10 Financial Benefits for Federal Pharmacists You Wish You Had

The post is for educational purposes and does not constitute financial advice. The post may contain affiliate links through which YFP receives compensation.

The federal government is one of the largest employers of pharmacists and offers many unique practice opportunities beyond traditional roles.

Besides the Veterans Health Administration and the Indian Health Service, federal pharmacists also are employed at the Centers for Disease Control and Prevention, the Federal Drug Administration, the National Institutes of Health, the Department of Defense through one of the military branches, and the Department of Justice in the Federal Prison Bureau.

Pharmacists tend to find their work extremely satisfying with the hours and flexibility in schedule being among the top reasons which are something I can personally attest to after spending nearly a decade in a government position.

But beyond these factors that can positively contribute to one’s quality of life, there are also some huge financial perks of being a federal pharmacist.

While salaries are usually less than those in community pharmacy positions, the gap isn’t that wide. However, it’s really the employee benefits in combination with one’s salary that make the total compensation package so generous.

1. Federal Employment Retirement System (FERS) Annuity

As a federal pharmacist, your retirement plan has three components: a FERS basic benefit plan, Social Security, and the TSP (Thrift Savings Plan) which I’ll discuss later on. Contributing to your basic benefit plan each pay period is mandatory and the amount you contribute depends on when you were hired with those starting in 2013 and 2014 paying a higher percentage than those with an earlier start date.

The FERS basic benefit plan is essentially a pension paid out as a monthly annuity which is pretty amazing in a world where these are basically extinct. Remember, this is in addition to any social security income you are entitled to.

How much will I get?

Your benefit is calculated using a pretty straightforward formula:

1.1% x High-3 x Years of Service = Basic Annuity Annual Payment

If you retire before age 62 or at age 62 with less than 20 years of service the 1.1% multiple is reduced to 1.0%. Your “High-3” is your highest average salary for three consecutive years which is usually the last three years of your service. This number is based on your average rates of basic pay which does not include bonuses, overtime, allowances, or special pay for recruitment or retention purposes.

Length of service takes into consideration all periods of creditable civilian and military service and only years and months are used in this calculation, so odd days you worked beyond a month are dropped.

Here’s an example of this calculation: Let’s say you are 62 years old, have been a federal employee for 30 years and your “High-3” salary is $150,000. This would result in an annual annuity of $49,500.

If you don’t want to worry about all the rules check out the FERs Retirement calculator below.

FERS Retirement Calculator

When can I retire?

To be eligible to receive the basic retirement annuity you have to meet two conditions. First, there is a minimum number of service years. If you retire at 62, that number is 5, 20 years if you retire at 60, and 30 years if you want to retire at your minimum retirement age (MRA) and that happens to be prior to age 60.

You can also retire at your MRA with 10 years of service, but your benefit is reduced by 5% per year every year you are under 62 unless you have 20 years of service and your benefit starts when you reach age 60 or later.

