How Building a Platform Can Unlock Opportunities

Mike Corvino, clinical pharmacist and creator of CorConsult Rx, joins Tim Church on this week’s podcast episode to share his unique journey in pharmacy, how he built his side hustle, and how he’s persevered through challenges along the way.

About Today’s Guest

Mike Corvino received a BS degree in biochemistry from Charleston Southern University and his PharmD from the Medical University of South Carolina. He is board certified as a pharmacotherapy specialist and ambulatory care pharmacist. He is also a certified diabetes care and education specialist. Currently, he works as an ambulatory care pharmacist at Fetter Health Care Network. In addition, he holds the position of adjunct assistant professor of pharmacology for the physician assistant program at Charleston Southern University. Outside of work, he is the host of the evidence-based medicine podcast called CorConsult Rx as well as the CorConsult Rx social media pages and CorConsult Rx Flash Briefing on Amazon’s Alexa device.

Summary

Mike Corvino, currently a clinical pharmacist at Fetter Healthcare, graduated pharmacy school in 2015 and became a Walgreens pharmacy manager right after. He chose not to do a residency but stayed incredibly dedicated and committed to continual learning after graduation. Mike shares that he spent all of his free time furthering his clinical knowledge including on his days off from Walgreens, free time in the day, PTO days, etc. This “self-taught” residency built him a reputation of having clinical insight and helped him get a clinical pharmacist position without formal residency training.

Mike realized in 2017 that he could take the content he was learning and teaching to another level by starting a podcast and Instagram page. Mike began the CorConsult Rx podcast which now boasts 350,000 unique downloads and has a following on Instagram of 21,000 people.

Mike shares that he doesn’t monetize his platforms specifically, but has had several professional opportunities that are paid come from them. His podcast has led to opportunities like getting a teaching position at a new PA school where he built the program from scratch as well as various speaking engagements. Mike is hopeful that opportunities that bring in additional income will continue to arise. Because of his side hustle, Mike brings in an extra $1,500 a month.

Mike also shares his tips for starting a side hustle and his advice for those that are interested in entrepreneurship.

Mentioned on the Show

Episode Transcript

Tim Church: Mike, thanks for stopping by and being part of this side hustle edition.

Mike Corvino: No problem, man. Thanks for having me.

Tim Church: If you’ve listened to any of the other side hustle interviews I’ve done, I like to start out with an icebreaker. And because you’re somebody who does a lot of clinical work, I wanted to ask you this: So the zombie apocalypse is coming, and you can only bring three medications with you. What are you bringing with you?

Mike Corvino: Oooh. Good question. Let’s grab some I guess naproxen because I’m most likely going to trip and fall in the woods while running from the zombies. Let’s see, what else? We’ll grab — we’ll throw on like maybe a Z-pack or two just to make sure, in case I get some upper respiratory infection or something like that while I’m running. Got to keep the lungs clear. And then probably some allergy medicine so I can keep my sinuses and stuff open too because I’ll be doing a lot of running I imagine during the apocalypse.

Tim Church: OK. I like that. You’ve got to be able to maneuver and be in good shape to be able to do that. That’s interesting. I thought you might go with like pain med — another pain medication or maybe a benzo. But I guess that’s not always going to be in the best situation, depending on what you’re doing.

Mike Corvino: You’ve got to stay sharp when the zombies are coming after you, you know? It’s key.

Tim Church: Well Mike, talk a little bit about your career path as a pharmacist.

Mike Corvino: OK. So I graduated pharmacy school in 2015. I did not do the residency track, which in hindsight, I guess kind of worked out but probably would have been easier I think if I had gone and done residency and gotten it out of the way and done all that training ahead of time. But went straight into working for Walgreens. Got a pharmacy manager job probably 3-4 months after graduation. And then during that time, I had spent pretty much all of my free time going back to the Medical University of South Carolina, which is where I graduated, and volunteering to help teach and help them with osties and working with students, going to topic discussions that the real residents were having, things like that, just to kind of continue my education. And then from there, managed a Walgreens for about three years and then got an opportunity to be a clinical pharmacist for a place called Fetter Healthcare Network and worked in their diabetes program. It was kind of in the early stages at that point. And so took that opportunity, switched roles and transitioned over into more of a clinical role at that point. And been doing that as my main job since — for the last going on two years now.

Tim Church: And was that position difficult to obtain without a residency?

Mike Corvino: So I would say normally, I think yes. And even in my case, you know, it was difficult in the sense that I had spent so much time kind of furthering my own clinical knowledge. You know, I basically had zero time off from 2015-2018. Like I used all of PTO from work to basically go and spend time at MUSC. We went on our first — my wife and I went on our first actual, real vacation three years after I graduated. I spent literally every second of free time, every day off that I had doing something to kind of further my own clinical knowledge. And I kind of built this sort of reputation around myself as being more on that clinical side of things and being somebody that you could go to for some more clinical insight in the retail world. And that kind of trickled over into some of the clinical world. And so I was able to kind of make that transition easy at the time that it was actually presenting itself. But it was a long kind of road to get there. But yeah, once it was actually time, the actual transition was pretty effortless because I’d been prepping myself that whole time to make that jump.

Tim Church: So what it sounds like is you did your own version of a residency, just not in the traditional sense.

Mike Corvino: Yeah, so that was kind of like our joke, me going to my old professors and we would kind of say I was doing a self-taught residency. And that was kind of the way I looked at it. I just basically said, I’m going to put in as many hours as I can progressing as a pharmacist, I’m learning everything I can possibly get my hands on. And I actually saw it as that even though it was kind of silly to say out loud. But I looked at it as almost like this is my residency. I’m going to do it this way. And so I just got laser-focused for a few years. And it all kind of came together.

Tim Church: Wow, that’s really cool. And I don’t know if I know anyone who has done that. So essentially, you’re working at MUSC for free just to get that additional training and experience.

Mike Corvino: I was like the weirdo sitting in the topic discussions and people were like — all the other residents were like, who is this guy? I was kind of like sitting in the back answering some questions and then fade into the background. But no, it was good times. It was hard, it was a long road. But it was fun.

