Dr. Donisha Lewis talks about her debt-free journey, why and how she got involved in real estate investing, and how she and her husband got on the same page to achieve their financial goals.

About Today’s Guest

Dr. Donisha Lewis is a clinical pharmacist at an ambulatory care facility where she collaborates with providers of the Hematology/Oncology and Internal Medicine departments to create treatment plans for patients. She attended the University of Louisiana at Monroe College of Pharmacy where she received her Doctor of Pharmacy degree in 2011. During her career as a pharmacist, she has served patients in the community, inpatient, specialty, and ambulatory care settings. She is also a real estate investor alongside her husband. She enjoys traveling, spending time with family, and volunteering.

Episode Summary

This week on the YFP Podcast, YFP Co-Founder & CEO, Tim Ulbrich, PharmD, welcomes Dr. Donisha Lewis to the show to discuss her debt-free journey. During this episode, listeners will hear the how and why of Donisha’s path toward financial freedom, how she got her start in real estate investing, and how she and her husband got on the same page to tackle $115,000 in debt in just two years. Donisha shares her pharmacy story, what drew her to the pharmacy profession, and her financial picture upon graduation from pharmacy school. With plans to tackle her $99,000 in student loan debt as soon as possible, her mindset and approach to debt payoff were critical in achieving this goal. She shares practical tips and tricks from her experience in paying off a combined $115,000 between herself and her husband, and advice for recent graduates who may not have started making payments on their loans due to the student loan pause. Making sacrifices while remaining realistic, Donisha built a budget that allowed her and her husband to combine the snowball and avalanche strategies. Using her budget, she identified wasted spending and analyzed her savings to determine the amount she was comfortable contributing to the debt payment. Tim and Donisha talk about the importance of having a shared financial vision with your partner and the benefit of having varied strengths in personal finance.

Links Mentioned in Today’s Episode

Episode Transcript

[INTRODUCTION]

[00:00:00] TU: Hey, everybody. Tim Ulbrich here, and thank you for listening to the YFP Podcast, where each week, we strive to inspire and encourage you on your path towards achieving financial freedom.

This week, I welcome Donisha Lewis onto the show to talk about her debt-free journey, why and how she got started in real estate investing, and how she and her husband have been able to get on the same page to achieve their financial goals. If you’re interested in learning more about working one-on-one with a certified financial planner may help you achieve your financial goals. You can book a free discovery call at yfpplanning.com. The team at yfpplanning includes five certified financial planners that are serving more than 280 households in 40-plus states. YFP Planning offers fee-only, high-touch financial planning that is customized for the pharmacy professional. Whether or YFP Planning’s financial planning services are a good fit for you, know that we appreciate your support of this podcast and our mission to help pharmacists achieve financial freedom. Okay. Let’s jump in our interview with Donisha Lewis. Donisha, welcome to the show.

[0:01:02] DL: Thank you for having me.

[0:01:04] TU: Well, I am really excited for this conversation. You and I connected via LinkedIn through a mutual colleague, Dr. Jerrica Dodd. After we connected, and I learned a little bit more about your journey as eager to share your story with our listeners. So we’re going to dig into your debt-free journey, paying off the student loans. We’ll talk about some real estate investing as well. But before we get into all of that, let’s start with your career journey. Where did you go to pharmacy school and what led you into the profession?

[0:01:34] DL: Absolutely. I completed my pharmacy degree at the University of Louisiana at Monroe, back in 2011. As a child, I wanted to be a pediatrician, actually. My mom actually put me into a program, at the time, you could kind of shadow physicians. We didn’t shadow them seeing patients, but just the day in the life when they were doing their office hours. We went up to the operating room, and I saw all the tools and I just said, “You know, I have to find something else to do, because this is pretty intimidating.” I didn’t really want to perform any surgeries. I really didn’t think that I wanted to do anything that had that much patient contact as it related to doing surgery, stitches, anything like that. That really made me reconsider being a physician. So I started researching other medical professions that weren’t as hands-on, if you will. That’s when I came across pharmacy.

I actually have an uncle who’s a pharmacist too. That led me to the profession. I was still able to interact with patients, but not necessarily be as hands-on as I would have been as a physician. That’s what led me into the space.

[0:02:44] TU: I can relate to that. I went into pharmacy right out of high school and I was interested in medical professions at large. But the whole blood thing, you know, kind of scared me away. You hear that story often with pharmacists. One of the many reasons. I’m not sure that’s a great reason not to go into other ones, but it was an important one for me at that time. Tell us more.

So you graduated 2011. Coming up on your 12 years out into the profession, what have you been working on this point since graduation? I understand you’ve had experience in community practice, ambulatory care, a little bit in management as well. Give us that career journey over the last decade or so.

