What is discretionary income?

You know that money left over after you pay your rent, food, and other bills?

Discretionary income is commonly defined this way and is often viewed as the money you have to go on vacations, buy luxury items, and others things that are non-essential such as Kate Spade purses (Although my wife would disagree).

However, discretionary income for student loans is defined a little differently and has a more specific, technical definition. This is really important because it ultimately determines your federal student loan payments for the income driven repayment plans.

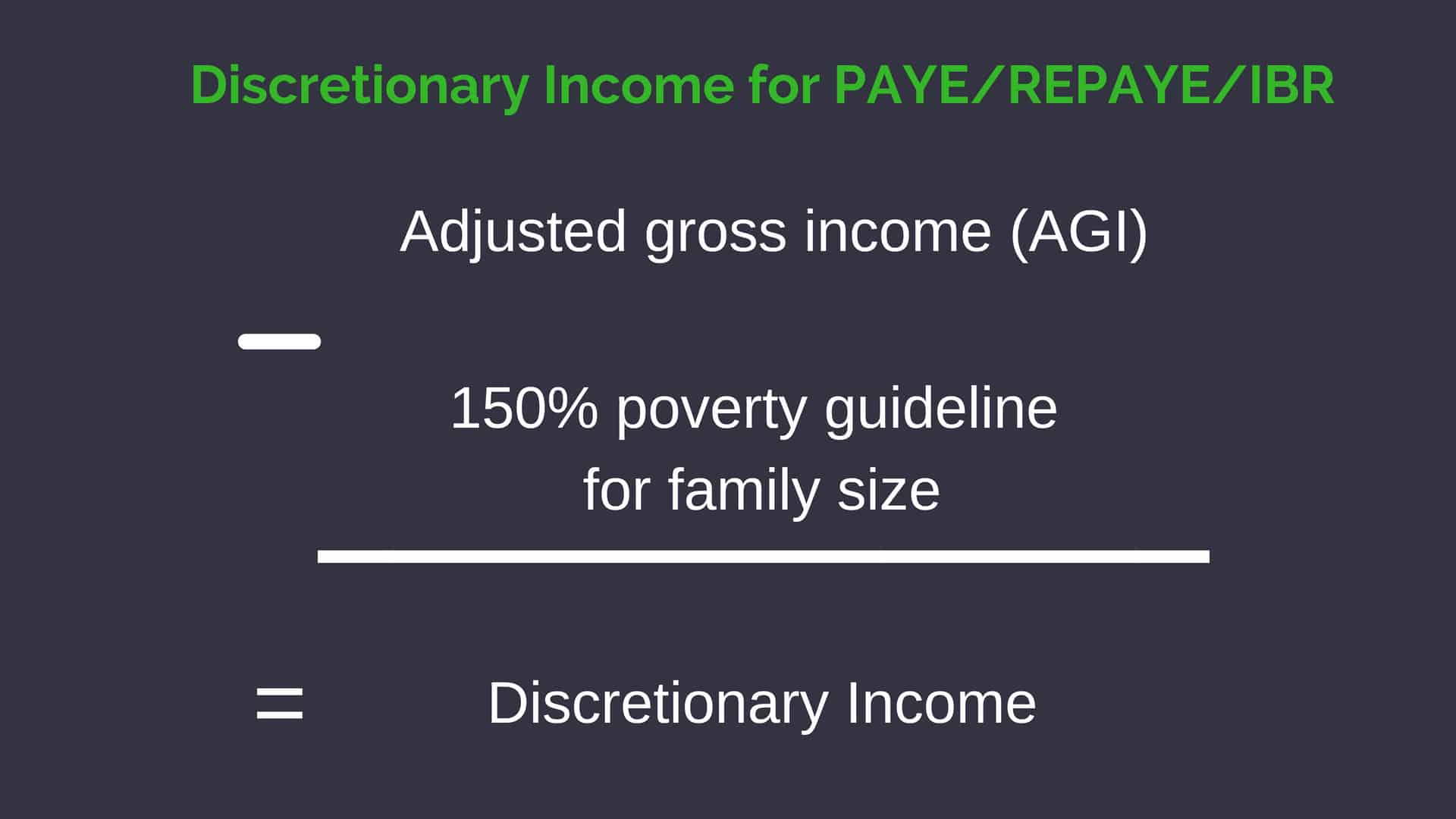

From the federal government’s perspective, your discretionary income comes down to two things: your adjusted gross income and the U.S. poverty guidelines for your family size. Specifically, it is your adjusted gross income minus the poverty guidelines.

