compre

How This New Practitioner is Leveraging a Team to Invest in Long-Distance Real Estate

Young Park, new practitioner and real estate investor, joins Tim Ulbrich on this week’s podcast episode, sponsored by APhA, to talk about his portfolio, why he likes real estate investing, how he got started, what has worked, what hasn’t worked, and why and how he invests in Kansas City while living in Hawaii.

About Today’s Guest

Young Park currently serves as an Ambulatory Care Clinical Pharmacy Specialist at the VA Pacific Islands Health Care System in Hawaii. He moved to Hawaii for this specific position after completing a PGY1 residency at the VA Sierra Nevada Health Care System in Reno, NV. He completed his undergraduate study at the University of Georgia, then completed the Doctor of Pharmacy program at Philadelphia College of Osteopathic Medicine (PCOM) in Georgia.

Young started learning about financial independence and investing after making the far move to Hawaii. His big “why” is to help provide financially for his parents and to be able to spend more quality time with his family and loved ones. He’s working towards financial independence through investing in out-of-state cash-flowing rental properties using the BRRRR strategy.

When he’s not working, he serves at his church on the Sound Team, enjoys Hawaii’s beautiful beaches, and learns about personal growth and investing.

Summary

Young Park, a 2017 pharmacy school graduate, stumbled upon real estate investing on YouTube and quickly discovered how powerful of an investment vehicle it can be. Young was originally interested in investing with stocks but decided to move forward with real estate investing because he felt it has the best return on investment and because of the long-term benefits like appreciation, tax benefits, and mortgage pay down.

In less than 2 years, Young has acquired 3 rental properties in Kansas City, Missouri while living in Hawaii. He decided to invest in real estate thousands of miles away for a few reasons. To start, the cost of homes in Hawaii is extremely high and it’s difficult to find a good real estate investment deal. Additionally, he connected and began working with a mentor that invests in the Kansas City market and was able to lean on him for advice while also leveraging the team that was already in place until he could build his own.

Young also digs into how he’s using the BRRRR method on his investment properties, how he’s getting the capital to fund them, how he analyzes a potential deal, how he’s formed a team to support him, the challenges he’s faced along the way, and how real estate investing is supporting his financial why.

Mentioned on the Show

Episode Transcript

Tim Ulbrich: Young, welcome to the podcast.

Young Park: Hey, Tim, thanks for having me.

Tim Ulbrich: Super excited to have you on. When I learned about your story as a new practitioner, active in real estate investing, getting started, taking that first step, we’re going to talk about your journey, what’s worked, what hasn’t worked, why you’ve been doing what you’re doing, what your plans are going forward, and I think this episode is going to be incredibly valuable to our community that is interested in learning more about real estate investing or perhaps even for those that have started looking to build upon the portfolio and the work that they’ve done so far. So Young, before we jump into your real estate journey, tell us a little bit about your background into pharmacy, how you got into pharmacy, what interested you, where you went to school, and the work that you’ve been doing since graduating in 2017.

Young Park: Alright. Hey, first of all, thank you again for having me here on the show. I am so excited to share my story today. So man, about myself. I don’t know how far I need to go back. But yeah, as a child, I guess in high school, I actually wanted to go into music, like into music engineering and recording and playing in a band and stuff. However, my parents were definitely against it. We’re immigrants, so we moved from South Korea back in ‘98. And you know, my parents moved to the States so that we can have better opportunity for me and my sister and just kind of live that American dream that they were hoping for us. They just heard about pharmacy from their friend, how their sons and daughters went to pharmacy school and they graduated, got a awesome deal with a brand new car and a brand new BMW. So to them, this was the American Dream for us. Eventually, I kind of followed that step. I went to — I finished my undergraduate study at the University of Georgia, and then I went to the Philadelphia College of Osteopathic Medicine in Georgia campus for my pharmacy school. So I think one of my professors, Dr. Brett Rollins, was on the show before.

Tim Ulbrich: Yes, he was.

Young Park: Yeah. So yeah, I went to that school and then after that, I completed my PGY1 at VA Sierra Nevada Healthcare System in Reno, Nevada. And after that, I took this current position that I have with the VA Pacific Island Healthcare System in Hawaii as an ambulatory care pharmacist.

Tim Ulbrich: So Georgia, Nevada, and then Hawaii, right?

Young Park: Traveled quite a bit, yes.

