The following post contains affiliate links through which Your Financial Pharmacist may receive compensation.

Updated 1/3/22

9 Financial Questions Pharmacists Need to Answer During the COVID-19 Pandemic

COVID-19 has had such a significant impact on the U.S. economy that an unprecedented $2 trillion stimulus package known as the Coronavirus Aid, Relief, and Economic Security or CARES Act was recently passed. From stimulus checks, suspended student loan payments, and the ability to tap into retirement accounts, it’s important to know how these changes can not only help you through a difficult time but also be advantageous even if your income hasn’t been affected.

In addition to the CARES Act, the Internal Revenue Service’s decision to extend the tax filing date presents some unique opportunities as well.

The following are some key questions you should be answering right now in the midst of the pandemic and with the recent federal legislative changes.

1. Do you have an adequate emergency fund?

If you suddenly lost your job and had no income, how many days could you survive financially? If you’re like many Americans, the answer is probably something like “not long.” According to a survey from Bankrate, only 40% of people would be able to cover an unexpected $1,000 emergency with savings.

During this pandemic, where many have suddenly found themselves without an income, it has unfortunately illuminated the above statistic as many are already turning to credit cards and even dipping into retirement accounts in order to keep their households running.

Although the textbook answer is to have 3-6 months of living expenses saved in an account that is liquid and is fairly easily accessible, should that still apply during this time? The answer is, it depends. How stable is your job? Does your household have multiple income streams? How much do you need to sleep well at night? Find an amount you are comfortable with and one that allows you to reduce your dependency on credit cards, loans, or other non-preferred options to bail you out.

If you are still employed but will likely lose your job soon then now is a great time to increase your emergency fund.

High yield savings accounts and money market accounts are great options to house your savings as they are not only safe but they offer an interest rate that’s usually significantly higher than a regular checking or savings account. I recently opened a money market account with CIT Bank that currently has a rate of 1.75%. You can check out my review about CIT Bank here.

2. What’s your game plan if your income drops?

One of my best friends is a dentist for a decent-sized office in a small midwest town. He has seen tremendous growth in the business since he started working there 6 years ago which has afforded him with an incredible salary in addition to monthly bonus checks. With always having a full schedule and a seemingly endless number of cases, it really came as a shock when he was told by the partners of the office that he wouldn’t be getting paid for at least the next two weeks and should apply for unemployment.

Millions of Americans across multiple sectors have lost their jobs or have been furloughed secondary to the outbreak of COVID-19. As stay-at-home orders in states and municipalities increase resulting in the closure of many non-essential businesses, the unemployment rate continues to climb and has been estimated to reach 32%.

While pharmacists have proven to be one of the most important and essential workers during this time (and even in higher demand currently as evidenced by CVS giving out raises and hiring thousands of employees), that, unfortunately, hasn’t been the case for everyone in the profession.

A number of pharmacists who work for hospital systems have had their hours cut or have been encouraged to take leave due to a low census or a suspension in elective surgeries and procedures that have been put on hold.

So what should you do if you already have had or anticipate a job loss or reduction in income?

First off, don’t panic!

It may only be a temporary situation and you could be right back to work as demand changes.

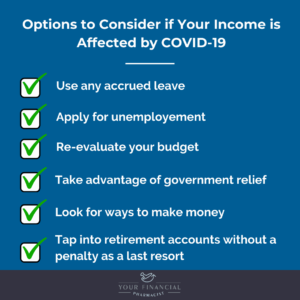

But if it turns out to be an extended or more permanent income hit, there are definitely options to help remedy the situation. This is obviously where having an emergency fund is critical but even if you don’t have a ton of cash saved or already have burned through it, consider these:

Explore employer benefits

Depending on your specific situation, you may be able to use your accrued leave to counteract any disruption in paychecks. Obviously, this would be a temporary solution but could be one of the easiest ways to ensure immediate cash flow.

Beyond that, if you are furloughed or laid off you may be eligible for unemployment benefits. While each state sets its own eligibility guidelines, some of the core requirements include being separated from your job through no fault of your own and you may have to meet a specific wage and time worked.

