The 6 Biggest Factors Affecting Credit Score Right Now

You often hear how important your credit score is especially leading up to a large purchase. Mom taught me it is important to pay my credit card balance each month, but I never really understood why except for the fact that I didn’t want to pay interest on an outstanding balance.

Yet this little number can have far reaching effects, such as the ability to even get credit or how much you’ll have to pay back based on the interest rate you’re afforded. The latter can move the needle tens of thousands of dollars, if not more. If I asked you what the biggest factors affecting credit score are, you might look at me like this:

It’s important to understand what goes into this score, so you can improve it if need be. Before we get into the six different factors, let me drop a little background knowledge on the subject. In 2003, Congress passed legislation called the Fair and Accurate Credit Transaction (FACT) Act that affords U.S. residents to receive one free credit report every 12 months for each of the three major credit reporting companies, which include Equifax, Experian and TransUnion.

These credit reports, populated by all those lenders/creditors out there, determine your credit score. One misnomer is that the law does NOT require these companies to give you your credit score for free (just the credit report).

Let’s first breakdown what your credit score is and why it matters. Your credit score is a number that summarizes your credit risk, based on a snapshot of your credit report at a particular point in time. So, for those of you that have a less than perfect score, fret not! There are things you can do immediately that can have a positive impact on your score.

Your credit score tells creditors how able you are to pay back your debt over the next 2-3 years. Credit scores are like batting averages, not golf scores, so the higher the better. Higher credit scores equate to the best credit approval rates (so you don’t get denied to finance that new whip), the best interest rates and the possibility of being extending unsecured credit (meaning there’s no collateral like the aforementioned whip that the lender can take back).

It is worth noting that there are different types of credit scores out there with FICO® being the most common. Others include the VantageScore or PLUS Score®. Typical credit scores range from 300 to 850 with 850 being the best. Okay, now that we have a little background information, let’s dive in to see what factors determine your credit score.

1. Credit Card Utilization (High Impact)

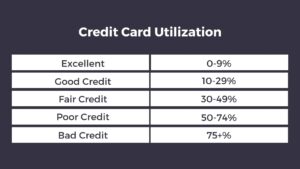

This is a high impact factor, which means it’s very important to your credit score! The lower the utilization, the better. Lenders like to see that you’re not using too much of the credit available to you. The tip here is to keep your balances low. Another trick is to ask for a credit limit increase, which will help keep your utilization low.

Use caution though! Don’t think that an increase to your credit limit is an invitation to spend more. A general rule of thumb is to keep your utilization under 30% for good credit and under 10% for excellent credit. This means that if you have a total $10,000 credit card limit, you should carry no more than a $1,000 balance to have excellent credit card utilization. See below for the utilization percentages.

2. Payment History (High Impact)

This is also a high impact factor. Lenders look at this factor to determine how likely you will make future payments on time. A payment that is more than thirty days late constitutes a late payment and, believe it or not, one late payment could hurt your credit score. Also, the credit report keeps track of payments that are 30, 60, 90 and 120 days late, so if you go beyond thirty days, go ahead and get a payment in so you don’t get hit for a sixty-day lateness. A tip here is to set up automatic bill pay so you’re never late.

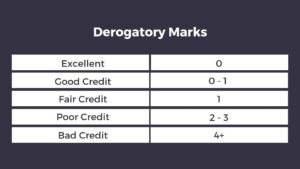

3. Derogatory Marks (High Impact)

This is the last high impact factor with less derogatory marks being better. A derogatory mark on your credit report could include something like the aforementioned late payment, repossession, a debt going into collections or even bankruptcy. The general rule of thumb is that these derogatory marks can camp out on your report for up to seven years, so do what you can to avoid them. Again, establishing automatic bill pay or setting reminders in your calendar to make a payment are crucial to avoid these on your credit report.

4. Age of Credit History

The higher (or longer) credit history, the better. Lenders like to see that you have experience using credit. This isn’t always fair to the young consumer out there but look at it from the lender perspective. Would you be more comfortable lending to someone approaching retirement that has an expansive credit history or someone who just graduated high school?

It’s a no brainer. One thing consumers often do is close paid off cards or zero balance lines of credit. This isn’t always the best method with regard to your credit score. You can actually improve your age of credit history over time by keeping your accounts open and in good standing. After all, it takes nearly a decade of history to be considered excellent in this regard!

5. Total Accounts

The total accounts are also important to lenders. This factor suggests that other lenders have trusted you before. When I first learned about this, my thinking was backward. I thought lenders would like to see fewer accounts, not more. However, lenders like to see several varying accounts, such as revolving, installment and open accounts because of the behaviors that are associated with them.

Revolving credit accounts (like a credit card) have varying payments and anything you don’t pay is carried over to the following month with an agreed-upon interest charge. Installment credit accounts (like an auto loan or home mortgage) are accounts that typically have fixed payments with balances that amortize on a fixed schedule over time. Open credit accounts (like utility payments or cell phone bills) are paid in full each month and don’t carry over.

These particular types of accounts rarely show up on a credit report unless you decide against paying the water bill or Verizon for all that data you mistakenly used last month. You can improve your credit score by adding another type of account, however, use caution. Think twice before adding an account just to improve your overall number of accounts. Sometimes it isn’t worth the additional risk of taking on more debt.

6. Hard Inquiries

The last factor is hard inquiries with less inquiries being better for your overall credit score. Hard inquiries hit your credit report when you apply for credit. Although they are unavoidable, try to avoid unnecessary hard inquiries because they stay on your credit report for 2 years.

One trick to practice is to take advantage of pre-approved credit card offers instead of applying for them. Pre-approval means the credit company doesn’t need to check your credit so you can avoid the hit. Buying a car or some household furniture and need financing? It’s still okay to shop around for the best deal because multiple inquiries in a short period of time are grouped together and viewed on the credit report as one incident.

A few more things to note about the credit score. Often times you will see that there are differences in your credit score among the credit reporting companies. It is worth noting that each of the reporting companies uses its own proprietary formula for calculating credit scores that are not available for public view (or scrutiny).

This means that the way Equifax calculates your credit score will be different than how TransUnion does it. Another variable to consider is that creditors do not always report to every credit reporting company, which could alter a score for a particular reporting company. Oftentimes, scores are fairly close, but if your scores have a wide range, you may want to research why (that means digging into your credit report for some answers!).

Now if you’re a big Dave Ramsey fan, you know that he advocates striving for a zero or indeterminable credit score. This is because he strongly recommends paying off all of your debt and never using a credit card, ultimately leading to that situation.

While the intention is good in that it promotes reduced reliance on debt utilization, the reality today is that many organizations and financial institutions strongly consider credit score, regardless of your net worth and the rest of your financial picture. Therefore, it can be more difficult to get approved for a mortgage, investment properties, a lower rate for refinancing student loans, and sometimes even rent if you have a low or no credit score.

Conclusion

I’ve outlined the six factors that determine your credit score, coupled with a few nuggets that are hopefully useful to your own situation. Your credit score is a glimpse into your financial life and your ability to make good on your debts. Know your credit score, know your shortcomings with regard to your credit score and take the necessary steps to fix them to get that score as high as possible!

Need help navigating your credit or finances?

Figuring out how to navigate your finances and improve your credit can be tough if you have student loans and a lot of other competing financial priorities. If you need help improving your financial health, you can book a free call with one of our CERTIFIED FINANCIAL PLANNERSTM.

Current Student Loan Refinance Offers

[wptb id="15454" not found ]Recent Posts

[pt_view id=”f651872qnv”]