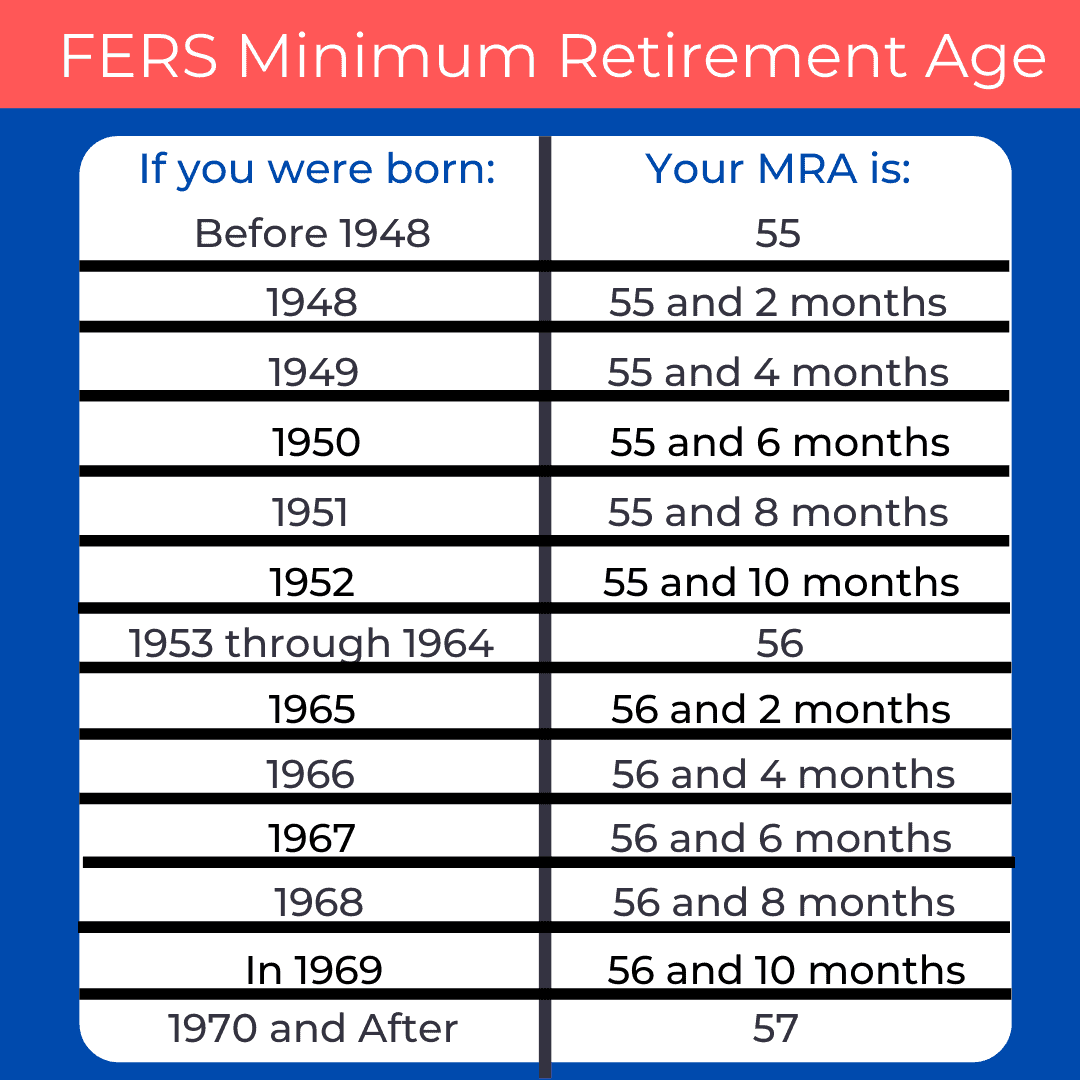

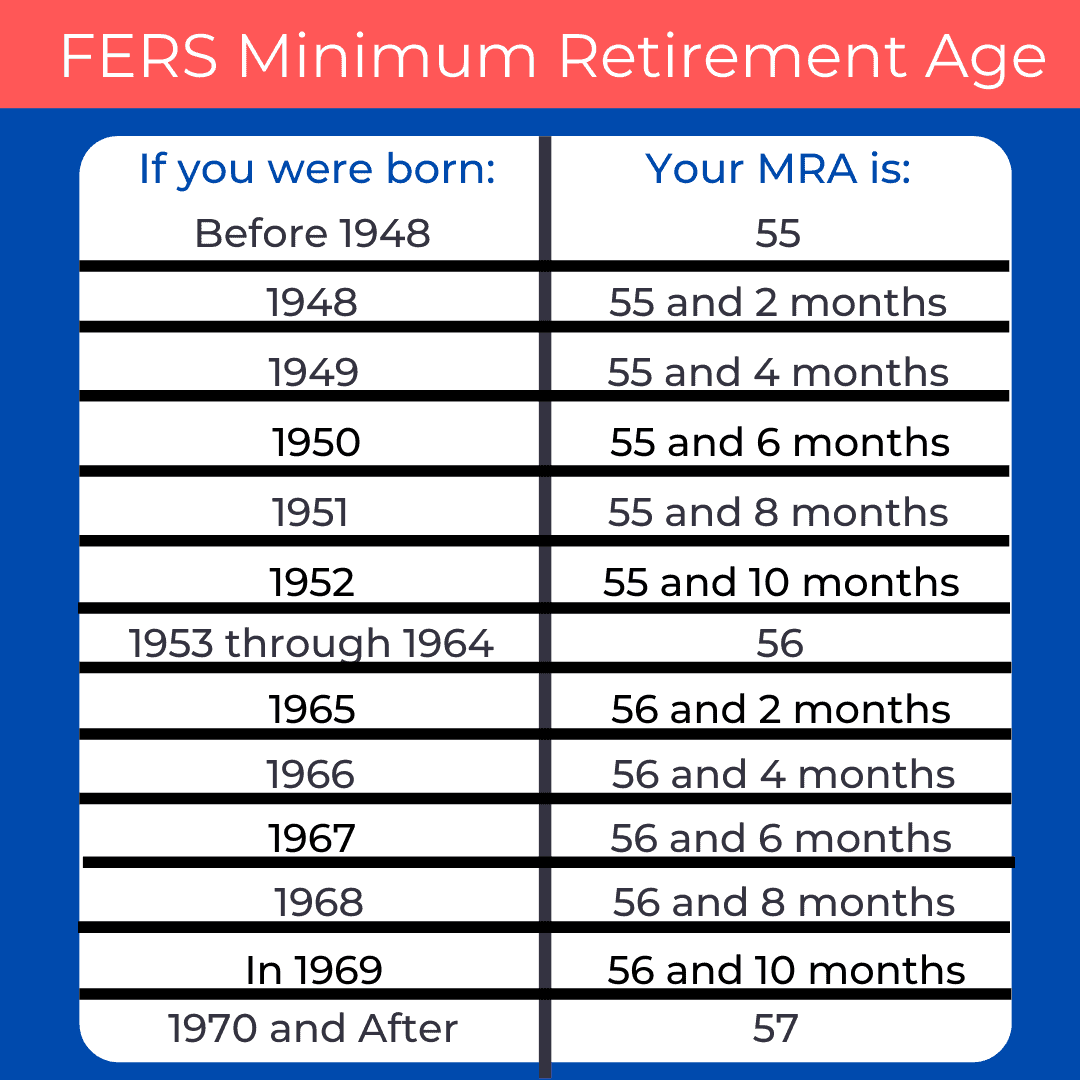

The second condition to retire is to reach your MRA and this depends on when you were born. If you are a millennial or Gen Z, then your MRA is 57. Sorry FIRE folks!

Check out this table to find out what your FERS minimum retirement age (MRA) is:

