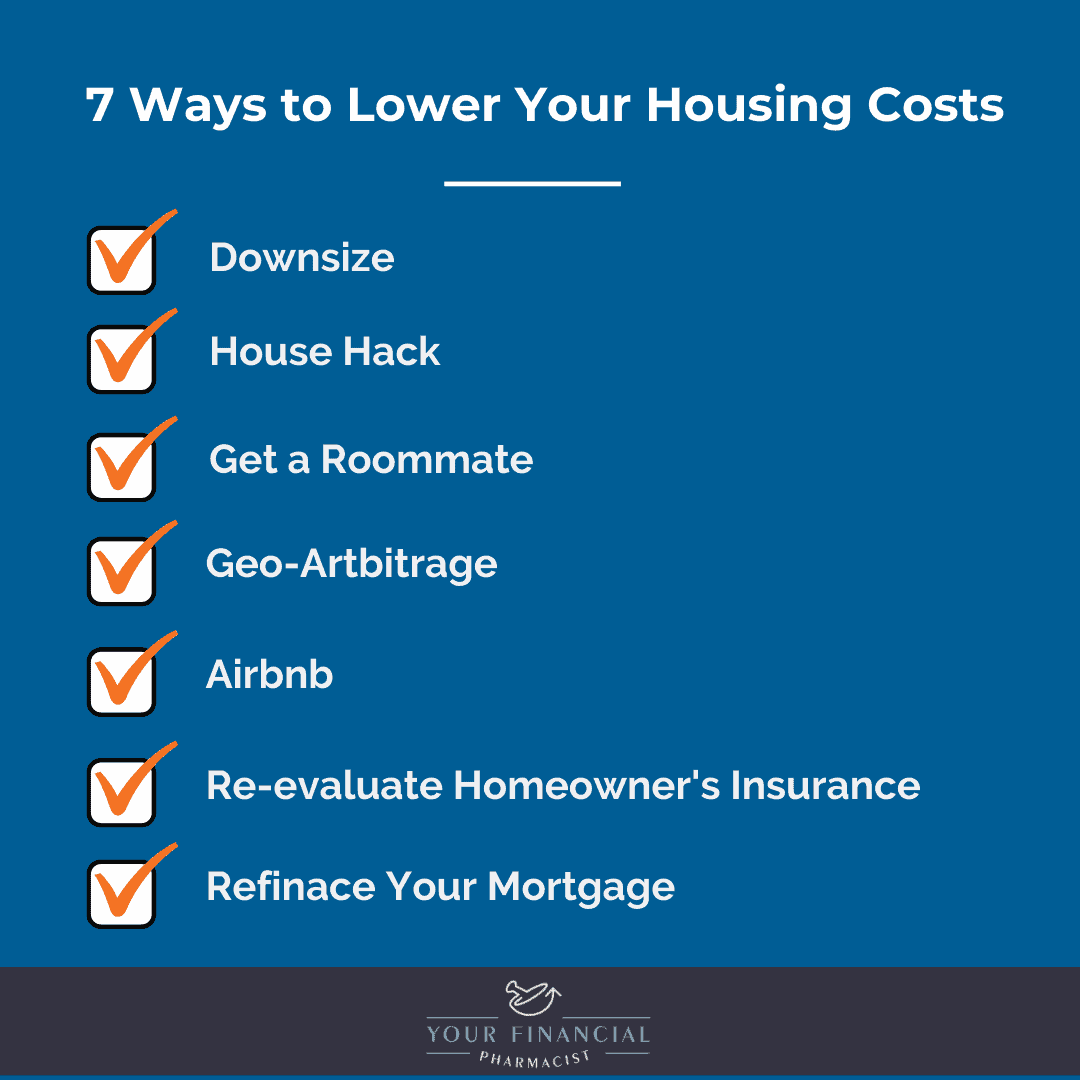

7 Ways to Reduce Your Monthly Housing Costs

The following post contains affiliate links through which YFP may receive compensation.