Tim Church: So you said that diabetes management was one of the things that you’re doing at Fetter Health. Walk us through a typical day. What would that be like?

Mike Corvino: So on a day where I’m just seeing patients, basically — like I’ll take yesterday for instance. I came in around 8 or so in the morning, and I basically had patients that had been referred to me. Most of them have uncontrolled diabetes. Some of them have some other things going on as well where they’re just on a whole bunch of meds, and their primary care doc would just say, “Fix this.” And they’d get referred to me. So their appointment that day is just with me. The nurse takes them back, does their vitals and all that. If we need to run an A1C or something, we can do that ahead of time. And then I start my appointment with them, go through the medications, figure out if there’s something that needs to be changed, what can be optimized. We’ll go through like lifestyle management, go through some diet, some exercise type stuff, whatever that patient needs specifically. And then if I need to order labs or change medications, then I kind of have the autonomy to do that, which is great. And then if I need to have the patient come back and see me, which a lot of my patients it’s the first time I’m seeing them, they’re pretty poorly controlled and things like that. So a lot of times, I’ll have them come back and follow up with me two or three times. And then once they’re A1C is good, their blood pressure’s good, whatever I’m dealing with with that particular patient, then I’ll turn them back over to primary care and let them take it from there.

Tim Church: That’s really cool. And it’s interesting because the position that I have through the VA is very similar, almost verbatim exactly kind of how you’re describing it. So one of the things that always comes up when I talk to other pharmacists who are in a similar type of position is what’s the culture like at the facility with the physicians and the other clinicians that are there?

Mike Corvino: So when I first got there, I was — there was only one other clinical pharmacist that had ever been through there. And he was kind of like a contract pharmacist from MUSC. So he was on the payroll of the actual college. He was going there as part of a grant that was doing some professional collaboration type of thing. Plus, he’s actually one of my old professors, kind of one of my mentors. So he was a lot older than me, and so they kind of looked at him as a little differently. Other than that, the only pharmacist they ever interacted with were dispensing pharmacists, which we have some great dispensing pharmacists there. But they just weren’t used to pharmacists being in the clinic. So when I first got there, it was kind of like, what are you doing here? You know, why are you back here with us instead of being in the pharmacy? But I kind of took the approach of I’m here just to learn, I’m here to do anything I can to help you guys. If you need me to get your coffee for you, I’m cool with that too. You know, whatever it was. And I tried to be as humble as I possibly could. A lot of the clinicians that work there are much older than me, had been doing this for years and years. And so I was as humble as I possibly could going in even though I’m very confident in my ability. But took a very humble approach and then kind of just let my work kind of speak for itself. And then over the months, it’s gotten to the point now where I basically, anything I make as a recommendation, they’ll jump on it. Like I mean, a lot of times I help with the psych department as well. And they could bring me a patient case with them and if I say, “Hey, let’s try this, this and this,” they’ll say, “OK, let’s do it. We’ll go that route.” So I’ve built up really good rapport with the providers there now. And it’s just kind of taken a little bit for them to kind of get used to. And basically I had to kind of prove myself a little bit, which is good. And yeah, but now, it’s great. I absolutely love the providers I work with, it’s fantastic. They make my life super easy. I have so much time, more than I could ever ask for. And yeah, it’s great.

Tim Church: So prior to getting that position, you did your own version, you did the Mike Corvino residency track. But did you have any board certifications or any other credentials prior to getting that position?

Mike Corvino: So when I was at Walgreens, I started doing some MTM. And Walgreens was on board — they’ve gotten a lot more on board with MTM since I left, which is great. But when I was there, at least in our state in South Carolina, we weren’t doing a ton of it. And so I started kind of picking up some MTM on my own. And I was the pharmacy manager, so I had to run the actual pharmacy. But I wanted to kind of proof of concept the idea, and so I was doing MTM claims on my own. I’d go in on my days off sometimes and work on and basically showed how it could be lucrative. And my district manager finally approached me and said, “Hey, if we give you a day a week or two days a week where you can just work on this and we bring somebody else in to actually run the pharmacy, would you be interested?” And so I jumped on that and was able to end up — finally ended up overseeing the MTM for like 80 different Walgreens after like a year’s time. And basically got enough direct patient contact hours to where I was able to sit for the — it was called the CDE exam, Certified Diabetes Educator exam, back then. Now it’s — what? CDCS. They had to change it and add more letters. It’s hard. It’s rough.

Tim Church: It looks better. It looks better now, Mike.

Mike Corvino: If you say so. I had to memorize a whole new set of letters. It was rough. But and then after that, I took the BCPS, I didn’t find out that I passed the BCPS until I actually got to my new job at Fetter. I think I was there for like a month or two, and I found out that I had passed from when I took it. I was at Walgreens when I took it and that was right during that transition. And then I got the AmCare board certification a year later. But I think going into Fetter, the only one I knew for sure that I had was the CDE.

Tim Church: So let’s talk about board certifications for a minute. And this is a little bit off-topic, but I think it’s an interesting discussion. So you know, I have the same diabetes credential that you do and also the ambulatory care. And a lot of people will argue, especially in the pharmacy realm, that having those credentials makes you much more marketable when you’re looking for positions. And arguably, there’s some positions that they’re required that you have some sort of credentials like that in order to be even considered. What do you think now in terms of when you think about the time it takes to prepare for the exams, the cost to take them, the ongoing costs, what is your thoughts in terms of the return on the investment to even get to that point?