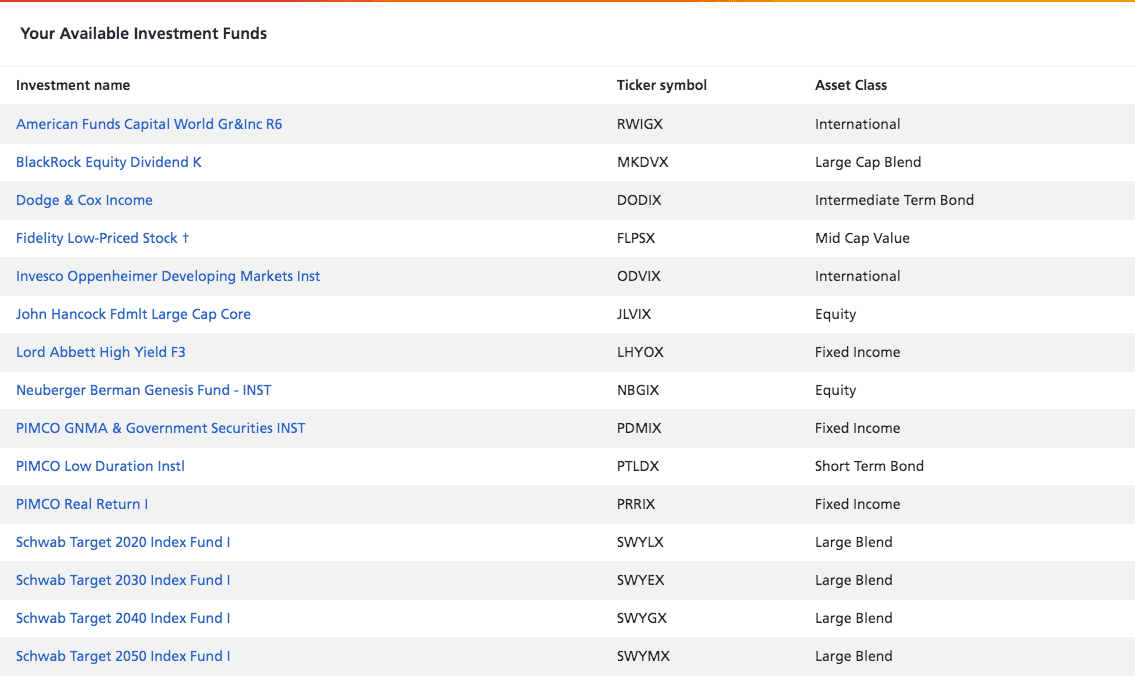

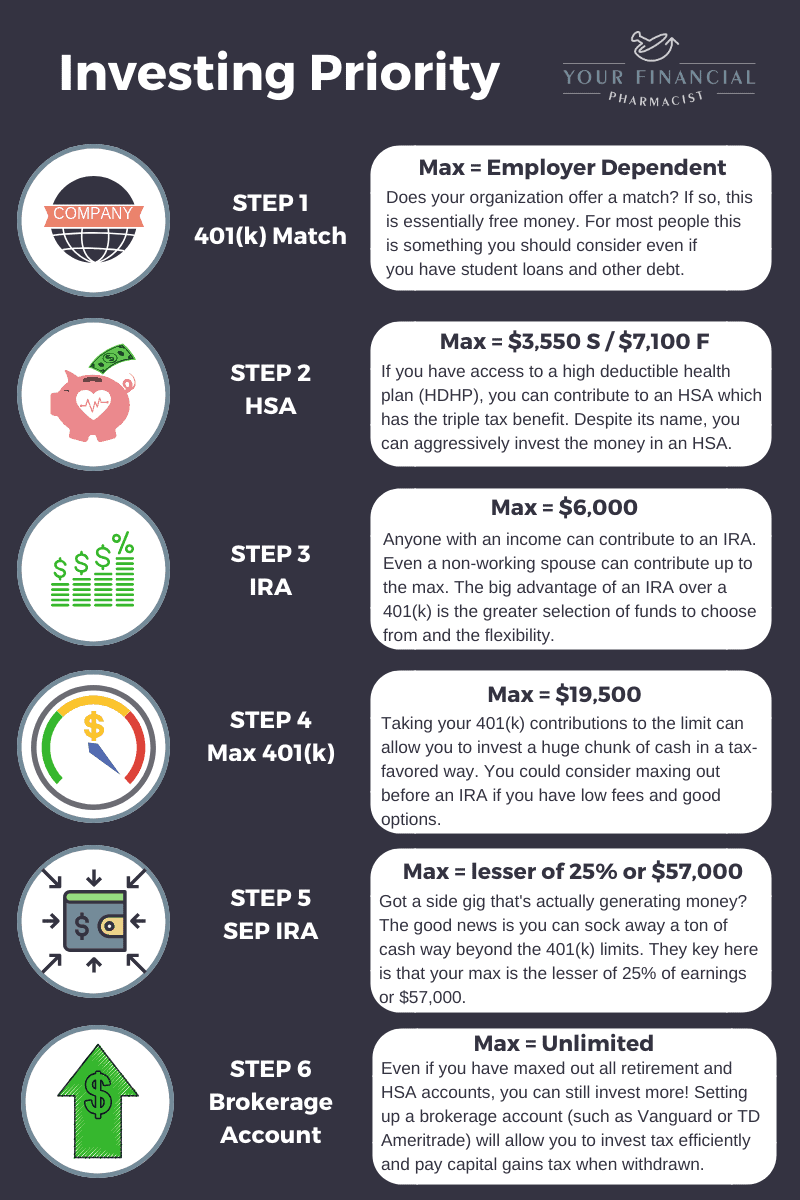

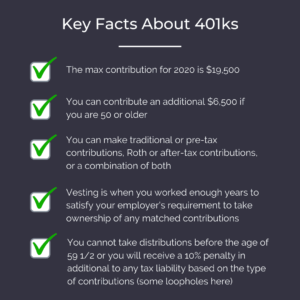

2. Access to the Thrift Savings Plan

The Thrift Savings Plan (TSP) is essentially the 401(k) equivalent for federal employees. It’s subject to the same contribution limits as other employer-sponsored plans at $19,500 with the option for $6,500 catch-up contributions if you’re 50 or older for 2020.

However, unlike many 401(k) plans there are some unique features and benefits.

First, regardless of how much you contribute, your employer will contribute an automatic 1% of your basic pay. In addition, your agency will match the first 3% you contribute dollar-for-dollar and 50 cents on the dollar for the next 2%. Essentially, you get a match up to 5%.

This is something to pay close attention to especially if you are a new employee as you are automatically enrolled in contributing 3% of your income. Therefore, unless you adjust this promptly when you start, you could be missing out on the additional matching contributions.

There is a 3 year vesting period but this does not include the 1% automatic contributions.

Similar to other employer-sponsored plans you have the option to make traditional contributions or after-tax contributions via the Roth TSP.

When it comes to fund selection, you have two basic choices: Lifecycle or target-date funds and individual funds. The lifecycle funds (L Funds) are a combination of the individual funds and every three months, the target allocations of all the L Funds except L Income are automatically adjusted, gradually shifting them from higher risk and reward to lower risk and reward as they get closer to their target dates.

There are five individual funds that range from government-backed securities to index funds with the objective to match the performance of the major stock and bond indices such as the S&P 500.

While one of the criticisms of the TSP is the lack of fund options especially for savvy investors, others tout the simplicity in the options and find it less challenging to navigate and make decisions.

