Why I’m Not Using My Health Savings Account to Pay for Medical Expenses

The post is for educational purposes and does not constitute financial advice

About a decade ago when I started my full-time pharmacist position after residency I made one of my biggest financial mistakes: Not taking advantage of a health savings account (HSA).

At that time, I received the same insurance recommendation from multiple colleagues, “It’s the best” and “It pays for everything.”

While there was no question that this PPO plan had its perks from low co-pays on medical visits and prescriptions to even having dental benefits, I had failed to understand all of my options.

Like many people, I had become victim to decision paralysis given there were 30+ options, and rather than spend hours trying to compare all of the features it was easier just to choose what everyone else had and call it a day.

And that decision cost me big because of the higher premiums I ended up paying for years of good health and the opportunity cost of not contributing to a health savings account.

High Deductible Health Plan

A health savings account is not a health plan per se but rather a benefit that’s unlocked by opting into a specific kind of plan called a high deductible health plan (HDHP).

In 2020 these plans, as defined by the IRS, are those with deductibles of at least $1,400 for an individual and $2,800 for a family. In addition, the max yearly out-of-pocket expenses cannot exceed $6,900 for individuals and $13,800 for in-network services.

Besides having a high deductible and out-of-pocket maximums, one of the distinct features of a high deductible health plan is that the monthly premiums are usually much less than traditional health plans. For example, when I switched from the traditional PPO plan to an HDHP for self plus one, my monthly premium went down by 38%!

Although the premiums are lower, the annual cost compared to traditional plans will depend on a few things but primarily on how much you use healthcare resources. For example, if you are relatively healthy in a given year, meaning without any accidents, injuries, or acute medical issues, and only go to an annual primary care visit (which is generally covered with an HDHP), then an HDHP will be a bargain compared on a premium to premium basis.

But obviously, you can’t predict the health of you and your family so some years you could end up paying more money out-of-pocket with an HDHP.

My out-of-pocket maximum (for in-network expenses) for my HDHP family plan is $6,850 and this is one of my favorite features. Knowing that 100% of expenses are covered beyond that is actually very comforting in the event that something catastrophic occurred. The old plan that I was on had an out-of-pocket maximum of $11,000.

The other consideration is that many HDHP plans will give you money every year toward your HSA just by being enrolled in the plan. Every year, my plan deposits $1,500 into my HSA for a self + one plan.

While you can incur more out-of-pocket costs with HDHP plans depending on how healthy you are, remember that the premiums are lower and this is the only way to unlock a health savings account.

What is a Health Savings Account?

An HSA allows you to contribute money on a pre-tax basis to pay for qualified medical expenses. These include costs for deductibles, copayments, coinsurance, and other expenses, but generally not premiums.

Unlike a flexible savings account or FSA, any amount you contribute is yours and you are not forced to spend it every year. The funds will be there until you use them (unless you’ve lost funds because of market changes). In addition, an HSA is portable, so anything you’ve contributed will still be yours even if you change employers.

An HSA is technically a tax-exempt trust or custodial account that is set up with a trustee. The trustee is typically a bank but could also be an insurance company or broker that offers investment options.

Although the insurance provider for the HDHP may suggest or even incentivize you to use a specific bank, you have the option to choose.