Tim Ulbrich: That’s awesome. Well, cool. And so we’re going to talk in a little bit about how do you effectively invest as a real estate investor in Hawaii and why you’ve chosen to go out of area to do your investing in Kansas City, and we’ll talk about why that’s important as we may have many listeners that say, “Hey, I’d love to get started with real estate investing, but you know what, my market isn’t really conducive to that,” high cost of living area, whatever be the reason. Obviously you ran into that, and we’ll talk about how you selected the market that you did and what has been difficult and what has worked with doing some long distance investing. But before we get there, talk to us about for you, why you like real estate investing as an investing vehicle for you going forward and one that you want to build your plan around. Obviously our listeners know there’s lots of different ways to go about investing, traditional accounts, 401k’s, 403b’s, IRAs, obviously they could invest in brokerage accounts, they could start their own businesses, real estate and within real estate, many different ways that you can do this. Why, for you, is real estate an investment vehicle that peaked your interest?

Young Park: OK, so I started getting interested in investing initially into paper assets such as stock, like most people, because that’s the easy one to get into. And I was learning more about that while I was watching YouTube videos, honestly. And I accidentally stumbled upon YouTube videos on real estate investing like Bigger Pockets and some other YouTubers who invest in real estate. And it really got me interested in real estate investing because to me, that had one of the best return on investments, and it’s a hard asset where you can physically obtain the asset. You know, paper asset is great, but it’s almost like a made-up money in the computer space somewhere that determines like this is worth that much. So yeah, that’s why I really got into real estate investing.

Tim Ulbrich: And how do you as an investor — you know, one of the benefits people always talk about with real estate of course is long-term appreciation, tax advantages, you know, that you may not see in more traditional investing — how do those things factor into you wanting to prioritize real estate investing?

Young Park: Yeah, so to me, if I were to compare real estate investing to stock investing, it’s like getting a really high-yield monthly dividend while the tenants are paying down your mortgage. And like exactly what you said, you know, you’re getting the long-term appreciation of the property, you’re getting tax benefits through the appreciation, you’re getting the mortgage paid down, also you’re getting the cash flow — and your cash flow over the long term is going to increase year by year because your mortgage will stay the same and your rent will increase.

Tim Ulbrich: Yeah, and of course — and we’ll talk about your specific properties and how you crunch the numbers. Obviously, we’re talking here under the assumption of you do this in a way that works and is financially viable and of course being able to analyze properties, determine what is a good deal, what is not, is very important as we look at the benefits of real estate investing. Now, before we get into the x’s and o’s and specifics of the property, I like to ask folks such as yourself, what’s the motivation, what’s the purpose, what’s the why? Because we talk all the time on the show about our mission of wanting to help as many pharmacists as we possibly can achieve financial freedom, but I know that that word, “financial freedom,” can mean something different to everyone that’s listening here to this episode. So for you, Young, as you think of that concept of financial freedom and how real estate investing fits into that goal, tell us about what your purpose is, what your why is, what your vision is, and why real estate is really just a piece of being able to achieve that.

Young Park: Great question. So why is extremely important. For most people, they really break it down. The money is never the goal of achieving whatever you want to achieve. It’s actually the time and what you can do with the time that you’re able to obtain through building wealth. So for me, my biggest why is — I will say two things. First of all, I want to provide for my parents financially and also to achieve financial freedom for myself, the time freedom. So my parents moved our family of four to the States with the hopes and dreams of providing a better life and opportunity for me and my sister. Neither of them went to college, and they still don’t speak much English at all. And they did manual labor well into their 60s to provide for us so that we can complete our education. All they knew was to work really, really hard for paychecks and bring food to the table. And because of this, I’m extremely privileged. So because of what they’ve done for us, my main why on investing is for my parents, so that I can help them to retire and live comfortably. And my other why is to be financially independent for myself and for my soon-to-be wife Jamie and our family that we’re going to have so that we can live on our own terms and have options. You know, God forbid, but if something were to happen to my family, I want to be in a position where I can just drop everything and go and be with my family as long as I need to. And building that financial freedom and wealth allows you to have that option.

Tim Ulbrich: And Young, what I heard there, which I love — and I hope our listeners will take heart — is the conviction in which you share that to me tells you’ve No. 1, put thought behind that but No. 2, really likely then provides clarity when you’re making your financial decisions, you know within what context, what frame you’re making those decisions because you’ve thought about, reflected upon, that why. And what I heard from you there was wanting to be able to provide and care for your parents, wanting to get to a point of financial independence such that if you were to wake up tomorrow and for whatever reason, you weren’t able to earn the income that you currently earn, that you would be able to move on without stress and continuing to move on with the rest of your goals and the things that you like doing. And the third thing that I heard was time. And my follow-up question there — because I hear a lot of entrepreneurs talk about time, I hear a lot of real estate investors talk about time, but I very rarely hear people talk about why is that time important. What do they want to do with that time to have that option, to have that freedom, with their time or to gain back more of that time? So for you and your family, more time means what?