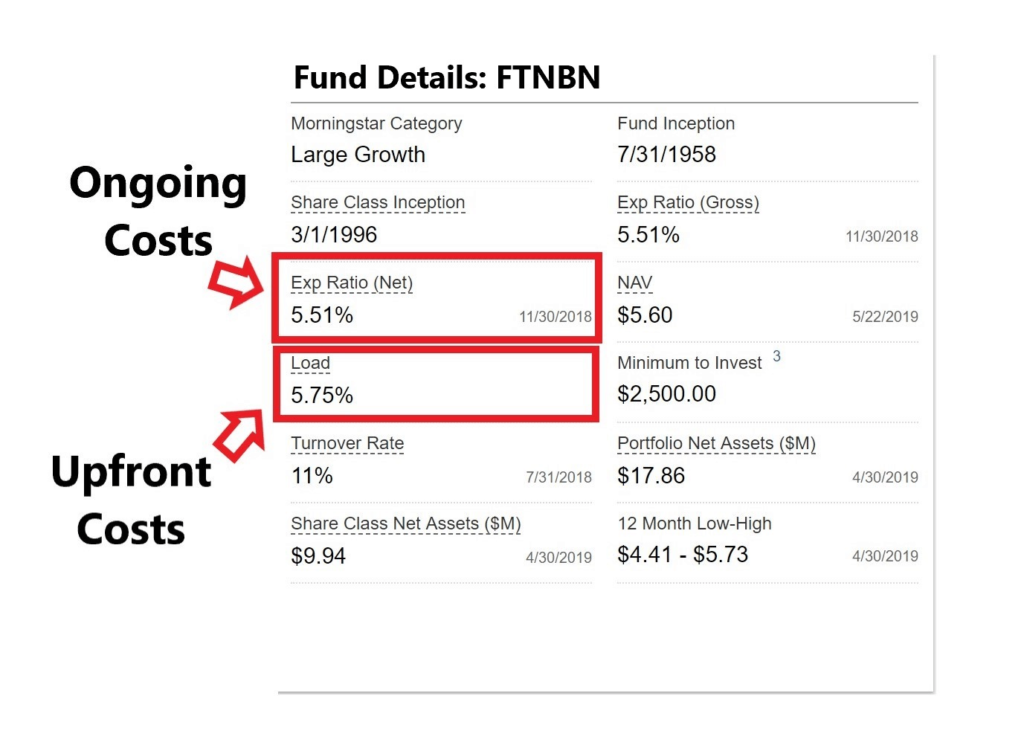

But beyond the options that exist, the number one feature that sets the TSP apart from other employer-sponsored plans is fees!

The average plan fees for those with 401(k)s range from 0.37% to 1.42%. Compare that to the expense for the C fund in the TSP at 0.042%!

Here’s why that’s a big deal. If you were to invest $500/month over 40 years into two different funds with a similar performance of 7% rate of return, one with an expense of 1% and one with fees similar to the C fund, that fund with an expense of 1% will cost you about $700,000 over that period, significantly lowering your overall rate of return.

That’s the power of fees.

You can see the current expenses of the individual funds within the TSP. One of the major reasons why the fees are so low is that many employees leave money on the table when they separate from federal service prior to becoming vested and that helps offset the administrative costs.

[wptb id="17373" not found ]

3. Life Insurance

Working for the federal government means that you’re eligible for the Federal Employees’ Group Life Insurance (FEGLI) program. FEGLI was started in 1954 and is the largest group life insurance program in the world covering over 4 million federal employees and retirees. This program provides basic term life insurance coverage as well as three additional options that can be added on (Standard, Additional and Family).

To give you an idea of cost, for ~$250,000 policy at age 35 would be around $40/month. You can calculate your potential cost based on coverage here.

One of the huge benefits of this program is that it does not require any medical exam prior to being in force. In fact, you are automatically enrolled when you start.

While getting access to affordable life insurance regardless of pre-existing medical conditions is an amazing benefit, the biggest downside is that it’s not portable. This means that if you are terminated or leave federal service for another position, you no longer have coverage. That’s why it’s important to consider a private term life insurance policy as well.

4. Long-term Disability Retirement Benefits

Beyond the life insurance benefit, you also have some protection in the event you became disabled while in federal service. This is known as disability retirement.

To be eligible, there are several requirements that have to be met including:

- Completed 18 months of Federal civilian service which is creditable under the Federal Employees Retirement System (FERS);

- The disability is expected to last at least one year;

- Your agency must certify that it’s unable to accommodate your disabling medical condition in your present position and has considered you for a vacant position in the same agency at the same pay grade or level;

- You, or your guardian, must apply before your separation from service or within one year thereafter;

- You must apply for social security benefits. Application for disability retirement under FERS requires an application for social security benefits

The amount you’ll receive varies depending on your age and number of years of service. If you meet the requirements for traditional FERS retirement benefit based on age and years of service, then the calculation of benefits is the same.