As of February of this year, the average unemployment check was $372/week according to the Bureau of Labor Statistics. You can check out your state’s requirements here. Under the CARES Act, self-employed, 1099 aka gig employees, and workers with a limited work history are also eligible for unemployment at this time. Beyond expanding eligibility, the act also increases the state’s benefit by $600/week (through July 31st, 2020) and there is an extension of 13 weeks of benefits.

The waiting period to receive benefits varies among states but is usually around one week. Many states are waiving this because of the current situation.

Re-evaluate your budget

What could you cut if you find yourself in a tough financial situation? Desperate times will force you to take a hard look at your spending and figure out what you can live without. Dave Ramsey frequently discusses something called the Four Walls whenever someone is having trouble paying the bills and trying to get by. They are food, utilities, shelter, and transportation. These are essentially the bare necessities you need to focus on first to protect yourself and your family.

If you have credit card debt, a car loan, or other non-government-backed loans that you are having difficulty paying, you should reach out to the servicer to see what your options are.

Many of the major car insurance companies such as Progressive, State Farm, Allstate, Geico, and others are offering a credit, discount, or payback during this time which could help with managing monthly bills. If you have already paid in full for several months you may actually be getting a credit.

Take advantage of government relief programs

While many landmark legislative moves were implemented through the CARES Act, one of the most unprecedented is the dissemination of economic impact payments aka “stimulus checks.” These checks will be automatically directly deposited into your checking account (assuming you have received direct deposit previously) linked to your most recent tax return sent out soon in amounts up to $1,200 with an additional $500 payments per qualifying child (<17 years old). You may experience a delay if you don’t have direct deposit set up and are expecting a paper check.

However, the rebates begin phasing out at an adjusted gross income of $75,000 for those filing as single and $150,000 for those married filing jointly, which will, unfortunately, exclude many pharmacists. This is based on your most recent tax return. You can check out this calculator to see how much if any you are eligible for.

There’s also a proposal for a COVID-19 HEROES Fund which would give essential workers premium or “hazard pay” of up to $25,000 and a $15,000 essential worker recruitment incentive to attract and secure needed workers. This is intended to be included in any future stimulus package. This could unlock some potential opportunities if passed.

If you own a home, your mortgage is likely one of your biggest monthly expenses. As a result of COVID-19, the Federal Housing Finance Agency has implemented relief in the form of forbearance for up to 12 months for loans owned by Fannie Mae or Freddie Mac, as well as the Federal Housing Administration (FHA).

You can reduce or suspend your payments for this time without any fees or penalties. However, you will have to pay back any missed payments at the end of the forbearance plan. This applies to owner-occupied properties in addition to investment properties. You can check more information on mortgage forbearance here. Even if your loan isn’t backed by one of the Enterprises, there are other private lenders who are currently offering relief as well.

If you currently rent and are going to struggle to make your payments, check with the landlord to see what options are available. Many states have issued a moratorium halting evictions temporarily. For more information, check out this Investopedia post: Renters: How to Get COVID-19 Rent Relief.

Tap into your retirement accounts as a last resort

You have probably been told to never take out money early from a retirement account because of penalties, taxes, and the fact that it stunts your opportunity for compound interest. While in most scenarios this general advice makes sense, when you are in an emergency, are desperate to pay your bills and have to make sure you are providing for your family, it could be an option. If you have non-retirement investment accounts you can liquidate, this could be obviously be considered as well.

Another provision under the CARES Act is that you can tap into a combination of employer-sponsored plans (401k, 403b, TSP) and IRAs up to $100,000 anytime in 2020 without paying the usual 10% penalty (if not yet 59 1/2) if you have been impacted by COVID-19. In addition, for IRA withdrawals you will have up to three years to pay any taxes incurred unless you are withdrawing Roth IRA contributions you previously made which wouldn’t have any tax consequences.

There’s also an option to put the money back over a three-year period.

For 401(k)s, you can borrow 100% of your vested balance up to $100,000 (up from $50,000) by September 27th (180 days within the signing of CARES act). Typically, you get five years to pay back a 401(k) loan before it gets treated as a distribution and becomes taxed. If you already have a 401(k) that you were supposed to finish repaying by December 31st, there’s a provision in the CARES Act that gives you an extra year to pay it back.

While not traditionally considered a “retirement account” but can be utilized in that way, a Health Savings Account (HSA) could be another option if you are in need of cash. If you have incurred health expenses that you have not reimbursed yourself for (even if the expenses occurred years prior) while the account was in place, you could make tax and penalty-free withdrawals.

