Debt Free Story Q&A

Jeff and Alex Keimer share their debt free story in this special Q&A format.

Jeff received his PharmD from Albany College of Pharmacy in 2011 and moved to Vermont to pursue a career in retail pharmacy. There, he met Alex, his future wife, who graduated from Cornell with a Master’s in Food Science in 2012. Jeff racked up about $150,000 in student loans and also purchased many items after graduating on his credit card, including the down payment for a brand new Subaru WRX. Alex managed to pay for grad school and accumulated only $50,000 in debt. The couple shares their journey of paying off their student loans, car loan and credit card balance while working toward financial independence.

Jeff, tell us a bit about your background and education and how much you accumulated in debt upon graduating with your PharmD.

I’m originally from the town of Guilderland, NY (a suburb of Albany) and got my PharmD from Albany College of Pharmacy and Health Sciences in 2011. In terms of career, my path has always centered around retail pharmacy. I’ve worked in a retail pharmacy ever since I was in high school and love it. No joke.

During school, I didn’t think about my loans. I knew they were there, but like many of my classmates at the time, I never thought they’d cause a problem since I was “guaranteed” to make the big bucks after graduation. Understand that this was a time where P3’s were getting 5 figure sign on bonuses, so most pharmacy students weren’t worrying about their loans.

All in all, I came out of school with a little over $150,000, which I believe it or not, thought was low. I distinctly remember someone in my class said they were in the $300k club, so I felt like I got out cheap.

Alex, what about you? What type of education do you have and how much debt did you accumulate while in school?

I have a Bachelor’s in Food Science from the University of Delaware and Master’s in Food Science from Cornell. A small portion of my undergrad was paid for by a scholarship and the majority of it was paid for by my parents. I paid for grad school myself and accumulated around $50,000 of debt from it.

Jeff, what was your parents’ or family influence on your money habits?

Growing up, both of my parents started their own businesses and worked from home so they could be there for my sister and I when we got home from school. We were taught a respect for how money was earned but not much was said about how it was managed. When money was tight, I remember my dad saying that we were going on the “austerity budget” and when money was good, we bought things and went on vacation. But, that’s really about it.

Alex, what about you?

I remember both of my parents working a lot. My mother was an accountant and my father was an administrator for a community college in Long Island City. We were always buying things on sale and using coupons. When I would ask my mom why we couldn’t have fancy clothes or why we couldn’t buy a boat like my best friend’s parents, she would say that we save our money so that we can go on vacation. She always stressed the value of experiences over material things. To be fair, we did travel a lot. While most of my friends were having Sweet 16s, my family and I were going to Hawaii. We travelled to California, Europe, and the Dominican Republic, just to name a few.

My mother would always talk about how important it was to save money. She would tell me that you never know what is going to happen in life, so it is important to have a healthy savings. When we were younger, she helped us set up CD’s and savings accounts and we would watch our money grow. This rubbed off on my because when I was in college, I remember her sending me money in the mail with a note saying “use this for something FUN, do not put this in the bank.” She knew that all of the extra cash I had was going in the bank and I was sacrificing time out with my friends.

Jeff, you mentioned to us before that you spent your money on a lot of nonsense as a new practitioner.

Where to start? Well, first I had to deck out my new apartment so I spent several thousand on new furniture. OK, that sounds mildly sensible. How about another grand on a new 3D TV? Another couple thousand on some new firearms? Or, my personal favorite, >$5,000 in a year spent on craft beer? All of it on a credit card that had been carrying a balance since I graduated. Just for good measure, I also bought a brand new Subaru WRX in 2013 that cost around $32k which I financed for the next 5 years. Oh, and lest I forget, I also put the $2,500 down payment for that car on that same credit card since I didn’t actually have any money.

I may not have been great at saving money, but I was a savant when it came to building negative net worth.

With all this debt getting piled on, you would’ve hoped I had a plan to get rid of it. But I didn’t. Even though I was starting to feel the pinch from my student loans, I didn’t have much motivation to get rid of them. I just assumed that they were there and I would have them kicking around for the full 15 years of my payment plan. The credit card was more egregious anyway. But, I managed to give myself a false sense of security about that. I figured that if I was paying more than the minimum on it every month, I was good. Never mind the fact that the balance was growing.

Alex, when you and Jeff started to get into a more serious relationship and talked deeper about your financial burdens, what were your feelings about his indebtedness?

I have never held a balance on my credit card and I have never paid a cent of credit card interest. When Jeff told me what kind of balance he was carrying on his credit card, I think the look on my face made it clear that we would not be combining our finances until he got serious about getting rid of that enormous debt. At this point I wasn’t really interested in helping Jeff out. I was pretty much like, “You get your house in order and let me know when you’re good.” It definitely didn’t take him as long as I thought it was going to. Turns out when you have a 6-figure salary and aren’t buying a ton of crap, it’s pretty easy to pay down your debts.

When did you start getting serious about paying this debt off?