Young Park: So more time means spending time with your family and your loved ones. So you can do whatever you would like with whoever you want, you know, going wherever you want to be and how you want to spend your time. You know, for me, growing up, my parents were both working really hard, so they weren’t around home that much. We were still extremely grateful for them, but I want to be a parent that’s there for my children whenever they — let’s say they have a play or they’re playing sports or we get to just enjoy our weekend time or go on vacation together, and I just want to be able to do all those things. Working W2 jobs, it’s great. You get great benefits, and I love my job. But you know, you’re still restricted to certain schedules. You have to meet certain quota, and you know, your schedule can always change — yours and your wife, right? Your spouse, you have to line up our schedules together and all of that’s considering I think that financial freedom and being able to build more time to spend with the loved ones, that’s all I want.

Tim Ulbrich: That’s great. And here, we’re talking about real estate investing being one vehicle in which you can achieve that goal of financial freedom, which of course means being able to do the things that you just said were most important. And so let’s jump into July 2019, you purchase your first property. So two years out from school, I want our listeners to hear, you know, obviously you’re at a point where making that transition post-residency into your first job and you pick up on real estate investing as an opportunity to pursue. So July 2019, tell us about that first property, where it was, what the property was like, what you purchased for it, what you spent to kind of get it ready for tenants, and then ultimately, what it means for you from a rental income standpoint.

Young Park: Sure. July 2019 was when I purchased my first property in Kansas City, Missouri. So I have a whole story about getting into Kansas City market, right, from Hawaii. But just to talk more about the property itself and the investment itself, it was purchased off-market. I actually got it from a wholesaler on Craigslist, believe it or not. Yeah. I didn’t know that was a thing. I was looking into a bunch of wholesalers group on Facebook, you could find that. I spoke with a bunch of realtors to get on their list, and you know, I was also searching on Craigslist to see if there are other owners that wanted to sell their properties or potentially wholesalers. So I found that property on Craigslist from a wholesaler. He actually posted it for — are we allowed to talk about numbers?

Tim Ulbrich: Yeah, go ahead.

Young Park: OK. So he listed the property at $65,000. And I offered $50,000. Of course, I kind of lowballed him. But he got back to me saying, “Hey, if you have the ability to close within five days, all cash, we can do it at $55,000.” And for a new practitioner coming out of pharmacy school, a year of residency, and you have about a year of actual job under your belt, you don’t have $50,000 in addition to me having a ton of student debt. So getting the cash was a — is a whole other story that I need to talk about. But I was able to pull that off, I had $50 in cash, so I close on the property, and we actually negotiated the route crosses. He actually wanted to close out within five days because he had a family reunion coming up the following week, so he just wanted to be done with it. We actually renegotiated so that we got it for $53,000 instead of $55,000. So I got that property at $53,000. And I actually have my mentor, who that’s how I got into Kansas City market. And I used his contractor, who’s been vetted, and they’ve been working 3, 4, 5 years together. So that contractor knows exactly how to turn a property, how everything should look, and I had my mentor, CJ, to be the project manager so that he’s just kind of managing everything and I’m just giving the rehab costs, I guess, on weekly, biweekly withdrawals so that I’m just continually funding it. And once I get some photos saying oh yeah, these were done, then I send in my next draw.

Tim Ulbrich: OK.

Young Park: So I did all that, and everything ended up — the rehab costed about $42,000, I want to say.

Tim Ulbrich: OK.

Young Park: So I’m all in $95,000. So I got that rented out — that was a whole other story about getting it rented out because it was during the holiday season, right around this time actually, and in the Midwest, I’m sure over there, it’s freezing cold, snowing, and no one wants to move during the holiday season.

Tim Ulbrich: Not a great time to find a tenant.

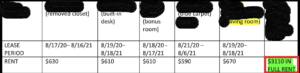

Young Park: It’s not. It’s really not. But you know, right after the new year, so it took a couple months, stayed vacant for a couple months, but I was able to get it rented out in January for $1,000 plus $25 in pet fee.

Tim Ulbrich: So $1,025. So just to rehash these numbers, you purchased it with some negotiation from a wholesaler, $53,000. $42,000 on the rehab, so you’re all in for $95,000. And you’re renting it for just over $1,000. And I’m guessing mortgage, interest, taxes, insurance, probably little less than $800?

Young Park: Correct, correct. But at that time, I didn’t refi yet.

Tim Ulbrich: Right.