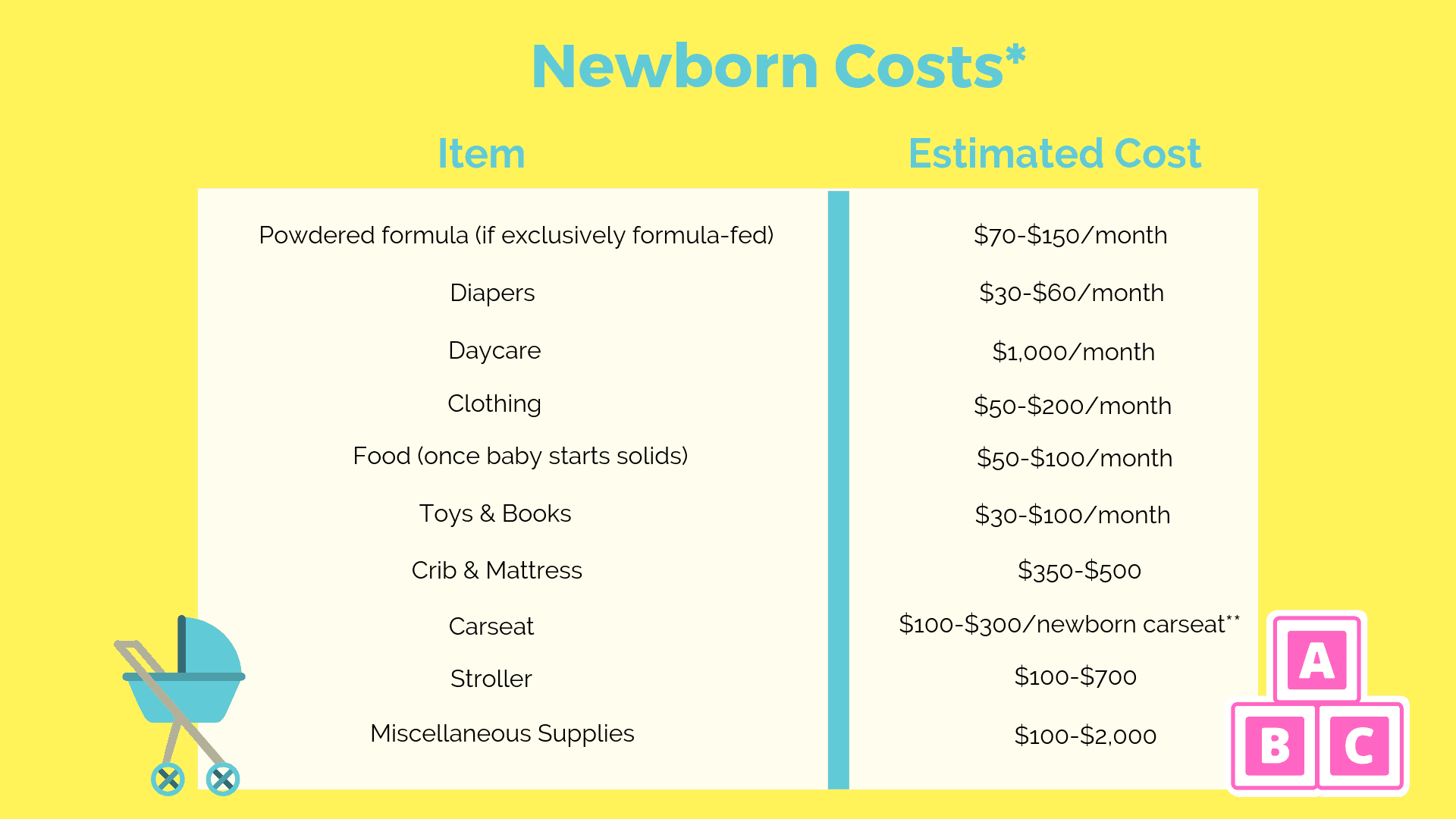

There are a few budget categories that eat up a large percentage of your take-home pay such as food, student loan payments, and maybe childcare.

But if you’re like most, housing costs, either as a mortgage or rent payment, will likely be one of if not the largest.

According to the U.S. Bureau of Labor and Statistics, those in the top income quintiles, which would include most pharmacists, spend around 30-32% of their pre-tax income on housing.

How does your spending compare?

You probably know many who stretch this percentage much further, maybe even up to 50% or more. This often leads to a situation known as being “house poor” and can be a huge reason many are living paycheck-to-paycheck.

And unless you are in a scenario where you can earn income directly from your living situation, this is purely an expense and can have a huge impact on your ability to direct your monthly income toward savings, retirement, debt, lifestyle, and other financial goals.