Additionally, if you are at least age 62, you could opt to start collecting your social security benefits. However, this move will greatly lower your overall total realized benefit since delaying until full retirement age results in greater monthly payments.

Look for other positions and ways to make money as a pharmacist

If your change in income is not likely going to be temporary, figuring out how to get your cash flow back on track is the most important move you can make. Many of the other options are simply bandaids and will not be great long-term solutions. You obviously have the option of searching for another traditional pharmacist position and there could be a huge demand in certain areas depending on the trajectory of the pandemic.

Recently, joint policy recommendations by all of the major pharmacy organizations entitled Pharmacists as Front-Line Responders for COVID-19 Patient Care were released to combat the pandemic which could help open up more job opportunities. The recommendations include authorizing pharmacists to test for COVID-19, flu, strep, and others and initiate treatment and expand current state immunization laws to include all FDA-approved vaccines in addition to the forthcoming COVID-19 vaccine.

They also recommend allowing pharmacists with a valid license to operate across state lines, especially through telehealth. Other recommendations include being able to make therapeutic substitutions as drug shortages arise without a physician or other provider authorization.

Beyond working in the community as a front-line responder, there are a number of ways to earn income. One good potential option, especially during the pandemic, is to remotely complete comprehensive medication reviews (CMRs) through a platform such as Aspen RxHealth. Aspen RxHealth is a company with an app-based platform that connects pharmacists with patients on Medicare plans who are eligible for a Comprehensive Medication Review (CMR).

What’s cool about their technology is you call the patient directly from the app and then perform all of the necessary functions of the CMR directly within the app. There’s no paperwork and once complete, the patient gets a copy of the review and any recommendations you have.

They currently pay $40/CMR and then typically throw in bonuses and incentives to complete a certain amount within a week or on particular days. You also get to work on your own schedule as long as it’s within their recommended time frame of operation.

According to their FAQs, they accept pharmacists for specific states and geographical areas that are in need but they do not specifically mention where the current needs are.

Master meme generator, pharmacist, and host of RxRadio Richard Waithe recently discussed on Instagram (@richardwaithe) how most people have at least $1,000 worth of stuff in their home and shares some key tips on how to get started selling on eBay and other platforms.

If you want other ideas, check out this post 19 Ways to Make Extra Money as a Pharmacist in 2020. You can also check out the YFP podcast as we frequently have pharmacists on the show who talk about the side hustles they started and have grown.

3. Do you need to change your investment strategy?

You probably haven’t been able to avoid seeing something related to the stock market tanking with headlines of “largest single-day point drop” or “worst quarter ever.” It’s true that we are seeing some of the biggest changes in the past decade.

On March 11, 2020, secondary to COVID-19, the Dow Jones Industrial Average entered a bear market for the first time in 11 years with the S&P 500 and NASDAQ entering the same territory the next day. If you looked at your retirement and other investment accounts that primarily housed equities, they are likely a lot less than what you remember seeing earlier in the year.

While there’s certainly a lot of fear and panic causing people to break open the glass and pull their investments off the shelf, this isn’t the first time this has happened. In fact, between 1926 and 2017 there have eight bear markets ranging in length from six months to 2.8 years. A bear market is when there is a decline of 20% or more in one of the major stock indices from its peak whereas a correction is a decline of 10%.

So how should this change your investment strategy?

If you have many working years left with time to be in the market, it may not really change anything. While the knee jerk reaction may be to bail and stop making investment contributions based on what everyone else is doing, staying the course could be your best move. But remember, the stock market will rise and fall. Over any 20 year period, the S&P 500 has always posted a positive return.

In addition, numerous studies have shown that beyond a select few, most people cannot consistently time the market and that’s where dollar-cost averaging can be key. The basic concept is that regardless of what’s currently happening in the market you contribute the same amount of money every month toward your asset allocation. By doing this, you will buy more shares when the market is down and fewer shares when the market is up.

So even if you haven’t started investing yet but have been meaning to, don’t let the current situation prevent you from getting started.

If you need help building your portfolio and putting together a solid investment strategy, you can book a free call with YFP Director of Business Development, Justin Woods, PharmD.

