize or change the terms of an existing loan(s). These changes include the term over which you pay back, the interest rate, type of interest rate, or a combination of those. Even though interest rates, in general, are rising, you can often get more competitive interest rates through private lenders.

Consider a pharmacist with $200,000 in student loans with a 6.8% overall interest rate. Under the standard 10-year plan, the total amount paid would be $276,192. If the interest rate was chopped to 4%, the total paid would be $242,988, a savings of over $33,000.

The total savings will vary based on the loan balance, how fast it’s paid off, and the change in interest rate. If you want to see your potential savings, check out our

refinance calculator.

You may be thinking “Wow, I could be saving a ton if refinance student loans.” But what’s the catch?” Refinancing is not without some drawbacks and it’s very important to know what you’re giving up if you make the move. First, once you refinance, you automatically become ineligible for any of the forgiveness programs. In addition, most private lenders do not offer income-driven plans, so you will lose the flexibility to change your monthly payments and could face a problem if you experience a sudden change in your income. Furthermore, the option to put your loans in deferment or forbearance may not be available either.

Also, not all lenders will forgive your loans if you die or become permanently disabled. So if you do decide to go this route you will want to know what their policy is on this. Regardless, most of the time you should have

adequate life and disability insurance policies in place if these events were to occur.

Goals of Refinancing

Goals of Refinancing

Your main goal of refinancing should be to get a lower interest rate so that you save more money over time. You can pick and choose which loans you want to refinance and if you have some that are already low, you would obviously want to leave those alone. Beyond that, it is important that you find a reputable lender. Unfortunately, there are many scams and frauds out there and you want to have your guard up. Nerd Wallet has a

watchlist of businesses that have been reported for criminal activity or who have filed bankruptcy or have tax issues. You can also check out the

Better Business Bureau to review ratings and reviews of prospective lenders.

Besides choosing a reputable lender to refinance with, you want to be sure there is no origination fee for the service. Remember, companies are eager for your business and are willing to pay you. Also, there should be no prepayment penalty. If you decide you want to pay off your loan faster than the term, there should be no additional fees.

Another potential goal of refinancing could be to lower your monthly payment. Since your total balance will not change, if you keep the same term (e.g. 10 years) but lower the interest rate, your payments will go down since a greater percentage of the payment will go toward the principal and less to interest. However, if you’re really trying to accelerate your payoff, your minimum payments could actually be higher than what they are currently. This would occur if you are reducing the term such as 10 to 5 years. Although you may argue that you could have a longer repayment term and make extra payments, some like being forced to make higher payments as a way to prevent overspending and stay disciplined.

Besides lowering your interest rate and finding a reputable lender, another goal for you should be to get some cash. Because many companies are eager for your business, they are offering a

welcome bonus for being a new customer. Now, of course, they will be making money as you pay off your loans in the form of interest but why not take advantage of this perk. Here’s the best part as well. There is really no limit to how many times you refinance. You can refinance your loans multiple times and get cash bonuses from more than one company. My wife and I actually made $2,500 in a year doing this and were able to get a lower rate each time. If you do this very frequently, you may see a reduction in your credit score since every time a full application is submitted, there is a hard pull.

YFP has partnered with multiple student loan refinance companies in order to get you a nice bonus of up to

$850 and sometimes more if there is a special promotion running. Yes, we get a referral fee when you refinance through our link, but we have shifted the majority of the payout to you.

Current Student Loan Refinance Offers

Advertising Disclosure

[wptb id="15454" not found ]

Types of Interest Rates

As mentioned above, all federal loans have fixed interest rates. That is not the case for refinanced loans. Generally, like home mortgages, they come in two flavors: fixed and variable. Fixed interest rates stay the same throughout the term and result in the same minimum monthly payment until it’s paid off. Variable interest rates tend to start out low, many times lower than fixed but can change depending on the Federal Reserve and LIBOR. There is usually a max or capped interest rate and specific frequency in which it could change.

Although variable rates can be very attractive, depending on the fluctuation, it could cost you thousands in interest. So if you decide to go this route, you have to be comfortable with the risk of rates climbing and increasing your monthly payment.

Besides fixed and variable, you may also encounter hybrid interest rates. In general, these are rates that stay fixed for a certain number of years and then changes to variable.

