The following post was written by Deeb Eid, PharmD. Deeb is a 2016 graduate of The University of Toledo College of Pharmacy and Pharmaceutical Sciences. He recently completed an Executive Residency at the Pharmacy Technician Certification Board (PTCB) in Washington, D.C. and is transitioning to Ferris State College of Pharmacy as Assistant Professor/Experiential Coordinator in July 2017. Dr. Eid’s vision of social and interactive education for all audiences about the profession of pharmacy has led to an ongoing startup development of Facebook, Twitter, and YouTube pages branded as Pharmacy Universe (Feel free to Follow/Like, but still under construction). For any questions, please contact him at [email protected].

Tim Ulbrich (Your Financial Pharmacist) and Deeb Eid have no financial tie to either one of the applications mentioned in this article.

From Your Financial Pharmacist (YFP): There are lots of apps out there that can help you automate your savings goals and invest your money (such as the ones noted below in this article). While automation is a great idea to help you achieve your goals, don’t forget about (1) appropriately balancing investing with your other goals (e.g., debt repayment, saving for an emergency, etc.) and (2) maximizing the use of tax-advantage retirement accounts (e.g., 401k, 403b, Roth IRA).

When smartphones were first introduced, I recall being fascinated with many mobile applications and the usefulness in daily activities. While some were very practical and useful (eBay®, Gmail™), others were simply entertaining and handy for those long car rides (Paper Toss, Temple Run). I found myself excited to learn about applications that made everyday life tasks more efficient. It was even more refreshing to refer friends to certain apps, if it felt like the “right fit” for their scenario. Somewhere along the way came bank accounts, personal finances, budgeting, and many other financial responsibilities that we all deal with each day.

During pharmacy school, I observed that many of my classmates, colleagues, and personal friends loved using their smartphones, but were often unfamiliar with many of the great personal finance mobile applications available. After reflecting, two common areas I’ve identified that we as pharmacy professionals commonly ask about or struggle with include saving and investing. The following mobile applications are both easy to use and provide alternative tools to utilize. They will help to address some of these commonly asked about areas and hopefully make your financial success that much easier!

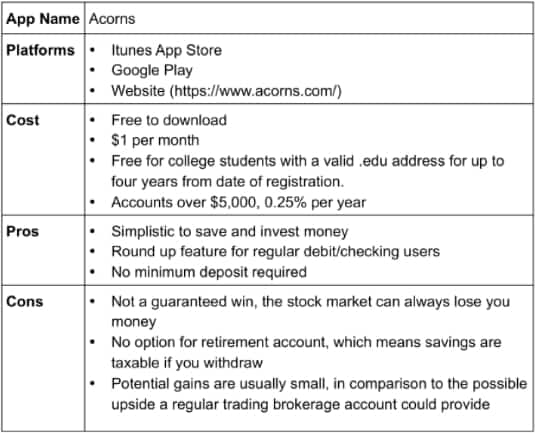

Acorns

Acorns is a seemingly effortless tool to help with saving as well as investing your money. On initial setup, you’ll be asked to connect to a checking account and a series of questions (since you are setting up an investment account, this is the usual). Don’t worry, Acorns encrypts and protects all of your data with bank level security. One of the main concepts within this app is to round up each purchase you make with the linked debit card/checking account. For example, say you go to get a cup of coffee and the total is $3.50. Swipe or pay with debit or the linked checking account and you will get charged $4 to your account, but $0.50 of that that will go into your Acorns account and be saved/invested. Some will find it necessary to turn this feature to “manual” which allows you to only round up those purchases if you choose to within the app.

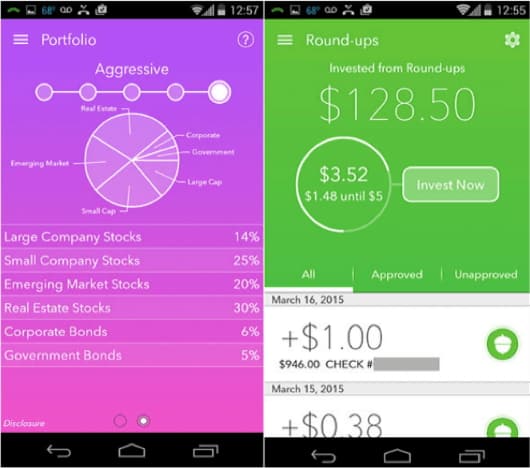

My personal favorite feature is recurring investments. This allows the ability to schedule a daily, weekly, or monthly investment from your checking account into your Acorns account. You would be surprised how quickly saving and investing $10 every Friday could add up! Acorns also simplifies investing. It allows you to pick an approach (1 of 6 available) to your portfolio with how you’d like to invest (from Conservative to Aggressive) (Figure 1). In addition, you can view the projection charts for each portfolio approach to gauge the predictions of how much money you can potentially save/earn based on the amount you put in over a period of time. If you are interested in exactly where your money is invested, Acorns also breaks down the percentages, funds, and sectors in simple and colorful fashion. Overall, Acorns provides a simplistic and easy way to start investing and saving, without all of the complicated financial terminology!

Figure 1

Robinhood

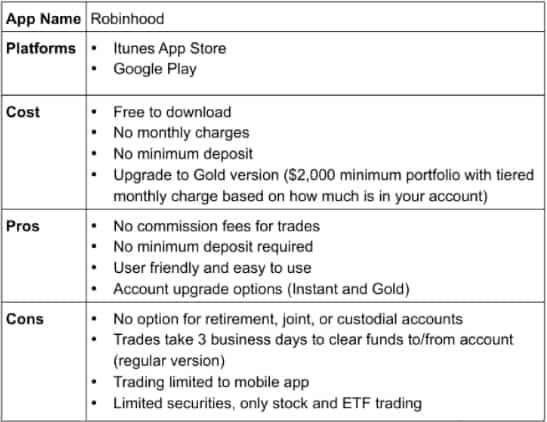

Finally, a stock brokerage that does not charge those pesky commission fees on every trade! For those of you looking to invest your money or who already do and are looking for an alternative broker, this app is worth checking out. Contrary to most other brokers (Schwab, Scottrade, E*Trade..etc.) Robinhood does not require a minimum deposit to get started, but does need your bank account to be linked for transferring money. The interface of the app itself is clean, colorful, and easy to navigate.

Additionally, Robinhood has two upgrade options (Instant and Gold) that have some friendly features for more experienced investors, including the recent addition of margin accounts. The app itself does not feature many of the extras you will find with other brokers (such as in-depth data or news) but serves more as a platform to trade instead.

When you click on a specific stock or EFT, you will find some basic statistical information, a trend chart, and a short informational piece on the company (Figure 2). You are not able to transfer funds from another brokerage account into Robinhood, but can transfer them out for a $75 transfer charge. In addition, with the regular account, funds from transfers and trades take around three days to process, which can be limiting. Robinhood Instant has included a feature to eliminate this waiting period, but you might have to be placed on a waiting list to be upgraded.

Figure 2

Overall, Robinhood is a simple way to get started with investing or an option for more experienced investors, looking to for an alternative platform with no commission or account minimum. I’d recommend giving it a shot!

Join the YFP Community!

Recent Posts

[pt_view id=”f651872qnv”]