Young Park: So I didn’t have any mortgage payments at that time. So after I was able to rent it out — so the strategy I used is the BRRRR strategy, right? So I bought it, I renovated, I rent it out, so I was able to refinance out and it appraised at $142,000.

Tim Ulbrich: Oh, wow. OK.

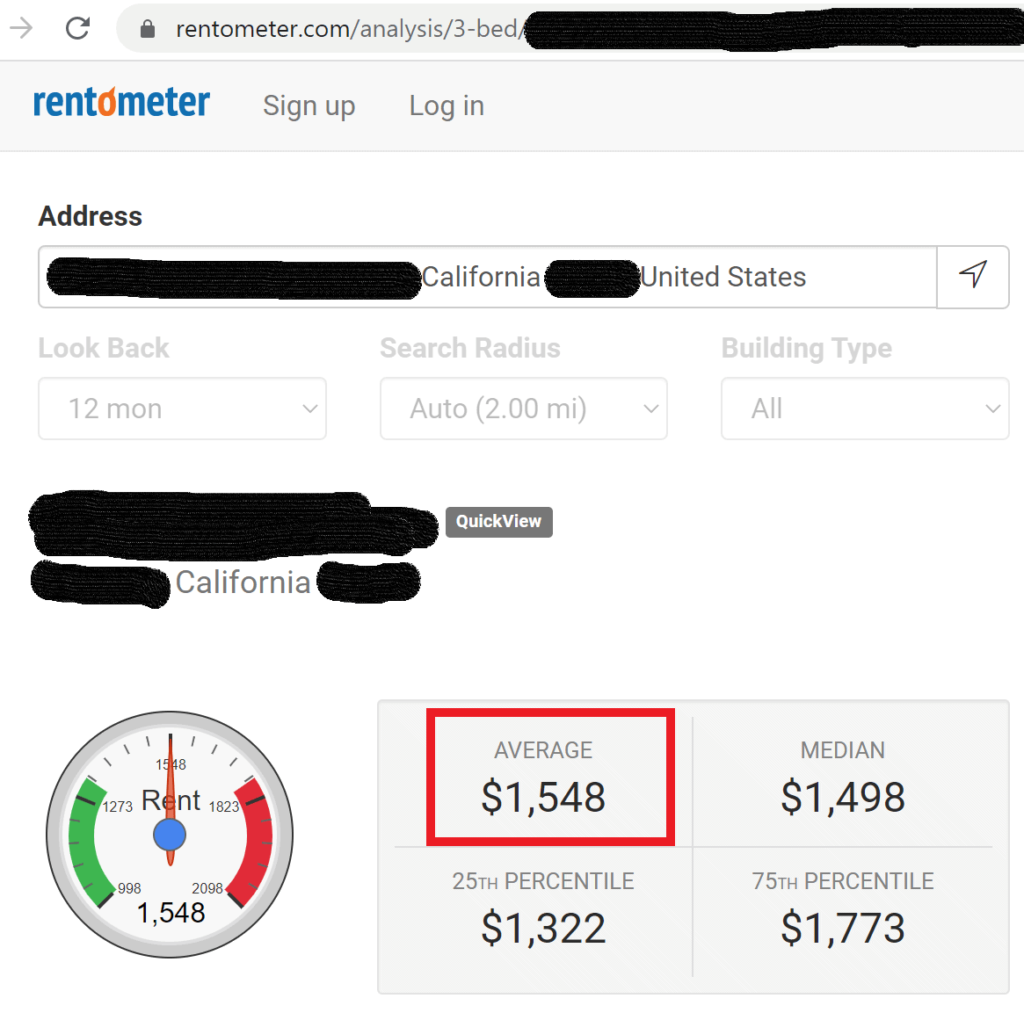

Young Park: Yeah. So there was a pretty decent chunk of spread there. So I was actually able to pull all my cash out and then some. So it covered all my purchase, my rehab, and then I think I — after closing costs and everything, I think I pocketed about $5,000.

Tim Ulbrich: $5,000. And for our listeners, we’ve talked about the BRRRR method on the show before, and I’d reference our listeners back to other episodes on real estate investing that we’ve done as well as the Bigger Pockets website, podcast, lots of great resources. They’ve got a book solely on the topic of BRRRR. But you know, the goal here — which Young’s story is a great example of that — is to with the cash investment of the property, be able to pull all of that money out or all that plus some, I guess ideal, or if not all of that, as close as you can, so that you can move on and repeat the process into the future, which you did in a second property, which we’ll talk about here in a moment. But I want to break down this one with a little bit more detail and get into some of the weeds here. When our listeners hear $53,000 purchase, $42,000 in rehab, $95,000 all in, rent a little over $1,000, how did you analyze or evaluate as you were projecting not only purchase price but rehab, potential rent? Talk us through your analysis process and determining what was or was not potentially a good deal.