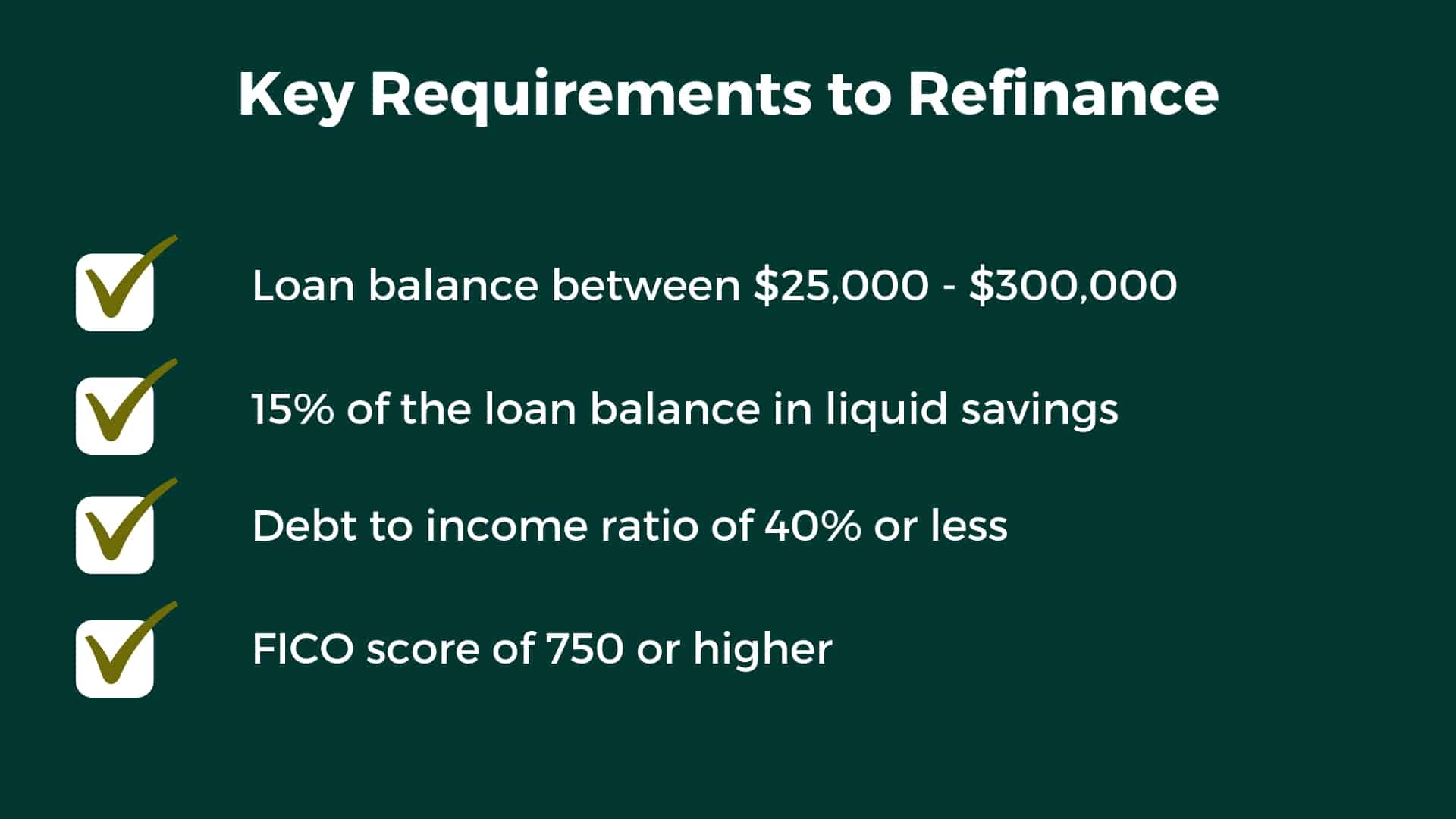

Typical Requirements to Refinance

Private lenders will not refinance student loans for anyone. You will be required to have a minimum credit score (usually at least 650), lending amount, proof of a certain level of income, and potentially a certain debt to income ratio. This will vary from lender to lender and not only will these items determine your eligibility, but it will also impact your quoted rate.