[0:03:22] DL: Sure. I began my career with one of the large retail pharmacies. I stayed with them for a little while. Then, during my time with them, I was able to get a PR, inpatient clinical pharmacist position, so I was doing both. From there, I was able to transition into a specialty pharmacy role, which was within a hospital practice. I like to say it was a combination of outpatient community pharmacy, as well as some inpatient clinical pharmacy. I really enjoyed that role. Now, I’m with an academic-based practice, and I’m helping them expand pharmacy services there. I am in a clinical role there, and we are expanding our services throughout the practice. We have some collaborative practice agreements in place. I’ve also started an ambulatory care clinic with the Department of Internal Medicine, and we’re launching specialty pharmacy there as well.

[0:04:16] TU: Wow. I love it. I love it. Some of our listeners, especially those that have graduated here in the last five or so years. I graduated in 2008, so we’re pretty close in that timeframe. When you and I graduated, student loans were – they were a thing, but they weren’t as big of a thing as they are today. We see lots of graduates coming out with you know, $200,000, $250,000 of student loan debt. Average right now is about 160,000. I think sometimes, when we talk about our own journeys, 10, 12, 13 years ago, people were like, “Oh, well. That was only $100,000.” It’s like context, context of what pharmacists were making at the time, as well as – that’s still a substantial amount to pay off. I think we’ve become a little bit numb to the indebtedness and the debt loads that are out there.

Let’s talk about your student loan journey. Give us the juicy details. How much did you have upon graduation, and what was your mindset at the point of graduation about how you wanted to approach the student loan debt?

[0:05:20] DL: Sure. When I graduated, I came out with right under $100,000 in student loan debt. Like 99,000 and some change is what I owed. For me, when I came out of school, we were at the end of the shortage, approaching really a saturation of pharmacist. One thing that I wanted to do was definitely be conservative in my spending because of that, but also not being comfortable with that type of debt that really led me to make decisions. Basically, like I was still a college student, related to my finances. I’m sort of grateful for that time coming out of school. It was an interesting time, because I saw a pharmacist when I started pharmacy school being offered all these incentives, and bonuses, and that stopped.

As soon as I graduated, those bonuses, and all of those incentives, they stopped. That’s a very big difference. I heard of people getting these extremely, just extreme amounts of bonuses, cars, all these things. For all of that to stop, I really wanted to be very cautious in my decision-making financially, because I really wasn’t sure what the future of pharmacy was at the time. One of the things to do with obviously, live below my means, but also reduce this debt. That was very important to me. With that large number, though, it’s intimidating.

Like you said, nowadays, 99,000 is not that much, unfortunately, for a lot of pharmacy grads. But to me, that was a lot. That was the framework, the mindset. I really did not want to have that debt looming over me like that for an extended amount of time.

[0:07:07] TU: It’s interesting to hear you share the timeframe you were in. I graduated in 2008, which was still at the time sign-on bonuses. We’re happy. I remember I made the decision to go do residency. I was going to make a whopping $31,000 salary all the while. Cars and sign-on bonuses we’re having. I remember one specific offer that was out there. It was one of the big chains that was offering a million dollars to go work in Alaska for a three-year deal.

[0:07:31] DL: Wow.

[0:07:33] TU: I remember, I mean, times changed significantly. You saw that happen, you graduate in 2011. We’re actually swinging back into some of that right now, which is an interesting discussion for another day. But you said something that I want to dig into a little bit deeper, which is, I’m not comfortable with that amount of debt, right? Whether the number was 99, or 150, or 50, I get a sense that just overall, you wanted this debt off of your shoulders. Tell us more about that, because I will talk with some people, Donisha that will say, “Hey, I’ve got $250,000 of debt.” And you’ll see a range of emotions to that debt. The number can be the same. In one instance, the house is on fire, it’s causing anxiety, it’s causing a lot of stress, and worry.

Then the other end, it might be, “Nah, it is what it is. It will kind of take care of itself over time.” Where was your motivation, your mindset around, “I want that off my shoulders”? Tell us more about why you felt that way.

[0:08:31] DL: Sure. For me, I, as a pharmacist, we have the actions to work part-time jobs, or pick up extra shifts and all of these things. Initially, I was thinking, “Oh, I can do that when I want to do extra things.” But I realized that that wasn’t very fun working all the time, so that was extra motivation to really have that time back and not feel like I had to work so hard in so much because I had this amount of debt. I felt like I couldn’t really do much else, because I owe someone else all this money. For me, personally, that’s just my belief with that, I really wasn’t comfortable making more decisions and making big purchases, and really moving my life forward the way that I wanted to, because I owe this large amount of money. It was really uncomfortable for me, but I do know, you know, like you said, other people, they’re totally comfortable with it. They’re like, “Well, hey, I’ll pay it off eventually.” But I just wasn’t okay with that, and I initially scheduled my student loans for a 10-year pay off. But even with that, I was like, “This isn’t going to work. Let’s speed this up.” So that’s what happened.

