Why Most Pharmacists Should Do a Backdoor Roth IRA

*Disclaimer – The following post is not tax or investment advice. It is meant to provide education on the subject matter covered and the ultimate decision to make any changes should be determined only by you and your designated financial professional(s).

Invest for retirement in tax-favored accounts. It’s one of the core financial recommendations you’re probably familiar with. While the 401(k), 403(b), or TSP is one of the best ways to do this, your contributions are limited to $19,500/year (for 2020). And if you’re someone looking to build a stellar retirement portfolio, that may not be enough to hit your goals.

As a pharmacist, you may have been told you make too much money to contribute to one of the best retirement accounts available, the Roth IRA. While that may be true, you may not have to settle for a traditional IRA or park your cash in a taxable brokerage account just yet.

That’s because there’s a legit strategy to work around this known as the “backdoor Roth IRA.”

While this retirement saving strategy does require a few extra steps, the ability to invest thousands of dollars with tax-free withdrawals can be well worth the effort. Plus, Roth IRAs have some other awesome benefits that are not available with traditional contributions.

When you’re eligible to take distributions at age 59 ½, you won’t owe any taxes on that growth.

Also, unlike a traditional IRA, there is no required minimum distribution and at any point you can withdraw any of your contributions you’ve made if needed tax free. Plus, if you have held a Roth IRA for at least 5 years, you can make early withdrawals on the earnings without penalty for a first time home purchase up to $10,000.

*Please note that the 5 year rule is different for a Roth conversion which allows you to move funds from your traditional IRA and place them in your Roth IRA. The 5 year holding period restarts for each conversion and any withdrawals during this time frame will result in a 10% early withdrawal penalty if you are under 59 ½.

Let’s go through why backdoor Roth IRA can be a great option and then how to actually do it.

The Issue with a Traditional IRA

IRAs or Individual Retirement Arrangements, are retirement accounts available to anyone who earns an income in addition to non-working spouses (covered later). No matter what company you work for or retirement plan they offer, you have the opportunity to contribute to an IRA. This is something you set up completely outside of work and can be done in addition to your 401(k).

Like your 401(k), IRAs also come in two flavors: traditional and Roth.

Contributions to traditional IRAs can lower your taxable income today with the amount growing tax-deferred resulting in you paying taxes at the time of withdrawal. However, because of the income limits to get the deduction, most pharmacists will never get this benefit.

Now the rules get a little tricky here because these limits are determined by whether you and your spouse have access to a retirement plan at work. But assuming you do, the ability to deduct traditional IRA contributions phases out completely at $75,000 if you file single and $124,000 if married filing jointly for 2020, hence excluding most pharmacists working full-time.

With this in mind, there is really is no question on whether a traditional or Roth IRA is better since there won’t be any benefit with the former. Therefore, either contributing directly to a Roth IRA or using the backdoor strategy will be your best move.

Roth IRA or Backdoor Roth IRA?

With the median pharmacist salary around $126,120, it’s very close to the income limits before you’re restricted from making standard Roth IRA contributions.

But rather than an all or nothing situation, the IRS begins phasing out your contribution limit once your modified adjusted gross income (MAGI) exceeds a certain threshold. These thresholds are listed below and depend on your filing status (single or married) and the tax year (2020 or 2019) you’re submitting your return for.

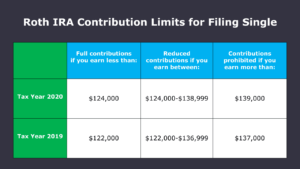

Single Taxpayers and Heads of Household

Single filers can make regular Roth IRA contributions when their income falls within these ranges for tax years 2020 and 2019.

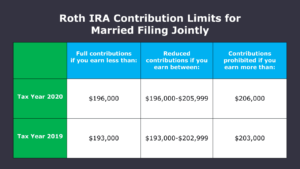

One perk of being married is higher income limits to contribute. If your household income is below the amounts listed below, you can make Roth IRA contributions for tax years 2020 and 2019.

Married, Filing Jointly and Qualified Widows or Widowers

Before you think the backdoor Roth is your only option, glance at the income limits to see if you qualify to contribute directly to a Roth IRA first. No need to put in the extra work if it’s not necessary!