Getting Multiple Quotes

You probably have received mail or emails from companies encouraging you to refinance with them. Even though you may be familiar with some brands or heard of good experiences about a particular one from friends and family, be sure you get multiple quotes to find the best deal.

When you are shopping around to find the best rate, companies will run a soft check of your credit to give you an accurate quote. This will not affect your credit score but if you proceed to a full application, then you could see a very minor drop.

When you receive quotes, this will usually be reported as fixed or variable along with the respective payment terms. Most companies have terms of 5,7,10,15, and 20 years and typically, the shorter the term, the better the rate.

Step 3: Do the Math

Even if you think there’s a clear winner for the payoff strategy that’s best for you it’s important to get crystal clear on the numbers. Knowing the projected total amount paid (including interest) for all of the strategies available will help you get clarity on which option will save you the most money. The

Repayment Estimator at studentaid.gov will help you determine the cost for the federal repayment plans. To determine your savings and new projected payments from refinancing check out our

refinance calculator.

Besides knowing your options and the total amount paid, you have to analyze how the monthly payments would fit into your budget. If you are too aggressive it may put you in a tough position and may limit your ability to contribute to your other financial goals.

Step 4: Evaluate Factors Beyond the Math

It can be easy to simply look at the numbers, find the strategy and repayment plan that costs you the least over time, and call it day. Although that can work and the math itself will likely hold the most weight, there are some things to consider beyond the numbers.

Your emotions and attitude toward your loans can have a big impact on your payoff strategy. If you are someone who is really anxious and has difficulty sleeping knowing you’re still in debt, you may feel inclined to pay it off as fast as you can rather than waiting the time for a forgiveness program. Mathematically, it may not even make sense to do this but it does give you more control and could make you feel a lot better about your situation. Now if the potential savings with a forgiveness program is overwhelming then you may just need a coach or a financial planner to help you along the way.