4. Do you need to update your estate plan or get one in place?

There’s no way to tiptoe around the current situation. We are in a pandemic and people are dying. Most deaths have occurred in those who are middle-aged or elderly and have underlying health conditions. However, there are also a number of cases of healthy 20-30-year-olds now being reported who have died.

Whether you are someone on the front line directly caring for those with COVID-19 or you’re practicing in a lower-risk environment, now is a good time to consider getting an estate plan in place.

I know that this is probably one of the last things on your financial to-do list but it’s something you don’t want to overlook. Having a will in place will ensure your property goes to whoever you decide, give you the ability to name an executor who will enforce your will, and name a guardian for your children if this applies. If you die without a will, this will be decided by probate court according to your state’s laws and regulations.

Along with a will, you want to have a living will which is also called a health care declaration or an advanced directive. This outlines how you would receive medical care and who you want to make decisions in the event that you are incapacitated. Depending on how complex your estate is, you may want to hire an attorney to help. Some employers offer this as part of your benefits package. You can also check out Thoughtful Wills, which is a law firm that specializes in estate planning available in multiple states and is endorsed by our financial planning team.

5. Are your life and disability insurance policies adequate?

Similar to estate planning, life and disability insurance are typically pretty low on the financial priority list. However, the reality is that if people are dependent on your income and you couldn’t financially survive if you become disabled, these are critical pieces of your financial plan. And they may be more important than ever if you are someone who is at high risk of being exposed to the virus.

Not everyone needs life insurance, but, if you have a family that depends on your income or someone would be responsible for your debt if you pass, you should have a policy in place. Even if you have a policy with your current employer, you may want to consider getting a private policy as well. Workplace policies are generally not portable and the death benefit may not be enough to cover your needs.

There are generally two major types of life insurance: term life insurance and permanent. Term is the way to go for most pharmacists because it’s less expensive and not flooded with fees.

The amount of coverage required will depend on your needs including existing debt, income support, and future expenses. Future expenses include things like funeral costs, childcare, and college tuition. Check out Episode 45 of the YFP podcast for more information on figuring out your life insurance needs. You can get a free quote in two minutes through PolicyGenius.

You put in a lot of time, energy, and effort to be able to become a pharmacist and make a good income. That’s why it’s so important to protect it. Disability insurance for pharmacists is really income insurance. It provides you with money in the event that you become disabled and are unable to work. Personally, I have known pharmacists that have been unfortunately out of work for months to years because of head trauma and autoimmune diseases.

What would happen if you were suddenly unable to work because of an accident or illness? How would you support yourself or your family?

Compared to other types of insurance, long-term disability insurance for pharmacists can be more expensive depending on your health status and coverage options. But can you afford not to have it? You may have a policy through your employer but many times they are not as robust a private policy and may not offer own-occupation coverage.

You can check out The Ultimate Guide to Disability Insurance for more information on things to look for in a policy and how to navigate all of the riders and other features.

6. How does the situation affect your student loan strategy?

The student loan changes within the CARES Act can have a big impact on how pharmacists pay back their debt. While the legislature may not change your overall strategy it can temporarily affect some key decisions.

Here are the key provisions:

1. Payments for qualifying federal loans were originally suspended until September 30th, 2020 due to the CARES Act. However, per an executive order, this date has been extended to December 31, 2022. This suspension of payments should be done automatically by your servicer without having to make any requests. Qualifying loans include:

- Direct Federal Loans (Direct Subsidized, Direct Unsubsidized, Direct Consolidation Loans)

- Federal Family Education Loans (FFEL) and Perkins Loans owned by the Department of Education

2. FFEL and Perkins loans not owned by the Department of Education, Health Professions Loans, and private loans do not qualify.

3. No interest will accrue during this time.

4. All $0 payments made during these months in administrative forbearance will “count” toward the Public Service Loan Forgiveness (PSLF) program and those seeking forgiveness after 20-25 years through an income-driven payment plan.

5. Any wage garnishments or seizure of tax refunds for delinquent student loans will cease during the six-month period.

6. Employers can offer up to $5,250 to repay an employee’s student loan balance without counting as realized income. (If only this was mandatory, right?)

