A Crash Course in 401k Planning (Part 1)

The following is a guest post from Dr. Jeffrey Keimer. Dr. Keimer is a 2011 graduate of Albany College of Pharmacy and Health Sciences and pharmacy manager for a regional drugstore chain in Vermont. He and his wife Alex have been pursuing financial independence since 2016.

If you’ve been following Your Financial Pharmacist for a while now, chances are you’ve been coming up with a game plan to deal with your debts and form a solid financial foundation. Is investing part of that financial foundation or plan?

Yes?

No?

Maybe?

While cleaning up your balance sheet or having some cash tucked away for a rainy day is great, that alone isn’t going to get you to financial freedom or prepare you for retirement. For that, your money needs to go out and hustle for you, meaning you need to invest it.

But how do you get started?

To help answer that question, we are going to give you a bit of an investing and 401k planning crash course with a focus on workplace retirement plans. Over the next few posts, it’s our hope that you learn a bit more about what they are, how they work, and how to manage them. With pensions becoming an endangered species (unless you’re a government employee), you can bet that you alone are responsible for your own retirement planning. The more informed you are, the better.

Alphabet Soup: The 401(k), 403(b), and TSP

So if you don’t get a pension, what DO you get as a retirement benefit from work? Well, depending on who you work for, you’ll likely have access to one of 3 different investment accounts that can help you save for retirement. Here’s who will have access to each:

- 401(k) – Most employees

- 403(b) – Employees that work for government agencies and certain non-profits

- Thrift Savings Plan (TSP) – Employees of the federal government

While there are some key differences between the three in terms of legal structure and requirements, there isn’t much of a practical difference for most savers. The main draw with these plans is the special tax treatment you get to enjoy which is the same across the board.

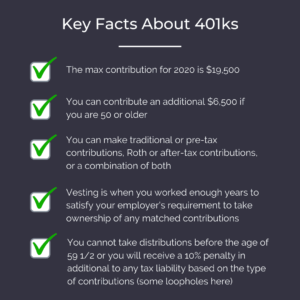

You can contribute to these plans in one of two ways:

- Traditional or Pre-tax Contributions

Money going in is tax deductible for the year you contribute, gets to grow tax free within the account, and withdrawals get taxed as income during retirement.

- Roth or After-tax Contributions

Money going in gets taxed with the rest of your income that year, gets to grow tax free within the account, and is tax free when withdrawn in retirement.

This tax treatment presents two opportunities for savers:

- The potential to profit off of the difference in your tax rate now vs. in retirement.

For example, if you plan on having a higher income in retirement than you have now, Roth contributions can make sense; and if the opposite is true, then Traditional contributions can make sense. In real life, this gets a little more complicated. Fortunately, there are some sophisticated calculators out there that can help guide your decision. Another strategy to consider is to simply split contributions between both as you don’t have to go all in on either.

- Freedom from taxes on income and capital gains generated within the account.

That second point is probably going to be the most important for savers. If you were to invest money side by side in a brokerage (taxable) account and Roth 401(k) in identical investments, after a year you’d always have more in the Roth 401(k).

This is because when you sell an investment that has appreciated in value or that investment pays you income, you have to pay taxes on that profit unless it’s in a tax advantaged account such as a 401(k). Over time, the amount of money saved by not having to pay these taxes can be incredible!

One key consideration when choosing between Traditional and Roth 401(k) is your student loan strategy. If you are pursuing the Public Service Loan Forgiveness program or even Non-PSLF forgiveness, it usually makes more sense to make all of your contributions Traditional.

The reason is that those contributions will directly lower your Adjusted Gross Income which will subsequently decrease your student loan payments. This allows you to build wealth while simultaneously decreasing your payments. Pretty awesome, right?

For PSLF remember any balance remaining after 120 payments is forgiven tax-free! Therefore, to optimize your strategy you would want to pay the least amount of money over that time.

How to Participate

First of all, in order to take advantage of these wonderful investment vehicles, your employer needs to offer one. Most larger employers will, though some require that you work for a set amount of time before you can start investing.

Once you’re eligible, your employer may automatically enroll you in the plan and start taking payroll deductions from your paycheck to fund the account. I bolded the word “may” for a reason. Some people don’t look at their pay stubs and go years without knowing that they weren’t saving for retirement. It’s important to read up on how your employer handles this benefit and make sure you participate when you can.

If your plan does automatically enroll you, chances are it’ll start taking out a small percentage of your pay for retirement savings, such as 3%. What you need to decide at this point are two things:

1. Is the amount being taken out high or low enough for your current financial situation?

2. Should your contributions be Traditional (pre-tax), Roth (after-tax), or a mix?

Only you are going to be able to answer those questions. Know that with these types of plans, you can always make changes.

How Much Should I Contribute?

This is going to be a very personal decision and there are a number of factors in play. For example, how many working years do you have left? Are you struggling to just pay bills right now and make ends meet? What is your student loan strategy?

Investing is great, but a good case can be made to put it on pause if you’re drowning in credit card or other high interest debt. Oftentimes, it’s best to clean that mess up before putting money into your retirement plan. Plus, determining the amount you’ll contribute will depend on your financial goals and how fast you want to achieve them.

Employer Match

One of the ways employers attract employees and encourage retirement plan participation is by offering to make contributions into the account as part of the overall compensation package. For some workers, they are lucky enough to work for an employer that will simply do this regardless of participation. But for most people, these contributions will be a match to your own contributions. So what does that mean?