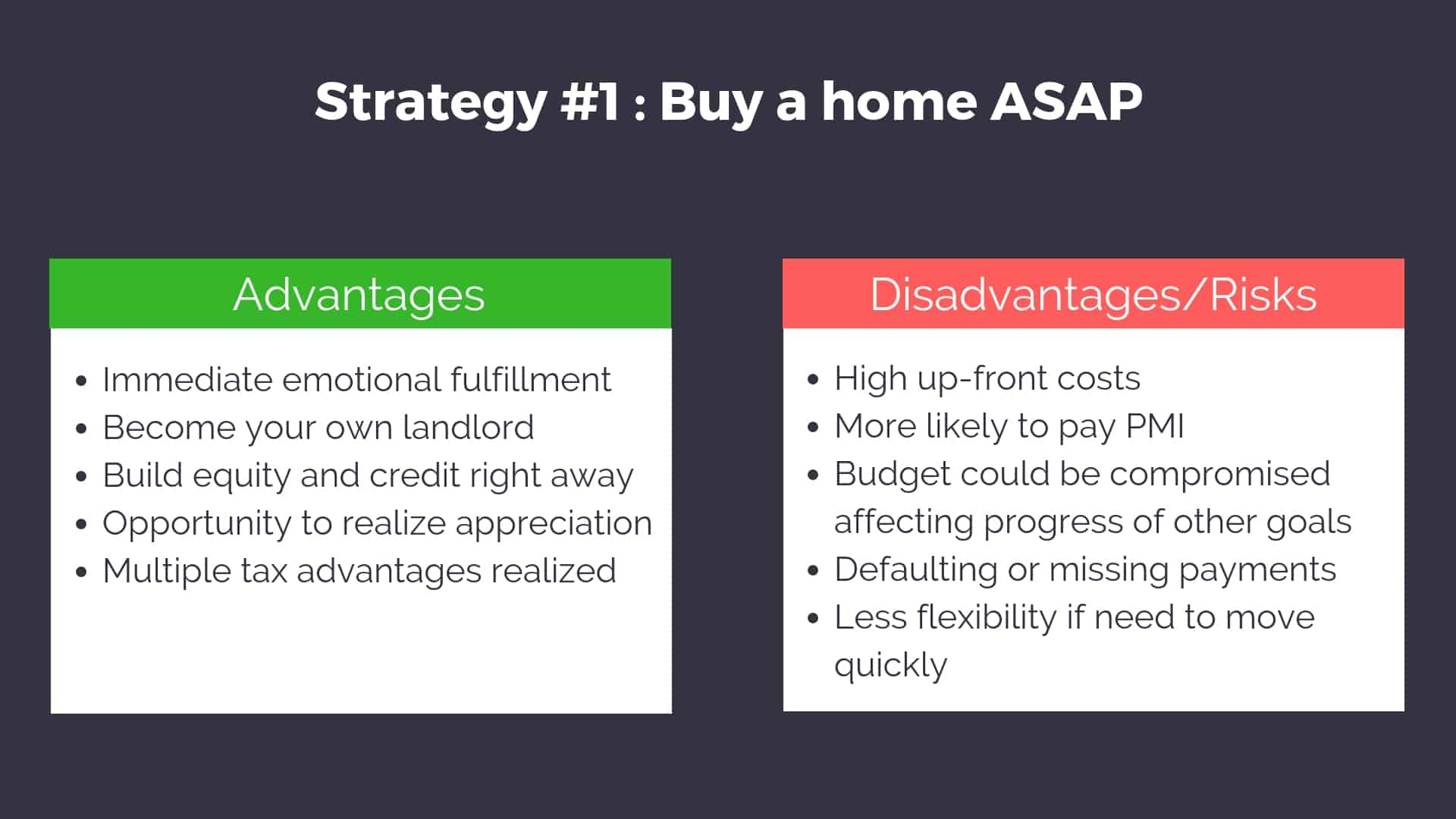

When you choose and stick with a payoff strategy there will always be trade-offs or an opportunity cost. For example, if you choose a payoff strategy that results in a very high monthly payment, you will not able to put as much money toward investing, home buying, entertainment, etc. Depending on your projected time to payoff and years left working, you may not be willing to deeply sacrifice some of your other financial goals.

With tuition reimbursement programs in addition to the Public Service Loan Forgiveness program, your career options will be more limited to fully reap the benefits of these programs. Since tuition reimbursement is mostly based on years of service for a particular company or organization, you have to be willing to stay employed there for the required time to realize the maximum benefit. Similarly, with PSLF you are essentially locked into working for a government or nonprofit organization for 10 years. If you have other career aspirations or plans on the table during this decade, you will have to weigh that against tax-free forgiven loan balance.

Step 5: Determine Your Payoff Strategy and Optimize

Ok, if you have read everything up to this point, first off congratulations. That was a ton of material! By now you should have considered the options available to you, figured out the math, and weighed in the other considerations putting you in a position to choose your payoff strategy for the first time or reorganize one you have already had in place.

Because everyone has a unique situation with different loan balances, goals, and attitudes, there’s no way to say that one strategy is the best for all. However, I do think there are some truths that are going to stand strong the majority of the time.

First, if you have access to a tuition reimbursement/repayment program, take it! This is free money! Most of these programs are 2-5 years and depending on the specific one, it could knock out all or a huge chunk of your debt.

If you’re not fortunate enough to get into one of these programs or you have maxed out that benefit, most pharmacists should either choose PSLF or the non-forgiveness route via

refinancing. However, if you have a high debt:income ratio and are not eligible for PSLF, you should also strongly consider non-PSLF forgiveness. Below is a flowchart summary of how to navigate the different strategies.

If you have the typical pharmacist student loan balance, it’s really hard to argue against PSLF. The math is not even close. You will pay thousands less than any other strategy. But not only that, you have the opportunity to optimize this strategy and be on the fast lane to building some serious wealth. Since your monthly payments through the program are dependent on your discretionary income and therefore adjusted gross income, there are ways you can lower payments while simultaneously investing aggressively. The key ways to do this will be maxing out traditional 401(k) contributions and HSA (if available to you). It’s possible to also count traditional IRA contributions. However, because the phase-out for this is a MAGI of $74,000 for single, and $123,000 for married filing jointly if you are covered by an employer-sponsored plan, most pharmacists will not be eligible to get the deduction. For more information on how to maximize forgiveness, check out this

podcast episode.

Now if PSLF is off the table, either because you don’t meet the qualifications or you don’t want to wait 10 years and rely on the government, refinancing is a strong option.

Refinancing student loans after pharmacy school should be done as you can if it makes sense so you don’t pay any unnecessary interest.