Mike Corvino: I really think it just depends on what you want to do. You know, I don’t think that I needed — other than the diabetes certification, which looked really good for this new job because they were wanting to do a diabetes program — I don’t think it would have made a difference either way. I don’t think any of them even knew what a BCPS or ACP or anything like that was. But I think it just depends on the job. As far as if it truly makes a difference as far as the person, I mean, me personally, if I was hiring somebody, I don’t know that I would care all that much. I mean, because when I passed like my board certifications, it wasn’t like all of a sudden I was this miraculous pharmacist comparatively to before. I mean, my knowledge was just basically proving that I knew what I knew. I think, you know, a test is a test, and you can only judge so much just because someone’s a good test taker doesn’t mean that they’re going to be fantastic with patients. So for me, I did it just because it was one of those things — one, I was told that I would never become a clinical pharmacist unless I had a residency. And then I was told that I would never be able to get board certified unless I’d done a residency and all of this kind of stuff. So honestly for me, it was more of like just a personal thing just to prove a point and prove that I could pass it. And it was more on that realm more so than it was I thought that it would make a huge difference in my actual career. But I definitely think like you said, some places like look at that and think that’s the end-all, be-all and if you don’t have that, they don’t even want to look at you. So I really just think it depends. It’s hard to judge whether it’s a good return on investment. I think it just ultimately ends up which employer you go with and how that person particularly sees it.

Tim Church: So does it get you a pay bump if you add more credentials, if you get another board certification?

Mike Corvino: No, not at my current job.

Tim Church: So I mean, I think that’s interesting too because obviously that’s not the incentive for most people why they’re doing it. But it could be one of the benefits, depending on where you are. There’s a lot of government organizations that that’s one of the ways that you can get extra steps or increase your pay. But I think it’s interesting. And I like that you said that that you would proving yourself in one respect because honestly, when I looked at kind of your resume before we jumped on here, I think most people would assume they’re like, OK, where’d you go to residency? Where’d you do your residency? Did you do a PGY2 or did you just do a PGY1?

Mike Corvino: Yeah. And that’s — usually when I tell people I didn’t do one, it’s like, well, what do you mean you didn’t do one? How did you get board-certified? There’s more than one path to do it, I promise.

Tim Church: Sure. So Mike, you’re doing well at Fetter Health Care Network working as AmCare pharmacist, working with patients, helping manage their chronic diseases. At what point do you say, I want to do something more, I want to do something beyond just my full-time position?

Mike Corvino: So realistically, I kind of started that part of it probably before — I guess it was probably 2017 when I first started thinking about ways that I could do more. And initially, it kind of just started off as a way of keeping myself accountable as far as continuing to learn. You know, it’s very easy when you get a job as a pharmacist, you can make great money in retail and it’s very easy to get a cushy paycheck and start watching Netflix instead of reading Medscape. And so I kind of just used that as a tool of I was trying — I like to teach even though I wasn’t in a position to teach at the time. And I like to teach, so I was like, well, how can I maybe use like social media or something like that as a way of helping up-and-coming students as well as kind of it would force me to keep accountable and keep learning and keep staying current with the newest evidence-based medicine trends and things like that. And so that’s kind of where all my side stuff started was that mentality. I had no intentions of it — I never even thought like six people would actually follow my stuff on social media or anything like that. It started off really as a personal thing just to kind of — I knew that if I started it, then I would keep going because I would refuse to stop at that point because I didn’t want to be like one of those people that start something for a month and then quit. And so it was more just that. It was more just an accountability thing. And then it just turned into a lot more as it went on. But initially, it was more so yeah, just something that was supposed to be very simple and just kind of almost for me. It was interesting how it kind of transformed from there.

Tim Church: And so what you’re talking, the things that you’ve done on social media, keeping yourself accountable for the clinical information, that eventually developed into you creating a podcast called CorConsultRx.

Mike Corvino: Yes.

Tim Church: So talk a little bit about that and how that got started.

Mike Corvino: So initially, it was just — CorConsultRx was just going to be like on social media for like posts and things like that. So you know, Instagram is the one that I use mainly. Facebook some, Twitter some as well. But Instagram is kind of like my main focus. And initially it was just that it was going to be just posts with like little clinical pearls or updates and things like that. I was also doing a little bit of like landmark clinical trial video reviews and things like that that I would put on YouTube. But my main focus was just posts on Instagram. And then the more I kind of got established with that, I wanted to try other avenues. And audio is kind of the other piece of the puzzle. Visual aids with social media, video from YouTube and then I wanted the audio piece. And so I kind of started — initially I was doing just like what they call flash briefings on Amazon’s Alexa. And so I learned how to like get a flash briefing going. Back then, like basically Amazon was like, if you don’t know how to code then forget you. Now it’s become like super easy. You just drag and click and you’re done. But back then, literally it was like me and my brother a glimpse in time looking through books on how to write an RSS code that would be able to be uploaded to Amazon. And then from there I got into the audio stuff and then I wanted to go full-scale podcast. And kind of worked my way through that. And that just kind of kept going and snowballed. And now it’s to the point where we just hit — so we’ve had the podcast now for two years. I think we’ve hit a little over 350,000 unique downloads and we’re on all major platforms and yeah. It’s pretty awesome now and something I absolutely love doing. But it started off as kind of just a let’s see if this can be something that could accent what we were doing on Instagram. And the podcast is now probably the main — the Instagram is still a big portal that we have a lot of followers and things on. But the podcast is kind of really where a lot of our listeners are and stuff. I brought in one of my old students, his name is Cole Swanson, he’s the co-host on the podcast. He had finished — he was on rotation with me initially and helped me with some of this stuff when it was early on. He was one of the hardest workers I had ever had on rotation. And so I asked him when he was getting closer to graduation if he’d be interested. And he jumped on board, and we’ve been going after it ever since.

Tim Church: Well, I think it’s awesome. And clearly people are really into what you’re doing and the podcast otherwise you wouldn’t have over 21,000 followers on Instagram and the number of downloads that you’ve had. But when somebody thinks about getting to that point or even just maintaining and keeping episodes going, I mean, was that difficult to do to keep it going, keeping things fresh, always coming up with new content?

