How To Prepare Financially When Expecting

The following is a guest post by Karen Berger, PharmD. Karen is a pharmacist and medical writer in Fair Lawn, NJ. Her husband has been trying unsuccessfully to put her on a budget for many years.

Congratulations – you’re expecting! In just a few short months, your life will change in a way you could never imagine. A precious baby will smile and coo at you all day, as you feel a powerful love like you never imagined. You will also never sleep, you will be up to your elbows in diapers, and you will have tons of new expenses.

If you are like me, you will also use one-click ordering to have Amazon packages delivered to your door daily, and you will have your credit card number memorized for all other websites. Having a baby can be a major life change and a financial wake-up call. Learning how to prepare financially when expecting is essential.

My husband and I had our kids pretty much back to back – 3 kids in 4 years. It all feels like a blur. Having a baby is like having your entire life as you know it turned upside down. At many times, you will feel that you have no control over this baby, who basically rules your life for the next 18 years. Although you cannot control your newborn, you can control your finances and take the steps of getting your finances in order when expecting.

According to Nerdwallet, raising a child costs at a minimum $260,000 from ages 0-18. This price includes basic (less expensive clothes and groceries) needs and does not include extras such as electronics, birthday parties, and vacations. Taking into account more expensive essentials plus all the extras, you are now looking at over $745,000 from birth to 18, and that is per child, and all before college.

When I was in high school, anytime I was asked what I wanted to be when I “grew up,” my answer of “a pharmacist” was frequently met with the same reply. “What a great career for a woman,” people would nod approvingly. At the age of 17, this made absolutely no sense to me. However, it makes a lot of sense now. A stable income with flexible options is a perfect job for a parent. A pharmacist salary puts you in a great place as you take on the task of financial planning for a baby.

Getting Your Finances in Order

When planning for a baby, there is a lot to do – you have to decorate the nursery, pick the perfect stroller – the list is endless. However, the biggest favor you can do for your family is to get your finances in order while expecting.

Knowledge and clarity about your current financial situation are of utmost importance. That means knowing exactly what it costs to run your household and your spending habits on nonessential items.

While the idea of having a monthly budget is not sexy or fun for most people, it’s a great way to help you organize your spending, eliminate or cut unnecessary expenses, and make adjustments to help you pay off debt and reach your other financial goals. You can learn more about budgeting by checking out this post.

Besides budgeting, knowing and tracking your net worth is a great way to get clarity on your current financial status. In short, your net worth is your total assets minus any outstanding debt. Many pharmacists, especially those starting out, will begin pretty far in the negative considering student loans. However, your progress and trajectory of your net worth is what’s really important.

Hopefully, you are making decisions to help grow your net worth in order to secure your financial future and achieve freedom from debt. But if that’s something you are struggling with, going back to the budget and optimizing is a great idea. If you want to determine and track your net worth we have a great tool through Right Capital you can use.

Besides getting clarity on your finances, it is really important to be on the same page as your spouse when it comes to budgeting and spending. There will be enough to argue about, such as who gets up with the baby and who does the laundry and cleaning (spoiler alert: it’s usually mom). If you can figure out money ahead of time, you are winning the game.

Insurance and Benefits

Now is the time to really understand your insurance benefits for your prenatal care, labor, and delivery. What is covered? Is there a maximum? Do you have a deductible or copays? What if your baby ends up in the NICU – how much will you have to pay? One of our children was in the NICU and the hospital billed over $100,000 – fortunately, we only had to pay a few hundred dollars.

It is also important to plan your leave; check with your company’s HR about sick pay and understand your state laws with disability/FMLA. You will want to predict how much money will be coming in while you (and possibly your spouse) are out of work.

Now is a great time to start an emergency fund, if you do not have one yet. You will want to save 3 to 6 months of expenses (not income), in a separate, accessible account such as a money market or savings account.

Once you establish your budget, taking into account newborn expenses, you want to ensure you have enough savings to cover any missing wages, in addition to the emergency fund. Depending on how tight your budget is, you may have to temporarily scale back on making extra debt payments or contributions to savings/investing accounts to build this up.

Take the time to research your benefits online, or call your insurance for more personalized service, and ask all your questions and write down the information because when you have a baby, you won’t even remember your own name.

Trust me. While on the topic of insurance, research pediatricians (and interview them!) and pick one that is in network, if possible. After the baby is born, be sure to call your insurance to notify them of your newest addition, so he/she can be added to your plan as quickly as possible.