Calculating Discretionary Income for Student Loans

Adjusted Gross Income

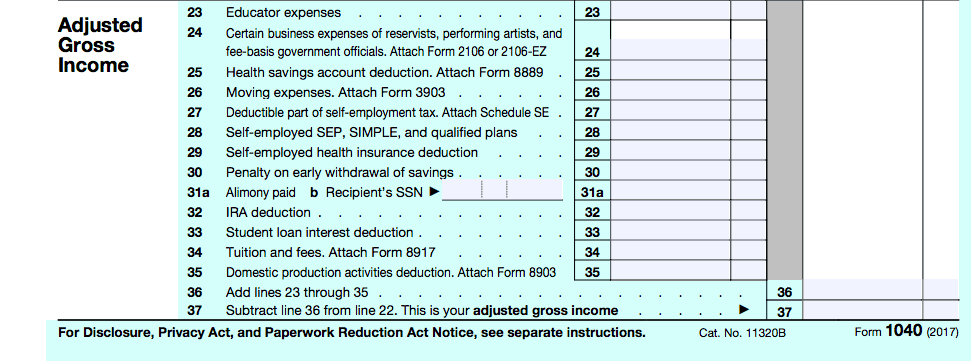

Adjusted gross income (AGI) is your income reported on your individual tax return after specific deductions or adjustments have been made. These are sometimes referred to as above-the-line deductions. These include student loan interest, IRA contributions, tuition, moving expenses, alimony payments, and HSA contributions.

U.S. Poverty Guidelines

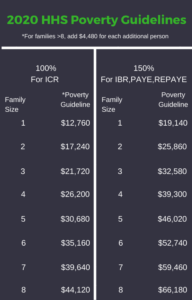

The U.S. poverty guidelines are set by the Department of Health and Human Services and help determine eligibility for certain federal programs. These are updated annually for inflation using the consumer price index. These guidelines are the same for all states with the exception of Alaska and Hawaii which have higher limits. If you live in either of those states you can find the guidelines here.

The specific income driven repayment plan will determine what percentage of the poverty guidelines is used in the calculation. For most plans including Pay-as-you earn (PAYE), Revised pay-as-you-earn (REPAYE), and Income-based repayment (IBR), it is 150%. For Income contingent repayment (ICR), it’s 100%.

The specific income driven repayment plan will determine what percentage of the poverty guidelines is used in the calculation. For most plans including Pay-as-you earn (PAYE), Revised pay-as-you-earn (REPAYE), and Income-based repayment (IBR), it is 150%. For Income contingent repayment (ICR), it’s 100%.

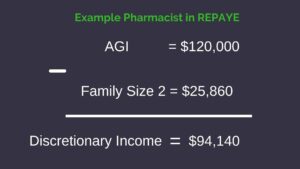

Let’s do an example to determine a pharmacist’s discretionary income who is in the REPAYE repayment plan. We will assume an AGI of $120,000 and a family size of 2.

You can see that discretionary income for student loans will vary year to year based on changes in your income, the poverty guidelines, and family size. In order to determine how this impacts your monthly payments, we have to do a few more calculations.

Incorporating spousal income into this calculation will depend on the income driven plan and how you file your taxes. For REPAYE, spousal income will count toward AGI regardless of how you file. If you file separate income tax returns, then only your income will be counted under PAYE, IBR, and ICR.

Calculating Payments for Income Driven Plans

Your monthly student loan payments are calculated using a percentage of your discretionary income from the previous year. Therefore, if you are a first-year resident and had little to no income in your last year of pharmacy school, your payment under an income driven plan could actually be $0.