Considerations During Pharmacy Residency or Fellowship

Doing a

pharmacy residency is a great way to further your skills and knowledge and can unlock some great job opportunities. However, for 1-2 years, depending on your path, it can be difficult just trying to pay bills and survive let alone fight through student loans with only 1/3 of a typical pharmacist salary.

Since the

grace period for student loans will usually end midway through your PGY1 experience, you will have to make some decisions at that point. If you do nothing, you will be put in the 10-year standard repayment plan and unless you have significant side income or a working significant other, that payment is not going to be feasible if you have a typical loan balance.

One of the biggest mistakes that I see residents make is putting their loans in deferment or forbearance. On the surface, this doesn’t seem like that big of an issue and will allow you to stop making payments during your pharmacy residency. However, interest will continue to accrue and

there are much better options!

First, you definitely want to keep PSLF in mind and if your residency program is a qualifying employer and you plan on continuing to work there or another qualifying employer, you want to make sure you start the process ASAP. One of the huge benefits of doing a pharmacy residency and pursuing PSLF is that for 1-2 years you could be making very minimal student loan payments.

Think about it. If you made little to no money during your last year of pharmacy school, you could be making $0 qualifying payments or very little during your first year of residency based on your current salary. If you do a second year of residency, your payments will again likely be very low since it’s based on that salary.

As I mentioned earlier, IBR, ICR, REPAYE, and PAYE are all qualifying repayment plans for PSLF but what is the best one for pharmacy residency? While most of these are based on 10% of your discretionary income except ICR, REPAYE has some unique features. For all Direct Unsubsidized loans, the government will pay 50% of the interest that accrues every month if your loan payment is less than the amount of the monthly interest. So let’s assume you have $160,000 in student loans at 7% interest. $933 in interest will accrue every month as soon as the grace period ends. If your payment is $0 which very well could be if you had little to no income in your last year of pharmacy school, the amount of interest that would accrue would only be $466. Plus, that $0 payment would still count as a qualifying payment toward PSLF.

Even if you don’t continue working for a qualifying employer post-residency and won’t be pursuing PSLF, REPAYE would help reduce the accumulated interest during your years of training. Because the different repayment plans have different rules regarding how spousal income is incorporated you definitely want to also keep that in mind when choosing the best repayment plan during residency.

Refinancing is not likely going to be an option during residency unless you have substantial side income since your debt to income ratio would be too high to get approved and it could be difficult making the monthly payments even if the term is extended to 15 or 20 years.

Even if you are enrolled in an income-driven plan during residency, you could technically make “extra” payments if you wanted. However, this would not make sense if there is a possibility of going for PSLF since your goal is to pay the least amount of money possible. If you are pursuing PSLF and find you have a little disposable income each month, instead of paying extra on loans consider contributing to your 401(k) if available, IRA, or HSA.

Conclusion

The average student loan debt to income ratio for new pharmacists has increased significantly in the past decade. This has resulted in pharmacists being in debt longer and can significantly impact the ability to save and invest and put delay other financial goals and life events.

There are a number of ways to tackle pharmacy student loans and choosing the wrong strategy could cost you thousands. It’s important to calculate the total amount paid and determine the monthly payments to get a clear picture of your options. Also, you should consider the factors in play beyond the math so that you can choose a plan that most closely aligns with your goals.

If you still have questions or are unsure about what to do with your loans, you can always reach out to us and

schedule a 1-on-1 consult. We will develop a customized plan that considers multiple scenarios and helps you determine how to save the most money. It will also include any tax implications that may be in play with forgiveness programs.

Therefore, now more than ever you as a pharmacist have to have a solid game plan to pay back pharmacy school loans. Pharmacy schools are not currently required to teach personal finance. Some offer electives and some provide education for their graduating class, but in general, the onus is on you to become informed. Sure, everyone is required to do the mandatory federal loan “exit” counseling but that’s really insufficient and doesn’t typically provide clarity in choosing the best payoff strategy.

With the multitude of student loan types, repayment plans, forgiveness programs, and

Therefore, now more than ever you as a pharmacist have to have a solid game plan to pay back pharmacy school loans. Pharmacy schools are not currently required to teach personal finance. Some offer electives and some provide education for their graduating class, but in general, the onus is on you to become informed. Sure, everyone is required to do the mandatory federal loan “exit” counseling but that’s really insufficient and doesn’t typically provide clarity in choosing the best payoff strategy.