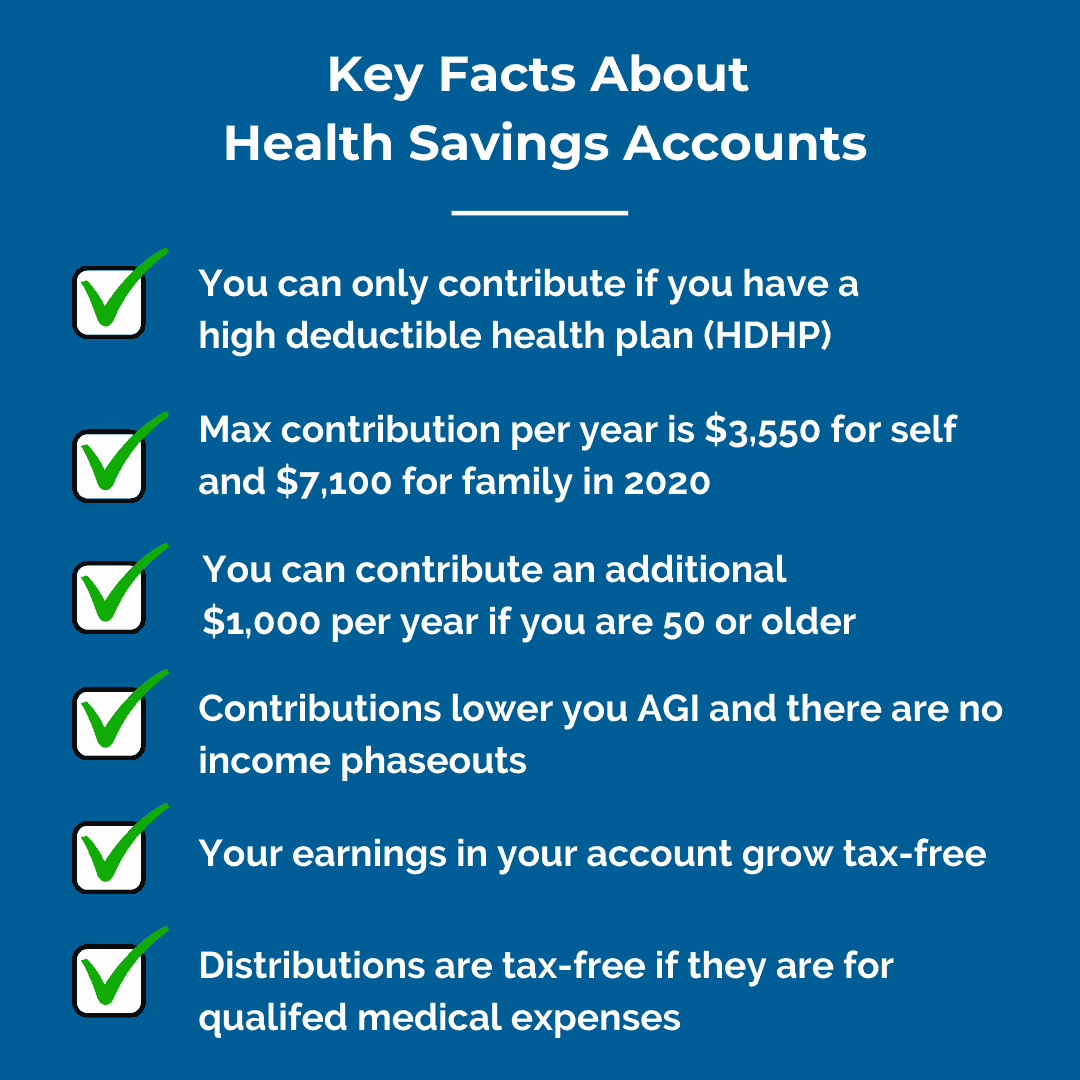

Health Savings Account Contributions for 2020

For 2020, you can contribute up to $3,550 for self and up to $7,100 for self + one and family. There’s also a catch-up contribution of an additional $1,000 for those 55 and older. These maximums include any contributions made by your health plan. For example, if you are under 55 and your HDHP contributes $1,500/year and you’re on a family plan, you can personally contribute $5,600 to get up to the max of $7,100.

You have until April 15th, 2021 to make your contributions for the 2020 tax year.

Triple Tax Benefits

So beyond being able to pay for qualified medical expenses, what’s with all the hype around HSAs?

It really comes down to one word. Taxes.

Health savings accounts have triple tax benefits.