Young Park: So yes, so you want to start before you purchase it, you want to start with the end in mind. You need to start from the ARV, which means After Repair Value. So you want to know what the property would appraise at at the end of the day. So from that point on, you want to figure out what the rehab costs would be and then that gives you what your purchase price can be. So that would be your offer price. So once I do that, I kind of analyze it. So let’s just say for this property as an example, I actually estimated this property to appraise at about $120,000-130,000. So I actually got really lucky. And $120,000-130,000 is actually — you know, if I really think about it, it’s on the conservative side. I always calculate it in the worst case scenario. And if everything works — if it makes sense for me, even if I were to pay like $10,000, $20,000, $30,000 out of pocket, would I be OK with that? And if I am, then I go with it because that’s the worst case scenario, and you can only get better. Whatever you do better, that’s all extra sauce on it, you know what I mean?

Tim Ulbrich: Absolutely.

Young Park: And so yeah. So I do that. So I analyze the property by finding the ARV. And then I estimated the rehab with me and my mentor because he’s done it for so long that he could kind of look at the pictures and see what the estimate would be. And it actually aligned pretty much what we thought it was going to be. So we got that rehab, and we were OK with the purchase price because I was thinking $53,000 purchase, about $40,000 rehab, and appraise it for $120,000. So that’s roughly about 75% of that $120,000 for me to do a full BRRRR.

Tim Ulbrich: Got it.

Young Park: The rehab was a little bit more, but the ARV was a lot higher than I thought. So I was able to actually do a whole run deal on my first deal.

Tim Ulbrich: And that makes sense, Young, if you had projected your numbers at an ARV that was $120,000-125,000 and it came out at $142,000, it makes sense when our listeners hear that you were able to pull out all your cash plus some because of the higher ARV, what ultimately came in at the appraisal when you went to go do the refinance. The other thing I wanted to touch on here, if I had to pick what I think are probably the two most common objections to getting started with real estate investing, they would be that one, I don’t feel like I have the knowledge or experience and two, I don’t have the cash, right, because of whatever. I’ve got student loan debt, I’ve got all of these other priorities of which we talk about on the show all the time, and I can’t necessarily save up $50,000, $70,000, $100,000 to be able to put down on a property. So talk us through how you addressed those two things. You mentioned student loan debt, so I’m sure our listeners are curious, you know, how did you go down this path while you still had student loan debt and how did you reconcile that? But how did you address this knowledge piece? And you’ve talked a little bit about a mentor. And then how did you address the capital and being able to have enough money to get started with investing?

Young Park: First of all, the knowledge portion. So you can get a lot of education just from — and they’re all available online. You can go on YouTube, you can listen to podcasts like the Bigger Pockets. You can read books. I read at least three books from Bigger Pockets and other investment books. However, these to me are just knowledge. And knowledge is important. And people say knowledge is power, but I really think it’s knowledge is just a potential power. It’s only powerful if you are able to take actions and apply it, right? If you just learn, learn and learn, it’s just information. But that doesn’t really get you anywhere. So you have to be able to take that action. And for me, just taking that mentorship was the action step that I needed. Through that mentorship program with CJ, I learned a lot. I learned every week. It was like a weekly phone call. But the biggest thing is that he guided me so that I can actually take the action that if I didn’t take that mentorship and have all these knowledge, who knows if I’d even have a property under my belt right now? Or maybe I bought a turnkey product. But yeah, to me, just learning, keep learning and just taking that step, leap of faith, to get into that deal, get to that first deal, that’s the biggest hurdle.

Tim Ulbrich: And how did you find, Young, that mentor? Because I think a lot of our listeners would say, “Hey, I’d love to have a Yoda in my life on the real estate side.” What steps did you take to say, to move from ‘I’m interested in real estate investing. I’ve read this book, and I’m ready to act and I need to find some people that can help me.’ Talk us through that process.

Young Park: Yes. So I started attending meetups. So after learning, learning, learning and Bigger Pockets, they always talk about, “Oh, come to our meetups.” People are always hosting in different cities. So I actually went on their website, found a meetup there, so I went to one of those meetups, and I learned a lot. And one of the guys that I met there actually pointed out to CJ and Jasmine, telling me that, “Oh, there’s this couple from Hawaii that invests in Kansas City. You should go check them out.” So I went to their meetup, and CJ was actually giving a presentation on investing out-of-state versus locally in Hawaii and how the numbers make so much more sense going out of state. The housing price here is ridiculous. The median housing price here is about $780,000.