[0:09:37] TU: Yes. I would really encourage the listeners, especially those that are listening, that our students are just getting started. When it comes to the financial plan, I think what you’re highlighting so well here is there’s the objective numbers part of it, how much debt, what’s the strategy, what’s the plan. But then there’s the emotional side of it as well, which is really important. Folks often talk about how much a personal finance is behavioral. As each year goes on, I’m believing that more, and more, and more. There’s so much to be said about acknowledging the emotional side, the behavioral side of financial planning. There is no right or wrong answer. That’s I think it’s so important to communicate that, whether you are someone that looks at debt, and you have a lot of aversion to it, and it’s causing you stress, and it’s causing anxiety, like honor that. Honor that and develop a plan around that.

For folks that feel differently, making sure you’re finding a way to mitigate the risk, but just understanding having the self-awareness of where you are, emotionally in terms of viewing different parts of the plan.

[0:10:35] DL: Absolutely.

[0:10:37] TU: Donisha, I’m curious to hear your perspective. We are now approaching three years since the beginning of the pause on any payments being due for federal student loans because of the pandemic. So March 2020 was the beginning of the passage of the CARES Act, it’s been extended several times. We’ve had a freeze on payments, a freeze on interest rates. We now are coming up on class of 2023. We’ll be the fourth graduating class, and depending on what happens here, with the Supreme Court decision, and when the when the payments begin, potentially the fourth class that has not had to make payments on their student loans. I think that is a blessing, and it also presents some challenges. I’d love your perspective as someone who has gone through this journey, what would you have to say to those that are coming out, and those that are recent graduates about, “Hey, be thinking about this when these payments begin, because they will begin at some point.”

[0:11:32] DL: Absolutely. I think if you’re in the position where you are making the money that the average pharmacist makes. I would strongly consider starting to plan now, or starting to make those payments, and loan forgiveness and all of that. Those things are still in legislation. I really don’t recommend waiting for that to happen. It may very well happen. But I feel like if you’re in the six-figure zone, I don’t think the full amount will be forgiven. Even just now, thinking about your strategy, thinking about how you want to approach it, and especially if you’re someone who’s not comfortable with it, you definitely don’t want to just ignore it. There are different strategies that you can take to make sure that you aren’t – it’s completely ignoring it, but you’re still comfortable in your lifestyle. I would really do my research there and begin to plan and have a decision to take some action on that.

[0:12:30] TU: Yes. Such a good time to game plan, right? That timeline to game plan has been extended. We were saying back in 2020, use this window, come up with the plan. I think that’s had a – it’s lost its effect right over time, because it’s been extended so many times. But I love what you’re sharing there, because if payments start back up, and you’ve got a plan, great, you hit the ground running. If payments don’t start back up, but you have a plan, and you’ve just had expenses. That’s great, too, We can allocate that to different parts of the plan. I think my fear is that, especially with rising housing costs, often we have student loan borrowers, that are also first-time homebuyers, like pharmacists making a great income. But at the end of the day, there’s only so much income to go around.

When you’re looking at $200,000 of student loan debt, rising home costs, and obviously inflation. There’s been other competing expenses, I’m sure for many people as well. You start to get pinched in all different directions, and we’ve got a reset. What is that payment going to be when we come out of the pause? Look at the options. Are we doing a 10-year standard repayment? Are we doing an income-driven repayment? Are we doing a loan-forgiveness pathway? What is that monthly amount going to be based on the strategy, and then how do we work that into the budget to make sure that we’re ready?

I do think, though, that for folks that have really optimized this time period, the we have heard of situations of pharmacists that hey, I had a big student loan payment. But because that’s been on pause, I’ve been able to pay off credit card debt or I’ve been able to build up my emergency fund, or focus on another debt that was getting paid off as well. Hopefully, there’s been a lot of wins and opportunities that have come from this

[0:14:05] DL: Yes, I hope so too.

[0:14:07] TU: Let’s talk about how you were able to accomplish this. We can debate whether or not $100,000 is a lot. I think it’s a lot.

[0:14:14] DL: I do too.

[0:14:16] TU: It wasn’t just the amount, but it was the time period and the intensity. Couple years that you paid this off. I’m curious, you know, what sacrifices did you have to make to be able to allocate as much as possible towards the student loans, and then how did you keep up that momentum and the intensity of it knowing that two years, yes, it’s a short period. But when you’re in that type of intense debt repay off, that can feel like a long time. What were the sacrifices and then how did you keep the momentum?