Contributions Lower Your Adjusted Gross Income

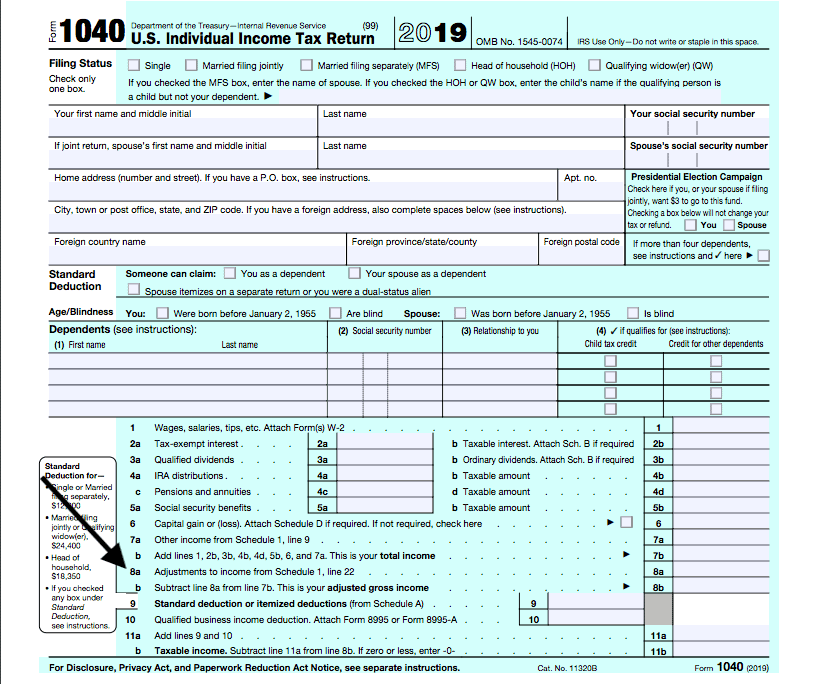

First, any contributions you make lower your adjusted gross income. These are considered above-the-line deductions or adjustments because they reduce taxable income prior to applying the standard or itemized deductions.

Unlike other deductions which have income phaseouts, there are no income caps to get the full health savings account deduction. That’s why this is such an attractive way for pharmacists and other high-income earners to reduce their tax liability.

Plus, if you are pursuing the Public Service Loan Forgiveness program or forgiveness after 20-25 years, this is another way to lower the payments since they are based on your AGI.

This is reported on line 8 of the 1040 form via schedule 1 and form 8889.