Tim Ulbrich: Sheesh.

Young Park: Yeah, and your rents probably won’t even be .5% Rule, if you were to call that.

Tim Ulbrich: Yeah.

Young Park: So it just made more sense to go out of state. And they were doing exactly what I wanted to do, so I went up to go talk to CJ one-on-one and told him like, “Hey, I’m in this position right now. I really want to invest in real estate out of state as well.”

Tim Ulbrich: OK.

Young Park: And then that kind of led to us working together.

Tim Ulbrich: So that’s the knowledge/mentor piece. And I think the meetups is a great idea. We’ve been featuring more stories on this show with the hopes that we can connect more investors that can serve as a supporting community for one another. So that’s the knowledge piece, which led to a mentor, which led to some execution. What about the capital piece? I think many pharmacists may be in your shoes, three years out, five years out, seven years out, “Hey, Tim, I’ve got a boat load of student loan debt. I’d love to do real estate investing,” or, “I don’t even have student loan debt, but I just can’t imagine being able to save up $50,000-100,000.” Here, if you’re buying a property for $53,000, you’re doing a rehab for $42,000, you’re all in for $95,000. And the BRRRR method means that you’re bringing $95,000 of cash to get that done. Was that your money? Did you partner with other folks? How did you manage that?

Young Park: Yes, so I definitely didn’t have money. I had some money that I was getting from a W2 job, but this was actually one of the challenges or action steps that I needed to take during the mentorship course so that I can raise capital. So I had to go out and ask family and friends. I honestly — I think I raised $90,000 — I used some of my money too — from family and friends. And I got a ton of rejections. I asked over 30 people. And just to kind of explain to them what I’m doing, but you know, to them, of course I got a ton of rejections because I had zero track record.

Tim Ulbrich: Sure.

Young Park: I had no track record. People who invested in me — invested with me, invested in me because of our personal relationship. They just know me personally and they know my character. So I was able to raise that. And I think another thing that — I keep coming back to the mentorship. Because I had that guidance to show them like, “Hey, I’m not just going there blindly. I have the people there. I have someone who’s guiding me through the whole step,” I think that helped as well. So I was able to raise $90,000.

Tim Ulbrich: That’s awesome. Which makes that deal possible.

Young Park: It does. It does.

Tim Ulbrich: So and before we talk about your second property, your most recent property — unless you’ve done more since we touched base last — I’m sure our listeners are as curious as I am when somebody hears, “Hey, Young’s living in Hawaii, he’s investing thousands of miles away in Kansas City,” you know, what challenges — we’ve talked about the opportunity, right, obviously you have a more affordable market, you’ve got a group there that has connections through your mentor, through contractors, so you’ve got some track record and experienced people that know the market. So the opportunities I think are obvious. But the challenges may be not so much, or folks may hear that and think, eh, it’s not for me. You know, I can’t see the property, per se, I don’t know it, I’ve got to trust people, this is my first time. Talk to us about some of those challenges with the out-of-area investing and how you were able to overcome those.

Young Park: Good question. Yeah, of course. I think the biggest challenges that people can’t get out of their head is not being able to see and feel, touch the property. I personally have not been to Kansas City yet. And I did get a third property recently, by the way.

Tim Ulbrich: Oh, cool.

Young Park: Yeah. So just working remotely and you have to be able to — at one point, just go with your gut so you can trust people. And I’m not just doing that blindly. I’m starting out with the people I know. So I start with let’s say a realtor or I start with my mentor CJ, and he’s giving me referrals so I try this other contractor, which I used for my second property and now again for my third property. I’m just slowly building a network, building relationships, building my team. And when you’re able to do that, you’re putting a lot of pressure off of you. Right? You have people that are doing the jobs for you. You know, really, at the end of the day, you really don’t have to see the property. Don’t attach your emotion to the property. It’s the numbers. But of course you still need to figure out how can you trust those people? And you just — at one point just have to trust them, right? They’re not intentionally trying to rip you off. They’re good people trying to make their living as well. And we’re giving them opportunity, they’re sharing their experience by working with us. So I think it’s almost the same. You just don’t see them face-to-face. But working remotely has been a good system for me.

Tim Ulbrich: Yeah, and that’s one thing, Young, that I think about, you know, one of the takeaways. And I’d recommend to our listeners Bigger Pockets, David Green has a book, “Long Distance Real Estate Investing: How to Buy, Rehab, Manage Out-of-State Rental Properties.” That was the takeaway I had from that book was it in part forces you to think about your systems and your processes because there’s certain things you just can’t do, right? You’re not getting on the plane often to go to Kansas City. Not happening.

Young Park: Nope.