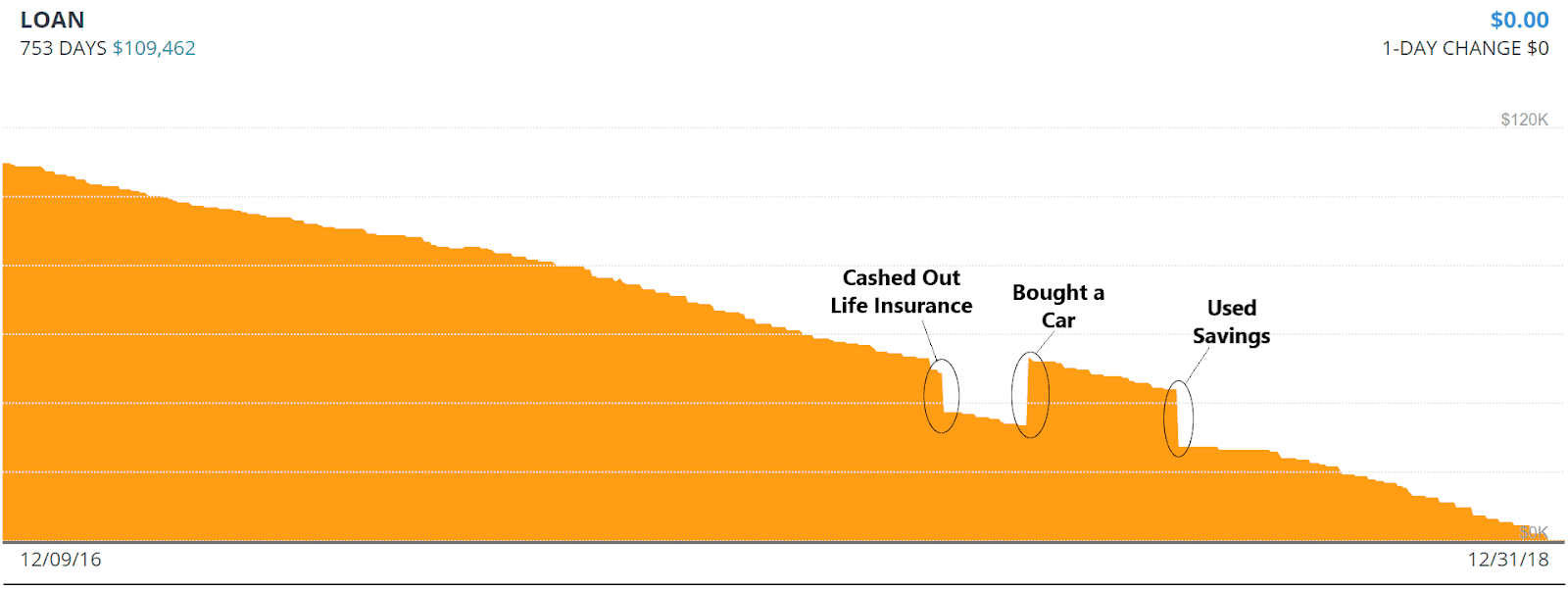

[0:14:47] DL: Sure. I did this with my husband. Total, it was $115,000 together, between the two of us and that did include a car loan. We just included all the debt. We didn’t have credit card debt, but we did have the student loan debt and the car loan. I will be honest, in the beginning, we really didn’t know how long it was going to take us. We just knew we wanted to get more aggressive with our payoff. We use the snowball strategy. Some people don’t know what that is. You just put all your loans in order, you start with the lowest amount, and put them down in order, and you pay the first one off, and then you just roll that payment into the next payment, and you keep going.

The first thing we did, Tim, was we just looked at our budget. If you don’t have a budget, you can create one. I would say, look at the last few months of your banking statements, credit card, all that stuff, put it together, create a budget based off that. Now, the first thing you would do is, you want to see, “Am I spending more than I’m making?” If that’s the case, then you really need to, again, create some type of strategy. That’s what we did. We looked at our budget, we looked at our spending. Even though we did live below our means, I think everybody can identify areas of waste in their budget. For us, that was food.

We would go to the store, buy groceries for the week or so, get tired, go buy food out, because we didn’t want to cook. Meanwhile, those groceries, they’re no longer, you know, you can no longer eat them. They’ve gone bad. So now, we’re throwing away food and buying more food. We really identified that, and that was a big area for us that we could cut down on. So really, looking at your budget, identifying areas of waste. That’s another thing that we did. Then, we just looked at our savings to see what we were comfortable with going at the debt.

I know a popular snowball or the author of Snowball, they recommend the $1,000 for your emergency fund. That wasn’t realistic for us. I live in DC, my husband and I are both from Louisiana. If something happened, $1,000, we couldn’t even get home. We had to make that a larger number, but whatever is comfortable for you.

We did take some of our savings, and we just did the Avalanche Method, which is where you put a large amount of money towards the debt. We use that. During that time, we had just purchased our first home, which was a fixer-upper, pre-foreclosure. In that, the next year, we got a lot of tax benefits, because we did a lot of improvements. When we received that tax return, threw it at the debt, like that’s what we did. So, sometimes things like that happen. Anytime that happens, just throw it at the debt. I recommend being realistic. When I say create your budget, identify areas of waste, going back to the food example. If you’re someone that’s eating out five or six times a week, don’t just say, “Oh, I’m going cold turkey.” It’s not realistic, and you’ll probably be miserable. That’s not the goal, because then you really, probably will quit before you get to the finish line.