With the multitude of student loan types, repayment plans, forgiveness programs, and

Compared to the 10-year Standard Repayment plan, pursuing forgiveness through REPAYE, PAYE, or IBR-New would result in only $130,657 paid, a difference of almost $150,000! Plus, the total amount paid could be even lower if the pharmacist were to maximize traditional 401(k) contributions and other options to lower adjusted gross income. Oh and that $209,343 loan balance remaining after 10 years? Forgedda bout it! It’s eliminated and no taxes to pay on that money.

Compared to the 10-year Standard Repayment plan, pursuing forgiveness through REPAYE, PAYE, or IBR-New would result in only $130,657 paid, a difference of almost $150,000! Plus, the total amount paid could be even lower if the pharmacist were to maximize traditional 401(k) contributions and other options to lower adjusted gross income. Oh and that $209,343 loan balance remaining after 10 years? Forgedda bout it! It’s eliminated and no taxes to pay on that money.

Qualified Employment

Qualified Employment

This is a big deal especially if you are a resident or fellow transitioning from student life or from resident to first-year practitioner. Previously, you would have had to disclose if your income increased which would be true going from having zero to minimal earnings as a student to 1/3 of a typical pharmacist salary or from resident to new practitioner.

However, with this change, you are going to pay substantially less during your transition years since your income is going to be based on the previous year’s earnings. Of course, you want to be truthful and accurate when filling out the form but if you are not required to disclose increases in your income then you shouldn’t. Why not take full advantage of the system in place?

Incorporating spousal income into this calculation will depend on the income-driven plan and how you file your taxes. For REPAYE, spousal income will count toward AGI regardless of how you file. If you file separate income tax returns, then only your income will be counted under PAYE (and IBR-New).

Initially, to qualify for PAYE you cannot have any outstanding loan balance on a Direct or FFEL Program loan when you received a Direct Loan or FFEL Program loan on or after October, 1, 2007, and you must have received a disbursement of Direct Loan on or after 10/1/11. Confusing right? If you can need more clarity on this check out

This is a big deal especially if you are a resident or fellow transitioning from student life or from resident to first-year practitioner. Previously, you would have had to disclose if your income increased which would be true going from having zero to minimal earnings as a student to 1/3 of a typical pharmacist salary or from resident to new practitioner.

However, with this change, you are going to pay substantially less during your transition years since your income is going to be based on the previous year’s earnings. Of course, you want to be truthful and accurate when filling out the form but if you are not required to disclose increases in your income then you shouldn’t. Why not take full advantage of the system in place?

Incorporating spousal income into this calculation will depend on the income-driven plan and how you file your taxes. For REPAYE, spousal income will count toward AGI regardless of how you file. If you file separate income tax returns, then only your income will be counted under PAYE (and IBR-New).

Initially, to qualify for PAYE you cannot have any outstanding loan balance on a Direct or FFEL Program loan when you received a Direct Loan or FFEL Program loan on or after October, 1, 2007, and you must have received a disbursement of Direct Loan on or after 10/1/11. Confusing right? If you can need more clarity on this check out

You can see that if this person were to extend payments out 25 years using the extended fixed plan, there would be a $1,944 payment and a total amount paid of $583,093. However, considering non-PSLF forgiveness using PAYE or IBR-New, payments would start $848 and increase to $2,289 (using a 5% increase in income/year per calculator assumption) and the total paid would only be $350,821. However, there would be $309,179 forgiven that is treated as taxable income. If we continue with the assumption of a 25% tax bracket, there would a tax bill of around $77,000. So even with the tax bomb, there are definitely some advantages here:

1. The total amount paid over 25 years will be much less even with considering the additional tax bill (by over $100,000).

2. For many of the years during repayment, the monthly payments will be significantly lower which allows more disposable income for retirement contributions and other financial goals.

3. The tax bill of $77,000 is in future value which is much less than it is today

You can see that if this person were to extend payments out 25 years using the extended fixed plan, there would be a $1,944 payment and a total amount paid of $583,093. However, considering non-PSLF forgiveness using PAYE or IBR-New, payments would start $848 and increase to $2,289 (using a 5% increase in income/year per calculator assumption) and the total paid would only be $350,821. However, there would be $309,179 forgiven that is treated as taxable income. If we continue with the assumption of a 25% tax bracket, there would a tax bill of around $77,000. So even with the tax bomb, there are definitely some advantages here:

1. The total amount paid over 25 years will be much less even with considering the additional tax bill (by over $100,000).