One important note on the suspension of payments is that your specific servicer may not have updated their system yet to reflect the change. Therefore, if you happen to make any payments starting March 13th prior to the update, these could be refunded through your servicer.

How these changes will affect you will depend mostly on whether you have loans that qualify for this temporary relief, what your overall strategy is, and also whether your income has been affected. Let’s look at considerations through the lens of your strategy.

PSLF

If you have already started the process for PSLF or plan to within this time frame then you basically get a few months of “free payments”. Remember, even though this is considered an administrative forbearance, these $0 amounts owed for the upcoming months still count toward your 120 payments. And since your overall goal is to pay the least amount of money you are legally obligated to, you should not try to manually make payments or pay your usual amount when you don’t have to. Be sure to keep good records as you want to make sure you get the credit.

Non-PSLF Forgiveness

You can get forgiveness if you make income-driven repayments over 20-25 years depending on your specific repayment plan regardless of your employer. However, unlike PSLF you do have to pay income taxes on any amount forgiven. Generally, this is a good strategy if you are not eligible for PSLF and have a very high debt to income ratio such as 2:1 or greater.

Similar to PSLF, these $0 payment months count toward the overall 240-300 payments you are required to make. While you could still make payments during this time which would lower your eventual “tax bomb”, you’re likely going to be better off putting your money in other investments or even a high yield savings account especially since whatever the estimated tax you determine today in 20-25 years will be in the context of future value.

Traditional contributions to your employer-sponsored plan (401k, 403b, TSP) and HSA contributions will lower your adjusted gross income which in turn will lower your income-driven student loan payments.

Non-Forgiveness

If you aren’t planning on going the forgiveness route, you generally have two options: pay off your loans through the federal loan system using any of the repayment plans and accelerate payoff depending on your situation or refinance to a private lender. While in general private lenders for the past several years have offered much better rates than those for federal loans you used for pharmacy school, they do not currently offer the same COVID-19 relief options.

Therefore, if you have direct federal student loans and were planning to refinance, you should probably hold off for now. While the 0% interest rate through May 1, 2022, is temporary for the time being, you are not going to get a 0% interest rate if you refinance. Once the time’s up for the administrative forbearance and assuming you are able to get lower rates, then make the move to refinance.

The other big question if you are in this camp is: Should you make payments even though you don’t have to?

Since no interest is accruing during this timeframe, any payments you do make will attack the principal and potentially accelerate your overall payoff date, that is once you’ve paid off any outstanding interest that accrued prior to March 13, 2020.

While making payments despite the forbearance is certainly not a bad option especially if you have had no changes to your income and you want to pay off your student loans ASAP, think about what else you could do with that money instead. Yes, buying a Kate Spade handbag is an option, but I was thinking something along the lines of eradicating credit card or any other high-interest outstanding debt, starting or building an emergency fund or even funding an IRA or another investment.

If you want more information on this, you can check out the Coronavirus and Forbearance Info for Students, Borrowers, and Parents section on the Federal StudentAid website.

What if your loans don’t qualify for suspension under the CARES Act?

For FFEL loans or other federal loans that don’t qualify, you may be able to do a Direct Consolidation Loan which could convert them to become eligible. However, you would have to consider the impact on the interest rate and any capitalized interest that may follow.

If you have private or refinanced loans or loans that don’t qualify, then nothing may change for you. If you, unfortunately, had a job loss or change in your income, you can reach out to your specific lender to see what options are available. Some may offer a temporary forbearance or the option for a reduction in payment.

If you are someone who has refinanced your loans and you have had no change to your income, then you should continue to shop for competitive rates. You’re not limited to refinancing one time and it’s not uncommon for another company to provide a better rate than what you refinanced to the first time. You can check out current rates and cash bonus opportunities through our partners below.

[wptb id="15454" not found ]7. Should You Put Big Purchases on Hold?

In early March, my wife and I were in the initial phase of making an offer on a home as this was our next big financial goal after paying off our student loans. After a few rounds of negotiations, things with COVID-19 started to get worse and because there was uncertainty if our income would be affected at first, we ultimately decided to back out of the deal. Plus, we thought it would have been pretty stressful trying to move.