What I would recommend is, being realistic with your goals. If you’re eating out five times a week, maybe cut it down to one to two times a week, and also reduce the level of the restaurant. Maybe not the most expensive place, maybe like a mid-range place. You definitely don’t want to deprive yourself. For us, we also like to travel. We decided, okay, instead of maybe taking three to four trips a year, you just do one. That’s what we decided to do, so that reduced a lot of money going out as well.

Setting up some realistic expectations once you do your budget, identifying that waste. Another thing with a budget, some people don’t realize, if you get paid bi-weekly, two times out of the year, you get a third check. For us, that was a mini bonus. What we would do was really strategize with that check. Do I want to spend a portion of that to do something that I’ve kind of cut back on to pay off the debt? To pay off the debt, do I want to put the entire mini bonus toward the debt? Really like looking at different areas that you can strategize in. Another area of waste is subscriptions to the gym, to subscription services, with television or all those things. Just looking at your finances, there may be things coming out every month, $7 here, $10 there. Those things add up.

If you’re not using those things, you can cancel those subscriptions. That’s what I advise, looking at those bank accounts. That’s what we did. Identify as much waste as possible within reason. Then any type of extra money that we received via from tax return, a bonus from your job, or just that extra third check, being strategic about that, and putting it toward the debt. By doing that, we really started to change the way we viewed money during that timeframe, and we got excited about it, and we just really wanted to keep it moving, keep rolling, put more and more money toward it.

During that time, “Tim,” life was still happening. We had unexpected things come up, where we had to pivot, we had to make adjustments. But we never touch the emergency fund, we just adjusted how much we were paying on the debt. We still did it. In two years, we were not expecting that at all. So if you really are serious about it, and you set the foundation, and really make realistic goals, I think you can be successful and also run your own race. Don’t compare too much. It took us two years, but we were only responsible for ourselves financially at the time. That was another thing we knew, “Hey, we’re only responsible for ourselves right now. Let’s take this opportunity, because we don’t know what may change in the future to get this done now.” When your own race, if it takes you longer, that’s fine as long as you’re trying and you’re taking some action on that.

[0:20:48] TU: I love that. So much to unpack there. I think the theme I heard was really a mindset around the intentionality with the financial plan, and several things that you outlined, right? Making sure that you’ve got a budget that is realistic, that one is going to be able to keep the momentum so important. I think we often try to go from 0 to 60 budget. We get frustrated. It further disenfranchises us from the process overall, and it’s something as important as track back 90 days. You said a few months of looking at expenses, before we set these goals that may or may not be realistic. Let’s look at what we have been spending. Sure, we might pivot. You gave the example of eating out. But we want to pivot in a way that, yes, it’s going to free up some cash flow that allows us to achieve the goal. Whether that’s paying down student loan debt, whether it’s paying down other debt, maybe it’s saving for a home, saving for investment property. Whatever the goal is, we got to have cash flow. But just as important, if not maybe more important is the momentum to keep going.

We don’t want a system and a process that’s going to bog us down, it’s going to leave us frustrated. I think making sure that we’re finding that balance of enjoying things along the way, but also, whatever system we’re building, we feel that it’s built in a way that we’re going to be able to sustain it.

[0:22:04] DL: Absolutely.

[0:22:05] TU: I know. I’ve fallen victim too, and I think we see this a lot with people that are getting started, is they develop a beautiful system because they’re really motivated and excited. Then two months later, we’re kind of falling back into the patterns we were, because it’s so much to manage and so much to keep up with. We have a free template for folks that want to get started with the budgeting process, you can go to yourfinancialpharmacist.com/budget. We’ll link to that in the show notes, you can download that.

Then from there, you could use Excel. If you’d like to stay in Excel, you can use a bank tool, you can use mint, you can use – [inaudible 0:22:39] lots of different budgeting tools and options that are out there. Donisha, I want to dig into the we factor more, I heard you say we multiple times throughout the journey. We as in the debt, we as in the plan that we’re developing, we as in making the decisions on what was most important and what goals we’re going to achieve. There’s a lot to get on the same page with and I don’t want to take for granted how hard it can be to have a shared vision where two people are rowing in the same direction. I often have the opportunity to talk with folks, but that may not be the case. You may have one person who’s really engaged, one person who’s not engaged, or one person that grew up in a very different money household than someone else. For different reasons, they’re grown in two different directions.

It’s so hard for them to achieve the goals without first sharing the vision of being on the same page. I sense a very united we front as you were talking. Tell us more about what that looks like, give us the sneak peek into the kitchen table. How have you been able to get on the same page and keep that momentum together?

[0:23:45] DL: Absolutely. I appreciate you for acknowledging that. One thing about us, we’re blessed to go to a church that has a budget class. We took a budget class before we even got married together. That really put us on the same footing. We had the same vision and the same goals of what we wanted to achieve, but the pathways were a little different. In taking that class, we took it together, and we’ve really kind of established that foundation. The budget to me is the first step for everything. Now, once we got married and our finances were together, we really had to look at each other’s strengths. My husband is the big-picture person, I’m the day-to-day person.