I can’t remember the exact time I decided it was time to clean up my act, but I do remember it was as Alex and I were starting to take our relationship to the next level. We were starting to plan a life together and I while I knew she loved me despite my faults, I didn’t want her to have to live with all of them. And, like Alex said before, she really wanted me to get my house in order.

My debts at the time were three-fold: credit card, car loan, and student loans. Since we both knew the credit card represented both the highest interest rate and a monument to my stupidity, I decided that needed to go first. And, I needed to do that on my own.

Jeff, how did you decide that creating a budget was what was needed to pay down your debt?

Just like it’s common sense that getting on a diet and exercise plan is what you need to do to lose weight, I’ve always known that I needed a budget to control my finances. But like many people with wanting to diet or exercise, I chose not to do it since I thought it would be hard. The idea of having to plan out all my spending ahead of time and restricting myself to what I’d planned for just never sounded appealing.

But, I had to do it. At first, I decided to make a traditional type of budget. I made categories and used the Mint app to help me track my spending. This worked to a degree, but I still couldn’t see myself adhering to this type of budget long term. It just felt so foreign to me.

What I was used to was living paycheck to paycheck. So I decided one day to try and make a budget that took that lifestyle and would make it work for me instead of against me. Like all great ideas, I think it came to me in the bathroom. Instead of figuring out how much I have leftover at the end of every month to throw at the debt, why don’t I just send money there first and give myself a smaller paycheck to live off? In the end, I created a budget that’s sometimes referred to as a “reverse” or “pay yourself first” style of budget.

In the months that followed, I was able to get rid of the credit card debt and use the same budget to start saving money for an engagement ring. With Alex’s help (she started packing me lunches) and forgoing the things that I knew were nonsense, adhering to my new budget was relatively painless.

You mentioned to us before that in the marriage process, you and Alex read The 5 Love Languages by Gary Chapman.

Yes, before we got married, the priest we worked with had us read it as part of a premarital course. We ended up reading it to each other rather than on our own which I think was a great way to do it. What we learned was that we shared a lot of common ground when it came to what our love languages are. Quality time, for one, topped both of our lists, and gift-giving was at the bottom. Looking back, I think this realization was what set the stage for the next chapter in our financial journey.

You mentioned that you are pursuing financial independence (FI).

Yes! Shortly after we got married in late 2016, I stumbled on the blog Mr. Money Mustache while doing some internet research on investing. The name sounded ridiculous so I had to check it out. What I found there was pure gold. In that blog, Pete Adeney (aka Mr. Money Mustache), describes how a combination of frugality, hard work, and unconventional retirement planning allowed him to “retire” at the ripe old age of 30 and that early retirement is something anyone living in this country has a shot at. This was my introduction to the financial independence/retire early (FIRE) movement.

While I love being a pharmacist, I love being able to spend more time with Alex. What I read in his blog and others was that making more of that time was entirely possible through financial independence. So for me, I was sold. If this was a way for us to get more out of the finite amount of time we have on this planet, then that’s what I wanted to do.

I plugged our numbers into some of the calculators online and found that if we were able to start maxing out our retirement accounts and tweak our budget a bit, we had a decent shot at financial independence in the next 15 years. Needless to say, Alex was skeptical at first. I clearly remember her saying in a thick Long Island accent, “You don’t know this man on the internet,” and that this all sounded a little far-fetched. But, to her credit, she said that if I wanted to give it a try she would support me.

So I got to work adjusting our budget and adapting it to a higher retirement contribution rate. Thanks to the tax deduction, it wasn’t that hard. Once that was in place, I set our debts in the cross-hairs.

How did you pay off the rest of your non-mortgage debt? What was the total you paid off and how long did it take you to pay it off?

When we decided to get out of debt, we had 3 different debts: my car, the student loans, and a loan we took out to finance a solar array we put on the house. In order to tackle them, I thought it best to go after the highest interest debts first. But before that, let me tell you what went down on November 28th, 2016.

I had been reading Mr. Money Mustache now for a few months and had been coming around to his way of thinking, particularly around cars. The dude hates them but realizes they have a place. That said, the supercharged rally car I was using as a daily driver on paved roads didn’t fit with the overall FIRE mindset I was getting into. It had to go.

So, the morning of November 28th, I got up and started looking online at replacements that were more sensible, but still had a stick shift (not giving that up). I texted Alex that morning telling her that I found a Toyota Corolla for sale across the state that looked like a good deal and wanted to check it out. She said OK and I drove over to the dealership. While there, I did a test drive, negotiated a trade, and signed over my WRX for the Corolla. I got rid of the car debt in a day and felt awesome. Did I forget to talk to Alex before getting a new car? Absolutely. I learned some things about marriage that day.