However, if you are under 62 and not eligible for immediate retirement, the calculation gets a little more complex. For the first 12 months it is 60% of your high-3 minus 100% of your social security benefits you are entitled to and after that the calculation is based on 40% of your high-3.

Benefits are recalculated after 12 months and again at age 62 if the person is under age 62 at the time of disability retirement.

While this does guarantee at least some income beyond social security once you have at least 18 months of service, it’s not going to be similar to your take-home pay as a pharmacist.

Therefore, you should strongly consider an individual long term disability insurance policy as a supplement in order to move your potential replacement income closer to your current pay.

You will notice that when you are applying for policies, you will be asked if you are a federal employee. That’s because most states will not allow you to replace over 60% of your total income and this will essentially be a supplement.

5. HSA Eligibility

There are a variety of health plans that are offered for federal employees including fee-for-service plans (both PPO and non-PPO), health maintenance organizations (HMO), and high deductible health plans (HDHP) which offers a health reimbursement arrangement (HRA) or health savings account (HSA). This large variety of health plans allows federal employees to choose a plan that makes the most sense for themselves and their families.

I explained in a recent blog post Why I’m Not Using My Health Savings Account to Pay for Medical Expenses that choosing to use a PPO instead of the HDHP that was available to me was one of my biggest financial mistakes. This is because I was making high premium payments each month but wasn’t utilizing the majority of coverage that was available and I was missing out on the triple tax benefits that an HSA account boasts.