Tim Ulbrich: So you’ve got to have a team there that you trust, that you have systems for communication, that you have systems for vetting contractors, for paying those invoices. Then obviously with more experience will come more of a track record, and I think that will become a magnet to other investors and other partners along the way as well. So tell us a little bit about your second property, which I knew of, April 2020. Didn’t know you added the third, so congratulations. Tell us a little bit more about those and the numbers as you’re willing to share.

Young Park: Sure. The second property, as you can imagine, was April 2020. Right in the start of COVID. So that deal was so — I was scared, honestly. I thought about backing out from the deal multiple times. But I’m so glad I went with it. So this property was actually listed on the MLS, Multiple Listings Service. I saw that on Zillow, and I spoke with the realtor who posted it. And it was actually a HUD property, which if I’m trying to define it, I think it’s a property that was purchased with an FHA loan. And the person who purchased it couldn’t make the payments, so it was like a foreclosure. So it was bank-owned property. And that property actually had some plumbing issues, so it wasn’t eligible for a bank- or like Fannie Mae-backed loans.

Tim Ulbrich: OK.

Young Park: So you only — you could only buy it cash. So that was actually an opportunity for investors like us because most people who are paying down payments wouldn’t be able to afford that. Right? So that property was listed at $79,000. And I used a current contractor that I have and I had to trust him. I had not used him before. We had some ups and downs, but at the end of the day, he did me right, and we are working on the third property together.

Tim Ulbrich: Awesome.

Young Park: Those are the things you actually have to work on as an investor or with anyone, in fact. You know, people have different expectations. Right? So you know, his expectation and my expectations were different. But we talked it out like, “Hey, this is kind of like the finished product that I would like.” He’s like, “Alright, let’s do that moving forward.” So anyways, going back to my second property, so it was about a $25,000 rehab. So $79,000, $25,000, what is that? Like $104,000?

Tim Ulbrich: Yep.

Young Park: So that was my all-in. And I actually got it rented out, and it was rented out in September, I believe. Or maybe before. Oh, I’m sorry. I think it actually rented out in July. And this one was a lot higher because it was during the summer, so I got a tenant in there for $1,100 plus two pets, so $1,150 per month for the rent. And then I was actually able to refi out of that last month, less than a month ago, and it appraised at $144,000.

Tim Ulbrich: You like that $140,000 range.

Young Park: I didn’t go for that one, but it just ends up being that way. And to me, like when I was doing that conservative analysis, I was expecting it to be somewhere between $120,000-130,000.

Tim Ulbrich: OK.

Young Park: So with this one, I was actually expecting to have some of my money left in the deal, which was totally OK with me. But I ended up doing another home run. Maybe I have a couple thousand dollars in the deal at the end of the day.

Tim Ulbrich: So after the second one, if I’m doing my math right here, you’ve got about $286,000 worth of appraised property, and monthly cash flow in rent of just over $2,100, almost $2,200.

Young Park: Right, the gross rent is that.

Tim Ulbrich: Great. And then break down the third one for us.

Young Park: Third one, so I just got it under contract maybe — ooh, maybe two days after I refi’ed out of the other one or before. Somewhere around the same time. And oh man, this was an interesting one. So it was listed on the MLS since March. And it was initially listed at $115,000.

Tim Ulbrich: OK.

Young Park: And no one — there was like absolutely no interest on that property because it was still available by the time I purchased it. So every month, they’re cutting down by maybe $10,000. And in November — or actually, toward the end of October — they listed it at $85,000.

Tim Ulbrich: Wow. OK.

Young Park: Yeah. And I offered $65,000.

Tim Ulbrich: OK.

Young Park: And they came back to me saying, “Hey, we could do it for about maybe $75,000.” And I said, “There’s no way I could, I’m going to do it.” And this one actually was not an owner that was selling. It’s a huge investment firm that’s just purchasing these properties from auction, and they just keep the ones they like and they sell off the ones they don’t. So this was obviously one of the ones they didn’t like. So they were selling it, and I told them, “Hey, it’s $70,000 or nothing.” And then we agreed into the deal. So we got it under contract at $70,000. And then I sent in my contractor and got the estimated bid for it, and it was a little bit higher than I thought because they had a really good photographer, I guess, taking really nice pictures that looked a lot better than what it actually was.

Tim Ulbrich: OK.

Young Park: So yeah, my bid came back a little higher. So I went back to them and said, “Hey, I want another $10,000 discount or else I can’t do it.” And eventually, after a couple negotiations, they did settle for $60,000.

Tim Ulbrich: Awesome.

Young Park: So I got it from $85,000 down to $60,000. And my estimated rehab is about $40,000 on it.