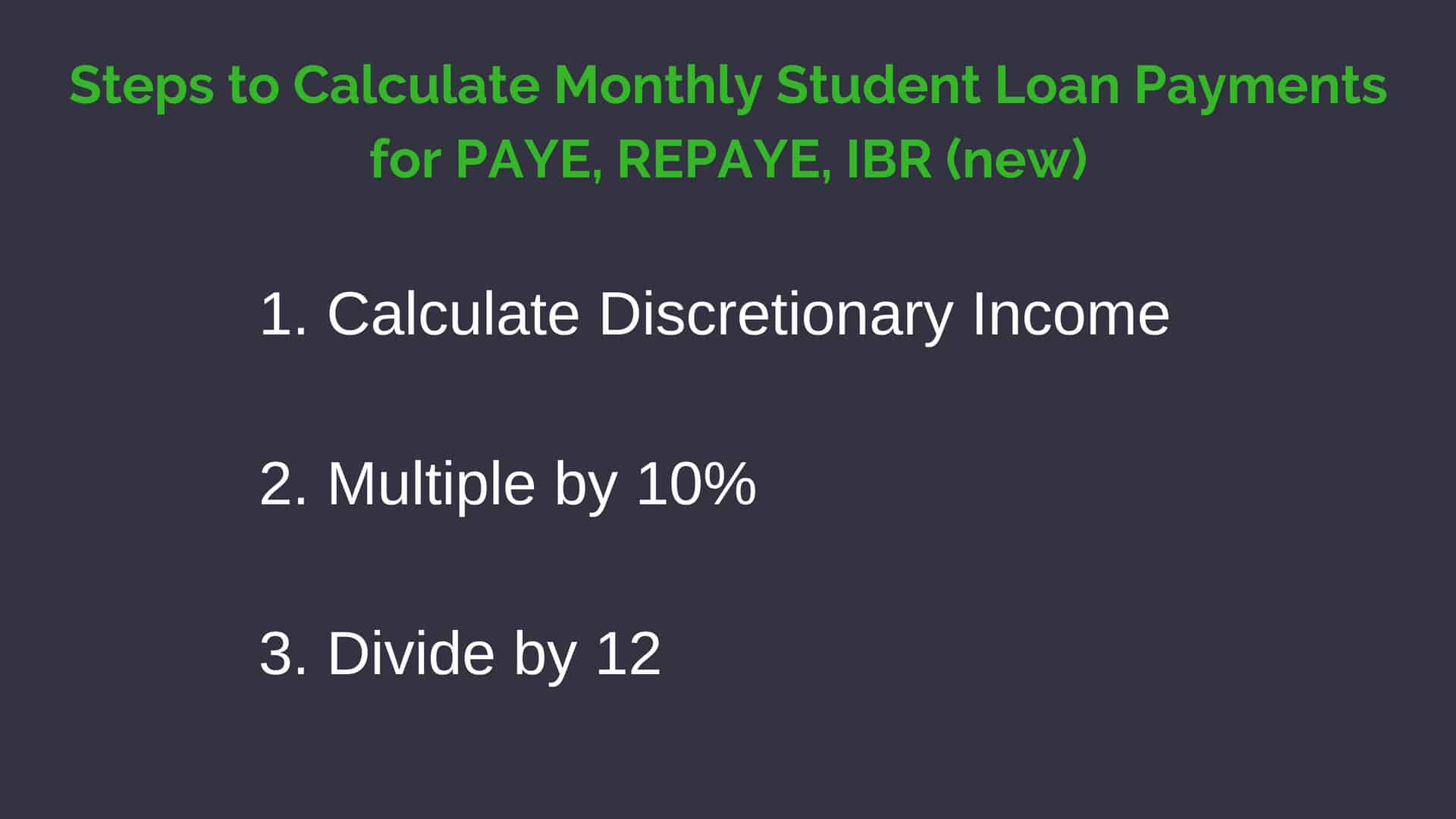

For most income driven repayment plans, your monthly payments will be 10% of your discretionary income. For the old IBR plan with loans borrowed before July 1, 2014, it’s 15%. ICR is sort of the oddball in the group. Not only is discretionary income calculated differently, the payment is also different from the other plans. It’s the lesser of 20% of discretionary income or what you would pay in fixed payments over 12 years. Once you multiply the percentage by discretionary income, dividing that number by 12 will result in your monthly payment.