I can honestly say that one of the biggest reasons my wife and I were able to tackle our $400,000 of student loan debt in just five years was that we minimized our cost of living. Sure it wasn’t that easy living in a one-bedroom apartment for the first three years but with the overall cost of living at 15% of income, it allowed us to make some serious progress.

So whether you are house poor or just looking to unlock more disposable income, here are some ways to reduce your housing costs.

For COVID-19 housing relief info check out this post.

1. Downsize

Is your current living situation more than you need or stretching your budget too thin?

If so downsizing might be a good option for you.

No, you don’t have to sell all of your stuff and move into a 250 square foot tiny home (although, that is an option), but selling your current property and moving into a smaller house (or apartment) could save you a ton of money.

Larger expenses generally coincide with more square footage beyond just the mortgage payment (or rent payment). These include property taxes, utilities, and overall maintenance bills.

This can be tough especially if you are comfortable in your situation or used to a certain standard. Plus, it can take some time, energy, and money to make this happen.

However, this doesn’t have to be permanent and may just be a temporary move to improve your financial situation.

2. House Hack

Ah, house hacking.

It’s one of the best-kept secrets of real estate investing and can drastically reduce your housing costs while building your net worth.

The goal of house hacking is to eliminate your housing expense.

You read that right: eliminate your housing expense!

The cool thing is that there are several different ways to house hack.

Many purchase a 2 to 4 multi-family property with a loan that allows for a low down payment under 5% (like an FHA loan) and then live in the property for at least a year (mandated by the loan terms). While living there, you rent out the other units and those tenants pay down your mortgage thus greatly reducing or (hopefully) eliminating your housing expenses!

Other options for house hacking include purchasing a single-family home and renting out the other rooms or buying your dream home and living in the mother-in-law suite while you rent out the main house.

With any of these scenarios, you can drastically reduce your monthly housing expenses and even generate an income.

After your year obligation is up, you can continue living in the property or do it all over again by purchasing another house hack, ultimately creating even more cash flow.

Or, you can stash away the money you saved by house hacking to purchase a home of your own or to propel your retirement savings or other financial goals.

House hacking might not be for everyone as you have to be comfortable with sharing a wall or being in close quarters with someone else, but if you’re able to stick it out for a year or two, the savings, not to mention the tax benefits, could be huge!

To learn more about this strategy check out episode 130 where we interviewed Craig Curelop, author of The House Hacking Strategy and the Finance Guy at BiggerPockets.

3. Get a Roommate

Maybe you thought your days of living with a roomie were over, but have you ever thought of splitting your rent or mortgage with one of your BFFs or a French couple you met off Craiglist? (true story)

Having a roommate may not seem like the most appealing option especially if they don’t have the best habits and are straight-up annoying but just hear me out for a minute.

What if your housing payment was suddenly cut in half? What could you do with that extra cash?

Similar to downsizing this could be a temporary move but a powerful one to accelerate your financial goals.

4. Geo-Arbitrage

The average rent for 703 sq. ft in Manhattan is around $4,200. Not a small chunk of change, right?

I’m no stranger to high housing costs living in South Florida, but compared to places in New York and California, sometimes it feels like a bargain.

Unfortunately, areas with high costs of living don’t always grant a comparable boost in salary forcing a huge percentage of your income to go toward this expense.

So besides getting 7 roommates just to get by, what about moving?

Geo-arbitrage is a concept that’s been picking up some steam over the years especially among those in the FIRE community. Essentially, in order to save money on housing costs, healthcare, or the general cost of living (think gas, food, taxes, transportation, etc) and get more for your dollar, you pick up and relocate to a new place.

I know this can be a really tough decision especially if it requires moving away from family and close friends and means leaving a job you really enjoy. However, out of everything you can do to reduce your housing costs, this could be the one that has the greatest impact.

5. Airbnb

Ok, so you might not be ready to pick up and move yourself or your family to a different country or even to the next city over.

But what if you could bring people from around the world to you without having to leave the comfort of your home?

Putting your house, an extra room, a finished basement, or in-law suite on Airbnb for people to rent short-term out can not only help you justify having extra space in your home but allows you to monetize the home you’re already paying on.

While this strategy is obviously not going to be very desirable or lucrative in the COVID-19 era as demand has significantly decreased, it could make a comeback and something to be on your radar.