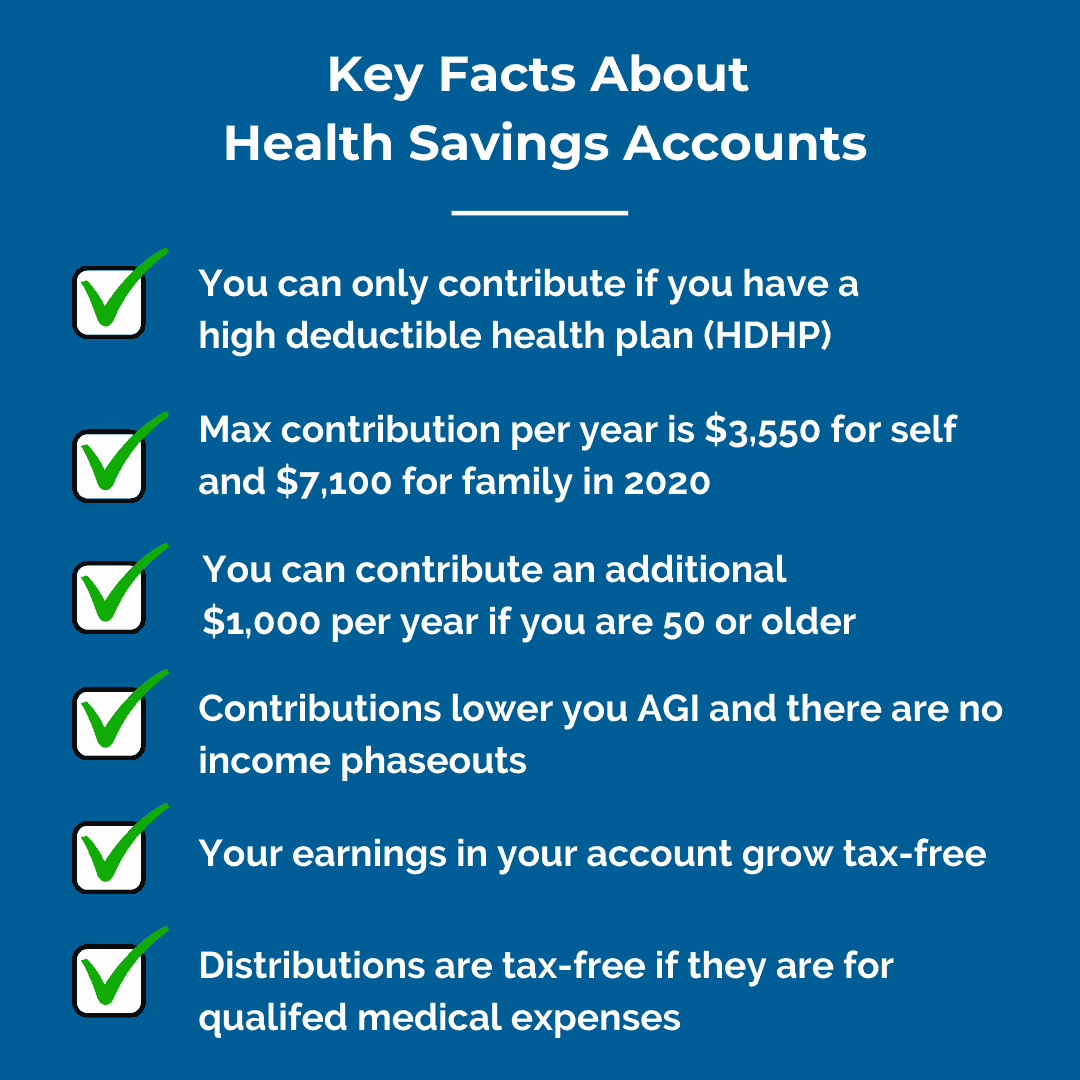

As mentioned, an HSA is unlocked through a high deductible health plan (HDHP) and can be used as an account to save for medical expenses. An HSA allows you to contribute money on a pre-tax basis to pay for qualified medical expenses, like costs for deductibles, copayments, coinsurance, and other expenses aside from premiums. If you’re using your HSA to pay for a qualified medical cost, you don’t have to pay any taxes on the money that’s withdrawn from the account.

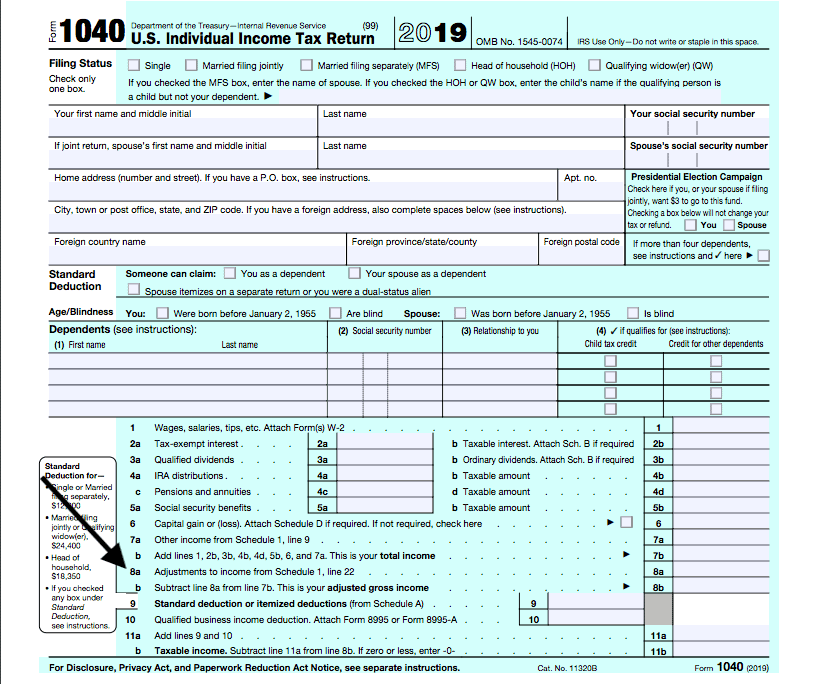

In my opinion, the most powerful aspect of an HSA is that it can be used as a retirement vehicle, like an IRA. What makes an HSA so appealing are those triple tax benefits I mentioned. Triple tax benefits, you guessed it, all have to do with taxes; your HSA contributions lower your adjusted gross income (AGI), the contributions grow tax-free and the distributions are tax-free. If you’re under 65, the distributions are only tax-free if they are being used to pay for a qualified medical expense. If they aren’t, you’ll have to pay a 20% penalty. After age 65, your distributions don’t have to be for qualified medical expenses, but you will have to pay income taxes if they aren’t.

To learn about how I’m leveraging this benefit and how I’m allowing my money to stay in my HSA as long as possible, check out this post.

6. Paid Parental Leave

Paid parental leave varies so much from one employer to the next. Some companies like Netflix offer up to a year off of paid maternity or paternity leave while employees at other companies are “lucky” to get 4 or 6 weeks off, if any.

Due to recent changes, federal pharmacists will be able to receive up to 12 weeks paid parental leave for the birth, adoption or foster of a new child. This benefit is supposed to go into effect October 1, 2020.

7. Raises for additional credentials and board certifications

Federal employees are paid based on their grade and step and will have a GS or General Schedule status. The grade usually pertains to the position and the step is typically determined by initial qualifications at the time employment starts and also the years of service. Therefore, the most common way to get to the next level is often just to keep your job.

