The following is a guest post from Dr. Jeffrey Keimer. Dr. Keimer is a 2011 graduate of Albany College of Pharmacy and Health Sciences and pharmacy manager for a regional drugstore chain in Vermont. He and his wife Alex have been pursuing financial independence since 2016.

The following post contains affiliate links through which YFP or its team members may receive compensation.

For the first 24 years of my life, the only people who really cared about my financial well-being were my parents. Sure, I had a business relationship with my bank; but outside of getting the account set up and telling me to use a bankbook to keep track of it, they (or anyone else in the financial services industry) didn’t really seem interested in me or my money. As I neared graduation though, something curious happened. Seemingly out of nowhere, my email inbox was chock full of requests to meet with people wanting to be my financial advisor.

“Well, well, well,” I thought. Now that I’m about to be a pharmacist and make some real money, I must be important! Right? So I met with a few of these people, and in retrospect, I said a lot of dumb things that didn’t do me any favors. I remember when one guy asked me what one of my major financial goals was, I told him I wanted to buy an Ariel Atom. Now if you don’t know what that is, that’s fine. It’s basically a street-legal go-kart that can go 0-60 faster than a Ferrari and can peel your face back like this:

#LifeGoals

Source: Top Gear (UK), BBC

Yeah, looking back on it, I deserved what I got in the end.

After deciding to take one of these people on as my “financial advisor” we had a couple of lunch meetings to discuss my financial situation. I laid my cards out on the table including all of my account balances and all my debts. You’d think we would’ve come up with a strategy for me to build some cash savings and address my student loans, but did we? Not really.

However, there was one aspect of my student loans that seemed to pique this person’s interest.

Was it the balance? No.

How about the monthly payments? Getting warmer…but no.

It was the fact that my parents co-signed them for me.

If for whatever reason I stopped making the minimum monthly payment on my loans, my parents were at risk of assuming that responsibility. A truly unacceptable situation. This, of course, prompted my advisor to ask the question:

“Do you have life insurance?”

“Well…no, I don’t.”

Life insurance is one of those things that no one really wants but many people need. Like any type of insurance, you hate paying for it when you’re not using it, but it can keep the world from falling apart in those rare situations when you need it.

If you have to send in a claim for insurance on your car or your home, you’ll reap the benefits of that claim. However, you’ll never personally reap the benefits of a claim with life insurance because, well, you’ll be dead.

So why get one?

Two words: income protection.

Rarely do people shuffle off this mortal coil without leaving behind some baggage for others to sort out. At the very least, it costs money to put you in the ground; and unless you know a way to work your day job from beyond the grave or set aside a burial fund, someone else will need to foot that bill for you.

But what about the regular bills your income used to pay for? While you won’t be living in your house anymore, I’m sure your spouse and/or kids still want to. How’s the mortgage going to get paid when you’re not around?

As a pharmacist, there’s a very good chance you’re the breadwinner of the house and your income is essential for making household ends meet. But here’s the rub: if something were to happen to you, the financial hit to your household could be catastrophic. And we’re not talking about “no more trips to Disney this year” catastrophic, we’re talking about fast-track to living under a bridge in bankruptcy catastrophic.

But it doesn’t have to be that way and that’s where life insurance comes in.

With life insurance, the people you leave behind can get a cash payout in the event of your death that can act as a replacement for your income. And, if set up properly, a life insurance policy (or policies) can bulletproof your financial plan in the case of your untimely demise.

So how should a pharmacist go about getting a life insurance policy and how do you know which one to get?

At first glance, it seems like a daunting task. But thankfully, getting yourself insured doesn’t have to be complicated. The team at YFP is here to provide tools that can make the process simple and straightforward.

Before we get into that though, we need to talk some more about the types of policies that exist.

Huh?

Isn’t life insurance just…life insurance?

Yes, and no.

A life insurance policy can be incredibly simple or one of the most convoluted financial products in existence. What’s more, individual policy options can complicate things to the point where it’s questionable if the person selling you the policy even understands it. Yikes!

Fortunately for us, there are really only two types of policies: permanent and term. One is good for pharmacists, and one…not so much. First, let’s talk about permanent life insurance because I’m not done with my story.

At this point, the topic of life insurance came to dominate my meetings with my financial advisor and honestly, I found it kind of boring. While I knew I had a duty to protect my parents from my loans if anything happened to me, I was much more interested in what I could do to make money in the markets. After all, isn’t the point of working with a financial advisor is to get rich? Yeah, I was an easy mark.

Picking up on this, my advisor pitched me a solution.

“What if you could take the death benefits of a life insurance policy and combine them with an investment component? Not only could you protect the ones you love, you could also set yourself up for life in the process!”

That’s a win-win if I’ve ever heard one. Sign me up!

And thus, I was sold quite the bill of goods.