If you are interested in this, check out Episode 121 of the Your Financial Pharmacist Podcast where I interviewed Hilary Blackburn on how she and her husband created another stream of income by becoming Airbnb hosts. The Blackburns rent out their Nashville home 14 times a year which brings in about $600 a night.

If you’re interested in seeing how much you could earn by having your home or rooms on Airbnb, check out this Airbnb earnings calculator.

6. Re-evaluate Your Homeowners Insurance Policy

If you own your home and have a mortgage, you have homeowner’s insurance. Unlike property taxes, an HOA fee, or other fixed costs, it’s one of the few expenses with a home you may be able to change.

These policies vary in price and have different types of coverage including protection on the property, your personal belongings, other people, among other features.

Since you initially got your policy in force, have you shopped around to see if you could get a lower payment?

It’s not uncommon to do this with car, disability, or even life insurance but this is one many people forget about.

One of the companies that I have personally used and YFP recommends comparing multiple quotes for life and disability insurance, Policygenius, actually now has a platform to easily compare companies that offer homeowner’s insurance.

Within 3-5 min you can find out if you are overpaying and able to get a better deal.

Now even if there is a savings, this is not likely going to be to the same magnitude as some of the ways I mentioned but every bit helps.

Credible Advertising Disclosure

NMLS ID: 1681276

320 Blackwell Street

Suite 200

Durham, NC 27701

7. Refinance Your Mortgage

When you refinance your mortgage, you change the terms of the loan which could be the interest rate, type of interest rate, time to repay, or a combination of those.

Reasons to refinance include reducing the loan term, eliminating private mortgage insurance (PMI), cashing out on your home equity, or getting out of a variable interest rate.

However, the most obvious reason to refinance your mortgage is to get a lower rate. Depending on the term, a lower rate could reduce your monthly payment and result in less interest paid over the course of the loan.

This year, in large part due to COVID-19 and intervention by the Federal Reserve, mortgage interest rates have plummeted to historic lows. This is good news if you are a homeowner and are eligible for lower rates.

Now often times there are some closing costs to refinance so often in order for it to make sense financially, you may have to live at your current residence for a period of time at least to break even. You can check out our mortgage refinance calculator below.

Mortgage Refinance Calculator

There are multiple lenders that offer mortgage refinancing. Unfortunately, the process for comparing rates traditionally hasn’t been an easy one.

You can go to local banks or obtain rates from individual lenders online but this requires you to submit documents multiple times and could take significant time and effort.

Or you could go to sites that partner with multiple lenders, but the moment you provide your information, it’s sold to third parties and then you get bombarded with annoying phone calls, text messages, and emails by multiple companies.

Fortunately, there is a faster and easier way to compare rates and that’s why we partnered with Credible.

Not only does Credible have an outstanding user-friendly platform that lets you compare multiple lenders within minutes, but you also deal with them directly until the final stages of the process.

Another lender we recommend is IberiaBank. They offer a 3% down loan with no PMI for pharmacists who are first-time homebuyers but they also offer refinancing options as well.

Like all aspects of your financial plan, mortgage refinancing has several considerations that need to be weighed and might not be for everyone. To help you decide whether or not you should refinance your mortgage, check out our recent podcast episode with Nate Hedrick, The Real Estate RPh.

Another Possible Option: Live the Van Life

To say that Rena Crawford took a unique and unconventional approach to combat a high cost of living is an understatement.

On episode 152 of the podcast, Rena shared her story on how she purchased a 1994 Dodge Ram van and with about $7,000 renovated it so that she could make it her home during residency. Her dad helped with the renovation and built custom fit furniture for her new 60 square foot home. The van also boasts nice flooring, 200 watt solar panels, a full size dresser that doubles as a cooktop, a mini fridge, and a full size bed.

While living in a van down by the river may not be your answer to offset your housing costs, Rena showed that it can be done and it’s definitely an option.

Conclusion

Housing costs can take up a huge percentage of your monthly income and make it challenging to fund your financial goals. If your current living situation is not making you money and you are struggling, downsizing or moving to an area with a lower cost of living can be powerful moves. Also, getting roommates or house hacking are alternative options to have others bear some of your overall costs. Finally, comparing quotes for homeowner’s insurance or mortgage interest rates can also assist.