If you’re like most pharmacists, student loans will be your biggest expense aside from a mortgage, and a major barrier to achieving financial freedom.

Other than some of the forgiveness and tuition repayment/reimbursement programs available, dying, or becoming permanently disabled, you’re pretty much stuck paying them off.

If your goal is to pay off your loans as fast as possible, you essentially can do one of two things to accelerate the payoff: increase your income and/or decrease your expenses to make bigger payments.

While these strategies are powerful and arguably most important, there’s another tactic that can help: refinancing

When you refinance your student loans, you change the terms of the loan which could be the interest rate, type of interest rate, time to repay, or a combination of those.

While refinancing can be a good move, it’s not for everyone. If you’re pursuing or plan to pursue the Public Service Loan Forgiveness (PSLF) program you will automatically lose your eligibility if you refinance.

Also, if you need an income based repayment plan, can’t get a lower interest rate, or can’t make big monthly payments based on the new terms, then refinancing probably isn’t the best move right now.

However, if that doesn’t apply and you’re thinking about refinancing, here are the top reasons why you should.

Big Potential Savings

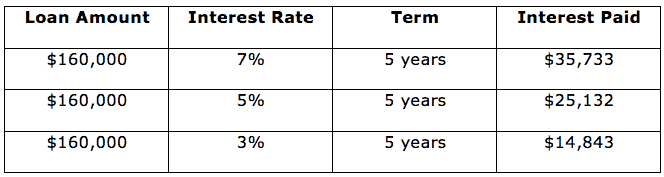

Pharmacy graduates are now facing an average student loan debt of $160,000.

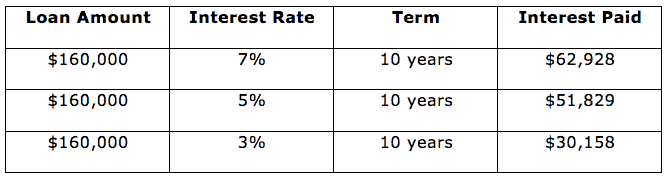

If that’s paid back over a 10 year period with a typical federal interest rate of 7%, the amount paid in interest would be $62,928. Ouch!

Let’s look at what the savings would be if the loan was refinanced to a 3% or 5% interest rate and the loan is paid back over 10 years.

Refinancing to a 5% rate results in a $11,000 savings but a 3% rate results in over $30,000 in savings!

What if you want to be aggressive and knock out the loan in 5 years.

You can see the savings between interest rates isn’t as big the faster you pay off the loans but it’s still pretty substantial and the overall interest paid is significantly less than the total over 10 years.

If you want to calculate your potential savings with a new interest rate and time to payoff, you can check out our free student loan refinancing calculator.

Catalyze Your Payoff

When I refinanced my student loans a couple years ago my minimum payment went from about $1,000/month to $2,700/month. While some people refinance their loans to lower their monthly payment, I almost tripled mine.

In order to get the best interest rate, I had to refinance to a 5 year term resulting in that big monthly payment. However, that wasn’t the only reason for this move.

I wanted to get rid of my loans as fast as possible and wanted to eliminate one of the biggest barriers to my progress: myself.

When my monthly payments were $1,000, I had some disposable income in my budget and could have paid extra on the loans. But do you think I did that each and every month? Of course not. I spent it!

Being forced to make $2,700 monthly payments on auto-draft minimized the opportunity to spend money on things that were not consistent with my big financial goals. Refinancing jump started my payoff and forced me to be intentional.

If you’ve been making monthly payments through one of the income-based or extended plans you may have no trouble making your minimum monthly student loan payment but you also may not be making much progress. Refinancing can help you get focused and serious about paying off your loans.

Cash Bonus

Beyond the savings in interest you can get from refinancing, many companies also offer a cash bonus just for being a new customer. Obviously, they make money off you from the interest you pay over time but it’s a great perk and better than paying a fee for the service.

We have partnered with some reputable refinancing companies that offer great cash bonuses. Full disclosure here. We get a small amount when you refinance using one of our links but we have negotiated to make sure most of the bonus goes to you.

You can see the offers below or on our refinance page. Checking your rate does not affect your credit and takes just a few minutes. I would recommend checking them all to see the best rate you can get.

Even if you refinanced in the past, you can do it again, and could be a good move if you can get a better rate.

[vc_custom_heading text=”Check out these companies to find the best interest rate. ” font_container=”tag:p|font_size:28|text_align:center|color:%23343341″ google_fonts=”font_family:Montserrat%3Aregular%2C700|font_style:700%20bold%20regular%3A700%3Anormal”][mk_custom_list margin_bottom=”10″ align=”center”][/mk_custom_list][vc_custom_heading text=”If you refinance student loans using one of the links below we’ll both get a bonus. We take just a small amount to make sure you get the highest bonus possible. Checking your rate will not impact your credit score. ” font_container=”tag:p|font_size:21|text_align:center|color:%23343341″ google_fonts=”font_family:Montserrat%3Aregular%2C700|font_style:700%20bold%20regular%3A700%3Anormal”][mk_padding_divider size=”25″][vc_separator color=”custom” border_width=”6″ el_width=”10″ accent_color=”#343341″][mk_padding_divider size=”25″]

Credible Disclosure: To check the rates and terms you qualify for, Credible or our partner lender(s) conduct a soft credit pull that will not affect your credit score. However, when you apply for credit, your full credit report from one or more consumer reporting agencies will be requested, which is considered a hard credit pull and will affect your credit.

Current Student Loan Refinance Offers

[wptb id="15454" not found ]

Join the YFP Community!

Recent Posts

[pt_view id=”f651872qnv”]

0 thoughts on “The Top 3 Reasons Why Pharmacists Should Refinance Their Student Loans”

Can you refinance loans you have already consolidated?

Hey Jeremy! Yes you can refinance if you have consolidated or refinanced previously. I have done this myself actually. I refinanced my federal loans to Sofi and then a couple years later I was able to get a better interest rate with Commonbond and refinanced again. If you consolidated loans through the federal system to qualify for PSLF, then you would not want to refinance to lose eligibility.