The type of policy my advisor sold me on belongs to a family of life insurance policies known as “Permanent Life Insurance.” Permanent policies are just as they say, permanent, and they go by a few different names:

When you take out the policy, the intent is that you hold it till the day you die, pay premiums on the policy till the day you die, and your heirs get the death benefit when you die. Sounds good, right? But wait, there’s more!

Remember when I said that these types of policies have benefits for you when you’re alive? This is where another part of the policy known as the “cash value” comes into play. In this part of the policy you have an account that exists outside of the death benefit. Depending on the specific policy, part of the premium gets added to this account and it will have either a set rate of return or exposure to the market. In addition, the funds inside can grow tax-free within the confines of policy and be protected from the claims of creditors depending on your state law.

What’s not to like?

A lot as it turns out.

And for most pharmacists, permanent life policies should be avoided like the plague.

But why?

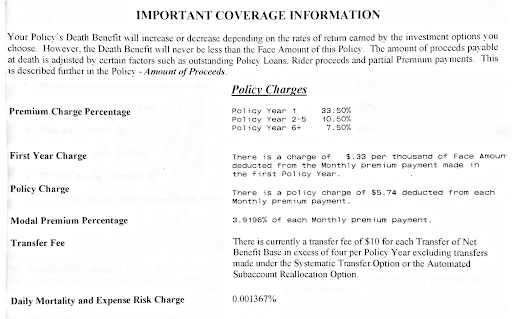

Above all else, these types of policies can be insanely expensive. Compared to the other type of life insurance you can get like term life insurance, you can spend on premiums in a month what you would spend in a year otherwise. How can that be? To answer that, let’s take a look at a snippet from the variable life policy sold to me when I was a new practitioner.

I know there’s a lot to digest there but let me distill it down to one word: fees.

While part of the premium goes into the cash value portion, a good chunk of the premium goes to paying additional fees that get layered into the policy. From sales commissions to general management fees, a lot of the money you pay into these policies doesn’t really go into the cost to insure you.

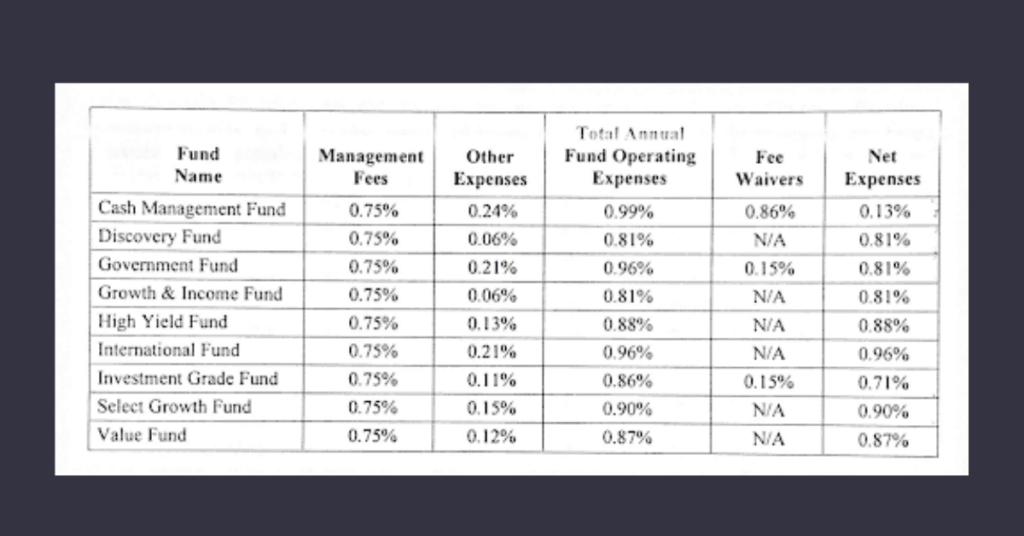

Oh, and these are just the fees that get taken out of the premiums, we haven’t even gotten to the investment side of things.

If you read my article on stocks, bonds, and funds on the YFP blog, you’ll know I’m no fan of investment fees and you shouldn’t be either. These are the fees that seem small when you first look at them, but over time can eat away a massive amount of your potential gains. The investment fees you’ll find within these policies (like the one above) are usually terrible compared to what you can invest in yourself.

Because of all these hidden costs and fees, permanent life policies are generally products designed to be sold. Sure, there are certain situations where they may offer a benefit, but those are usually limited to high net worth individuals and very well structured policies as part of estate trusts.

But for most pharmacists, especially the new practitioner who’s a HENRY (high earner, not rich yet – yes, that’s an actual industry term for you), the type of policy that gets hawked to you by the “financial advisor” down the street can be safely avoided.

You still probably need life insurance though. This brings us to the other form of life insurance; the one you should get. Term life insurance.