Contributions grow tax-free

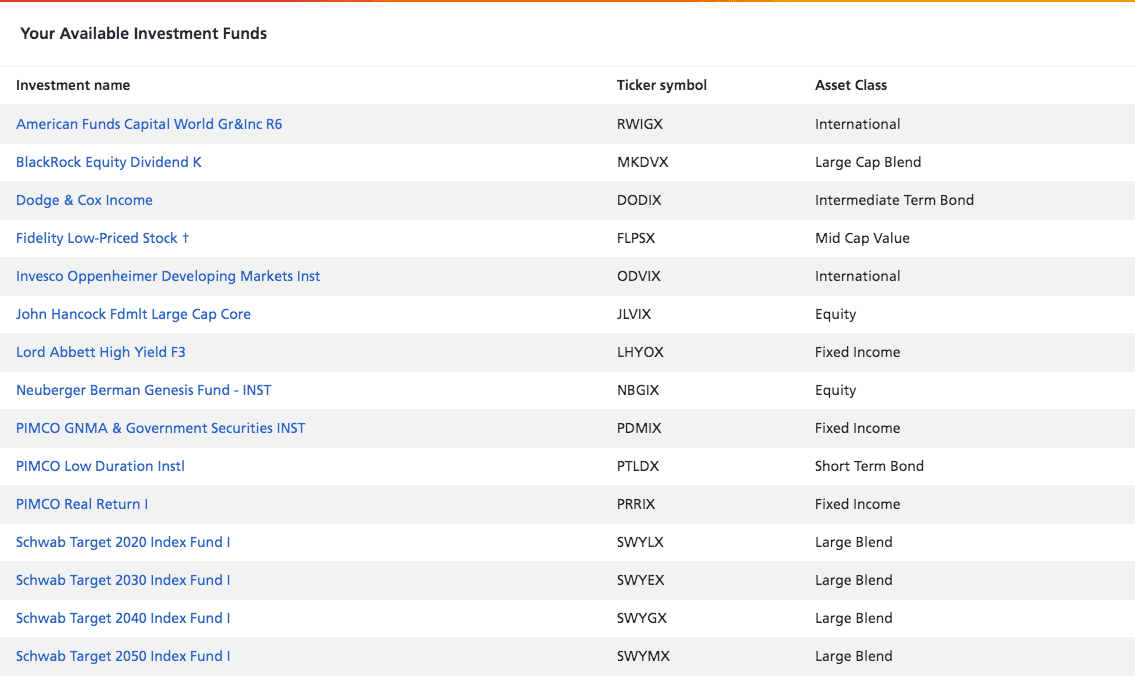

The name health SAVINGS account is sort of a misnomer because you actually have the opportunity to invest the contributions in a variety of funds. And this is a big deal because any earnings you have on the money within your account grows tax-free.

Whether you invest or simply save the funds in an HSA or not really comes down to how you want it to function.

You could use it as an emergency fund for medical expenses you may incur in a given year or plan to pay for medical expenses on a pre-tax basis throughout the year. In those cases, you want the money to be available, and storing it in a regular savings account or another account that is not subject to substantial market risk would be best.

However, what if you were able to pay for all medical expenses out-of-pocket and avoid taking funds from your HSA for several years?

If that’s you, then you can essentially create another retirement account. Because in this case, an HSA is similar to an IRA and it is often referred to as an IRA in disguise.

By forgoing using the funds in your HSA for several years, you can then incur more risk over time and consider more aggressive investment options beyond a simple savings account.

As an example, take a look at all the funds that are offered through OptumBank, the HSA holder that I am currently using. You can see there are many different equity funds, index funds, in addition to fixed-income or bond funds, and money market.

Distributions are tax-free

The final tax advantage of an HSA is that your distributions are tax-free! However, there are some stipulations.

First, if you are under 65, the distributions you make have to be for qualified medical expenses otherwise you have to pay a 20% penalty and will be taxed according to your marginal rate. After age 65, your distributions don’t have to be for qualified medical expenses, but you will have to pay income taxes if they aren’t.

The key is that you still have to tie distributions to medical expenses you incur but here is the most important point:

You do not have to reimburse yourself through distributions in the same year that you incurred the medical expenses.

Because of this feature, you can max out your contributions for several years, invest aggressively, and then once in retirement or at some later point in time start taking distributions to “reimburse” yourself for medical expenses you’ve incurred throughout the years that you have been contributing.

This is the main reason why I’m not using the funds in my HSA to pay for medical expenses TODAY.

The key is keeping good records of receipts for proof of qualified medical expenses that you paid out-of-pocket in the event that you get audited after you’ve taken distributions. I generally scan in receipts to the cloud on an annual basis to help with recordkeeping.

If you’ve been fortunate to have good health for several years and have accumulated more money in your HSA than what you could reimburse yourself for, then you have a couple of options. You could use it for medical expenses during retirement, take distributions and just pay the taxes, or leave it as an inheritance.

Where does an HSA fit within the priority of investing?

When it comes to saving and investing, you’ve probably been told to take advantage of tax-favored accounts especially if you are looking at a long-term strategy. The two most common ways include a 401(k) or equivalent and an IRA. But where does the HSA fit?

Obviously, if you don’t have access to an HDHP, then it’s a moot point. But if you do, then because of all the tax benefits, it can often make sense to fund right after you’ve obtained an employer match if one is available.