Mike Corvino: So I think as far as keeping it going, the good thing about medicine is you can never get to the bottom of it. I mean, that’s one of the things we’ve actually joked about on the podcast is well, I mean, heck, we can just start back over at Episode 1 and go through the topics again if we want to. And it’ll basically be fresh because all the stuff, the guidelines will change and new meds will come out. You never really run out of topics. Ours is very broad. I mean, ours is pharmacotherapy like as a whole, evidence-based medicine. We didn’t want to like get only on one topic or one set specific area. So it was super broad range of topics that we’d go over, so that makes it easy. And as far as like kind of staying with it, when we were first starting, I just always kept everything in perspective as far as followers. Like I never really cared much about how many people were following. Now that I look at the number of followers and things on Instagram, it blows my mind that six people listen to what I have to say. And so I literally just kept that in perspective. I remember being like so crazy excited when we had hit like 100 downloads on one episode. I’d be like, “Cole, check this out! 100 people downloaded our podcast! That is ridiculous. Who are these crazy people? Why would they want to listen to us talk about anything?” I mean, it blew my mind. And so I always had that. I was always so appreciative of anybody that would take 5 seconds to glance at our stuff that I never even really thought about the fact that when we had 500 followers on Instagram, I was like, “Yo, this is great! 500 people.” And then it would just build and build and build. And so it never really got to the point where I felt like oh, come on, when is this going to happen? When are we going to finally get to the 10,000 or whatever? Just because I was just enjoying the fact that these people were — I mean, you think about 100 people, what that would actually look like if you put them in a room. And people complain that they don’t have enough followers. I’m like, 100 people have to care what you have to say. Like that’s huge. And so 21,000 is like unfathomable if I were to actually like line those people up. And so you know, I just always try to keep it in perspective. And I’m super thankful that anybody listens to my podcast. And so that’s always been a driving factor as far as I don’t want to let them down either and make sure the information’s good and something that’s entertaining and what they want to listen to and helpful and all that. So it’s actually been fairly easy to kind of keep the momentum going just because it’s grown and yeah, just looking back, it’s been like, I mean, the absolute best ride ever.

Tim Church: Is there anything you guys do to make it more entertaining? Because obviously, you know, not everyone enjoys diving into randomized clinical trials for hours upon hours. Is there a — how do you guys keep it so obviously you’re delivering the content but you always keep it entertaining and keep people engaged?

Mike Corvino: So like when I first was thinking about doing the podcast, my idea for it was I want high level nerd stuff, but then I also want it to be super laid back coffee shop type tone. And so we literally just talk as if we were going to sit down at Starbucks and then go over some stuff. Like you know, just hey, did you hear about this trial, blah, blah, blah, blah, blah. You know, we joke. I don’t act any differently on my podcast than I do in real life, which I joke around a lot. I’m always cutting up and stuff at work. I mean, I grew up surfing and things like that. I mean, before I was a pharmacist, I was a professional MMA fighter. I mean, I’ve had a very different non-medical background in my past. So now, it’s like, I say dude and I use a lot of slang. And so I just didn’t change any of that. I literally just brought that into my podcast. And I was like, yeah, this is how I talk. I’m not going to try to change it or try to make it sound like I’m something I’m not. What you hear is what you get. But we just try to make sure that the content was there but that it was just not in the typical dry format that usually that kind of stuff is presented in. There’s always like this you have to like have a certain tone when you talk about clinical medicine. It’s like, why though? Who made that stupid rule? And so we just kind of did our own thing. And it’s apparently — I mean, there’s definitely people who say that — I’ve gotten emails that say, “Hey, your stuff’s great, but it’s a little distracting when you guys go off on tangents.” I’m like, I’m sorry, but that’s how my brain works. I don’t know how to fix that. If I could, I’d probably be a lot more successful. But you know, we just keep it as honest as we can and you know, if — basically if you don’t like it, there’s so many other good podcasts that are more like lecture-style that they can definitely check those out too. So we just kind of — we’re trying to be authentic with it and let it go from there.

Tim Church: So obviously, having a platform like yours where you have a lot of followers, a lot of people download the podcast, that opens up opportunities to start monetizing that platform, not that that was the intention or is the intention. But obviously those opportunities come about. So how has the podcast and the followership allowed you to monetize that platform? Or if not, has it led to opportunities to be monetized?

Mike Corvino: So initially, my main focus for the podcast was to open up more professional doors for Cole and I. And so it wasn’t so much that I was ever trying to like monetize the podcast itself, not that I was opposed to that. But I just kind of wanted that to be the attention-grabber, if you will, and get people to kind of know who I was because of that kind of stuff and the free content that I was putting out. And then hopefully that would lead to more opportunities. And because of the podcast and because of my certain things that I’ve done clinically and whatnot, I basically was offered a chance to interview for a position of a new PA school that was being started in Charleston and was going to basically be the first one besides MUSC that had been done ever in this area. And they were a new program, and they said, “Hey, we want to bring a PharmD in to teach pharmacology.” And they wanted somebody that was looking to really like kind of build the program from scratch because they didn’t have a curriculum or anything. They had like a skeleton of what they needed to cover topic-wise. But they had not even a single PowerPoint slide made. And so they wanted someone that wanted to build the curriculum as well as, as they put it, somebody who was looking at more innovative ways of teaching. And so I really kind of went to the interview as just sort of like an experience thing. I didn’t think there was any chance that I was ever going to actually get to teach. And on paper at the time, I had no business teaching, to be totally honest. I mean, I was 28 years old. I didn’t need to be teaching grad school. And during the interview, I just kind of told them what I had been working on, the stuff I had done with like Amazon and the Amazon Alexa and different podcasts and the stuff on social media. And they said they liked it and they wanted to give me a chance and brought me onto the program. And so that was the first time where I really had like a big jump in my pay, if you will, just from something that had been kind of directly from the stuff I’d been doing with CorConsult. And since then, I’ve had speaking opportunities that have paid well and I’ve gotten other different thing and I’ve gotten opportunities to help teach things here and there, other schools and whatnot. And it’s given me a lot of other opportunities that I know will in the next probably 6 months to a year will lead to even more opportunities and things like that. Not to get too ahead of myself, but I see the path now that it’s opening up and all these different doors that it’s opening up. And so that’s really what I’ve been focused on now is kind of using it as that funnel, if you will, to open up doors that I can then jump through and keep it interesting for me from a career standpoint as well as find ways to supplement income and things like that.