Where permanent policies tend to be fraught with all sorts of riders and additional layers of complexity, a term policy is very simple to understand. It can be boiled down to two numbers: the death benefit and the term.

How a term life insurance policy works is really simple.

If you die within the term window, your heirs collect. For example, if you take out a 30-year term policy on January 1st, 2020, and die at any point before January 1st, 2050, your heirs get to collect the death benefit. If you don’t die by that time, the policy simply terminates and the insurance company keeps all your premiums. That’s really all there is to it.

In addition to simplicity, the other main draw of term over permanent life insurance is the cost. Remember how I said that what you spend on a permanent policy in a month is similar to what you’d pay in a year for term? That’s not far from the truth! And, given the costs associated with investments within a permanent policy, it’s easy to see why the mantra “buy term and invest the rest” makes sense. You simply have a much better chance at building wealth when costs are low.

Here’s an example of how affordable a term life policy is. A 30-year-old woman who’s healthy that doesn’t smoke would only pay about $35 per month for a $1,000,000 policy with a 25-year term.

With a term policy, the cost to insure you typically comes down to a few factors.

Death Benefit Amount

A greater death benefit demands a greater premium. You don’t need to be an actuary to prove that one.

Term Length

As term length increases, so do the chances you’ll die within the term window. In order to cover that risk, you’ll pay a larger premium for a policy with the same death benefit over a longer-term.

Age

The younger you are, the less chance you’ll die soon and the lower your premium will be.

Sex

Sorry guys, but women tend to live longer than men and get the advantage here. Unless your state specifically disallows it, all else being equal, women can expect to pay lower premiums than men.

Personal Health

Most policies will require some sort of medical exam and/or documentation of your medical history as part of the underwriting process. Things that come up on your medical exam (bloodwork is usually done), evidence of pre-existing conditions, and most importantly your smoking habits can make your policy more expensive. In some cases where you have a serious medical condition, you might be uninsurable. If you are overweight or obese that can also increase the cost of a policy.

Family History

Usually not a make or break for the policy, but evidence of some hereditary conditions that crop up later in life can increase the cost to insure.

Recreational Activities

Do you enjoy base jumping? How about doing wheelies on the interstate at 100MPH on your new sports bike? If so, it should come as no surprise that the cost to insure against your “unexpected” death is more expensive.

#higherinsurancepremiums

Criminal History

Yes, blemishes on your legal record (speeding tickets included!) can make insurance more expensive.

Additional Riders

If you want bells and whistles on your policy such as the ability to collect ahead of time if diagnosed with a terminal illness, the policy is going to cost more.

While I know it seems like there are a lot of things that can make a term policy unaffordable, don’t worry. These factors go into the pricing of any life insurance policy, even the super expensive permanent policies. What makes term so much of a better deal though is that the simplicity of a term policy commoditizes these policies in the marketplace.

In other words, just like generic drugs, they get super cheap because a lot of companies compete in offering the same product. Unless you’re looking for a policy with a bunch of exotic riders on it, you can shop around to get a good deal. Nice!

Many of us nowadays can get life insurance coverage as a benefit through work. In fact, when you first started as a full-time pharmacist, you might’ve seen one of these benefits when filling out your new hire paperwork. In most cases, all you have to do is pick a death benefit and a set amount will get taken out of your paycheck. Simple right? While it may seem like a great idea to get insured this way, there are some good reasons you shouldn’t totally rely on workplace life insurance:

It’s non-portable.

When you leave your job, do you get to take your benefits with you? Nope. While there can be a grace period after you leave, by and large, that policy will be just as terminated as your employment.

It might not be enough.

Typically, the death benefits on workplace life insurance plans are limited. You’ll likely need more coverage than what your benefits allow.

It might be more expensive.

Since there’s rarely a medical exam associated with these policies, the premiums on them tend to be more expensive. If you’re young and otherwise healthy, you could be spending more than you should.

It might not be there for you.

You know what’s sad and sometimes happens when people become seriously ill? They’re forced to leave their jobs. If a serious illness were to result in your death, that workplace plan might not be there when you needed it most.

Good question!

Unfortunately, there’s no straight answer to that.

Oftentimes you’ll see the recommendation of 10-12x your annual income getting thrown about, but that doesn’t really take into consideration any of your personal situations. So how can you get a better idea?

Tim Ulbrich and Tim Baker tackled this question head-on in YFP Podcast Episode 44. In a nutshell, you need to make a projection of future income needs and use those projected needs to come up with a death benefit number. Huh? Don’t worry, it’s not as hard as it sounds.

Add these liabilities:

Debts: student loans, mortgages, and other debts

Future expenses: college tuition, burial, and other foreseeable expenses

Income support: How much you feel is enough to support the lifestyle enabled by your income for your loved ones, childcare support if applicable, dependent on the length of time you want to support (ie. 10, 20, or 30 years), include considerations for future inflation (ie. 3-4%/year), investment returns, and taxes.