When we were doing our debt payoff, I was the one looking at the budget every day and saying, “Okay, we need to slow down in this area because we’re only two weeks into the month and we’re not going to reach our budget goal if we don’t slow down.” That was my job. That’s okay. Then, what we would do is we would have meetings together where I would discuss certain things with him. He’s looking at the bigger picture, and also projecting what’s the next stage after that. That’s kind of his role. I’m the person that goes back, kind of works on the strategy, and looks at the day-to-day and the little details that he really does not want to do at all. We really show one another grace in that and really appreciate our differences, and use those differences for the benefit of the team. That’s how we do it.

[0:25:21] TU: I love that. I think just the awareness to acknowledge the different strengths to articulate that to one another, to embrace the strengths that come with those roles naturally, and then to align those so you can move forward. I love what you’re saying about the budget. I often encourage folks, “Hey, start with the vision and the dream.” Then as you work into the budget, the budget is really the roadmap for how you’re executing your goals. It’s a direct representation of what you are saying collectively is the priority or is not the priority. I think for folks that are listening, and maybe don’t feel like you’re on the same page with a vision, I would really encourage you to start there. Because I think when two people get excited about the vision, before you maybe get bogged down in the weeds of the numbers, like if we can get on the same page about the vision, awesome.

This is what financial success looks like for us as a couple or for us as our family. All right. Now, let’s develop the budget in the system that is the roadmap to achieve those goals. We said these things are most important. Are they represented? If not, why not? What can we change? What should we do differently? I think that that really helps folks get aligned. I think we often think of budgeting as restrictive.

[0:26:35] DL: Absolutely.

[0:26:36] TU: But if we reframe as, “Hey, this is the mechanism in which we’re achieving our goals. I’ll never say it’s exciting, but I think it’s a path in that direction of – and especially if we layer automation on top of that.” Okay. We’re now identifying the goals and automating the goals that we collectively said are most important. Then watch out, right? Because if you have come together on the same page to define the vision, and you’re starting to achieve that, and you both see that happening, things start to move from that forward of what else is possible.

[0:27:08] DL: Absolutely. You hit the nail on the head, especially for us, because the next move was real estate investing for us. That was something that my husband was much more on board with than I was. I’m a pharmacist. We like things to be in a nice little package. It all has to make sense. That was risky to me. I was interested, but I just really didn’t want to dive in. But once we work together to pay that debt off, and I saw the power of the teamwork for us, I just felt like, “Hey, we can do this.” Even if things go beyond what we expected, or things change, and we have to pivot, we have already done that with the loan payoff. So it really strengthened that teamwork, and I was able to get on board with the real estate investing afterward.

[0:28:01] TU: Yes, right. We’ve accomplished this as a team. Obviously, at that point, you’re working from a position of financial strength. We’ve got no debt. We’ve got a fully-funded emergency fund. We’re able to take on a little bit of risk, such that, if things go differently than as planned, it’s not going to create additional stressors. Let’s talk about the real estate. There’s lots of different types of real estate, from passive to active. The guys on the real estate investing podcast that we launched, every Saturday, David and Nate do a great job of talking about the spectrum of real estate, featuring different pharmacists that are investing in all different types.

I think that, at least for me, when I first heard about real estate investing, and really started to dig into learning more. I had a very active image in my mind of, you know, you buy a property, you hold it for the long term, you manage it, you’re fixing things, and a lot of people do that. But there are also more passive strategies, there’s fix and flips, short-term rentals, being in the bank, there’s a lot of different ways to go at it. Knowing the variety of pathways that are out there, tell us more about the pathway that you and your husband decided to go, and how you got to the decision to go down that path.

[0:29:06] DL: The first property that we purchased, it was a pre-foreclosure. It was a situation where it was in the budget that we wanted and the location was good. But the location is really what was most important to us. That’s why I got on board with something that needed renovation, because I realized if you want something that’s turnkey in this neighborhood, it’s far past your budget. I said, “Okay. We’re going to do this, and so we did.” We renovated the home, we didn’t do any structural renovations, but we did – basically got the house. We did that, that went off really well. We stayed in the home for a little while and then we sold it. When we sold it, we sold it before the pandemic when the prices just went crazy. It was before that.

But to see the amount of appreciation in that home, a light bulb went off in my head like, “This is what they’re talking about when they say, real estate can really propel you into financial independence.” From there, the plan was to continue to buy homes, renovate, and then maybe hold them for a little while, depending on what the market was looking like, and then to sell them. That was the plan. But we ended up moving into another home that was a newer build. From there, we have the home that we’re in now, we just renovated this one. We’re kind of still working out the strategy, but the other home is – we’re using it as a long-term rental.

Ideally, we would like to be able to do a flipping business, because we like to do it. But as we’ve done more research, we realize that being able to hold on to some of these properties, and leverage the equity in them, we can propel a lot faster. Our strategy really is to buy, renovate, hold. Then, you know, use that leverage to buy again, which is called the birth strategy. That’s really what we’ve chosen to do. We are open though, toshort-termm rentals. We are exploring other markets for that as well, and really just trying to have a somewhat diversified real estate portfolio. Not to diversify, because I do feel like if you focus on one or two things, you do a lot better. But that’s really our strategy.