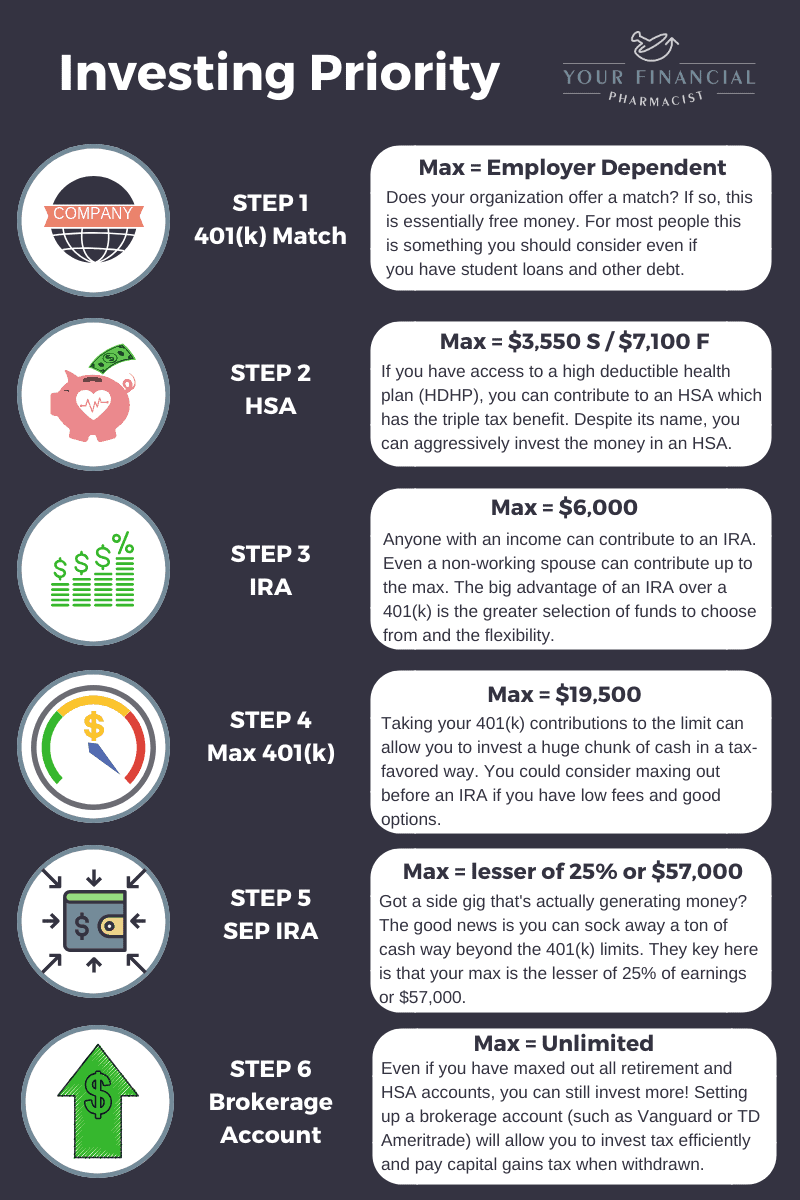

Beyond the tax-favored accounts available to you, it will also depend on how you are prioritizing your other financial goals as well. Check out the chart below for additional guidance on prioritizing your investment accounts.

Conclusion

The health savings account is one of the best ways to pay for medical expenses as it enables you to do so on a pre-tax basis. Contributions you make lower your AGI and there are no income phaseouts. Any earnings grow tax-free and distributions can also be made tax-free for qualified medical expenses. Despite the name, the contributions made can be aggressively invested giving the potential for greater returns over time. Because these distributions can be applied to reimburse for medical expenses from years in the past, an HSA can essentially function like an IRA.

Need Help Starting or Managing Your HSA?

Figuring out where an HSA fits into your plan can be tough if you have student loans and a lot of other competing financial priorities. If you need help funding an HSA or managing the funds within your account, you can book a free call with the YFP team to see if our fee-only financial planning services are the right fit for you and your financial goals.