Tim Church: And so how often are you teaching at the Physician Assistant program?

Mike Corvino: So I teach an hour and a half lecture twice a week, and I do that almost year-round. I have like December and January pretty much off. I do like a couple like review classes for the students that are going onto clinicals. But I don’t have like regular, set lecture times during those two months. But other than that, I just teach year-round.

Tim Church: And what kind of income does that bring in that’s extra beyond what you’re making in your full-time position?

Mike Corvino: It ends up being — with other speaking things kind of thrown in there and other opportunities, like all in all, it probably ends up being around $1,500 or so a month extra.

Tim Church: That’s a nice boost in pay, right?

Mike Corvino: Yeah, it’s a nice little thing of change.

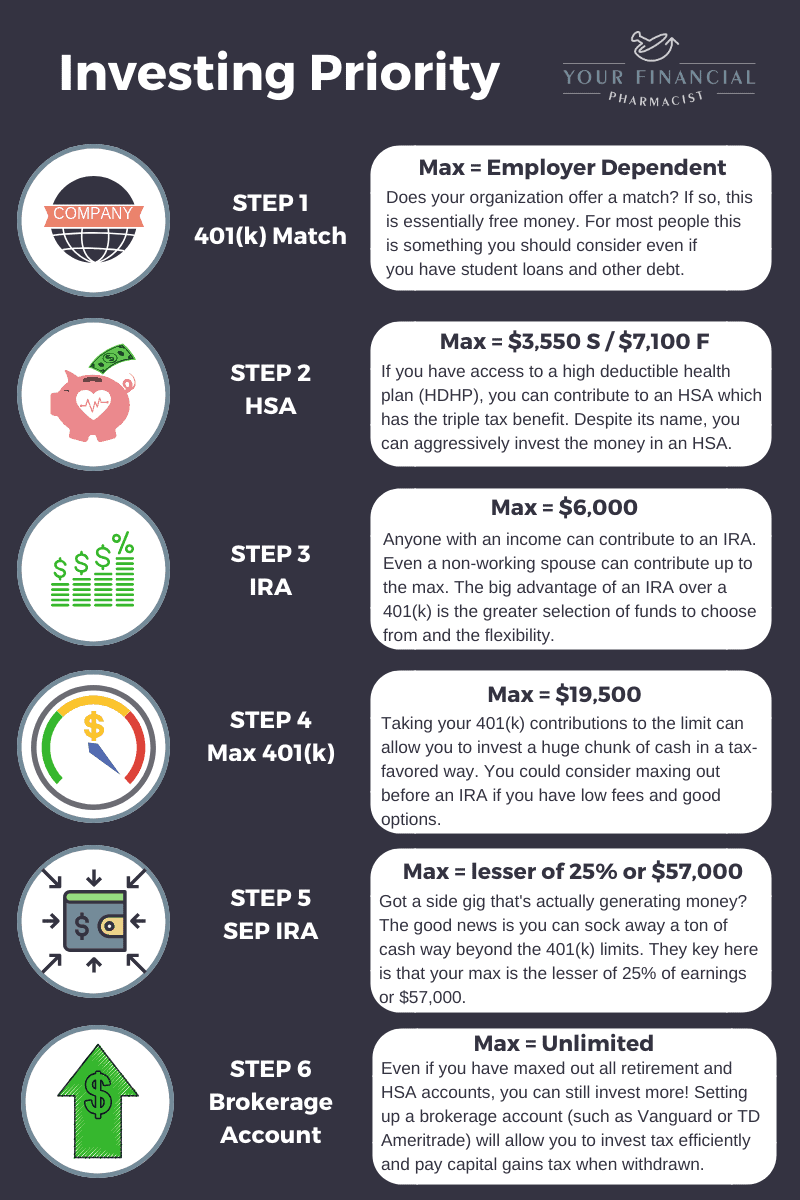

Tim Church: And so when you look at that additional income beyond what you’re making in your full-time position, how do you funnel that extra income? How do you figure out what you’re going to do with that every month?

Mike Corvino: I don’t have like a set — I mean, some of it I reinvest make into CorConsult. And I mean, realistically, I feel very, very comfortable where I am now. My wife is a pharmacist too. She also works — she’s a pharmacy manager for Walgreens. And she works part-time with her cousin’s opioid treatment center and does clinical work for them. So we feel very comfortable financially. And so anything that we make at this point is something I try to reinvest back into the other future things, whether that’s savings or reinvesting back into CorConsult. It gives me a little bit more justification when I tell her I’m going to buy something for the studio for the house. In our house, she let me build a studio. So she deserves like an award for that because it’s pretty awesome.

Tim Church: We’ll have to add some photos of that in the show notes.

Mike Corvino: There you go. But yeah, it’s one of those things that I just kind of try to — I don’t have anything set each month that I do with it or anything. But we just kind of use it to, you know, further things along, if you will.

Tim Church: So you mentioned that besides the teaching position, that through your platform, through CorConsult, you’ve been able to get other speaking gigs kind of even in addition to that. So what do those look like? And what would those typically bring in?

Mike Corvino: It depends. So some of them will be — usually if I’m speaking at an event, it’s usually on a certain topic like I’m speaking in August on dislipidemia, doing like an hour talk on that. I did one in Hilton Head, South Carolina not too long ago that was on — I think it was diabetes I did there. I did one on just like how different ways of like staying current with inflammation, different techniques to kind of keep up-to-date with everything. I spoke at the Kennedy Center on innovation in your field and things like that. So just different topics. But it can range from anywhere from a couple hundred bucks to almost $1,000 to speak at something, it just kind of depends on the event. I mean, there’s some events that like I’ll still absolutely do for free. I mean, I’m not opposed to that at all. I don’t think I’m a fancy speaker or anything like that by any stretch of the imagination. So the fact that people want to hear me speak, I’m like, sweet. I’ll be there. You know, it just depends on the event. It can be a range of that.