Even if your annual income falls within the IRS income phaseout range, you can still make partial backdoor Roth contributions. For example, if you’re a single taxpayer with a MAGI of $125,000, your maximum Roth contribution is $5,600 in 2020 and $4,800 in 2019.

This means you can contribute $5,600 directly to your Roth for tax year 2020 and the remaining $400 with the backdoor method to still contribute $6,000 annually. If you are able to make partial contributions and want to determine your limit, check out the IRS guidance for 2020.

Roth IRA Contribution Limits

The amount you can contribute to backdoor Roth is the same as the standard Roth IRA before the IRS phaseouts start applying.

You and your spouse can contribute up to the following amount to your Roth IRA:

- Tax Year 2020: $6,000 ($7,000 if you’re 50 years or older)

- Tax Year 2019: $6,000 ($7,000 if you’re 50 years or older)

To maximize your peak earning years, the IRS lets you contribute an extra $1,000 annually once you turn 50, something known as a catch-up contribution.

These are also the same contribution limits if you fund a pre-tax traditional IRA. Keep this in mind as you will need a traditional IRA to make valid backdoor Roth IRA contributions.

Make sure you only contribute up to the annual limit to your Roth IRA. In 2020, that’s either $6,000 or $7,000 per person. For non-backdoor Roth contributions, you can request a refund to correct the problem. If you don’t correct the excess contribution, you will pay a 6% penalty on the excess amount.

Open a Spousal IRA

If you file your taxes under married filing jointly (MFJ) and your wife or husband either earns a small income or doesn’t work, you can consider opening a spousal IRA to double your annual contributions. As long as your earned income is equal to the amount you contribute to your IRA and your spouse’s IRA (at least $12,000 if you each contribute $6,000), the spousal IRA contribution is valid.

In 2020, having a spousal IRA lets you and your spouse both contribute $6,000 ($7,000 if you’re 50 or older). That’s up to $14,000 of cash that grows tax-free until you withdraw it. Pretty cool right?

In order to take advantage of the spousal IRA option you will need to open up both a traditional IRA and and a Roth IRA in the spouse’s name. After contributing the annual contribution to the spouse’s traditional IRA you will then convert the balance to the spouse’s Roth IRA.

A Step-by-Step Guide to Making a Backdoor Roth IRA Conversion

Ok. We’ve gone through the benefits of a backdoor Roth IRA, why it’s a great move, and the contribution limits. Now let’s go through how to make this happen step-by-step:

1. Make Nondeductible Traditional IRA Contributions

The first step is funding your traditional IRA with nondeductible income. If you’re making this contribution before April 15, you can either date it for last year (2019) or the current year (2020).

After the federal tax filing deadline (April 15 for most years), your only tax year option is the current year.

You’ll be completing an extra form, but this step is like making regular post-tax Roth IRA contribution. These contributions don’t reduce your taxable income for the current tax year.

The best way to fund your IRA contributions is from the checking account you use to deposit your paycheck. You must then decide if you want to make a lump sum conversion or dollar cost average as money becomes available.

Lump Sum Contributions

If you have $6,000 in idle cash and are close to the deadline for making your contributions, lump sum is the best option. With this strategy, you only have to make one contribution each year and your tax implications will be minimal if you make the conversion relatively quickly.

Dollar Cost Averaging

If you can’t max out your IRA at once or prefer to take advantages of changes in the market, you can also considering dollar cost averaging. With a $6,000 annual contribution limit, you can contribute $500 a month if you want 12 equal monthly payments but you could also come up with some other schedule.

Besides doing this out of necessity, there are other benefits with this technique. By contributing an equal amount over a period of time, you will naturally avoid trying to time the market. You will buy more shares when the market is down and fewer shares when the market is up.

Where to Set Up Your IRA

You have a lot of options on where to fund your IRA including banks, brokerage firms, and mutual fund companies. Companies such as Vanguard, T. Rowe Price, or Fidelity allow you to open accounts without any fees or commissions but there may be a minimum initial amount depending on the investment you choose.

Now, when you make your contributions, you will have to decide how you actually invest the money. Remember, the IRA is not the actual investment but rather a tax-advantaged vehicle or shield for your money.

You will have thousands of options here and how you invest will depend on your goals and your risk tolerance.The one point to keep in mind will be to minimize the fees. Many index funds and ETFs exist with expenses ratios as low as 0.03-0.08.