We’re okay with doing construction, we’re okay with doing renovation, we’ve done it, and we’re okay. At this point, we’re doing long-distance investing. That’s really our next step.

[0:31:32] TU: I love it. I think it’s a great example of you, take that initial step and kind of get over that initial fear. Then, some things goes plan, some don’t. It opens up some different doors or opportunities. I think for everyone, their journey may be different of what they’re comfortable with in terms of risk tolerance, how active they do or don’t want to be in the process as well.

For folks that are listening to this and hearing some of the strategies that you’re talking about with the birth strategy and leveraging the equity in long-term rentals versus short-term rentals. The Real Estate Podcast, they’ve covered much of that and a future pharmacist stories as well. So we’ll link to that in the show notes. I would encourage folks to check out that podcast as well. I’m curious to know, it sounds like you’re fairly active, right? When you’re talking about the flipping, the construction, is that you and your husband? Is that you managing the project? Are you passive? It sounds like you’re very active. Am I reading that right?

[0:32:23] DL: We are very active. He’s more of the project manager. I’m the money person. I actually analyze the deals, I research areas, and research deals. Then I bring them to him, and we kind of analyze those together. He is the negotiator as well. When the negotiations happen, I walk away, Tim. I’m a lot more polite when it comes to that. I just walk away and let him do his thing. That’s him. He’s definitely the project manager. Working with the contractors and all of that, and I’m more so the person managing the budget, finding the deals, and then we work together on design.

[0:33:02] TU: Okay. Just like your personal finances, it sounds like you have identified strengths, and roles, and areas of responsibility. It’s your own business, within the family unit, which is really cool. I’m curious to know, deal finding. I think that’s one of the biggest barriers for people getting started is where do I look? It feels like people that are in this are just a huge disadvantage of somebody getting started. Are you looking off-market? Are you looking on the MLS? Do you have referral sources? How are you sourcing those opportunities?

[0:33:32] DL: Right now, as you know, these interest rates are very expensive. This market is very unique. But when we started out, we did a lot of driving, just driving ourselves around, and really looking for opportunities where a home may look vacant, or a home looks like it’s not being properly taken care of. Then from there, we will try to see if it was on the MLS. In the case of our first home, it was a pre-foreclosure. It was actually on the MLS as a pre-foreclosure. Then we use a realtor to help us with that.

Now, there are so many just groups of wholesalers and all of this that are out there. If you are trying to get started, there are ways to get in contact with other folks doing that. If you feel like, “Hey, I don’t really want to invest that much money into it” and you want to kind of get that experience and exposure, you can always ask people if you can just link up with them, and ask them what you can add to their system where their pain points are. That’s a great way for you to learn and a great opportunity for you if you’re not really at the point where you really want to invest a lot of money into it.

Right now, we’re currently working with realtors, especially since we’re looking in other markets. So we are working with realtors to try to find some of those properties. We don’t focus too heavily on off-market deals at this point in time. But I do know people do that, and they do that well. There are a lot of systems out there that can help you with that as well.

[0:35:06] TU: When done well, I think real estate can really add to, you mentioned, a pathway to financial independence that could potentially create wealth, lots of reasons to accelerate the financial plan, different tax advantages, et cetera. When not done well, it can be a hindrance on the financial plan, and there is a risk side of it. There’s obviously folks that have built systems and processes that have done this well. There’s individuals that maybe haven’t done as well, or analyzing deals properly, and not looking at the full breadth of what the numbers really are.

I sense that you guys really do have a system, a process. You’re looking at growing and scaling, which tells me the numbers are working. My question is, how do you view real estate investing, impacting and accelerating your personal financial planet. Is it a long-term strategy of building wealth, it’s part of the retirement plan, it’s a tax strategy? Is it short-term that the income from real estate you’re using towards other financial goals? How do you view the intersection of real estate with your financial plan?

[0:36:09] DL: Sure. That’s a good question. We like to kind of be right in the middle with that. What I mean by the middle, is by us holding those properties. They are a part of our long-term plan. But we also like to choose properties where we will cash flow pretty well, also. That’s a good balance there, because we know there are markets where you can really cash flow. But if you go to sell the home and 10 years, it’s going to be the same price you paid for it. You don’t really have a lot of appreciation on that front. That long-term game isn’t necessarily there. We try to find a good balance, and that’s one of the reasons we’re leaning towards short-term or midterm rentals. Because right now, in this market, especially, that’s really going to give us that that cash flow, but we can also have that appreciation.