If you want a shortcut and don’t want to do all the math you can use the studentaid.gov Repayment Estimator. While it will give you accurate payments based on your current income and family size, one of the limitations is that you cannot change these for different years. It has built-in assumptions that your income will grow by 5% each year and your family size will not change. So if you want to change these, you can just do another calculation or determine it manually.

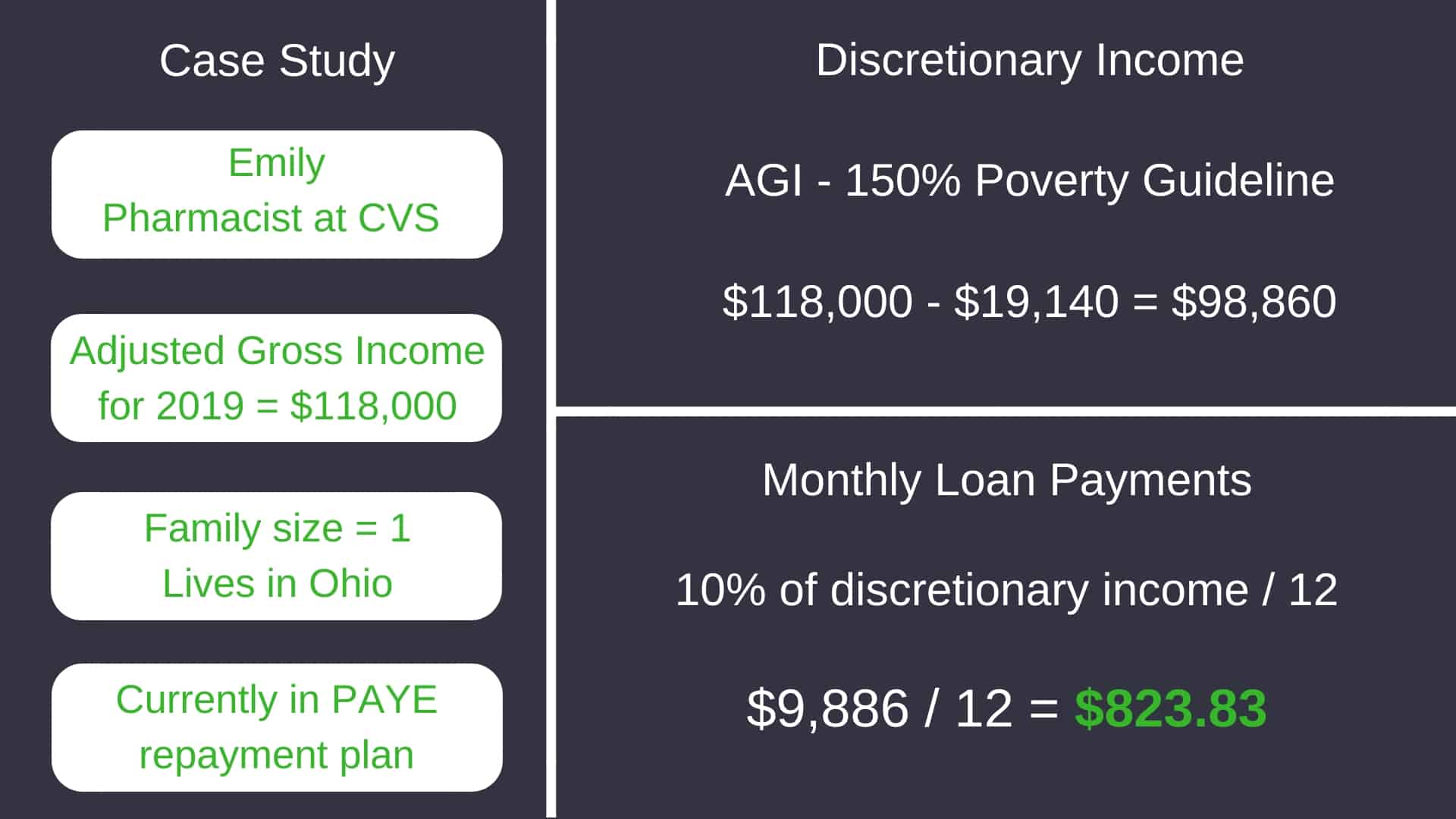

In the case study below, Emily is single and works as a pharmacist at CVS. She is still trying to figure out her student loan payoff strategy but wants to start making payments so she chooses the income driven plan PAYE. Based on last year’s income and the current poverty guidelines for Ohio, her monthly student loan payments would be a little over $800.

No Longer Necessary to Recertify for Income Driven Repayment

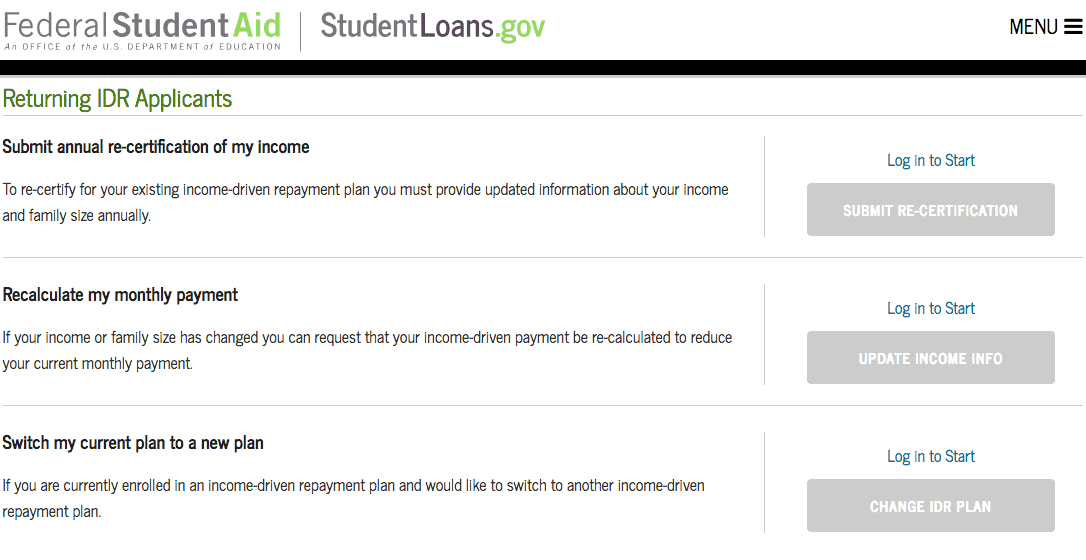

Instead of having to recertify to stay on an income-driven repayment plan like before, borrowers can have their plans automatically renewed every year based on their tax return due to the implementation of the FUTURES Act. To stay in an income driven repayment plan, you will need to opt-in one time to allow the IRS to share your tax returns with the U.S. Department of Education. This eliminates the need to recertify your income annually.

If your income or family size changes throughout the year, you can make a request to have your payments recalculated. This can be a great remedy if you experience a financial hardship that results in a change in your income but you don’t want to apply for forbearance.

REPAYE Subsidy

Up to this point, I have discussed the factors that determine discretionary income and monthly loan payments under an income driven repayment plan but haven’t mentioned anything about student loan balances. That’s because in general, it does not factor into any of the plans. However, there are some circumstances in which it can have an impact. Since most pharmacists will have loans that are unsubsidized, I will focus on the REPAYE subsidy.

Depending on your loan balance, it’s possible that your monthly payment under REPAYE may not cover all of the interest that accrues in a month. That could be pretty depressing right? Fortunately, there’s a provision in the federal loan program that can help with that.

