A New Practitioner’s Perspective on House Hacking

By: Dylan Koch, PharmD

In my second year of pharmacy school, I was introduced to Dave Ramsey. Dave Ramsey is a personal finance coach who is most known for his book, “The Total Money Makeover” and his podcast, “The Dave Ramsey Show.” Mr. Ramsey boils down his path to financial freedom through seven baby steps. Those include:

- Save $1,000 for an emergency fund

- Pay off all personal debt with the exception of your mortgage via debt snowball technique

- Save 3-6 months of expenses for an emergency fund

- Save 15% of your income towards retirement

- Save for kids’ college

- Pay off your mortgage

- Build wealth (and give)

As a pharmacist, you may consider re-prioritizing paying off student loan debt to baby step #6 instead of baby step #2. However, this is only relevant if your student loan debt is comparable to your mortgage payment.

These baby steps can definitely work to move you out of debt and into financial freedom. With an average pharmacist’s income, everyone should be able to retire a millionaire, at the minimum. The “Seven Figure Pharmacist” book dives into this in detail so I won’t go into that here.

During my own personal finance education, I came across another book titled “Rich Dad Poor Dad” by Robert Kiyosaki. Mr. Kiyosaki states that rich people buy assets and poor people buy liabilities. The most common examples of assets include stocks, bonds, and real estate. The most common example of a liability is a new car. The main difference between the two is that assets increase in value over time whereas liabilities decrease in value over time. Multiple streams of income are important and allow people to leave the “rat race”. After reading “Rich Dad Poor Dad”, I started researching real estate as an investment opportunity, and that’s when I first discovered the concept of “house hacking”.

House hacking is buying a small multi-unit property (either 2, 3, or 4 units) and living in one unit while renting out the others. House hacking appealed to me because it would lower my living expenses, while creating equity at the same time. This would allow me to save more money in order to pay off my student loans quicker. I will go over my personal journey of how I purchased my duplex and dramatically lowered my monthly expenses.

I downloaded several real estate apps on my smart phone (such as Zillow, Trulia, Realtor, and Redfin) and changed my search criteria to “multi-family” properties inside a specific mile radius where my girlfriend and I wanted to live. You can be as specific as you want with the various filters including the number of bedrooms, number of bathrooms, square footage, etc., but I really just wanted to see what was out there.

After a few months of filtering and searching, I ended up looking at five different properties – two of which I made offers on only to be outbid by someone else.

A couple weeks later, I got a notification that a two-unit, two bedrooms/one bathroom duplex just came on the market, which fit the criteria we were looking for. I called my real estate agent that day to tour the property as soon as possible. After the showing, I made an offer that was accepted the same that night! I was overwhelmed with emotion. Excited that my offer had been accepted, but also fearful at the same time. Did I do all my calculations correctly? Was I making a mistake? What if the roof leaks a month after moving in?

The property was listed for $270,000. I was using an FHA loan, a loan that is used often for first-time homebuyers, that allows for a 3.5% down payment (versus 20 for a conventional loan). After closing costs, inspection costs, and appraisal, I needed just under $13,000 to make it to closing.

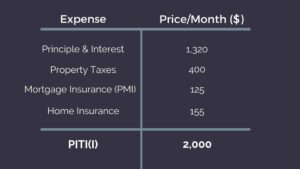

Here is where the fun began. At $270,000 with a 3.5% down payment, the loan balance was $260,550. I financed this property on a 30-year mortgage at 4.5%. That means my monthly mortgage payment would be $1,320.17. Considering each unit in the property I was buying was a 2 bed/1 bath unit and the average rent in the same area was $1,600/month, this seemed like a no brainer.

The other expense that needed to be factored in was property taxes. You can find information on property taxes for a home you are thinking about purchasing on the county auditor’s website. My property taxes are high and equate to an extra $400 each month. The lender I used put my property taxes, home insurance, and private mortgage insurance (PMI) in an escrow account. This just means that the lender will pay my principle and interest, property taxes, and insurance for me in one monthly statement instead of billing me separately. Add this all up and my monthly bill is now $2,000/month. *

*Because of the low down payment option, lenders (banks) require private mortgage insurance (PMI) on properties. If a conventional loan is used (20% down), then you would not have this expense and the total per month would then be $1,875/month and would also be abbreviated PITI vs the PITI(I) that I have listed. You can also re-finance out of this at a later date once you have at least 20% equity in your property. FHA loans require that you live in the property for at least one year before refinancing.

Multi-family properties (2-4 units) are treated like single family homes in regard to lending and tax purposes. When a property has 5+ units, then the lender (bank) looks at the property more like a business.

As mentioned above, I should be able to rent out the unit I’m not living in for $1,600/month. I advertised this unit on Craigslist and Facebook Marketplace and I had renters sign for $2,000/month just two days after posting. This covers the cost of utilities which is not separated for my specific duplex. I am now living in a nice area for free!

I can take the money I’m saving (by not having a housing payment) and apply it towards other expenses, whether that be a car payment, student loans, credit card debt, or something else. Additionally, when someone pays rent, that money is going into someone else’s pocket. With house hacking, the money is at least going towards equity into the property that you own via paying down the mortgage. There are additional tax benefits to owning real estate as well, but that is beyond the scope of this blog post.

Personally, I have transitioned from a Dave Ramsey philosophy to more of a Robert Kiyosaki philosophy. With that being said, following the Dave Ramsey approach while in pharmacy school and during my first year post-pharmacy school put me in a better position to make myself more lendable. Banks look at certain key metrics (such as debt-to-income ratio, loan-to-value ratio, other assets, credit score, etc.) to see if you qualify for a home loan.

For more information regarding house hacking, take a listen to Episode 130 of the Your Financial Pharmacist featuring Craig Curelop, the Finance Guy at BiggerPockets and author of The House Hacking Strategy.

If you have further questions, please don’t hesitate to reach out to [email protected].

NMLS ID: 1681276

320 Blackwell Street

Suite 200

Durham, NC 27701

Current Student Loan Refinance Offers

[wptb id="15454" not found ]

Join the YFP Community!

Recent Posts

[pt_view id=”f651872qnv”]