Then, simply subtract the savings you have from the liabilities listed above and you’ll get a good estimate of what you’ll need for a policy. Want to get more into the weeds? Check out this handy calculator for estimating your coverage needs.

Now, does the number you come up with have to be exact? No! Chances are, things are going to change as life goes on. In the worst-case scenario, you can purchase an additional policy to layer on top of the one you just bought.

Speaking of which, getting additional policies to layer on each other is a legitimate life insurance strategy called “laddering.” As time goes on, most people’s need for life insurance will fluctuate. It might start out somewhat small, increase as a spouse and kids come into life, and then taper off again once the kids have left the nest. For this reason, many people choose to “ladder” multiple policies to accommodate this change in need.

If, at the end of the day, all this still seems daunting (don’t worry, it’s OK if it does), make sure to reach out to a professional that can help you put it all together. The team at Your Financial Pharmacist is uniquely suited to your situation as a pharmacist and can help you build the best plan possible.

Remember how I mentioned that you can shop around for term policies and get a great deal?

YFP has partnered with Policygenius to help you do just that!

Policygenius allows you to compare and shop all of the top, A-rated life insurance companies on one, easy to use platform. Just answer a few questions to determine your coverage needs and you’ll get presented with a bunch of accurate term life insurance quotes to choose from. Plus, unlike other platforms, the information you provide stays private while you shop! That’s right, you won’t get bombarded with phone calls and emails as soon as you hit submit.

Just because you made this bed doesn’t mean you have to lie in it. It is possible to get out of that permanent policy that was sold to you when you were a financial noob. But, and this is a big but, there’s probably going to be some pain. In all instances, you will be cashing out the policy and this will have one or a combination of the following consequences:

Loss of money

Typically in the first few years of the policy, the majority of the premiums you pay go toward sales commissions and fees, not the cash balance. Since you can only withdraw the cash balance, you may take a net loss on the difference between the cash balance and premiums paid. This was me when I finally got rid of mine. In the end, the VUL policy I took out ended up costing me several thousands of dollars lost to premiums.

In addition, there may be surrender charges on the policy. These charges are usually higher for the first few years of the policy and can eat up the entire cash balance in some cases.

Taxes

If you’ve had the policy for a long time and the cash value exceeds the total amount you’ve paid into the cash value through premiums (your cost basis), you’ll be required to pay taxes on the gains.

If that last one applies to you, there’s another strategy to get out of the policy without incurring a taxable event known as a 1035 exchange.

In this exchange, you basically exchange your permanent life policy for another insurance product such as an annuity. While annuities also get somewhat of a bad rap, there are annuities out there, such as variable annuities, that aren’t saddled with the types of fees annuities are famous for.

Finally, before you do anything with your old policy, make sure you have other life insurance! You should only cancel your permanent life insurance policy once your new policy is effective and fully replaces your old coverage.

Life insurance can be an incredibly important component of your financial plan.

From protecting your income and keeping your loved ones from living on the street to even help you sleep better at night, the benefits of having a life insurance policy are immense.

That said, there is a right way and a wrong way to do it. For most pharmacists, the right way is to buy term life and get the best deal on it by shopping around using a site such as Policygenius.

And, as always, if any part of this process seems confusing or you’re just looking to get a second opinion on what to do, make sure to book a free call with the team at Your Financial Pharmacist. You’ll be glad you did!

Current Student Loan Refinance Offers

Advertising Disclosure

| Cash Bonus | Starting Rates | About | ||

|---|---|---|---|---|

|

$800*Loans *≥150K = $800 $100-$149K = $450 ≤100K = $350 |

Variable: 1.86% APR (with autopay)* Fixed: 3.99% APR (with autopay)* *Read rates and terms at Credible.com |

The "kayak" of student loan refinancing, Credible compares rates from 10 lenders (including Sofi). |

Visit Credible |

|

$750*Loans ≥50K = $300 ≥150K = $750* |

Variable: 4.13% Fixed: 2.99% |

Uses credit unions and local banks to find competitive rates |

Visit Credible |

|

$850**In the Form of a Principal Reduction Loans >150K = $850 $50-$150k = $500 <$50k = $0 |

Variable: 2.48% Fixed: 4.29% |

ELFI offers student loan refinancing with flexible terms and award-winning customer service |

Visit ELFI |

|

$500 |

Variable: 2.49% (with autopay)* Fixed: 2.59% (with autopay)* *These rates contain an autopay discount. Read rates and terms at SplashFinancial.com |

Splash is a marketplace with loans available from an exclusive network of credit unions and banks as well as U-FI, Laurel Road, and PenFed. |

Visit Splash |

|

$500 |

Variable: 2.49%* Fixed: 3.74%* (*Includes 0.25% autopay discount) |

Save money on your loans |

Visit Earnest |