We do have a long-term rental, and thankfully, it’s in a location where we’re doing very well on both fronts. But trying to get there right now in this market can be challenging. We’re looking towards that short-term, midterm. But we really like to have a balance, because we do want to use the real estate. Right now, we’re just using the money to purchase other real estate, not for our personal use. But we do want to get to a point where, “Hey, we could if we wanted to.” It depends heavily on our real estate income, and maybe transition into a lower workload on our W-2s or something to that effect. But we are in this for the long run, so we’re not trying to accumulate all of these rentals and get rich quick. That’s not really our strategy.

[0:37:45] TU: Yes. You’re not having to replace your W-2 income. I think that’s an interesting point, because for many individuals, there’s the initial strategy of, “How do I do this well, and then how do I scale the system, so I can invest more into other properties, more opportunities?” But then, there becomes a point of the portfolio where, depending on what else is going on, your retirement plan, et cetera, you might want to draw from that asset. There’s a strategy involved in that, and the tax optimization and so forth there as well.\

As we wrap up, I’m curious to hear your perspective. You’re on the other side of paying off your student loans, you’ve been out for over 10 years, you’ve got a good base in real estate investing. For all intents and purposes, you built a really strong financial foundation that you and your husband are going to grow upon for the next several decades and beyond. For individuals that were – just for you and I were a little over a decade ago, I think there’s both excitement and feelings of maybe some level of overwhelmed. Hearing a story of, you’ve been through that, you’re beginning to build wealth, you’re investing in real estate. What advice would you have for those individuals that are on the front end of this journey may be feeling overwhelmed, frustrated, confused with where they’re at with their finances?

[0:38:58] DL: Absolutely. That’s a great question. I would say, write down what’s important to you and your why. So really, write down what’s important to me, my values, and you can even project that out over the next 10 years, what do I want my life to look like? I think if you start with that, then you work backwards, and you look at what you’re facing right now. Then, you leverage the tools and all these podcasts like this one that are out there, and all the different strategies that you can take to reach your goals. If you do have a lot of student loan debt, and that debt is going to impede you from getting to those goals, then maybe that’s where you start. If you don’t have student loan debt, or it’s not a significant amount of student loan debt, but you do know in 10 years, you do want to have the option of working a W-2.

Then you may want to start with looking at different ways that you can invest your money, so you can make it work for you and make it accumulate even faster. That’s what I would do. I would kind of project out maybe 10 years. Because let’s be honest, a lot of new pharmacists are in roles, and they’re thinking, I don’t want to do this for 10 years, and that’s fair. Trust me, we understand. If that’s where you are, then definitely, think about where do you want to be, and what your goals are, and then work backwards. Look at what’s in front of you, and decide what the, what the priority is, and then start to educate yourself on different methods and strategies that you can use and get help. Get help, there’s no problem asking questions, meeting with a financial planner that understands your goals, and is willing to work with you to achieve your goal. That’s what I would recommend to someone who’s at the front end of this journey.

[0:40:49] TU: I love that. Great words of wisdom, and I’m so grateful for you coming on the show to share your journey. Congratulations on the debt-free journey. I have a sense you’re just getting warmed up here into the future. I appreciate you sharing that with our listeners, and I look forward to following your journey as well.

[0:41:05] DL: Thank you. Thank you so much for having me. I’ve enjoyed it and we will definitely keep you posted on the journey. I appreciate you and this platform.

[0:41:12] TU: Thank you so much.

[0:41:13] DL: Thank you.

[END OF INTERVIEW]

[0:41:14] TU: As we conclude this week’s podcast, an important reminder that the content on this show is provided to you for informational purposes only and is not intended to provide and should not be relied on for investment or any other advice. Information in the podcast and corresponding material should not be construed as a solicitation or offer to buy or sell any investment or related financial products. We urge listeners to consult with a financial advisor with respect to any investment.

Furthermore, the information contained in our archive, newsletters, blog post, and podcast is not updated and may not be accurate at the time you listen to it on the podcast. Opinions and analyses expressed herein are solely those of your financial pharmacist unless otherwise noted and constitute judgments as of the dates publish. Such information may contain forward-looking statements, which are not intended to be guarantees of future events. Actual results could differ materially from those anticipated in the forward-looking statements.

For more information, please visit yourfinancialpharmacist.com/disclaimer. Thank you again for your support of the Your Financial Pharmacist podcast. Have a great rest of your week.

[END]

Current Student Loan Refinance Offers

Advertising Disclosure

| | | | YFP Gives accepts advertising compensation from companies that appear on this site, which impacts the location and order in which brands (and/or their products) are presented, and also impacts the score that is assigned to it. Company lists on this page DO NOT imply endorsement. We do not feature all providers on the market. |

| Loans ≥150K = $750* ≥50K-150k = $300 |

Fixed: 4.89%+ APR (with autopay) | A marketplace that compares multiple lenders that are credit unions and local banks | |

| | Variable: 4.99%+ (with autopay)* Fixed: 4.96%+ (with autopay)** Read rates and terms at SplashFinancial.com | Splash is a marketplace with loans available from an exclusive network of credit unions and banks as well as U-Fi, Laurenl Road, and PenFed | |

Recent Posts

[pt_view id=”f651872qnv”]