While the conservative approach would be to hold off buying homes, vehicles, investment properties, etc. until there is a more positive outlook and stash away cash instead, there may be opportunities to find deals during this time. For example, if your income has not been affected and seems pretty stable, you may have some pretty solid negotiating power trying to buy a home right now. This negotiating power isn’t just on the purchase price but also things like getting closing costs covered, getting a longer inspection period with the option to bail, and choosing an extended closing date.

The decision to hold off on big purchases really comes down to how comfortable you are with your current financial situation with regards to savings and also expected income.

8. How will the tax and retirement changes affect you?

On March 20, 2020, the IRS extended the deadline to file federal income taxes to July 15th, 2020 without any penalty with the ability to request an extension even beyond that. If you haven’t filed yet and are expecting a refund, then waiting may not be the best move if you are in need of cash right now. However, if you are expected to owe, then you get a few more months to save for the bill. Although most states that collect income tax have followed suit with the IRS extended filing date, you should check to check to confirm.

The deadline extension also gives you the opportunity to fund an IRA for 2019 until July 15th with the maximum contribution of $6,000 or $7,000 if you are 50 or older. Similarly, you have the ability to contribute to an HSA for 2019 with a max contribution of $3,500 if single or $7,000 if married. Remember, unlike a traditional IRA with income limits to get a tax deduction, contributions to an HSA will directly lower your AGI no matter what your income is. To contribute, you must have a high deductible health plan. A high deductible health plan can be a great option especially if you’re relatively healthy and rarely use health insurance as your premiums will generally be lower than traditional plans.

While the above considerations could persuade you to hold off on filing taxes right now, the other question that is coming up frequently is “How does this affect eligibility for the economic payments?” Since the IRS is currently in the process of directly depositing/mailing payments, they are determining eligibility and amount based on the most up to date tax filing. That means if you have yet to file for 2019, they will be basing eligibility on 2018 income.

For many pharmacists, this may not matter if income hasn’t changed drastically in the past two years, but those in transition years (such as student to new graduate, resident/fellow to new practitioner) may benefit from delaying filing if it means that you would get a larger payout. Full disclosure, this is totally a legal maneuver.

Another key provision of the CARES Act with regards to IRAs, is that Required Minimum Distributions (RMDs) are not required in 2020. So if you turned 70 1/2 before January 1, 2020, you are not required to take a distribution.

The CARES Act also added a new amendment to the Internal Revenue Code allowing taxpayers who do not itemize to deduct up to $300 for contributions made to a public charity and not a supporting organization or donor-advised fund. While this is not a huge amount, prior to this many people were not able to get any deduction and most people now take the standard deduction.

Something to keep on your radar is a bill called the Helping Emergency Responders Overcome Emergency Situations or HEROES Act 2020 introduced by Congressman Bill Huizenga that provides a four-month (with potential three-month extension) federal tax holiday for medical professionals that are providing care in counties that have at least one COVID-19 case. Originally, this did not include pharmacists so kudos to the legislative team at APhA for making it happen.

9. Do you need a coach or financial professional to help you during this time?

Managing all the aspects of a financial plan can be overwhelming by itself but with everything going on things can get even more complicated. That’s where having a good financial planner on your team can come in.

Having a good financial planner on your team can help coach you through uncertain financial times and give you some clarity and confidence when making important decisions.

While there are many types of financial planners and advisors out there, consider a Certified Financial Planner (CFP®). They have the most rigorous education requirements including thousands of hours of experience. Be sure they do comprehensive financial planning and not just investment management (unless that’s all your interested in). If you are interested in having a conversation with one of our certified financial planners, you can set up a free call to see if you would be a good fit.

Conclusion

The recent federal legislative changes enacted in response to COVID-19 will have a direct financial impact on millions of people. Most pharmacists have been able to keep employment and in some settings, particularly in the community, the demand has increased. Pharmacists, especially most who haven’t seen their income impacted, stand to benefit from the temporary student loan payment suspension without interest accrual, the extension to file taxes with the option to maximize 2019 IRA and HSA contributions, and potentially receive a federal tax holiday if the HEROES Act passes. There also may be additional financial incentives for those considered essential.

In addition, it is an important time to evaluate if liquid savings is sufficient in an emergency fund, whether your life and disability policies are sufficient, and determine if your estate plan is up-to-date and in place. Also, consider working with a certified financial planner to help you put a plan together and coach you through important financial decisions.