Tim Church: So obviously we keep talking about CorConsult, your platform, the thousands and thousands of followers you have on Instagram. It’s not something that just happens overnight. So one of my burning questions I have is how much time are you spending on all these activities beyond your full-time position? I mean, what does that look like?

Mike Corvino: So when I first started, literally 2017 was kind of when I decided to do this, I had a talk with my wife and was like, if I’m going to do this — because she’s always been super supportive of me. And she knows I get a little crazy with my projects that I want to go on. And so she was like telling me to go for it and things like that, and I said, “Look, if I’m going to do this, I need” — because I wanted to be able to do posts on Instagram and different graphic type stuff, so I didn’t know how to use any of the software that I would need to, let alone do video editing and audio. But as far as graphic design, I didn’t know how to do that either. So I had to like go through — I went to the University of YouTube for hours on end and learned how to do all these different tutorials and things like that with Adobe After Effects and Premiere Pro and all that stuff. And so at the time, I mean, I was basically working like every second I was awake. I mean, if I was off, when I was at Walgreens, I had more days off during the week because I was working like 14-hour shifts at Walgreens. And so I would just treat the next day — if I was off, I would just treat that as a shift at Walgreens and I would work 8 a.m. to 10 p.m. on my stuff. And I would eat some lunch and just keep going back at it. And I would just treat it like that. And it took a lot of my time. I mean, I spent a long, long time kind of learning and building and trying new things and seeing what worked and what wouldn’t work. Richard Waithe from RxRadio, him and I used to talk about our after-hours was 10 p.m. to 2 p.m. And he would text me and I would text him at like 1 a.m. to see if we were still working. That was kind of like the ongoing joke for a couple years. And it’s one of those things, it’s probably not the healthiest lifestyle, but it was something that I knew I wanted to do and kind of build this platform. So it was just something I kind of made peace with in my mind as well as getting my wife’s blessing on it. And we just went for it.

Tim Church: So has that scaled back after you’ve kind of gotten a lot of the pieces under your belt and got acclimated with all the tech involved with kind of running the operations?

Mike Corvino: It definitely has to a degree. Now, it depends, though. Like last week, not at all. Last week was a bad example because even my wife was like, I don’t think I saw you take a break the entire week. And I was like, I don’t even remember last week at all. It was just all a blur. And so I mean, because I was trying to get these different things done, I was trying to help a couple of my buddies start their podcast. And you know, I had to get stuff going for my class. And so it was just a ton of stuff. So it depends on the week, but a lot of times, I do take — if you’re looking at the week as a whole, I take a lot more time off trying to do more fun stuff. We’re going on vacation in July and then again in November, which was like unheard of for us before. So I’m trying to take more time to kind of have somewhat of a more normal life. It’s still not normal by anybody’s normal standards. But it feels like I’m working way less from my point of view. And so I feel like I’m trying at least to move in that direction. But I’m also having a great time with it, so it’s hard for me to like fully get into cruising mode, if you will.

Tim Church: Yeah, and I think one of the things that always comes up is people ask the question, well how do you balance these things? And you know, there was a book that I read one time by Gary Keller called “The One Thing.” And basically he kind of refutes that idea being balanced in all parts of your life because it can shift. And if you want to be mediocre in everything, then you can balance everything. But sometimes some weeks or some seasons, you’ve really got to get the grind on if you want to be successful with whatever you’re doing. And sometimes it can take time to get back. So it sounds like I’m kind of hearing a little bit of that from you because obviously you have to hustle in order to get the kind of response to get the followers, to get the downloads that you’re getting because it’s not something that’s going to happen with little work.

Mike Corvino: Yeah. And usually when people ask me that about my work-life balance, I’m like, it’s horrible. Like I know it’s horrible. I’m not going to sit here and try to give the cliche answer of like, oh I’m very balanced. I’m not at all whatsoever balanced. But that’s what works for me personally. That’s what I need to do to reach my goals. I also have no interest in pushing that life on anybody else. I always tell a story about I had a student of mine that I was — because I always talk to my students at the beginning of the rotation, I’m like, “Hey” — because a lot of them will say, “I just want to follow your exact schedule.” I’m like, “Cool. Do you want to do my clinical schedule? Or do you want to do my real schedule?” If you want to do my real schedule, you’re in for a horrible month. And you know, I always give them that choice because I don’t ever push my work — my poor work-life balance on anybody. And I always tell the story of a student that I had where I was talking to them about different things and he said, “Honestly,” he goes, “I don’t mean to sound like a slacker or anything,” he goes, “But I want to get my PharmD, I want to do well at my job, but I really just want to make enough to where I can surf whenever I want.” Like I loved him for that. Like that’s so authentic to him. And that’s awesome. Like he’s going to do a good job, he was going to make a good income, and he’s going to enjoy what he loves doing. So I have no interest in like ever pushing my personal thought process or my goals on anybody. But when I do have — when I hear somebody that’s like, “I want to be this. I want to take over the world. Blah blah blah blah blah.” I’m like, OK. Well, if that’s the case, then I better not see you at the beach this Saturday on Instagram. You better be working because that’s not how you get there. So it just depends. Like I just basically, you know, give my two cents on that person’s specific goals. And I think that’s kind of the way I look at it. So there is no right balance for anyone. I mean, there’s no blanket statement I can say, OK, now you’re balanced. It just depends on the person, what you want to do, and are you happy? And that’s all that matters to me. It’s like, is that person happy with where they’re at in life? And if they are not, then OK, let’s work and let’s buckle down and figure out what we need to do to get to the next stage. If you are happy, that’s awesome. Good for you. That’s great. I have a buddy of mine who makes a fraction of what I make, but he’s on multiple intramural leagues and he does whatever the heck he wants, living his best life. He loves it. I’m like, that’s great. I love that for him. So it just, it really just depends on the person.

Tim Church: Well, I think it’s cool — and you mentioned this a couple times — that your wife is really supportive of the work that you’re doing. And although it may seem a little bit hectic to somebody else and depending on the life that they want to live, but it seems to work for you guys and your wife is on board with helping you reach those goals and get to the next level.