Newborn Expenses

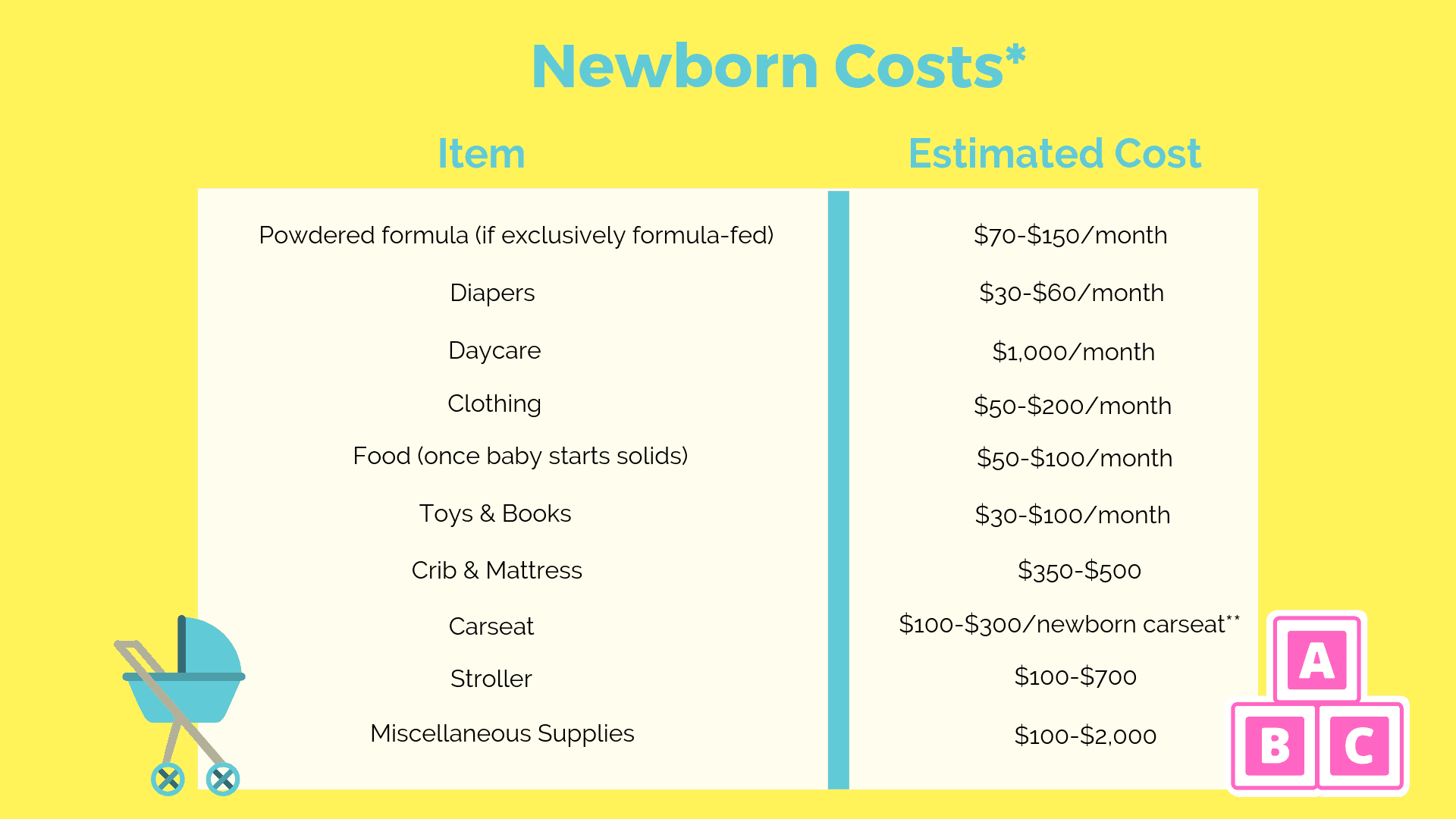

Last but certainly not least, you’ll want to have an idea of monthly costs after the baby is born. Diapers, diapers, and more diapers add up quickly. Also: pediatrician copays, formula if you choose to bottle feed, clothing, diaper bags, carriers, carseats, baby monitor, crib, strollers, baby swings, toys, books, and all of the adorable accessories at the baby store that you absolutely must have such as a squeaky giraffe, a pacifier attached to a stuffed animal, and those soft Muslin blankets. You may do a lot more take-out than cooking those first few months, which can really add up.

*These costs do not include insurance or medical expenses.

**Expect to need a new convertible car seat when baby is around one year old at an average cost of $80-$250 per carseat.

Pro Tip: Create a registry so that your friends and family can buy things that you need, rather than guessing what you want!

Childcare is another big cost. How long do you plan to take off? Are you going back to work part-time, full-time, or not quite yet? If you are going to work, do you have family to watch your little one or will you use daycare or a nanny? All have varying costs and they all have their own positives and negatives to explore, and now is a good time to interview possible candidates to care for your little one.

In our next segment, we will tackle some more must-do’s for after baby arrives, such as life and disability insurance, retirement planning, wills, and saving for college.

Financial planning for a baby, and in general, life events, can be overwhelming. Often it is best to bring in an experienced financial planner to help you plan and prepare. If you are looking for some extra help, you can book a free call with the YFP financial planning team.

Current Student Loan Refinance Offers

[wptb id="15454" not found ]Recent Posts

[pt_view id=”f651872qnv”]

One thought on “How To Prepare Financially When Expecting”

I’m glad you talked about how to be financially ready for a baby’s arrival. Last week, my sister found out she’s expecting her firstborn, so she’s currently losing her mind with all the congratulations, excitement, and worry. I believe that it’d be wise to create a budget and start a savings account for my sister’s baby needs, so I’ll be sure to give her a call later. Thank you for the advice on saving money for your baby’s arrival.