However, keep in mind that by subjecting your contributions to market fluctuation, you could actually lose money prior to making your conversion. Therefore, the conservative approach would be to keep contributions in a money market account or other low-risk investment with little to no volatility.

2. Make a Roth IRA Conversion

Your next step is to convert your contribution amount into a Roth IRA. It can take several days for your traditional contributions to settle before you are able to convert them but by having your Roth IRA with the same broker, you should be able to easily schedule the conversion.

When making the backdoor Roth IRA conversion, your broker will ask if you want to withhold any income for taxes. Since you made a nondeductible contribution in the first step, don’t have your broker withhold anything.

Potential Tax Implications for Lump Sum Contributions

You will be responsible for any taxes when you file your return, but the amount should be minimal if the cash doesn’t sit in your traditional IRA long enough to significantly appreciate in value. This is your most likely tax situation when you make lump sum contributions and you don’t have an existing balance in your traditional IRA that converts first.

Potential Tax Implications if You Dollar Cost Average

If you convert money that has appreciated in value, let’s say 30%, you pay taxes on those gains. For example, let’s say for 2020, you contribute $500/month to get up to the max contribution of $6,000. But, because the market was on fire, you actually have $7,800. You would be responsible for paying taxes on the $1,800.

How Long Should You Wait Between Traditional Contributions and Roth Conversions?

One of the questions that commonly comes up when making the Roth conversion is how long to wait. Technically, as soon as your account is funded with your nondeductible traditional contributions, you can make the move.

However, doing this could cause some issues with something called the step transaction doctrine. It has to do with the overall result of a series of transactions where the IRS could essentially penalize you with taxes because you are exploiting a loophole.

There is controversy by financial experts on what the best waiting period is. Some advocate for one month while others recommend waiting a full year before making the conversion.

3. Report Contributions and Conversions on Your Tax Return

When filing your federal return, report the nondeductible contributions and Roth IRA conversions. Your broker will send you the necessary tax forms each year to properly report the information to your accountant or online tax prep software.

Although you’re contributing to a traditional IRA first, you will make nondeductible transactions. You will need to complete IRS Tax Form 8606 to report your total traditional IRA contributions for the current tax year. This lets the IRS know you’re not funding your backdoor Roth with tax-deferred contributions.

4. Repeat as Necessary

Follow the same steps if you have a spouse as you can each do a backdoor Roth IRA every year.

Backdoor Roth IRA Tax Implications

I discussed earlier that you likely won’t have to pay taxes on your traditional IRA contributions when you make the conversion assuming there is no growth during that time frame. However, in that particular case, it assumes this is first time you are doing a backdoor Roth IRA and that you only have other existing Roth IRAs.

It gets a little more complicated if you have existing funds in nondeductible traditional IRAs. Because of the IRS aggregation rules, they look at everything you have contributed in the past, not just what you contributed for the current tax year and it all becomes “aggregated.” Therefore, if you have a large existing traditional IRA balance, it may negate the benefits of the backdoor strategy.

If you are in this situation, you could roll the existing IRA balance into a 401(k)-type account if your employer allows. This can either be your employer 401(k) or a self-employed 401(k). This way you can fund your backdoor Roth with the income you earn in the current tax year and have a starting traditional IRA account balance of $0 and avoid a potentially hefty tax bill

When your current traditional IRA balance is small or doesn’t have large investment gains, it might be better to pay the taxes on the amount you convert instead of rolling it into a 401(k), especially if you have limited investment options or high fees.

Conclusion

The backdoor Roth IRA is a legal and easy way to maximize your retirement savings and can be a great option for pharmacists given many will not be able to directly contribute to a Roth IRA because of the income limits.

If you haven’t filed your 2019 income taxes yet, you have until April 15, 2020 to make IRA contributions. You also have all of 2020 and until April 15, 2019 to make the tax-advantaged contributions we’re discussing today.

If you need help doing your conversion or want some guidance on how to invest the funds within your Roth IRA, you can schedule a free call with our financial planning team to see you’re a good fit.

Also, If you’re looking for other ways to reduce your taxable income when investing, IRAs aren’t your only option. I recommend listening to this podcast episode to help determine your priority of investing.

Current Student Loan Refinance Offers

[wptb id="15454" not found ]Recent Posts

[pt_view id=”f651872qnv”]