Mike Corvino: Yeah, absolutely. And if she wasn’t, then we’d have to obviously have a different conversation. Maybe I wouldn’t be able to do what I do. So it all just depends. This is working for us at this point. You know, once other things, life changes happen, I’m sure we’ll adjust and change or maybe slow down or who knows? It just depends. But yeah, it’s so far everything’s smooth sailing.

Tim Church: So Mike, obviously you’re doing a lot of great things. But one of the topics that comes up with entrepreneurship is failing or failures. Would you say that you’ve had any failures along your journey or things that really didn’t work out the way that you thought they were?

Mike Corvino: Yeah, for sure. I mean, like I said earlier just kind of briefly, basically when I got into pharmacy school, so I had been doing like some form of martial arts my entire life, like since I was a little kid. And when mixed martial arts became a thing like MMA — UFC is the big one that everybody knows about — but MMA became like a thing where there was a professional league and you could make money at it, that was like, oh my gosh, I want to do that so bad. I had been working towards that from my early — I guess late teens or early 20s. And then when I was 22-23, however old I was when I got accepted to pharmacy school, literally the same week I got a contract to fight professional MMA. And I was like, oh crap. So I like had a real dilemma there, which path I wanted to go. And I ended up doing both for a little while. I fought professionally for like two years of pharmacy school. And my first year of pharmacy school went terribly. Like I mean I was completely 100% focused on MMA. I barely went to class, barely studied, and I ended up actually getting — I don’t tell this story very much — but I actually ended up getting held back my first year. So my first year was so much fun I got to do it a second time. And like the school was literally like, why did we let this kid in here? They were like totally not wanting me to be a student there anymore. And I mean, you know, at the time, people looked at me like I was going to be a terrible — I was told by some people that I would never become a pharmacist, I didn’t belong there, blah, blah, blah. And you know, when I finally got to the crossroads of like OK, I need to pick a path that’s got the longer life expectancy as far as a career goes. I’m 32 right now, that’s like 108 in MMA years. And so you know, I was like, OK, pharmacy is kind of where it’s at. And then I got focused and I kind of just put all of my focus into pharmacy and my competitiveness into pharmacy instead of MMA. And that’s when things really turned for me. But my whole first two years of — almost my first three years of pharmacy school were like all failure to the point where literally nobody was expecting anything out of me. The fact that I have multiple board certifications and things like that, a lot of that stems from stuff that people had told me I would never be able to do back then, kind of got a little chip on my shoulder I guess from it. And a lot of that came from all the times I had done so poorly in school. If you saw my GPA from pharmacy school, you’d be like, oh gees, they let you teach people? That’s atrocious. But I mean, it’s just — I’ve redeemed myself since then and obviously I have learned good material since then. But I had a very rough start or rough half, if you will, to pharmacy school. I think I got used to being — disappointing my professors and things like that. And so it was a long turnaround period that I had to go through to kind of get the respect again and things like that. So that’s one example. There’s plenty of things I could go into, but I think — personally I think failing is super important. I think it teaches you something. I think as long as you look at it the right way, I think it’s motivating for a lot of people. I know for me, one of the best things that ever happened to me was someone telling me that I would never become a pharmacist while I was in pharmacy school. I still think about it. I’ll go on a run nowadays where it has nothing to do with pharmacy. I’ll be on a run and like, I’m so tired, I think I’m going to stop. And then I’ll think about that person telling me that and I’ll start running faster. It still motivates me to this day. And since that, I have a great relationship with that person, so it’s not like I have any ill will toward them or anything. But it’s just something that really, really motivated me and gave me a little bit of that competitiveness that I needed I guess. So I think failure is super important. There’s people that would disagree with me on that and don’t think adversity leads to success. But I definitely do. I think it’s all just the way you look at things and process what’s put in front of you.

Tim Church: Yeah, I totally agree. I mean, I think for me, I look at my own career and my path with pharmacy, with entrepreneurship, and failing has really been key. I look at people that are role models or that I look up to that are more successful in things than I am, and I look at they — typically the response what I’ve come up with is they either have better habits than I do or they failed more than I have to get to the point of where they are. So I think it’s something that’s really critical. What would you say to people who — let’s talk about pharmacists or pharmacy students specifically that are interested in pursuing a business, a side hustle, something like that but that fear of failure is just paralyzing them. What advice would you give them?

Mike Corvino: Probably just one, figuring out what your side hustle actually needs to be. There’s some people that want to build a side hustle that has to do with pharmacy because they happen to be a pharmacist, but they don’t like love it. And that I feel like is a very hard thing to do. I mean, I got very fortunate to where my career happens to be the thing that I love and am super interested in. But there’s a lot of people that’s not the case. So I think that that fear of failure comes into the fact that they don’t want to have to put in all those extra hours to begin with. And so that fear of failure is kind of amplified because if they do fail, they wasted all that time versus if you’re doing something that you love anyway, like for example, the student that I said that wanted to surf, if his business is around surf lessons or something like that, that fear of failure kind of goes down because he’s doing what he loves anyway. So if the business side of things doesn’t work out, then that’s not great. But at the same time, if that whole time he was just doing that was something he’d be doing anyway, that kind of de-escalates the fear a little bit. And then ultimately, I think that you need to really kind of figure out whose opinion I guess you’re worried about if you do fail. You know, are you worried about somebody thinking you’re a failure? Like who cares what that person thinks? I mean, even if it’s somebody close to you. I mean, ultimately, who really cares? And why do you care so much what they think? I think that’s something that a lot of people have to kind of battle with is they don’t want to put something on Instagram or social media or a podcast because they’re afraid that someone’s going to think that they’re not qualified and they’re not whatever. And I just, I don’t know, I just think you just need to really kind of figure out what’s going on internally in your own head to where that bothers you, that that person’s opinion would keep you from doing what you want to do. I think it’s something that a lot of people struggle with. And the sooner you can kind of get past that and where that is a badge of honor kind of thing and be like, look, just — I have people that I looked up to that told me that CorConsult wasn’t a good idea. And that literally like made me happy because I was like, oh man, I cannot wait to prove you wrong. This is going to be amazing. And so that’s kind of my personality from the get go. But if it’s not your personality, I think it’s important to kind of look at it in that sense of like, OK, they don’t think this is a good idea, they’re going to laugh at me if I fail. OK, this is an opportunity to prove them wrong. And if they’re right and you do fail, OK. Then you’ve got something funny to talk about later and you guys can just kind of poke fun at yourself. There’s plenty of things that I’ve done with CorConsult that haven’t worked out. So you know, I think everyone takes themselves so seriously, and they’re worried about wasting time and things like that. I mean, on paper watching Netflix is a waste of time too. And yet a majority of people do that. So it just depends on the person. But I think coming down to what you really want to do, is that really what’s going to make you happy? Or are you just doing the side hustle because you think you’re supposed to? And then ultimately caring about other people’s opinions on what you’re doing. I mean, are any of them doing side hustles or working extra or putting in extra work? Or are they all doing nonsense stuff too? It just, other people’s opinions I think is something that so many struggle with and I wish that they could kind of be eliminated from the equation. But it takes practice.