However, some federal employers may actually incentivize you to get these as well either in the form of a one-time bonus or even a permanent raise. In the VA they are referred to as Special Achievement Awards.

8. Opportunity to Pursue PSLF

When I graduated from pharmacy school, I made one of the biggest financial mistakes that ended up costing me hundreds of thousands of dollars! That was not pursuing the Public Service Loan Forgiveness (PSLF) program. As a government pharmacist, I was eligible for PSLF but because I wasn’t aware of all of my options and didn’t have a good handle on the program, I ended up paying way more money than I needed to.

Although PSLF has had a rocky past, it is one of the best payoff strategies available for pharmacists. The math doesn’t lie; PSLF is often the most beneficial to the borrower as far as the monthly payment is concerned (it’s the lowest) and the total amount paid over the course of the program (it’s the lowest).

Of course, determining your student loan payoff strategy takes a lot of thought and discussion. To learn more about all of your options, check out this post.

9. Tuition Reimbursement and Repayment Programs

Did you know that working as a federal pharmacist might qualify you for tuition reimbursement or to enroll in a tuition repayment program? These programs essentially provide “free” money typically from your employer or institution in exchange for working for a certain period of time.

Pretty awesome, right?

The programs that tend to provide the most generous reimbursement or repayment are those offered by the federal government through the military, Veterans Health Administration, and the Department of Health.

If you’re a pharmacist who works for or plans to work for one of these organizations, connect with your human resources department to see if you’re eligible. There is generally a set amount of funding for these programs, so even if you aren’t eligible initially, you may be able to reapply in a subsequent year.

Here’s a rundown of federal tuition reimbursement programs that are currently available:

Veterans Health Administration – Education Debt Reduction Program

Eligibility

Pharmacists at facilities that have available funding and critical staffing needs.

Benefit

Up to $120,000 over a 5 year period

Army Pharmacist Health Professions Loan Repayment Program

Eligibility

Pharmacists who commit to a period of service when funding is available

Benefit

Up to $120,000 ($40,000 per year over 3 years)

Navy Health Professions Loan Repayment Program

Eligibility

Must be qualified for, or hold an appointment as a commissioned officer, in one of the health professions and sign a written agreement to serve on active duty for a prescribed time period

Benefit

Offers have many variables

Indian Health Service Loan Repayment Program

Eligibility

Two-year service commitment to practice in health facilities serving American Indian and Alaska Native communities. Opportunities are based on Indian health program facilities with the greatest staffing needs

Benefit

$40,000 but can extend contract annually until student loans are paid off

National Institute of Health (NIH) Loan Repayment Program

Eligibility

Two year commitment to conduct biomedical or behavioral research funded by a nonprofit or government institution

Benefit

Up to $50,000 per year

NHSC Substance Use Disorder Workforce Loan Repayment Program

Eligibility

Three years commitment to provide substance use disorder treatment services at NHSC-approved sites

Benefit

$37,500 for part-time and $75,000 for full-time

10. Generous Leave Structure

One of the benefits that I have really appreciated while working for the federal government is the amount of paid time off. First, as a federal employee, you get all 10 federally recognized holidays off assuming you have a typical Monday-Friday schedule. But if you do have to work on one of those days, you get paid double time!

In addition to holidays, you start off accruing 4 hours of annual leave or vacation in addition to 4 hours of sick leave every pay period. This equates to a total of 7.2 weeks of leave as a brand new employee.

Once you hit 3 years of service, your annual leave increases to 6 hours and then to 8 hours per pay period once you reach 15 years of service.

When you become eligible for retirement, any accrued annual leave you have remaining is paid out to you in a lump sum whereas any remaining sick leave counts toward extending your time of service which can increase your overall FERS annuity benefit.

Conclusion

Working as a pharmacist in the federal government carries a lot of benefits that go way beyond your salary. Between possible student loan forgiveness with PSLF, access to TSP and HSA accounts, life and disability insurance, and raises for additional credentials and board certifications plus so many more, there are a lot of reasons to consider working for the government. If you’re currently unemployed, are a recent graduate or you’re looking to make a career change, I highly suggest checking out USA JOBs and sign up to get alerts as new positions become available.

Need Help With Your Financial Plan?

Trying to navigate your federal benefits can be overwhelming. If you need help analyzing how these benefits affect your overall plan or are looking to solidify your financial game plan, you can book a free call with one of our CERTIFIED FINANCIAL PLANNERSTM.

Current Student Loan Refinance Offers

Advertising Disclosure

[wptb id="15454" not found ]

Recent Posts

[pt_view id=”f651872qnv”]