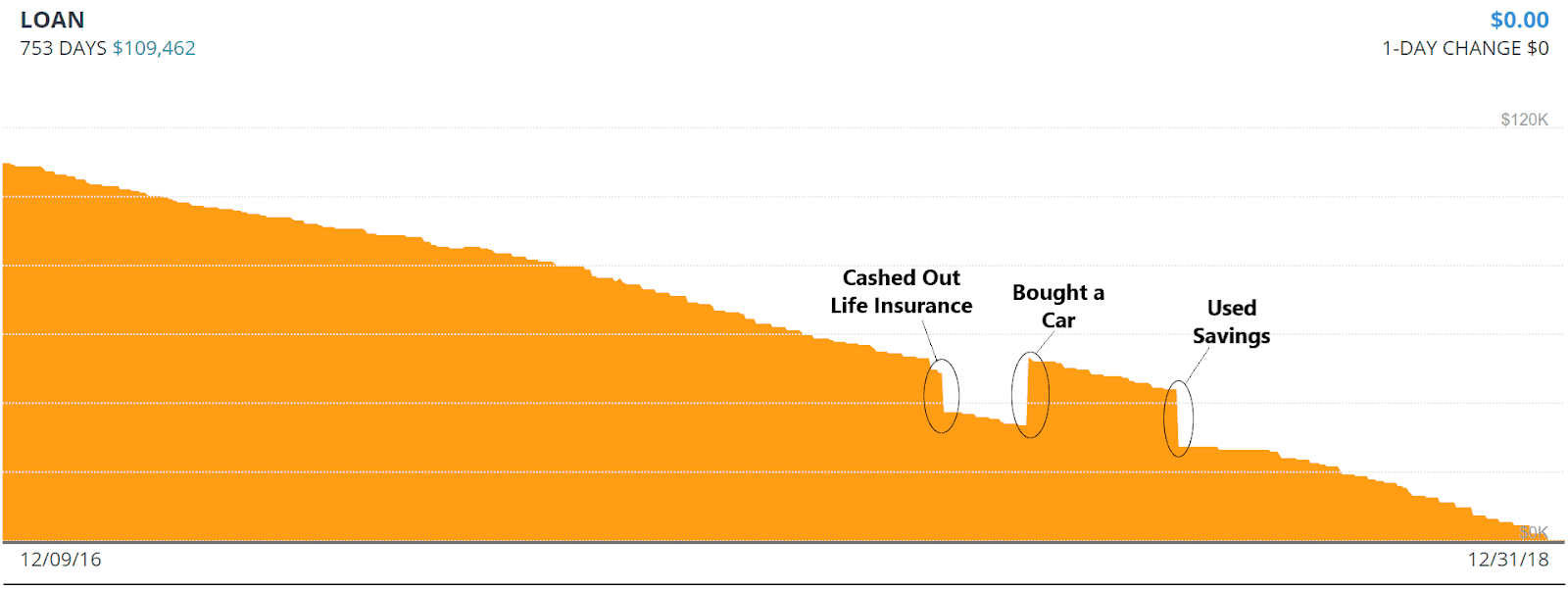

So with the car debt gone, we decided to go after the student loans. Alex’s loans at this point were a little under $7,000 total, so we used the money saved from our budget over the past year to kill those in one shot. Now, it was time to fight the good fight and get rid of my loans. Using our budget we put money toward the debt with every paycheck.

Over the next 19 months, we got rid of the student debt totaling $105,560.86. Most of it came from those incremental payments with every paycheck. Also, a little over $10k came from cashing out a variable universal life insurance policy that I took out in 2012. Finally, since our budget has us saving money simultaneously, I was able to take money that we had been saving for a new car for Alex to finish them off in June 2018. We bought the car though, so there’s more debt.

After the student loans, our other debts didn’t seem so big. The solar loan only had around $11k and the car loan started out at around $20k. Whatever, they needed to go. So for the rest of the year, we focused on those two debts, clearing them out finally on 12/22/18.

Overall, from the day I sold the car our payoff looked like this:

In the end, with interest payments (not reflected above), the total amount paid toward debt was $138,017.37 from November 28, 2016, to December 22, 2018.

Amazingly, we didn’t really feel deprived throughout the whole process. We still went out to eat and still went on vacations. Even though we were putting a huge amount toward debt, we didn’t feel it much since we did everything we could to optimize our expenses. Not having my car payment and replacing the life insurance policy were huge (~$800/month), but so were little things like getting rid of cable (~$75/month), sharing streaming services with family, and preparing meals ahead of time. We also tried our hand out at travel hacking which has been quite lucrative.

Now that you are debt-free, how do you feel?

When people say that getting rid of debt is like having a giant weight lifted, they’re not kidding. Getting rid of our debts, particularly the student loans, has been incredible. It’s even me more joy at work knowing that I’m not chained to my paycheck and has given us the ability to be more flexible in our career paths.

As far as near-future financial goals are concerned, we would like to get rid of the PMI on our mortgage this year, continue to maximize contributions to our retirement accounts, and possibly buy a rental property. In the end, we’re going for financial independence, so keeping our savings rate high is what we plan to do for the long haul.

Current Student Loan Refinance Offers

[wptb id="15454" not found ]Recent Posts

[pt_view id=”f651872qnv”]