Tim Church: Definitely. You reminded me of a quote, one of the great motivational speakers Les Brown. I don’t know if it was from him or somebody that he was mentored by, but he would say that somebody else’s opinion of you does not have to become your reality. And I think you demonstrated that on multiple accounts based on your story and the things that you’ve gone through, which I think is just amazing when you look at that and you look at how people, what their perception was and what they thought of you but where you are now. It’s just amazing. So any other books or resources for pharmacists, pharmacy students, who want to get into entrepreneurship, pursuing a side hustle?

Mike Corvino: I’ve got to be careful with how I word this because I don’t want to — I’m always careful with how I say this because again, this kind of stems from my personality. I’m like very anti-books about entrepreneurship. I think if you have an idea, you need to just try and figure out how you can make that work. And I am a much more of a kinetic learner. Like it would do me no good to read through a book on how to be an entrepreneur. One, I don’t think you can truly teach entrepreneurship. I think you teach like entrepreneurial tendencies, if you will, but not true entrepreneurship. And I think that’s something that some people just have and some people just have no desire to go that route. And I think that if you have an idea or you want to try something, like try it. Because the other thing is well, what if somebody’s never written a book about the thing you want to do or the idea that you had or no one’s ever — like that doesn’t mean that it’s not a good idea or it’s not innovative or not going to work or anything like that. And I think that so many people get caught up on trying to prep for their big starting moment that they sometimes get caught up in that. I — and this is just, again, this is 100% me personally and there’s plenty of people who are way more successful than me that would disagree with this, so take it as it is. I’ve personally read like zero books on entrepreneurship. I couldn’t tell you, like when you said Les Brown, like I have no idea who that is, to be honest with you. Like I read zero stuff about that. I just, I try things that I think feel right to me. And I see what happens. I roll with it. I’m like alright, let’s roll these dice and see if this works out. If it doesn’t work out, cool. If it does, then great. I’ll take that data and apply it to this next thing I’m going to try. And I just kind of go that way. And I know that doesn’t work for everybody. And you know, if books and things like that is how you learn, that’s great. I just, me personally, it’s hard for me to kind of give advice on that because I don’t really use that tactic. I just, it doesn’t come naturally to me to do that. In fact, usually when I’m reading a book about somebody who’s telling me I’ve got to do it this way and this way, my brain defaults into, I’m going to try it the opposite just to see what happens. It’s probably a flaw. I mean, it probably would be way easier if I would just go with the grain on that one, but I just, I can’t help it. That’s just the way my brain works. And it’s just very hard for me to see someone who — like I see the life coaches and things like that. I’m like eh, I mean, cool, I wish you all the best. But I just, I have a hard time getting behind a lot of that stuff.

Tim Church: Yeah, and I mean, I think you said it. I mean, you may operate in a much different wavelength than somebody else and be willing to take more failures and hits versus trying to prep for everything that you’re going to do versus just putting it out there and start. But I think a lot of people that they’re so afraid of getting started or so afraid of putting themselves out there that they never get their idea, they never get their business off the ground just because of that. So I think you shared some really key points there. Well Mike, really appreciate you coming on the podcast, sharing your story, sharing your tips for pharmacists, for pharmacy students, who have an interest in starting a side hustle, becoming an entrepreneur. What is the best way for someone to reach out to learn more about you and what you’re doing with CorConsult?

Mike Corvino: So you can email me directly if you want. It’s just [email protected]. And CorConsult, all one word. It’s like the worst branding of all time. So CorConsultRx.com is my email. You can go to the website. You can follow me on any social media platforms, Instagram, Facebook, TikTok, any of those things, even LinkedIn, Twitter, all that good stuff. All the same handle, CorConsultRx. You can reach out to me via text if you want. I have a texting platform that you can contact me directly. It’s (415) 943-6116. I do like answer pharmacotherapy questions and stuff over text in real time. So that’s been kind of fun. But yeah, any of those things you can get in touch with me. I’m fairly easy to contact, depending on which medium you want to use.

Tim Church: Wow. Are you as fired up as I am? As Mike was telling his story, I honestly felt like I was watching the movie “Rocky” and “Going to fly now” kept coming on. Has anyone ever told you that you weren’t good enough for something? You didn’t have the training or credentials to get a particular job? Or your business idea or plan wasn’t going to work? I’ve certainly heard things like that before. Sometimes, that can be the ultimate motivation to do or stick with something. But beyond that, I think Mike illustrated that building a brand or platform can take a ton of time and effort, not just hours but even years to gain a huge following and begin to start monetizing and unlocking these opportunities. While that may seem overwhelming and intimidating, just remember as Zig Zigler said, “You don’t have to be great to start. But you have to start to be great.”

Current Student Loan Refinance Offers

Advertising Disclosure

[wptb id="15454" not found ]

Recent Posts

[pt_view id=”f651872qnv”]