Tim Ulbrich: And you’re still doing the rehab right now or starting that?

Young Park: Just starting, uh huh. We just — I believe we just finished demo, and they’re buying materials. Yeah.

Tim Ulbrich: OK. And what’s your estimated After Repair Value on that one?

Young Park: Right around the same, $120,000-130,000.

Tim Ulbrich: OK. And we won’t jinx it, but likely it could come in the $140,000s. So.

Young Park: Right, right.

Tim Ulbrich: Well, that’s crazy. So you got it at $60,000 through negotiation after you got the estimated bid higher than you thought. You said that it was originally listed at what? $115,000?

Young Park: Right, back in March.

Tim Ulbrich: Wow.

Young Park: Yeah.

Tim Ulbrich: Crazy. You know, what I love about this too, Young, too, it’s just a methodical, steady approach to getting that first deal done, learning from it, building from it, developing the team, you know, that’s the value of the BRRRR method. You’re getting your cash back out or as much as you can. Obviously through the refinance, going onto the second, going onto the third. And I suggest you’re just getting started. You know, my next question, as I suspect if you and I were to talk in three years, it’s probably not three properties but maybe it’s 10 or 20 properties and you’re probably helping and coaching others along this as well, is I mentioned two objections that I often hear, which were, “Hey, I don’t have the money to get started,” and, “I don’t feel like I have the knowledge or the experience to get started.” The third one I would add to that would be time. So as I hear you kind of going through all this, I think, man, where are you finding time to do all this not only in getting the deals done but then also in managing them? Talk to us about your approach to saving time, especially once you have them rehabs done and then you’re obviously managing these properties longer term. What have you done to minimize your time that’s invested?

Young Park: Good question. So first of all, I live in Hawaii and invest in Kansas City. So we are four or five time zones behind, so I start really early in the day. I usually wake up around 5 a.m. and get started and spend maybe an hour or hour and a half either analyzing or talking to my property manager or realtor or wholesaler or sending out emails and working on that. So I do that. Some days I come home and then if I see some properties that came through the email, I analyze them. And the other portion as far as maximizing my time, I have my property manager, who is managing everything. I would not recommend anyone to get into managing their own properties because your time is important. Yeah, you might be saving 8-10% of the rent, but you know, if you’re analyzing everything correctly and have that number included into your analysis, hey, it all works out. Another thing is I think more recently, I found a realtor that I really like, who is willing to write these low offers because most realtors think it’s a waste of time with the offers that they don’t think it’s going to go through. And you know, most of the time, it doesn’t. They’re correct. But if they find an investor who can actually close on the property, even though they’re on the lower price point, we could do multiple deals with them over the years. So that’s like an incentive for them as well. But kind of going back to that, I have my realtor, I just tell him, “Hey, John, I want to offer $60,000 on this property.” And then he just sends me the documents, and I just sign it online and he forwards it. So that saves a lot of time for me.

Tim Ulbrich: And I’m seeing a theme here of team. You know, you mentioned the mentor, you mentioned the agent that is willing to work with you on that, you mentioned the property management piece, you mentioned the contractors that you’ve gotten comfortable with, so I sense the team here has been incredibly important. And my last question for you is if we were to fast forward five years, what does success look like for you as it relates to your real estate investing?

Young Park: You know, I have to put more thought into that. I definitely — so personally for me, I don’t have x number of properties that I want because you know, number of property doesn’t mean really much. It’s really how much cash flow you’re getting. I would like to have maybe $5,000 worth of cash flow and I would like to go part-time if I can to free up time a little more and spend more time with my family and my loved ones and also be able to help my parents. I think that’s where I would like to be within five years. Sooner the better. We’ll see.

Tim Ulbrich: That’s awesome. And I love how you brought that full circle. I think it’s easy, especially as you’re having some success, you know, you kind of keep going, keep going, but what’s the purpose? Again, back to why you are doing this in the first place. And I sense for you that the time was important, the financial independence was important, the being able to provide for family and making sure that you’re investing in good cash flowing, profitable properties that will allow you to achieve those goals. So Young, thank you so much for taking time to come onto the show to share your story as a new practitioner that’s been active in real estate investing out of the area, what’s worked, and I think your story is going to be an inspiration and perhaps a guide for some that are recent graduates or have been out for awhile and wanting to figure out how they can get started in real estate investing. So again, thank you for coming on the show.

Young Park: Yeah. Thank you so much for having me, Tim.

Current Student Loan Refinance Offers

Advertising Disclosure

[wptb id="15454" not found ]

Recent Posts

[pt_view id=”f651872qnv”]