2. For many of the years during repayment, the monthly payments will be significantly lower which allows more disposable income for retirement contributions and other financial goals.

3. The tax bill of $77,000 is in future value which is much less than it is today

Advantages of the Federal Loan System

Keeping your loans in the federal system will give you some protection and safeguards that are not always available through private lenders. If you die or become permanently disabled, your loans will be discharged without any tax bill on that amount. In addition, if you’re facing a financial hardship, want to go back to school, or have circumstances where it could be tough to make payments, you can request deferment or forbearance which would result in a temporary stop in making payments. The other advantage is the ability to make income-driven payments if needed which generally is not available through private lenders. Lastly, all federal loans have fixed interest rates so your monthly payments will not change unless you are in an income-driven plan or one of the graduated plans.

Advantages of the Federal Loan System

Keeping your loans in the federal system will give you some protection and safeguards that are not always available through private lenders. If you die or become permanently disabled, your loans will be discharged without any tax bill on that amount. In addition, if you’re facing a financial hardship, want to go back to school, or have circumstances where it could be tough to make payments, you can request deferment or forbearance which would result in a temporary stop in making payments. The other advantage is the ability to make income-driven payments if needed which generally is not available through private lenders. Lastly, all federal loans have fixed interest rates so your monthly payments will not change unless you are in an income-driven plan or one of the graduated plans.

If you have the typical pharmacist student loan balance, it’s really hard to argue against PSLF. The math is not even close. You will pay thousands less than any other strategy. But not only that, you have the opportunity to optimize this strategy and be on the fast lane to building some serious wealth. Since your monthly payments through the program are dependent on your discretionary income and therefore adjusted gross income, there are ways you can lower payments while simultaneously investing aggressively. The key ways to do this will be maxing out traditional 401(k) contributions and HSA (if available to you). It’s possible to also count traditional IRA contributions. However, because the phase-out for this is a MAGI of $74,000 for single, and $123,000 for married filing jointly if you are covered by an employer-sponsored plan, most pharmacists will not be eligible to get the deduction. For more information on how to maximize forgiveness, check out this

If you have the typical pharmacist student loan balance, it’s really hard to argue against PSLF. The math is not even close. You will pay thousands less than any other strategy. But not only that, you have the opportunity to optimize this strategy and be on the fast lane to building some serious wealth. Since your monthly payments through the program are dependent on your discretionary income and therefore adjusted gross income, there are ways you can lower payments while simultaneously investing aggressively. The key ways to do this will be maxing out traditional 401(k) contributions and HSA (if available to you). It’s possible to also count traditional IRA contributions. However, because the phase-out for this is a MAGI of $74,000 for single, and $123,000 for married filing jointly if you are covered by an employer-sponsored plan, most pharmacists will not be eligible to get the deduction. For more information on how to maximize forgiveness, check out this  Even if you don’t continue working for a qualifying employer post-residency and won’t be pursuing PSLF, REPAYE would help reduce the accumulated interest during your years of training. Because the different repayment plans have different rules regarding how spousal income is incorporated you definitely want to also keep that in mind when choosing the best repayment plan during residency.

Even if you don’t continue working for a qualifying employer post-residency and won’t be pursuing PSLF, REPAYE would help reduce the accumulated interest during your years of training. Because the different repayment plans have different rules regarding how spousal income is incorporated you definitely want to also keep that in mind when choosing the best repayment plan during residency.

The specific income driven repayment plan will determine what percentage of the poverty guidelines is used in the calculation. For most plans including Pay-as-you earn (PAYE), Revised pay-as-you-earn (REPAYE), and Income-based repayment (IBR), it is 150%. For Income contingent repayment (ICR), it’s 100%.

The specific income driven repayment plan will determine what percentage of the poverty guidelines is used in the calculation. For most plans including Pay-as-you earn (PAYE), Revised pay-as-you-earn (REPAYE), and Income-based repayment (IBR), it is 150%. For Income contingent repayment (ICR), it’s 100%.