Let’s say you work for Company X and they offer the following retirement benefit:

Up to a 100% match on the first 5% of compensation

In this scenario, Company X would match dollar for dollar your contributions into the retirement plan up to 5% of your total salary. In a given year, if you made $100,000 and contributed 5% or $5,000 into the plan, Company X would also put in $5,000. Put in 4%, and they will put in 4%. Now, if you put in 6% or more of your pay, Company X would stop at the 5% mark since the benefit is only up to 5% of compensation.

This type of benefit presents a challenge to the conventional notion of paying off all debt first and then investing. With a match, you are able to realize a 100% gain risk free within the account as long as you contribute.

Because of this, it may be more profitable to contribute to a retirement account before paying off debt, including high interest debt. In general, unless you are struggling and can’t pay your bills, you should always contribute to a retirement account enough to get an employer match.

Now, if it makes sense, you can contribute above and beyond the employer match. Given all of the tax benefits these types of accounts have, you should strongly consider contributing above the match. However, there is a cap on how much you can contribute. As of 2020, the cap is $19,500 per year ($26,000 if you’re age 50+) for 401(k)s, 403(b)s, and TSPs.

One thing to keep in mind is that if you miss contributing to the match or making any contributions in general, you cannot go back in a subsequent year to “make up” for it. Only when you reach age 50 can you contribute beyond the maximum contributions.

Vesting

In order to keep employees, many companies employ a vesting schedule in which you get to take ownership of match contributions over time. If you leave a company before you’re said to be vested in employer contributions, you don’t get to take those contributions with you. To illustrate this, let’s look at the following vesting schedule for Company X:

30% after the 1st year of service

60% after 3rd year of service

100% after 5th year of service

With this type of schedule, you start getting partial ownership of employer contributions after you’ve been with the company for a year, but don’t get full ownership of those contributions until you’ve worked for them for 5 years. So in this case, if you left Company X after 4 years and the balance in your retirement account derived from employer contributions was $10,000, you’d only get to take $6,000 of that with you.

It’s important to note here that when an employer contributes to your account, those contributions go into a separate bucket from your own contributions. The percentage that you “vest” in only applies to the bucket containing the employer contributions. Your own contributions are always owned by you.

Also, some organizations have what’s known as a cliff vesting schedule. Rather than being partially vested after X years of service, this schedule will make you 100% vested after the required years of service have been met. Therefore, this is really an all or none situation. And because every employer is different, it’s extremely important for you to understand what type of schedule is used by yours.

The Downside to Retirement Plans

For all the good things these plans do to help you save for retirement, they come with strings attached. While not an exhaustive list, the big ones for you to be aware of are: plan fees, investment restrictions, early withdrawal penalties, and required minimum distributions.

1. Plan Fees

With the exception of the TSP, where all expenses are presented in the individual fund expenses, each plan will have additional administrative fees that are layered onto the fees charged by the individual investments themselves.

While there’s not much you can do about these while working for a company, they can impact the decision to keep money in a previous employer’s plan or transfer it (rollover) to a new employer’s plan. Plans are required to disclose these fees but don’t make it easy to find that disclosure. If you’re curious about a plan’s administrative fees, search the plan documents for a 404(a)(5) disclosure document.

2. Investment Restrictions

In general, unlike a brokerage account or individual retirement account (IRA), the retirement plans we’ve been talking about don’t let you invest in whatever you want. You’ll typically be restricted to whatever investment options the plan chooses to provide. This usually won’t prevent you from building a decent portfolio within the account, but you might be forced to use investment options that charge exorbitant fees compared to those you’d find elsewhere.

3. Early Withdrawal Penalties

Since these plans are designed to fund retirement, the IRS will hit you with a penalty if you decide to take money out early. How early? The ripe old age of 59 ½ (as of 2020). If you take a distribution or cash out one of these plans, you’re going to get taxed like crazy for the year you do it.

If the money you take out came from traditional contributions, that amount will get added to your taxable income AND you get the privilege of paying an extra 10% of the amount as a penalty!

If the money came from Roth contributions, you don’t pay tax on the contributions BUT you do get that same treatment as traditional contributions for any gains you may have which will get intermingled with your withdrawal of contributions.

4. Required Minimum Distributions (RMDs)

The IRS also doesn’t want people hoarding money and not paying taxes on it indefinitely. At some point, they want to start milking your retirement account for tax dollars. To do this, they subject money derived from Traditional contributions to RMDs once you hit age 72 (as of 2020). Once you reach that age, you must withdraw an amount equal to your account balance as of December 31st the previous year by a number determined by the IRS.

The IRS calls this number a life expectancy factor. In retirement, these RMDs can significantly increase your tax bill and impact the long term viability of your retirement savings. This is one area where Roth IRA contributions can really shine since they’re not subject to RMDs. (Note that RMDs are still required in a Roth 401(k))

Hopefully, you now have a better understanding of how these types of plans work and how to take advantage of this important workplace benefit. While there’s much more to these things in terms of what you can do with them and how to optimize them, you should be able to start thinking about how they’ll fit into your overall plan.

In our next post, we’re going to dive into the basics of investing and the typical options within retirement accounts, so stick tight!

If you are looking for some extra help your 401k or retirement planning, you can book a free call with the YFP financial planning team.

Current Student Loan Refinance Offers

[wptb id="15454" not found ]