When you consider inflation, money sitting in regular checking or savings accounts can lose a lot of purchasing power over time given most interest rates are essentially next to nothing.

Sure you avoid market risk or the risk of keeping cash in other investments but there are other options that are less risky and can yield at least some return. These include high yield savings accounts and money market accounts.

High yield savings accounts and money market accounts are great options to house your emergency fund or when saving for large purchases such as a home, vehicle, or an awesome vacation because you have the ability to keep your money safe while earning interest.

The interest you can earn varies and will fluctuate depending on the Federal Reserve but, generally, you can get somewhere around 1% right now.

I recently came across CIT bank when evaluating high yield savings and money market accounts as they offer some of the highest rates available right now with a couple of different options that get close to 1%.

CIT Bank has been in business since 2000. CIT Bank is the banking subsidiary of CIT Group and is one of the top 50 U.S. Banks (According to Monitor Daily). They have over 60 physical locations in California and also operate as an online bank. They offer solutions for personal and business banking with a focus on savings products in addition to home lending.

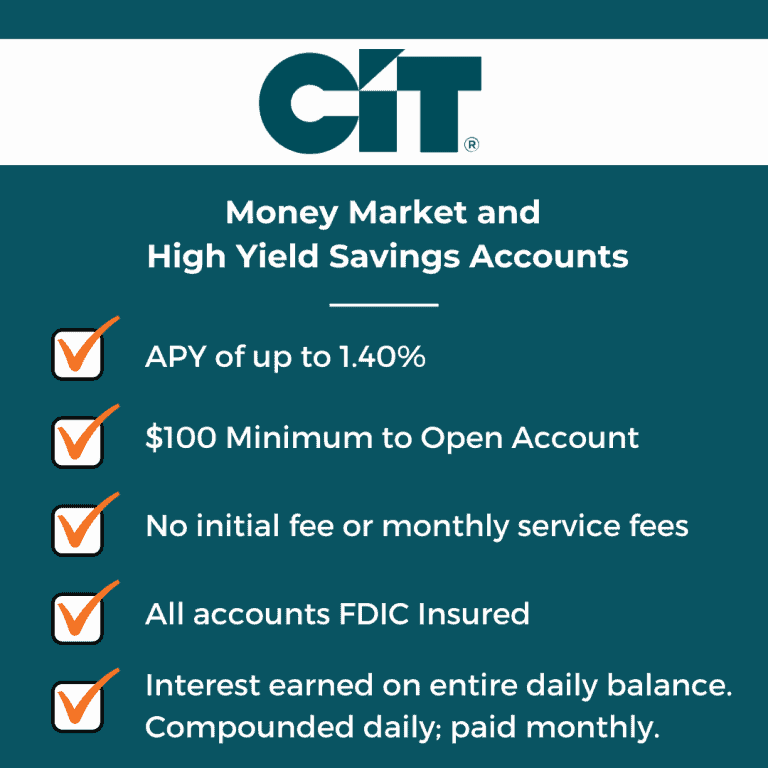

As an FDIC bank, they have received a lot of recognition for their savings products including the Ascent’s Best Online Savings Account for 2020 and GoBankingRates 10 Best Money Market Account for 2020.

They have a Better Business Bureau rating of B-. Of the complaints made in the past 12 months, they appear to be related to financing and lending and not their savings products. Their Trustpilot rating is a 4.6/5 out of 191 reviews.

The CIT Bank Savings Builder is a high yield savings account that currently offers an APY (Annual Percentage Yield) of up to 0.85% and requires a minimum deposit of $100. There are no fees to open or maintain the account.

To get the maximum APY you have two options: Maintain a balance of $25,000 or more or make monthly contributions of $100 or more.

On each evaluation day (the fourth business day prior to the end of the month), accounts with an end-of-day balance of at least $25,000 on the Evaluation Day or with at least one deposit of $100 or more that posts to the account during the Evaluation Period will earn the Upper Tier interest rate of 0.85% during the next Evaluation Period.

Through the CIT Bank mobile app, you can deposit checks remotely and make transfers.

The CIT Money Market Account currently has an APY of 1.40%. Similar to the Savings Builder account, you need $100 to open an account and there are no fees to open the account or monthly service fees.

The major difference from the Savings Builder is that you don’t have any balance or contribution requirements to maintain the APY. In addition, since it’s a money market account, you can make payments from it like you would from a checking account. However, this is limited to $50 per day if you’re paying an individual or making a Paypal payment.

There is a limit on 6 transactions per month per the federal rule, known as Reg D, which comes from the Federal Reserve with a penalty fee of $10 per excessive transaction and $50 monthly cap.

There is also a bill pay feature you can use from the app or online account as well and unlike the person to person max, the limit is up to what you have in your account balance.

Similar to the Savings Builder, through the CIT Bank mobile app, you can also deposit checks remotely.

Comparison of CIT Accounts

| Cash Bonus | Starting Rates | About | ||

|---|---|---|---|---|

|

$800*Loans *≥150K = $800 $100-$149K = $450 ≤100K = $350 |

Variable: 1.86% APR (with autopay)* Fixed: 3.99% APR (with autopay)* *Read rates and terms at Credible.com |

The "kayak" of student loan refinancing, Credible compares rates from 10 lenders (including Sofi). |

Visit Credible |

|

$750*Loans ≥50K = $300 ≥150K = $750* |

Variable: 4.13% Fixed: 2.99% |

Uses credit unions and local banks to find competitive rates |

Visit Credible |

|

$850**In the Form of a Principal Reduction Loans >150K = $850 $50-$150k = $500 <$50k = $0 |

Variable: 2.48% Fixed: 4.29% |

ELFI offers student loan refinancing with flexible terms and award-winning customer service |

Visit ELFI |

|

$500 |

Variable: 2.49% (with autopay)* Fixed: 2.59% (with autopay)* *These rates contain an autopay discount. Read rates and terms at SplashFinancial.com |

Splash is a marketplace with loans available from an exclusive network of credit unions and banks as well as U-FI, Laurel Road, and PenFed. |

Visit Splash |

|

$500 |

Variable: 2.49%* Fixed: 3.74%* (*Includes 0.25% autopay discount) |

Save money on your loans |

Visit Earnest |

What I really liked about their savings account options is the low amount to get started. Some banks and credit unions require thousands either to get started and/or to receive their highest marketed interest rate.

I decided to go with their Money Market Account because it offers a little higher APY compared to the Savings Builder and gives me a little more flexibility on how I want to deposit funds given there is no contribution or balance requirement beyond the initial $100.

The application process was smooth and straightforward until I got to the final steps. For some reason, I received a message that they couldn’t verify my identity and that someone would contact me within 5 days to get more information. However, the next day I received an email that my account was successfully set up.

In addition to that slight delay, when attempting to make the initial deposit, my bank was not able to be instantly verified despite going through multiple steps to verify so I had to wait two days for micro-deposits to be made in order to confirm. This didn’t surprise me though as I had to do this multiple times in the past.

The overall process to get the account up and running and funded took about 3 days.

The mobile app has most of the features and functionality as their online portal, was easy to set up and is pretty user-friendly. CIT bank is connected to Zelle, so you can easily pay someone if needed. You can also deposit checks and make external transfers. However, only through the online portal can you make your transfers between banks on a recurring basis in addition to setting up bill pay.

CIT Bank offers one of the highest APY on their savings and money market accounts making it a great option for your emergency fund or a short or long-term savings goal. And you only need $100 to open an account. Although their Money Market Account and Savings Builder offer a similar APY, the money market account gives you more flexibility since there is no balance or contribution requirement and also allows you to pay bills or other people.