If you are in this position, the government will pay half of the remaining interest that is due on all unsubsidized loans. Let’s say you have $185,000 in unsubsidized loans at 7%. When you start paying your loans, the interest accrued in the first month would be approximately $1,079. Assuming you’re single with an AGI of $120,000 and live within the contiguous states, your monthly payment would be $840.50. Since this payment would not cover the total amount of interest accrued, the government would pay half of the difference which is ~$119.

The REPAYE plan can be a great option if you are a pharmacy resident and trying to survive on a limited income. When applying for income driven payments, you would likely be reporting an income of $0 or a very small amount depending on how much you worked during your last year of school, which could result in payments of $0. Under any other income driven repayment plans besides REPAYE, the interest on your loans would accrue at the full amount each month.

This is why choosing to defer or put loans in forbearance in residency could be a huge mistake because interest will also accrue at the full amount while in that status.

Public Service Loan Forgiveness and discretionary income

You may be wondering what income driven repayment plan is best for you. Unfortunately, there is no one plan that fits all and it can really depend on your student loan payoff strategy. It also depends on the type of loans you have and your overall financial situation.

If you’re pursuing the Public Service Loan Forgiveness (PSLF) program, it’s very important to understand your discretionary income and the different income driven plans. If you are all in with PSLF, one of your main goals should be to pay the least amount of money over 10 years. Remember, assuming you meet all of the requirements and make all of your 120 monthly payments on time, any balance remaining on your loans will be forgiven tax-free.

To accomplish this goal you want to first choose the right repayment plan which for most people will be REPAYE or PAYE since payments will be 10% of discretionary income. Second, knowing that AGI will determine how discretionary income is calculated, you want to look for ways to lower this.

Did you know that you can actually build wealth while simultaneously lowering your payments on your student loans? While this may sound like a scam, there’s actually a legal way to make this happen. You just have to take advantage of how the tax system is set up.

I discussed earlier that your adjusted gross income is determined after certain deductions are made. Some of these are retirement contributions or vehicles that allow you to invest. The first major one is contributions made to a Health Savings Account (HSA). If you have a qualified high deductible health plan, you can contribute up to $3,450 per year if you are single and $6,900 if you are married or have a family. While the name can be a misnomer, these contributions can be invested aggressively in things like index funds and exchange-traded funds (ETFs).

Another way to lower AGI is to contribute to a traditional Individual Retirement Arrangement or IRA. Currently, the max is $6,000 per year with an additional $1,000 if you are 50 or older. Unfortunately, many pharmacists will not be eligible to deduct this from their taxes since there are income limits. This completely phases out at a modified adjusted gross income of $75,000 for single and $206,000 for married filing jointly.

If you are self-employed, you may be eligible to contribute to a Simplified Employee Pension or SEP IRA. Depending on your income, you could significantly reduce your AGI given the limits are the lesser of 25% of your income or $57,000.

What you won’t find under the AGI section of the IRS 1040 form is contributions made to a 401(k), 403(b), or Thrift Savings Plan (TSP). That’s because this is actually reduced from the total income that you report on line 7 of the 1040 form. When you receive your W-2 from your employer, your total income will be your gross wages minus any traditional contributions you make. Keep in mind any Roth 401(k) contributions will not be deducted since you get the tax break when you make distributions at retirement age. For 2020, you can contribute up to $19,500 and an extra $6,500 if you are 50 or older.

You can see that there are some great tax-efficient ways to invest that also lower your AGI, ultimately lowering your student loan payments. So if the Public Service Loan Forgiveness program is right for you, make sure you take a look at these options.

Conclusion

Discretionary income for student loans directly determines your payments for income driven repayment plans. These can be a great option if you are struggling financially and don’t want to put your loans in forbearance but also the recommended option for the public service loan forgiveness program and non-PSLF forgiveness.

While in PSLF, you have the opportunity to lower your payments while building wealth by taking advantage of retirement accounts and other vehicles.

What is the best student loan payoff strategy for you and what repayment plan should you be in?

Current Student Loan Refinance Offers

[wptb id="15454" not found ]

Recent Posts

[pt_view id=”f651872qnv”]